Marriott (MAR)

We wouldn’t recommend Marriott. Its weak sales growth and low returns on capital show it struggled to generate demand and profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Marriott Will Underperform

Founded by J. Willard Marriott in 1927, Marriott International (NASDAQ:MAR) is a global hospitality company with a portfolio of over 7,000 properties and 30 brands, spanning 130+ countries and territories.

- Scale is a double-edged sword because it limits the company’s growth potential compared to its smaller competitors, as reflected in its below-average annual revenue increases of 19.9% for the last five years

- Ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 9% for the last two years

- Softer revenue per room over the past two years suggests it might have to invest in new amenities such as restaurants and bars to attract customers

Marriott’s quality doesn’t meet our hurdle. There are better opportunities in the market.

Why There Are Better Opportunities Than Marriott

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Marriott

At $355 per share, Marriott trades at 30.7x forward P/E. Not only does Marriott trade at a premium to companies in the consumer discretionary space, but this multiple is also high for its top-line growth.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Marriott (MAR) Research Report: Q4 CY2025 Update

Global hospitality company Marriott (NASDAQ:MAR) met Wall Street’s revenue expectations in Q4 CY2025, with sales up 4.1% year on year to $6.69 billion. Its non-GAAP profit of $2.58 per share was 1.5% below analysts’ consensus estimates.

Marriott (MAR) Q4 CY2025 Highlights:

- Revenue: $6.69 billion vs analyst estimates of $6.69 billion (4.1% year-on-year growth, in line)

- Adjusted EPS: $2.58 vs analyst expectations of $2.62 (1.5% miss)

- Adjusted EBITDA: $1.40 billion vs analyst estimates of $1.39 billion (21% margin, 0.9% beat)

- Adjusted EPS guidance for the upcoming financial year 2026 is $11.45 at the midpoint, in line with analyst estimates

- EBITDA guidance for the upcoming financial year 2026 is $5.89 billion at the midpoint, above analyst estimates of $5.72 billion

- Operating Margin: 11.6%, in line with the same quarter last year

- RevPAR: $182.43 at quarter end, up 44.7% year on year

- Market Capitalization: $88.88 billion

Company Overview

Founded by J. Willard Marriott in 1927, Marriott International (NASDAQ:MAR) is a global hospitality company with a portfolio of over 7,000 properties and 30 brands, spanning 130+ countries and territories.

Marriott’s global presence is divided among 30+ hotel brands, catering to a wide range of traveler needs, preferences, and budgets. At the luxury end, Marriott offers iconic brands like The Ritz-Carlton, St. Regis, and JW Marriott. In the premium segment, brands like Marriott Hotels, Sheraton, and Renaissance Hotels provide sophisticated and thoughtful amenities for business and leisure travelers. Additionally, the company's select-service brands, such as Courtyard, Fairfield by Marriott, and Moxy Hotels, offer more affordable options for those who want convenience and cleanliness without breaking the bank.

Because the company operates in a competitive industry, personalized guest experiences are central to Marriott's customer acquisition and retention efforts. At the heart of this is the Marriott Bonvoy loyalty program that digitizes much of the guest experience for maximum convenience and offers perks such as upgrades, member-exclusive rates, and points that can be redeemed for meals and services.

Marriott's go-to-market and growth strategy includes a mix of franchised and owned-and-operated properties. This mix results in advantages such as an asset-light model (since franchise partners assume much of the investment costs) and more flexibility to expand in certain geographies with partners who know their locales best.

4. Travel and Vacation Providers

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

Marriott International's primary competitors include Hilton Worldwide (NYSE:HLT), InterContinental Hotels Group (NYSE:IHG), Hyatt Hotels (NYSE:H), Wyndham Hotels & Resorts (NYSE:WH), and Accor (EPA:AC).

