Earnings results often give us a good indication of what direction the company will take in the months ahead. With Q2 now behind us, let’s have a look at Expedia (NASDAQ:EXPE) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 18 consumer internet stocks we track reported a slower Q2; on average, revenues were in line with analyst consensus estimates, while on average next quarter revenue guidance was 8.04% under consensus. There has been a stampede out of high valuation technology stocks as raising interest encourage investors to value profits over growth again and consumer internet stocks have not been spared, with share price down 12.5% since the previous earnings results, on average.

Best Q2: Expedia (NASDAQ:EXPE)

Originally founded as a part of Microsoft, Expedia (NASDAQ: EXPE) is one of the world’s leading online travel agencies.

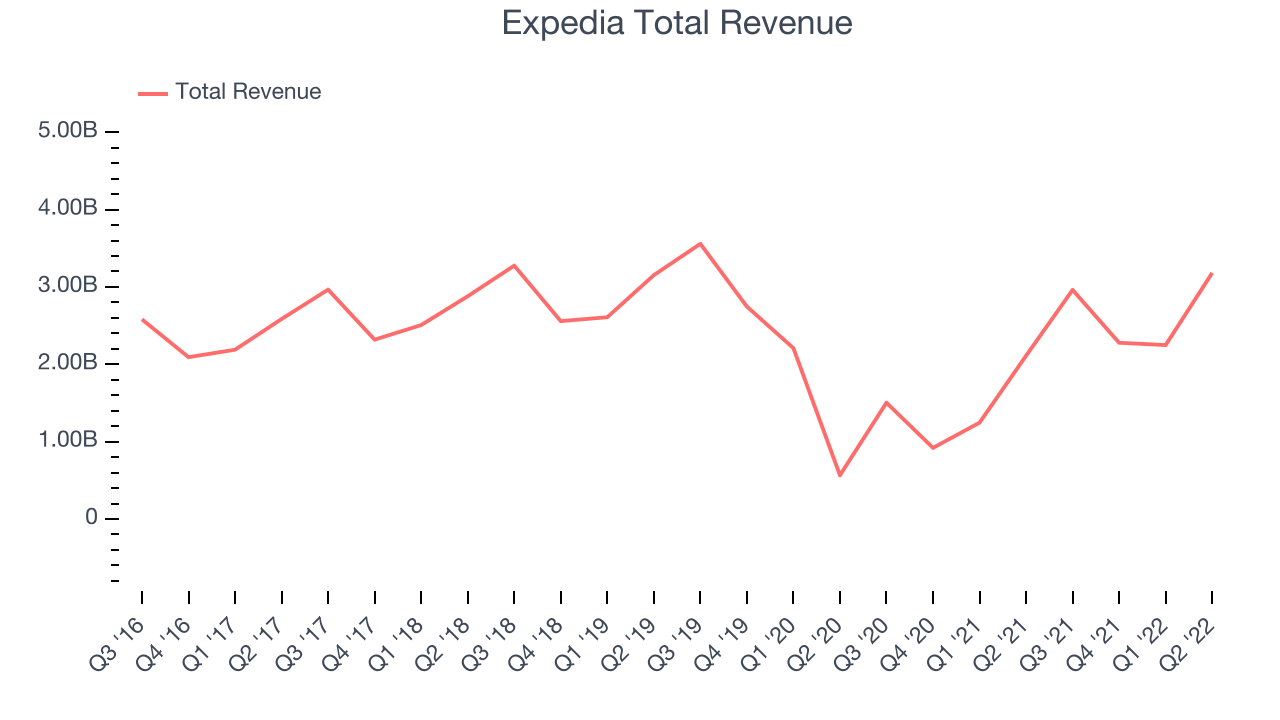

Expedia reported revenues of $3.18 billion, up 50.6% year on year, beating analyst expectations by 6.42%. It was a good quarter for the company, with exceptional revenue growth and growing number of users pointing to recovery after the pandemic.

“We are very pleased with our financial performance this quarter. Lodging bookings reached a record high, and we posted our highest ever second quarter revenue and adjusted EBITDA. These were even more noteworthy given the simplification efforts we undertook two years ago including the sale of our Egencia corporate travel business.” said Peter Kern, Vice Chairman and CEO, Expedia Group.

The stock is down 4.25% since the results and currently trades at $98.

We think Expedia is a good business, but is it a buy today? Read our full report here, it's free.

Uber (NYSE:UBER)

Born out of a winter night thought: "What if you could request a ride from your phone?" Uber (NYSE: UBER) operates a global network of on demand services, most prominently ride hailing and food delivery, and freight.

