Expedia (EXPE)

Expedia is intriguing. Although its sales growth has been weak, its profitability gives it the flexibility to ride out cycles.― StockStory Analyst Team

1. News

2. Summary

Why Expedia Is Interesting

Originally founded as a part of Microsoft, Expedia (NASDAQ:EXPE) is one of the world’s leading online travel agencies.

- Superior platform functionality and low servicing costs are reflected in its best-in-class gross margin of 89.8%

- Healthy EBITDA margin shows it’s a well-run company with efficient processes, and its rise over the last few years was fueled by some leverage on its fixed costs

- One risk is its focus on expanding its platform came at the expense of monetization as its average revenue per booking fell by 1.5% annually

Expedia has the potential to be a high-quality business. If you’re a believer, the price looks reasonable.

Why Is Now The Time To Buy Expedia?

Why Is Now The Time To Buy Expedia?

Expedia’s stock price of $248.60 implies a valuation ratio of 8.3x forward EV/EBITDA. When stacked up against other consumer internet companies, we think Expedia’s multiple is fair for the fundamentals you get.

Now could be a good time to invest if you believe in the story.

3. Expedia (EXPE) Research Report: Q4 CY2025 Update

Online travel agency Expedia (NASDAQ:EXPE) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 11.4% year on year to $3.55 billion. On top of that, next quarter’s revenue guidance ($3.35 billion at the midpoint) was surprisingly good and 3.7% above what analysts were expecting. Its non-GAAP profit of $3.78 per share was 12.2% above analysts’ consensus estimates.

Expedia (EXPE) Q4 CY2025 Highlights:

- Revenue: $3.55 billion vs analyst estimates of $3.42 billion (11.4% year-on-year growth, 3.8% beat)

- Adjusted EPS: $3.78 vs analyst estimates of $3.37 (12.2% beat)

- Adjusted EBITDA: $848 million vs analyst estimates of $760.6 million (23.9% margin, 11.5% beat)

- Revenue Guidance for Q1 CY2026 is $3.35 billion at the midpoint, above analyst estimates of $3.23 billion

- Operating Margin: 11.8%, up from 6.8% in the same quarter last year

- Free Cash Flow was $119 million, up from -$686 million in the previous quarter

- Room Nights Booked: 94 million, up 7.6 million year on year

- Market Capitalization: $28.62 billion

Company Overview

Originally founded as a part of Microsoft, Expedia (NASDAQ:EXPE) is one of the world’s leading online travel agencies.

Expedia owns a wide portfolio of online travel brands, and owns stakes in many others. Its core Expedia site is a full service online travel agency (OTA) featuring airfare, lodging, car rentals, cruises, and insurance. Hotels.com is focused exclusively on hotels globally, Vrbo (previously HomeAway) is Expedia’s alternative accommodations property. Other properties include Orbitz, CheapTickets, Travelocity and business travel unit Egencia. Expedia also owns a majority stake in trivago, a hotel metasearch company, that generates revenues through advertising.

For consumers, Expedia simplifies planning travel, by aggregating supply of hotels, flights, and experiences and using its scale and rewards programs to offer the best prices, while for suppliers, Expedia delivers one of the largest audiences of travel shoppers online.

Historically, Expedia has held its largest market share in North America, specifically in Hotels, while it has long sought to take market share from market leader Booking.com and Priceline in Europe. It acquired HomeAway in recent years and has begun building up an alternative accommodations business to compete with AirBnB.

4. Online Travel

Because of the enormous number of flights, hotels, and accommodations available, travel is a natural fit for marketplaces that aggregate suppliers, simplifying the shopping process for consumers. Online travel platforms today make up over 50% of the industry’s bookings, a percentage that has been rising for 20 years, and will likely continue in the years ahead.

Expedia (NASDAQ:EXPE) competes with a range of online travel companies such as Booking Holdings (NASDAQ:BKNG), Airbnb (NASDAQ:ABNB), TripAdvisor (NASDAQ:TRIP), Trivago (NASDAQ:TRIV) and Alphabet (NASDAQ:GOOG.L).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Expedia’s sales grew at a mediocre 8.1% compounded annual growth rate over the last three years. This wasn’t a great result compared to the rest of the consumer internet sector, but there are still things to like about Expedia.

This quarter, Expedia reported year-on-year revenue growth of 11.4%, and its $3.55 billion of revenue exceeded Wall Street’s estimates by 3.8%. Company management is currently guiding for a 12% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.5% over the next 12 months, a slight deceleration versus the last three years. This projection doesn't excite us and indicates its products and services will see some demand headwinds. At least the company is tracking well in other measures of financial health.

6. Room Nights Booked

Booking Growth

As an online travel company, Expedia generates revenue growth by increasing both the number of stays (or experiences) booked and the commission charged on those bookings.

Over the last two years, Expedia’s room nights booked, a key performance metric for the company, increased by 8.9% annually to 94 million in the latest quarter. This growth rate is decent for a consumer internet business and indicates people enjoy using its offerings.