5. Revenue Growth

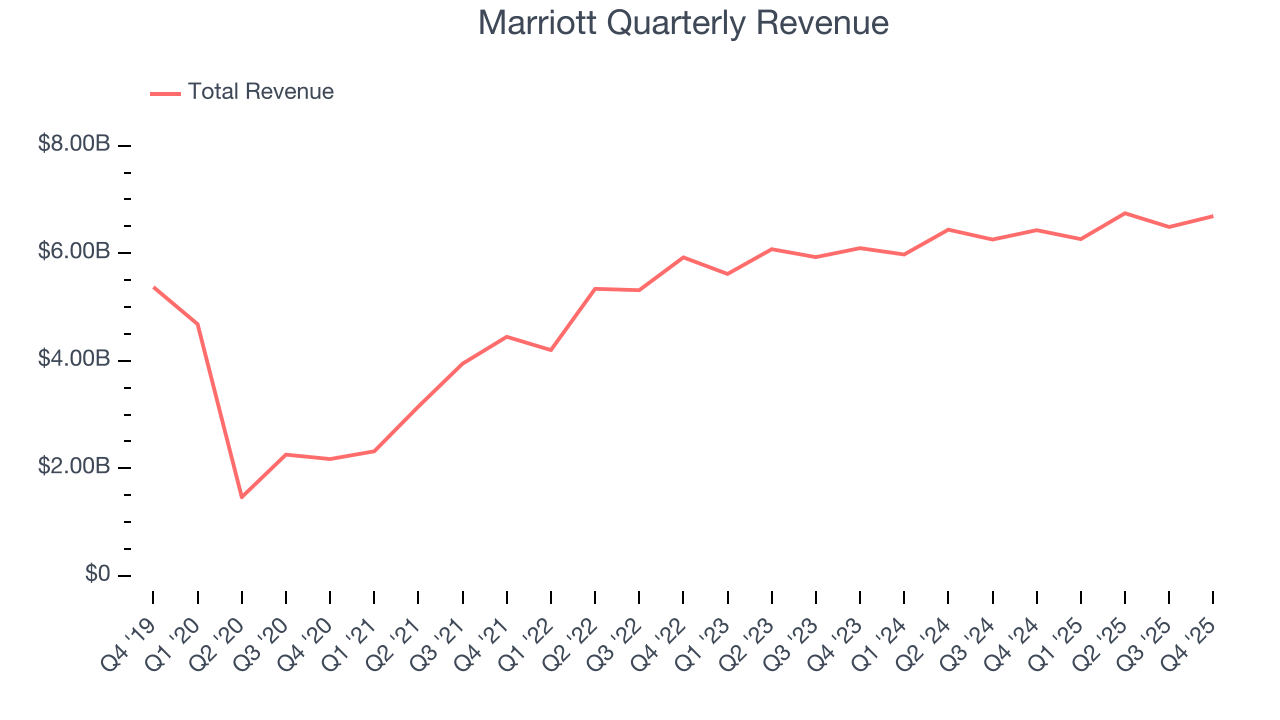

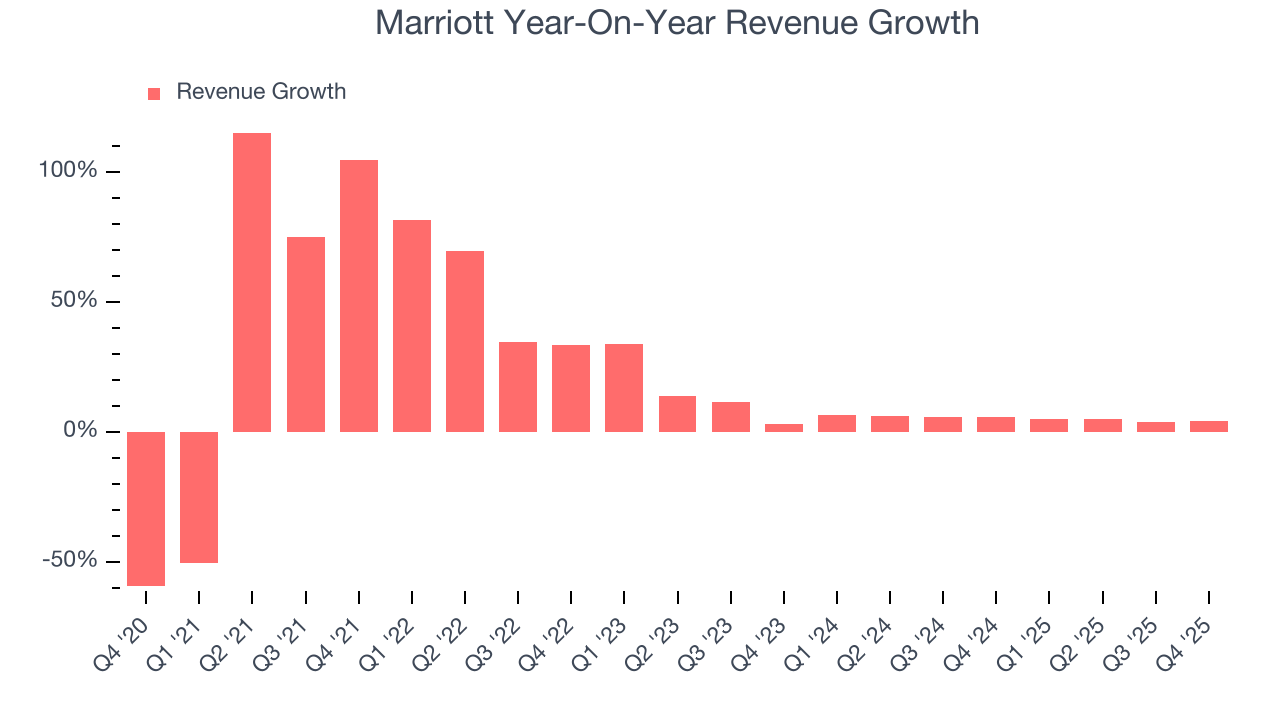

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Marriott grew its sales at a 19.9% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new property or trend. Marriott’s recent performance shows its demand has slowed as its annualized revenue growth of 5.1% over the last two years was below its five-year trend.

Marriott also reports revenue per available room, which clocked in at $182.43 this quarter and is a key metric accounting for daily rates and occupancy levels. Over the last two years, Marriott’s revenue per room averaged 6.2% year-on-year growth. This number doesn’t surprise us as it’s in line with its revenue growth.

This quarter, Marriott grew its revenue by 4.1% year on year, and its $6.69 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5.5% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not catalyze better top-line performance yet.