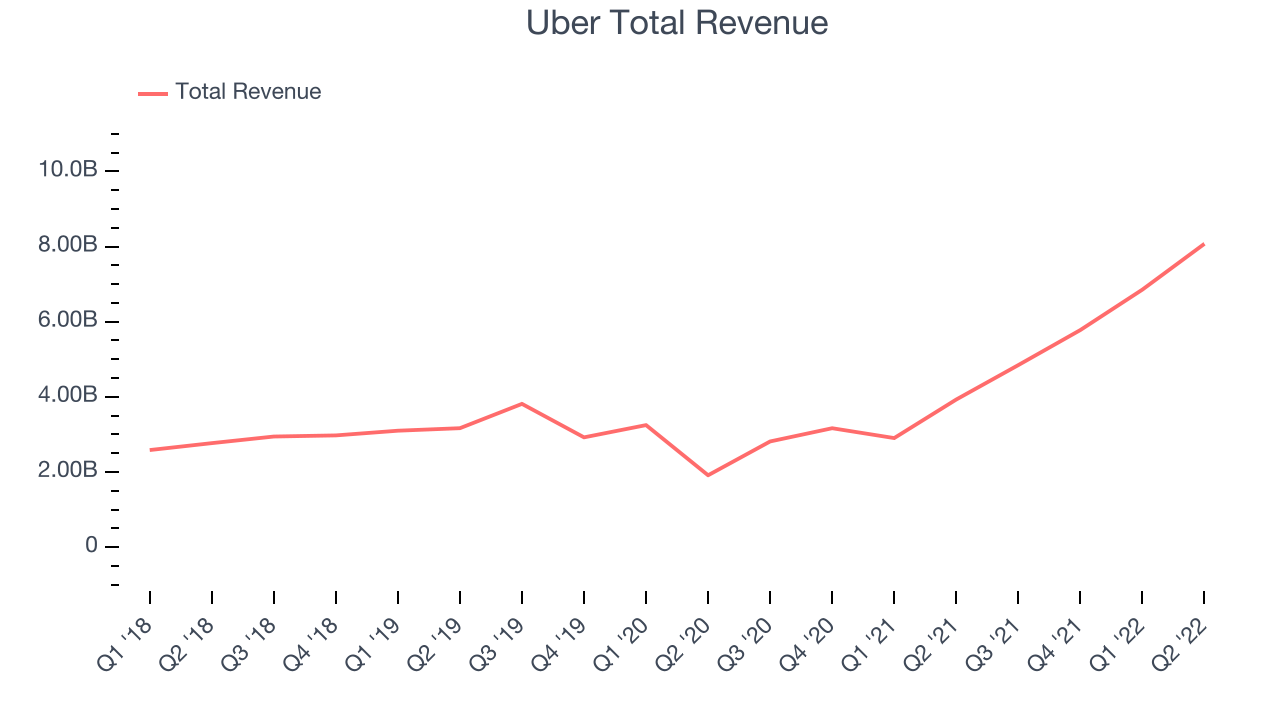

Uber reported revenues of $8.07 billion, up 105% year on year, beating analyst expectations by 9.48%. It was a very strong quarter for the company, with an exceptional revenue growth and an impressive beat of analyst estimates.

Uber delivered the strongest analyst estimates beat and fastest revenue growth among its peers. The company reported 122 million paying users, up 20.7% year on year. The stock is up 22.3% since the results and currently trades at $30.10.

Is now the time to buy Uber? Access our full analysis of the earnings results here, it's free.

Slowest Q2: Overstock (NASDAQ:OSTK)

Originally launched as a website focusing on selling clearance sale electronics and home goods merchandise, Overstock (NASDAQ: OSTK) is a leading online retailer of home goods, primarily furniture.

Overstock reported revenues of $528.1 million, down 33.6% year on year, missing analyst expectations by 12%. It was a weak quarter for the company, with declining number of users and a slow revenue growth.

Overstock had the weakest performance against analyst estimates and slowest revenue growth in the group. The company reported 6.5 million active buyers, down 29.4% year on year. The stock is down 12.2% since the results and currently trades at $24.83.

Read our full analysis of Overstock's results here.

Angi (NASDAQ:ANGI)

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

Angi reported revenues of $515.7 million, up 22.5% year on year, beating analyst expectations by 4.11%. Despite the decent beat of topline estimates, it was a slower quarter for the company, with declining number of users.

The company reported 8.49 million service requests, down 9.78% year on year. The stock is down 51.5% since the results and currently trades at $2.97.

Read our full, actionable report on Angi here, it's free.

Twitter (NYSE:TWTR)

Born out of a failed podcasting startup, Twitter (NYSE: TWTR) is the town square of the internet, one part social network, one part media distribution platform.

Twitter reported revenues of $1.17 billion, down 1.16% year on year, missing analyst expectations by 11.9%. It was a weak quarter for the company, with a slow revenue growth and a miss of the top line analyst estimates.

The company reported 237.8 million daily active users, up 15.4% year on year. The stock is up 4.03% since the results and currently trades at $41.15.

Twitter has previously entered into a definitive agreement to be acquired by Elon Musk, for $54.20 per share in cash in a transaction valued at approximately $44 billion.

Read our full, actionable report on Twitter here, it's free.

The author has no position in any of the stocks mentioned