In Q4, Expedia added 7.6 million room nights booked, leading to 8.8% year-on-year growth. The quarterly print isn’t too different from its two-year result, suggesting its new initiatives aren’t accelerating booking growth just yet.

Revenue Per Booking

Average revenue per booking (ARPB) is a critical metric to track because it not only measures how much users book on its platform but also the commission that Expedia can charge.

Expedia’s ARPB fell over the last two years, averaging 1.5% annual declines. This isn’t great, but the increase in room nights booked is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Expedia tries boosting ARPB by taking a more aggressive approach to monetization, it’s unclear whether bookings can continue growing at the current pace.

This quarter, Expedia’s ARPB clocked in at $37.73. It grew by 2.4% year on year, slower than its booking growth.

7. Gross Margin & Pricing Power

A company’s gross profit margin has a significant impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors can determine the winner in a competitive market.

For online travel businesses like Expedia, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include customer support, payment processing, fulfillment fees (paid to the airlines, hotels, or car rental companies), and data center expenses to keep the app or website online.

Expedia’s gross margin is one of the highest in the consumer internet sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in product and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 89.8% gross margin over the last two years. That means Expedia only paid its providers $10.20 for every $100 in revenue.

Expedia produced a 90.2% gross profit margin in Q4, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

8. User Acquisition Efficiency

Consumer internet businesses like Expedia grow from a combination of product virality, paid advertisement, and incentives (unlike enterprise software products, which are often sold by dedicated sales teams).

It’s very expensive for Expedia to acquire new users as the company has spent 61% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates a highly competitive environment with little differentiation between Expedia and its peers.

9. EBITDA

EBITDA is a good way of judging operating profitability for consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a more standardized view of the business’s profit potential.

Expedia has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 22.6%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Expedia’s EBITDA margin rose by 3.6 percentage points over the last few years, as its sales growth gave it operating leverage.

This quarter, Expedia generated an EBITDA margin profit margin of 23.9%, up 3.7 percentage points year on year. The increase was encouraging, and because its EBITDA margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

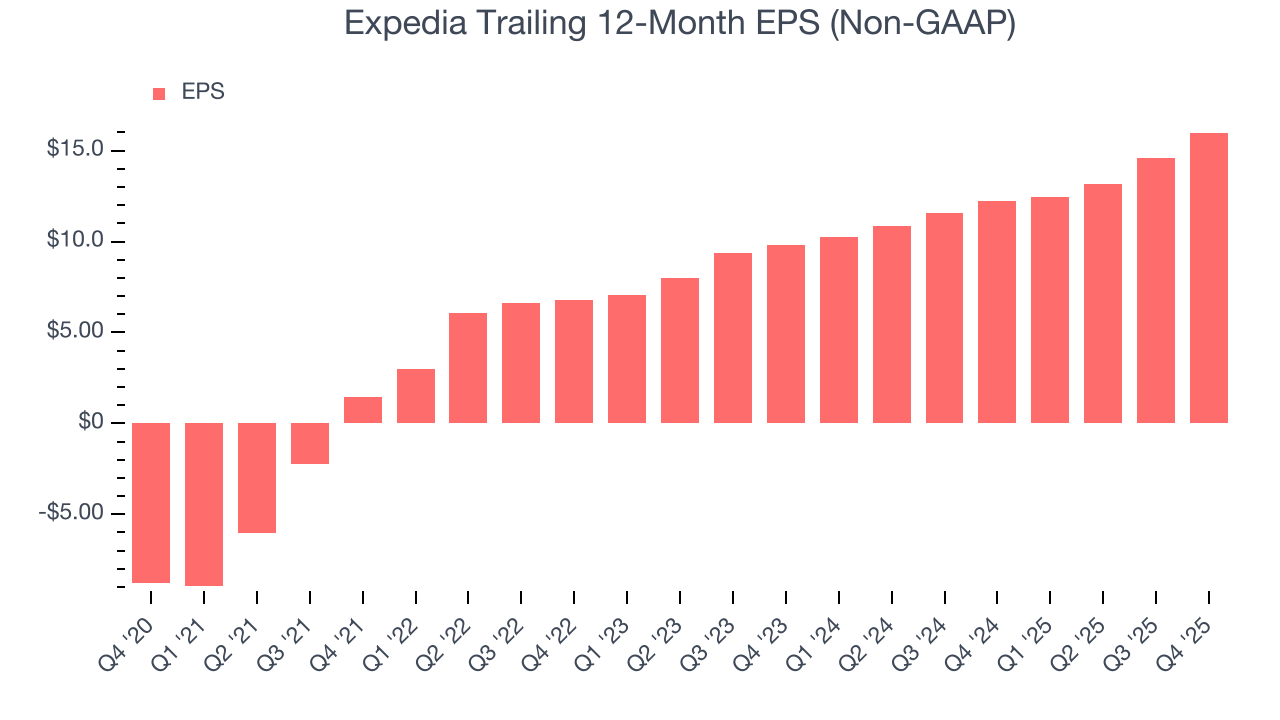

10. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Expedia’s EPS grew at an astounding 33% compounded annual growth rate over the last three years, higher than its 8.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of Expedia’s earnings can give us a better understanding of its performance. As we mentioned earlier, Expedia’s EBITDA margin expanded by 3.6 percentage points over the last three years. On top of that, its share count shrank by 19.6%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, Expedia reported adjusted EPS of $3.78, up from $2.39 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Expedia’s full-year EPS of $15.99 to grow 15.3%.

11. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Expedia has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors while maintaining a cash cushion. The company’s free cash flow margin averaged 19.1% over the last two years, quite impressive for a consumer internet business.

Taking a step back, we can see that Expedia’s margin dropped by 2.7 percentage points over the last few years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity. We’re willing to give the company some leeway give it’s one of the more cash generative and investable businesses in its space.

Expedia’s free cash flow clocked in at $119 million in Q4, equivalent to a 3.4% margin. This result was good as its margin was 3.1 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

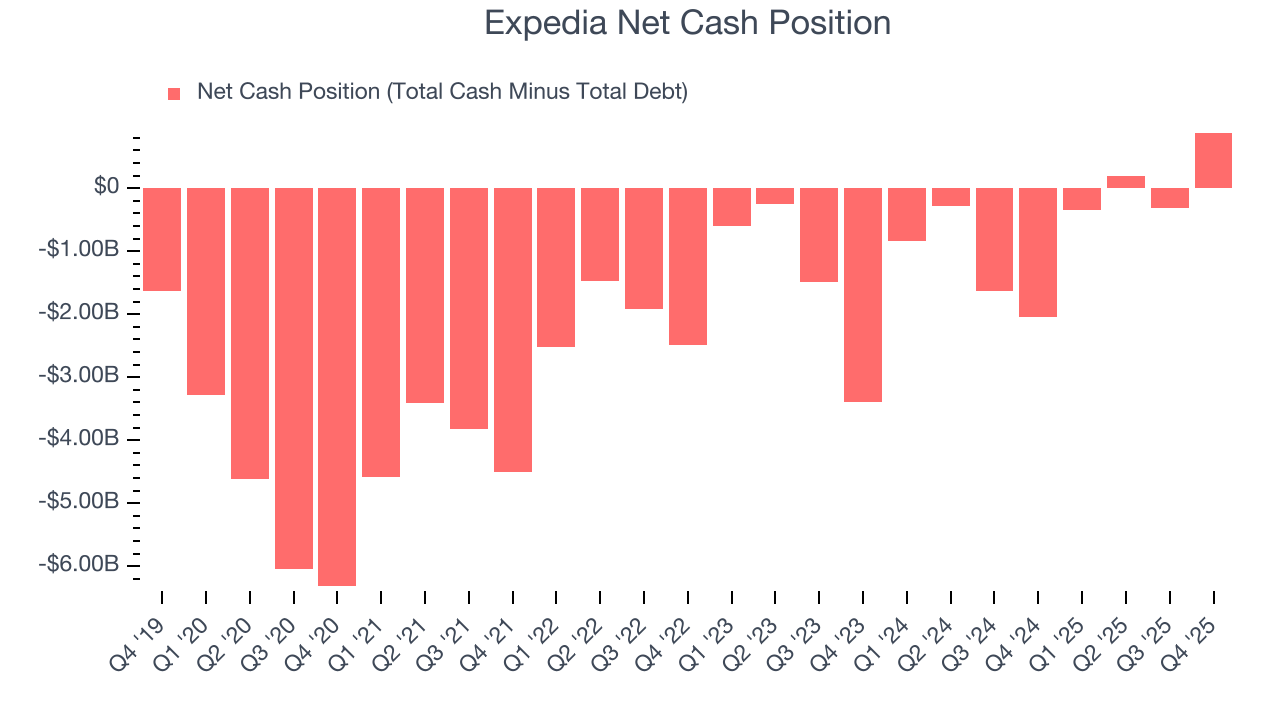

12. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Expedia is a profitable, well-capitalized company with $7.30 billion of cash and $6.42 billion of debt on its balance sheet. This $881 million net cash position is 3.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Expedia’s Q4 Results

We were impressed by how significantly Expedia blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The market seemed to be hoping for more, and the stock traded down 1.8% to $224.57 immediately after reporting.

14. Is Now The Time To Buy Expedia?

Updated: March 8, 2026 at 10:39 PM EDT

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Expedia.

Expedia is a fine business. Although its revenue growth was mediocre over the last three years, its admirable gross margins are a wonderful starting point for the overall profitability of the business. And while its ARPU has declined over the last two years, its impressive EBITDA margins show it has a highly efficient business model.

Expedia’s EV/EBITDA ratio based on the next 12 months is 8.3x. Looking at the consumer internet space right now, Expedia trades at a compelling valuation. If you believe in the company and its growth potential, now is an opportune time to buy shares.

Wall Street analysts have a consensus one-year price target of $280.85 on the company (compared to the current share price of $248.60), implying they see 13% upside in buying Expedia in the short term.