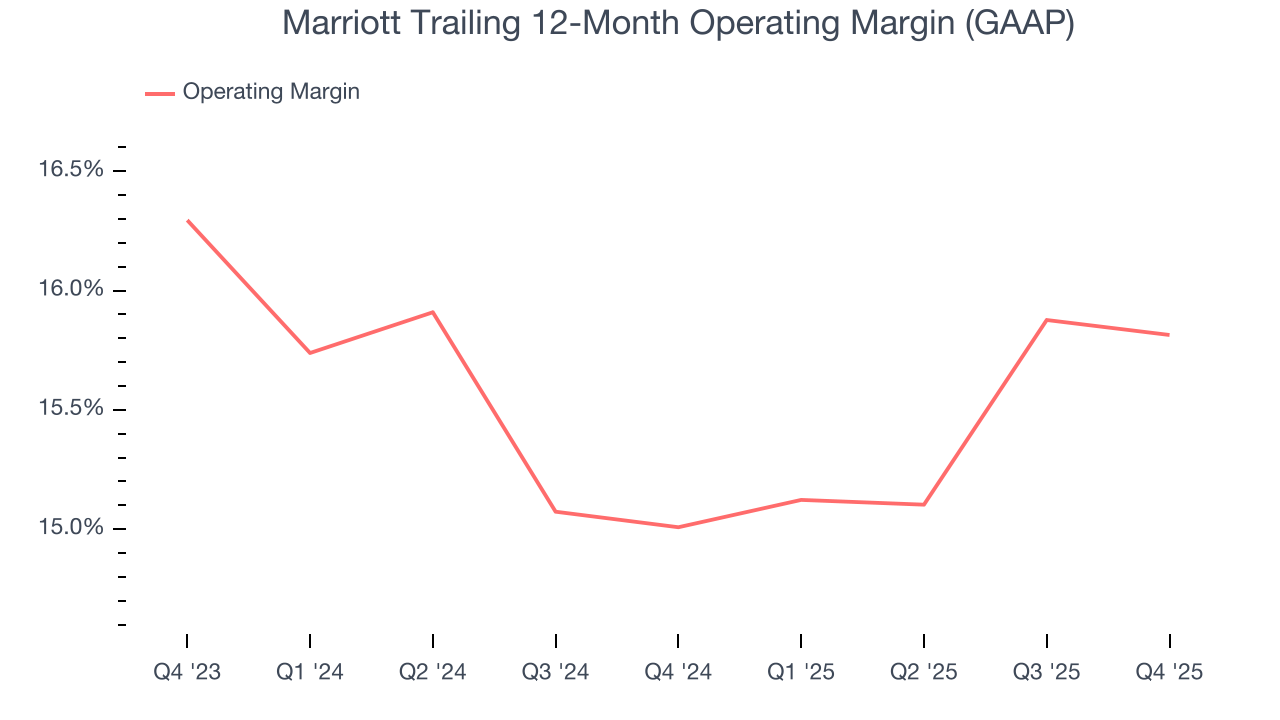

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Marriott’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 15.4% over the last two years. This profitability was inadequate for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, Marriott generated an operating margin profit margin of 11.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

