Earnings results often give us a good indicated what direction will the company will take in the months ahead. With Q2 now behind us, let’s have a look at DocuSign (NASDAQ:DOCU) and its peers.

Digitization of documents was one of the first initiatives that started the digital transformation of enterprises. The growth in digital documents has enabled the possibility of shared and remote collaboration, which in turn has been driving the demand for e-signature and content management platforms.

The 15 productivity software stocks we track reported a solid Q2; on average, revenues beat analyst consensus estimates by 4.81%, while on average next quarter revenue guidance was 5.04% above consensus. The market rewarded the results with the average return the day after earnings coming in at 10.3%.

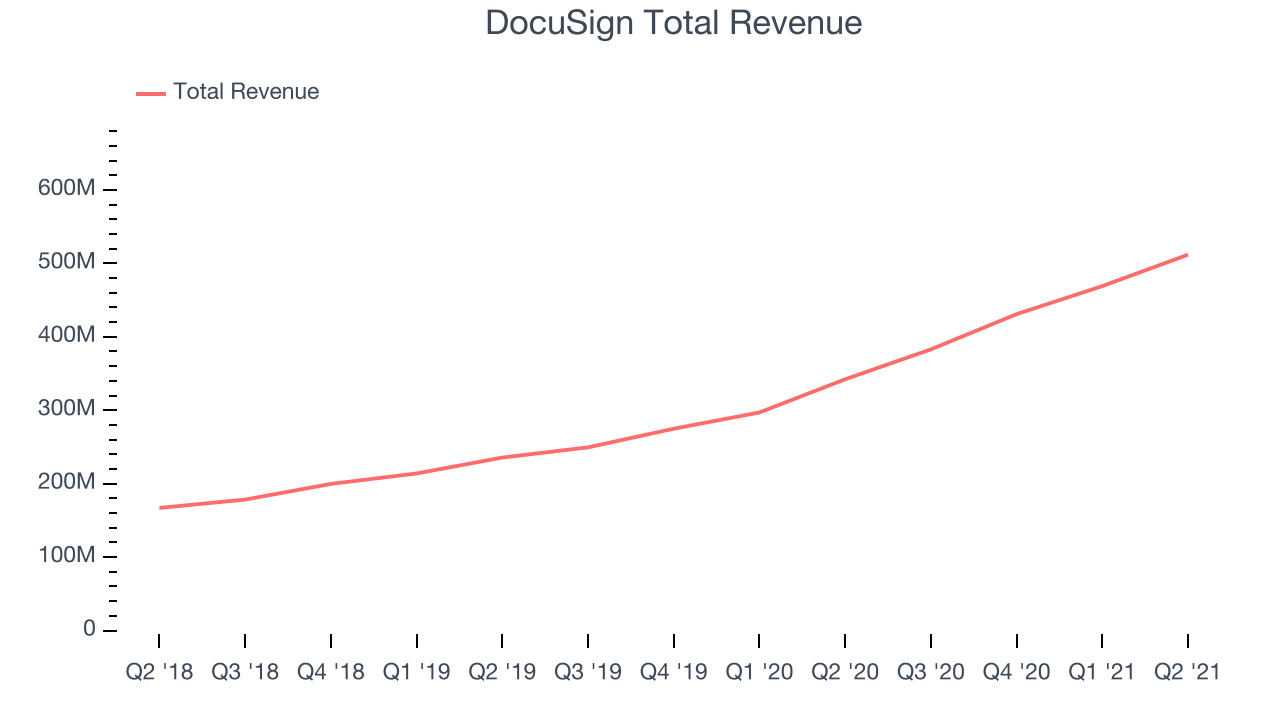

DocuSign (NASDAQ:DOCU)

Founded in 2003, DocuSign is the pioneer of e-signature and offers software as a service that allows people and organisations to sign legally binding documents electronically.

DocuSign reported revenues of $511.8 million, up 49.5% year on year, beating analyst expectations by 4.88%. It was a strong quarter for the company, with an exceptional revenue growth and a decent beat of analyst estimates.

"I'm proud of how our team has continued to stay in front of the evolving COVID business environment, helping our over one million customers and over one billion users move forward. This has driven strong performance for our business, reflected in our 50% year-over-year Q2 revenue growth," said Dan Springer, DocuSign's CEO.

The stock is up 5.39% since the results and currently trades at $258.70.

We think DocuSign is a good business, but is it a buy today? Read our full report here, it's free.

