Let’s dig into the relative performance of Dollar Tree (NASDAQ:DLTR) and its peers as we unravel the now-completed Q2 non-discretionary retail earnings season.

Food is non-discretionary because it's essential for life (maybe not those Oreos?), so consumers naturally need a place to buy it. Selling food is a notoriously tough business, however, as the costs of procuring and transporting oftentimes perishable products and operating stores fit to sell those products can be high. Competition is also fierce because the alternatives are numerous. While online competition threatens all of retail, grocery is one of the least penetrated because of the nature of the product. Still, we could be one startup or innovation away from a paradigm shift.

The 8 non-discretionary retail stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was 1.1% below.

Inflation progressed towards the Fed’s 2% goal at the end of 2023, leading to strong stock market performance. On the other hand, 2024 has been a bumpier ride as the market switches between optimism and pessimism around rate cuts and inflation, and while some non-discretionary retail stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 2.1% since the latest earnings results.

Dollar Tree (NASDAQ:DLTR)

A treasure hunt because there’s no guarantee of consistent product selection, Dollar Tree (NASDAQ:DLTR) is a discount retailer that sells general merchandise and select packaged food at extremely low prices.

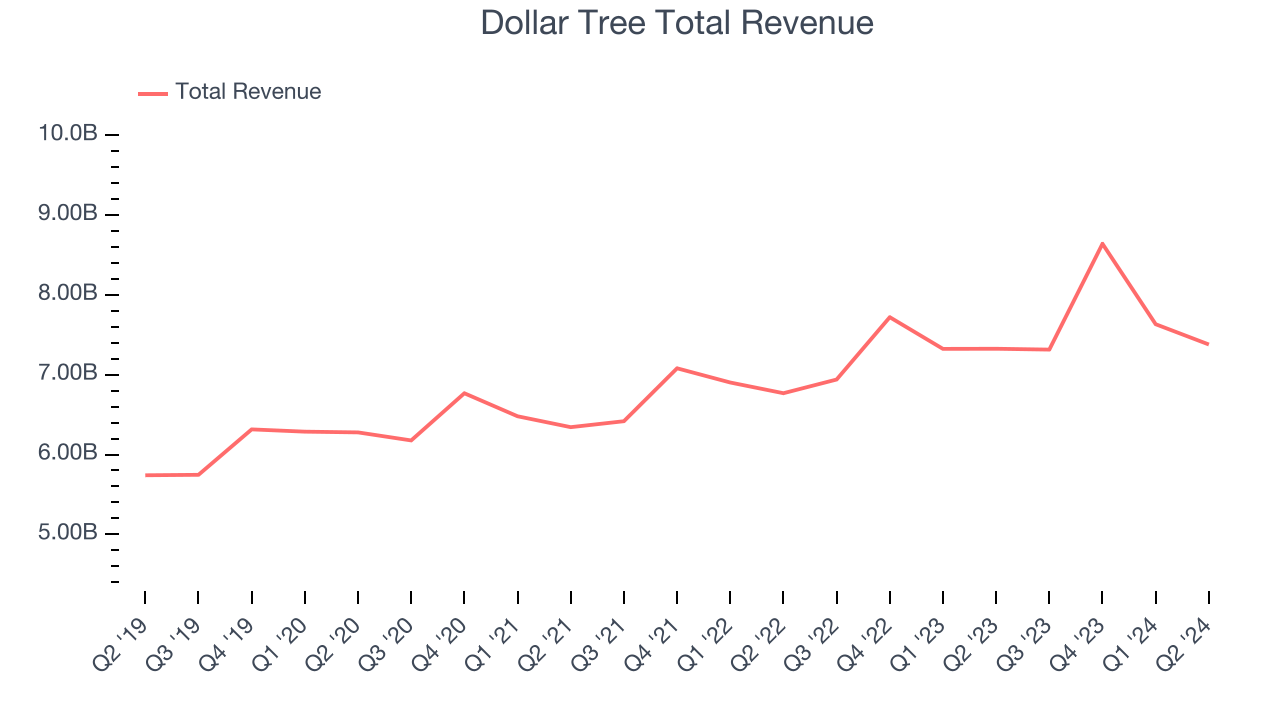

Dollar Tree reported revenues of $7.38 billion, flat year on year. This print fell short of analysts’ expectations by 1.4%. Overall, it was a slower quarter for the company with a miss of analysts’ earnings estimates and revenue guidance for next quarter missing analysts’ expectations.

Dollar Tree delivered the slowest revenue growth and weakest full-year guidance update of the whole group. Unsurprisingly, the stock is down 17.2% since reporting and currently trades at $67.57.

Read our full report on Dollar Tree here, it’s free.

Best Q2: Sprouts (NASDAQ:SFM)

Playing on the secular trend of healthier living, Sprouts Farmers Market (NASDAQ:SFM) is a grocery store chain emphasizing natural and organic products.