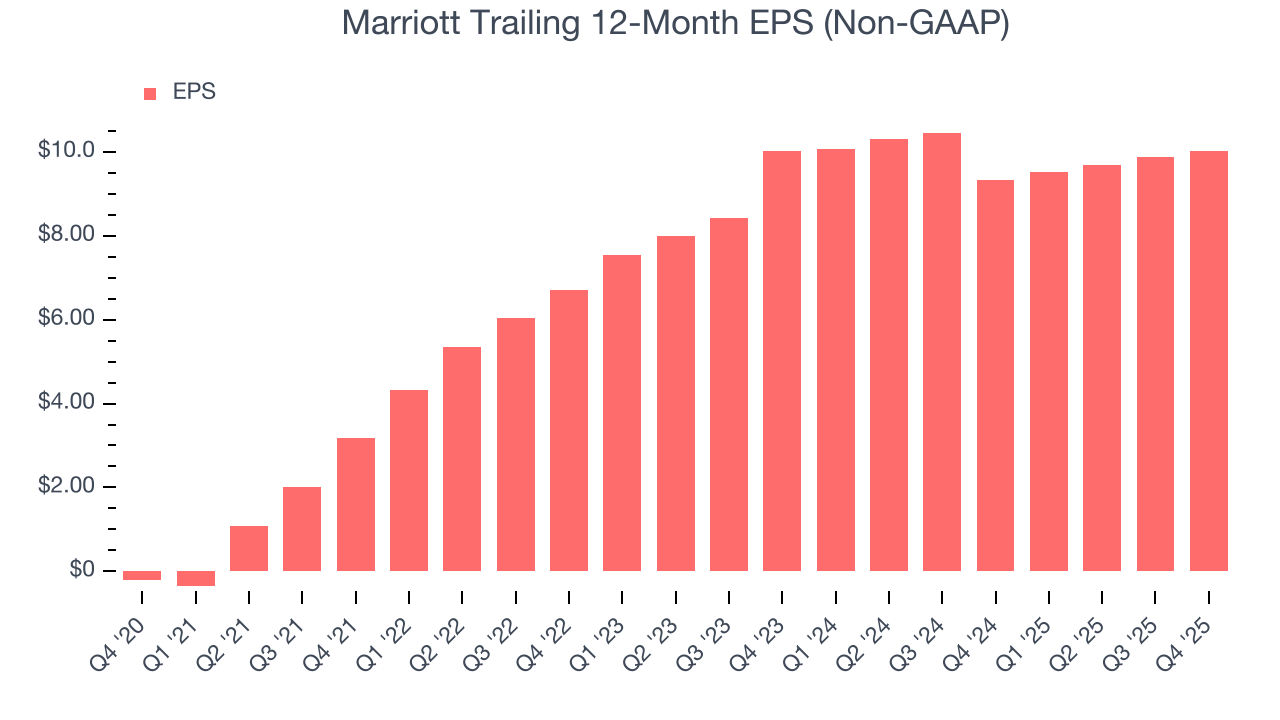

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Marriott’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Marriott reported adjusted EPS of $2.58, up from $2.45 in the same quarter last year. Despite growing year on year, this print slightly missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Marriott’s full-year EPS of $10.02 to grow 13.6%.

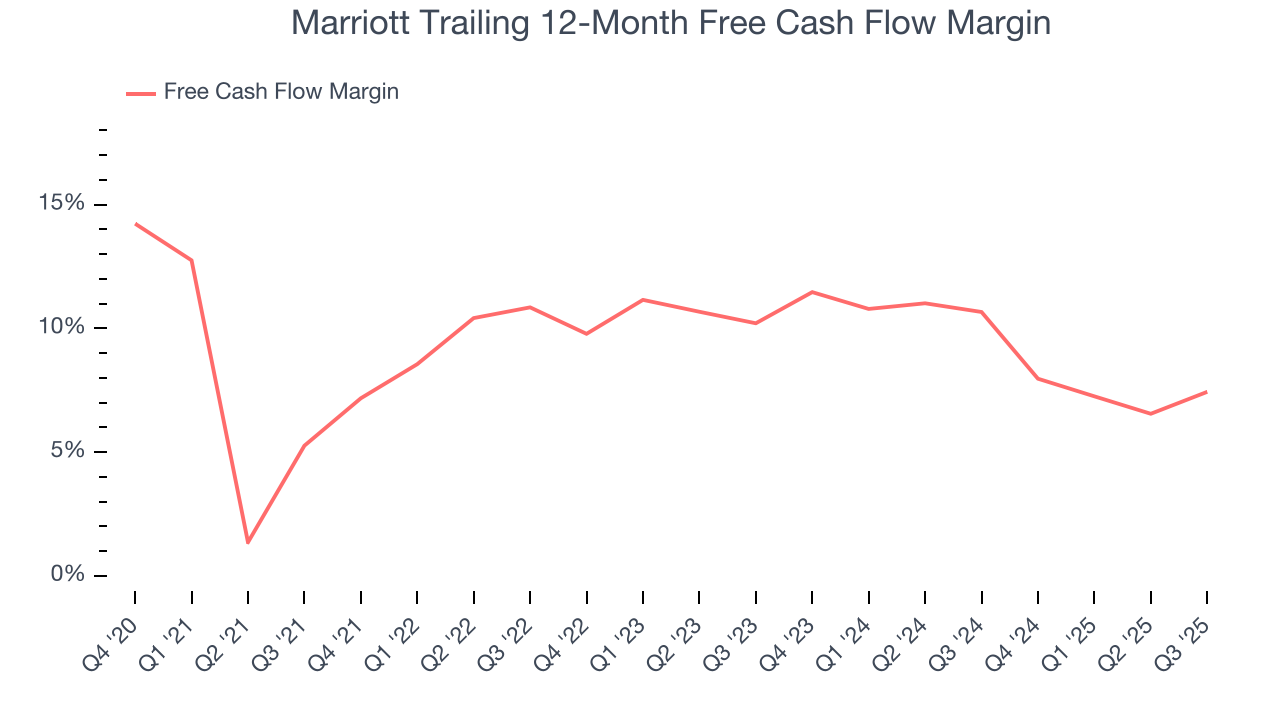

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Marriott has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 8.9%, lousy for a consumer discretionary business.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Marriott historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 29.1%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Marriott’s ROIC has increased over the last few years. This is a good sign, and we hope the company can continue improving.