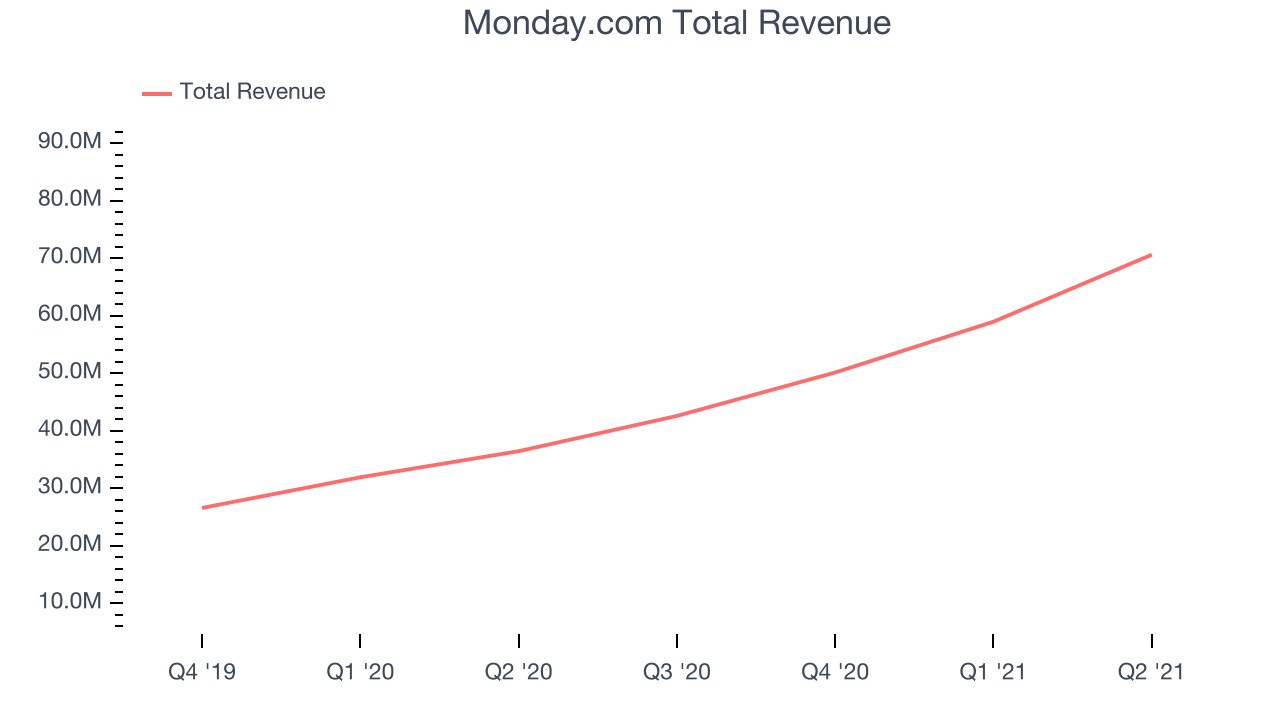

Best Q2: Monday.com (NASDAQ:MNDY)

Founded in Israel in 2014, and named after the dreaded first day of the work week, Monday.com makes software as a service platforms that helps teams plan and track work efficiently.

Monday.com reported revenues of $70.6 million, up 93.6% year on year, beating analyst expectations by 13.6%. It was a exceptional quarter for the company, with an impressive beat of analyst estimates and an exceptional revenue growth.

Monday.com achieved the strongest analyst estimates beat and fastest revenue growth among its peers. The stock is up 45.6% since the results and currently trades at $361.10.

Is now the time to buy Monday.com? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Dropbox (NASDAQ:DBX)

Founded by the long-serving CEO Drew Houston and Arash Ferdowsi in 2007, Dropbox provides a file hosting cloud platform that helps organizations collaborate and share documents.

Dropbox reported revenues of $530.6 million, up 13.5% year on year, beating analyst expectations by 1.29%. It was a weaker quarter for the company, with an improvement in gross margin but a slow revenue growth.

The stock is up 2.07% since the results and currently trades at $30.50.

Read our full analysis of Dropbox's results here.

ServiceNow (NYSE:NOW)

Founded by Fred Luddy who wrote the code for the initial prototype on a single flight from San Francisco to London, ServiceNow offers software as a service platform that helps companies become more efficient by allowing them to automate workflows across IT, HR and Customer Service.

ServiceNow reported revenues of $1.4 billion, up 31.5% year on year, beating analyst expectations by 3.5%. It was a decent quarter for the company, with a strong top line growth but a decline in gross margin.

ServiceNow achieved the fastest growth in large customers among the peers, adding 55 customers paying over $1m annually. The stock is up 0.51% since the results and currently trades at $642.40.

Read our full, actionable report on ServiceNow here, it's free.

Box (NYSE:BOX)

Founded in 2005 by Aaron Levie and Dylan Smith, Box provides organizations with software to securely store, share and collaborate around work documents in the cloud.

Box reported revenues of $214.4 million, up 11.5% year on year, in line with analyst expectations. It was a decent quarter for the company, with a meaningful improvement in gross margin but a slow revenue growth.

Box had the weakest performance against analyst estimates and slowest revenue growth among the peers. The stock is down 1.95% since the results and currently trades at $25.16.

Read our full, actionable report on Box here, it's free.

The author has no position in any of the stocks mentioned