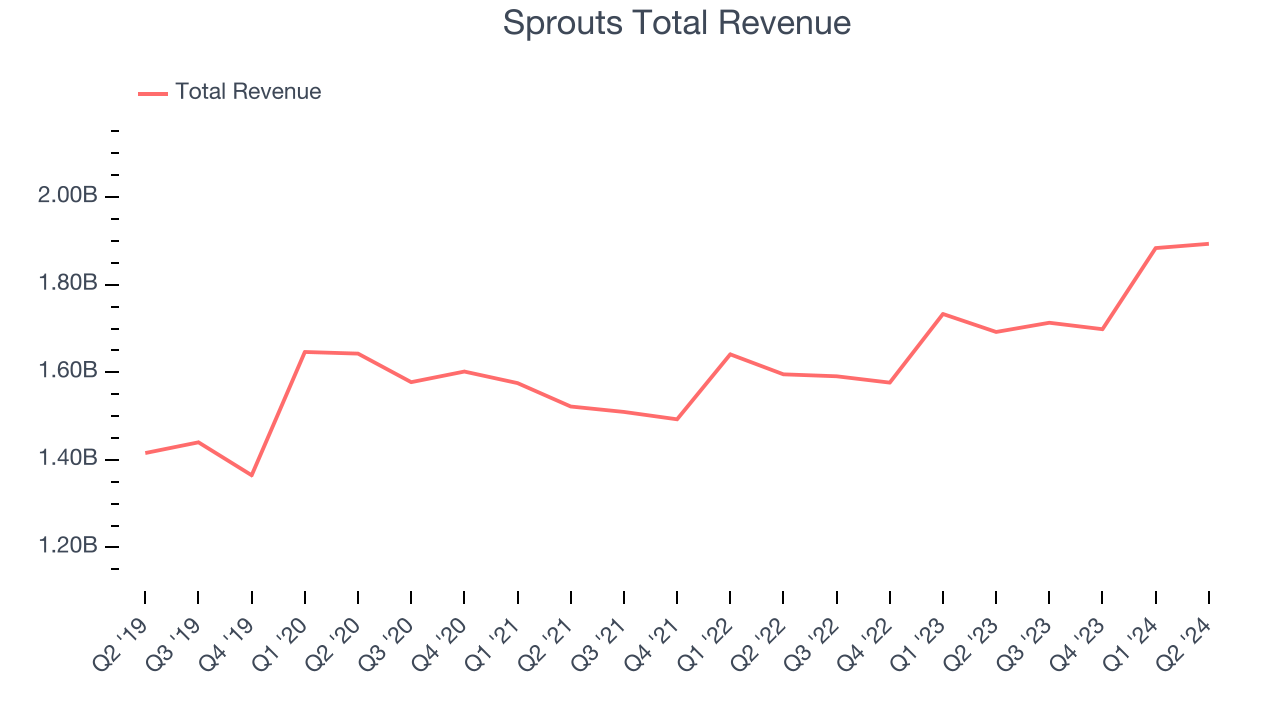

Sprouts reported revenues of $1.89 billion, up 11.9% year on year, outperforming analysts’ expectations by 3.2%. The business had a very strong quarter with optimistic earnings guidance for the full year and a solid beat of analysts’ earnings estimates.

Sprouts achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 20.3% since reporting. It currently trades at $101.82.

Is now the time to buy Sprouts? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Dollar General (NYSE:DG)

Appealing to the budget-conscious consumer, Dollar General (NYSE:DG) is a discount retailer that sells a wide range of household essentials, groceries, apparel/beauty products, and seasonal merchandise.

Dollar General reported revenues of $10.21 billion, up 4.2% year on year, falling short of analysts’ expectations by 1.5%. It was a softer quarter as it posted underwhelming earnings guidance for the full year and a miss of analysts’ gross margin estimates.

Dollar General delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 32.6% since the results and currently trades at $83.40.

Read our full analysis of Dollar General’s results here.

Costco (NASDAQ:COST)

Designed to be a one-stop shop for the suburban consumer, Costco (NASDAQ:COST) is a membership-only retail chain that sells groceries, apparel, toys, and household items, often in bulk quantities.

Costco reported revenues of $58.52 billion, up 9.1% year on year. This print met analysts’ expectations. Overall, it was a very strong quarter as it also logged an impressive beat of analysts’ gross margin estimates and a narrow beat of analysts’ earnings estimates.

The stock is up 12.4% since reporting and currently trades at $915.96.

Read our full, actionable report on Costco here, it’s free.

Target (NYSE:TGT)

With a higher focus on style and aesthetics compared to other large general merchandise retailers, Target (NYSE:TGT) serves the suburban consumer who is looking for a wide range of products under one roof.

Target reported revenues of $25.45 billion, up 2.7% year on year. This print met analysts’ expectations. It was a very strong quarter as it also produced an impressive beat of analysts’ gross margin estimates and a solid beat of analysts’ earnings estimates.

The stock is up 3% since reporting and currently trades at $148.80.

Read our full, actionable report on Target here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.