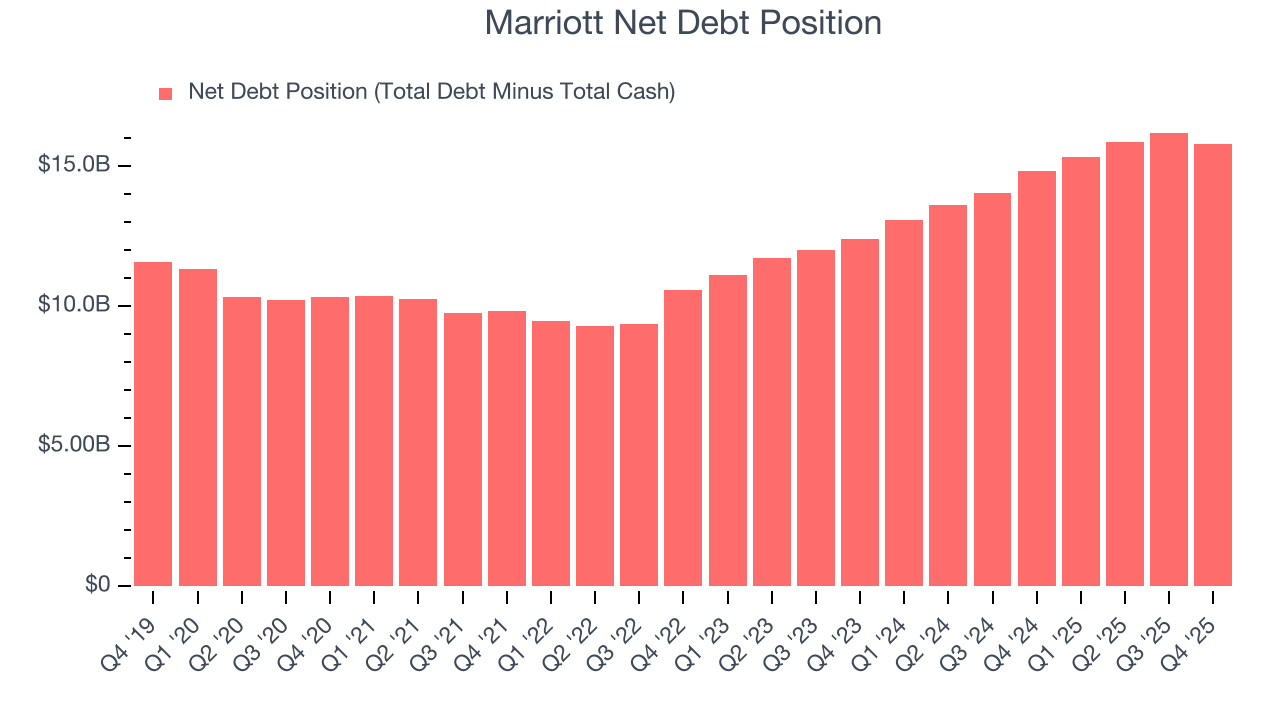

10. Balance Sheet Assessment

Marriott reported $400 million of cash and $16.2 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $5.38 billion of EBITDA over the last 12 months, we view Marriott’s 2.9× net-debt-to-EBITDA ratio as safe. We also see its $767 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Marriott’s Q4 Results

It was encouraging to see Marriott’s full-year EBITDA guidance beat analysts’ expectations. We were also glad its EBITDA guidance for next quarter slightly exceeded Wall Street’s estimates. On the other hand, its EPS missed. Zooming out, we think this was a mixed quarter. The stock traded up 3.4% to $342.47 immediately after reporting.

12. Is Now The Time To Buy Marriott?

Updated: February 16, 2026 at 10:20 PM EST

When considering an investment in Marriott, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We cheer for all companies serving everyday consumers, but in the case of Marriott, we’ll be cheering from the sidelines. While its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its Forecasted free cash flow margin suggests the company will ramp up its investments next year. On top of that, its revenue per room has disappointed.

Marriott’s P/E ratio based on the next 12 months is 30.7x. This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $351.28 on the company (compared to the current share price of $355).