Airbnb (ABNB)

Airbnb is an exciting business. Its efficient marketing engine and robust unit economics tee it up for immense long-term profits.― StockStory Analyst Team

1. News

2. Summary

Why We Like Airbnb

Founded by Brian Chesky and Joe Gebbia in their San Francisco apartment, Airbnb (NASDAQ:ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

- Successful business model is illustrated by its impressive EBITDA margin

- Strong free cash flow margin of 39% gives it the option to reinvest, repurchase shares, or pay dividends

- Platform is difficult to replicate at scale and leads to a top-tier gross margin of 83%

Airbnb is a market leader. The valuation looks reasonable based on its quality, so this might be a favorable time to invest in some shares.

Why Is Now The Time To Buy Airbnb?

Why Is Now The Time To Buy Airbnb?

Airbnb’s stock price of $134.44 implies a valuation ratio of 15.6x forward EV/EBITDA. Scanning the consumer internet landscape, we think this multiple is reasonable - arguably even attractive - for the quality you get.

Entry price matters far less than business fundamentals if you’re investing for a multi-year period. But if you can get a bargain price it’s certainly icing on the cake.

3. Airbnb (ABNB) Research Report: Q4 CY2025 Update

Online accommodations platform Airbnb (NASDAQ:ABNB) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 12% year on year to $2.78 billion. Guidance for next quarter’s revenue was optimistic at $2.61 billion at the midpoint, 3% above analysts’ estimates. Its GAAP profit of $0.56 per share was 15.6% below analysts’ consensus estimates.

Airbnb (ABNB) Q4 CY2025 Highlights:

- Revenue: $2.78 billion vs analyst estimates of $2.72 billion (12% year-on-year growth, 2.3% beat)

- EPS (GAAP): $0.56 vs analyst expectations of $0.66 (15.6% miss)

- Adjusted EBITDA: $786 million vs analyst estimates of $765.4 million (28.3% margin, 2.7% beat)

- Revenue Guidance for Q1 CY2026 is $2.61 billion at the midpoint, above analyst estimates of $2.54 billion

- Adjusted EBITDA Margin Guidance for Q1 CY2026 is in line with the same period last year, in line with analyst estimates

- Operating Margin: 9.7%, down from 17.3% in the same quarter last year

- Free Cash Flow Margin: 18.8%, down from 32.9% in the previous quarter

- Nights and Experiences Booked: 121.9 million, up 10.9 million year on year (beat)

- Market Capitalization: $72.49 billion

Company Overview

Founded by Brian Chesky and Joe Gebbia in their San Francisco apartment, Airbnb (NASDAQ:ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

Airbnb was founded on the premise that the travel industry had become commoditized into offering standardized accommodations in crowded hotel districts around landmarks and attractions. The founders' view was that a one-size-fits-all approach limited how much of the world a person could access, leaving guests feeling like outsiders in the places they visit. Airbnb solved this by enabling home sharing globally, creating a new category of travel.

Airbnb’s platform also opened up a whole new revenue stream to thousands of people around the world; earning money on spare rooms. For hosts, Airbnb provided them with an aggregation platform that brought global demand to their doorsteps while providing pricing, scheduling, liability protection, and merchandising functionality to remove the friction from bringing their inventory online. As the company has grown, it has expanded beyond its core of home-sharing into private vacation rentals, longer-term rentals (30+ days), and experiences, where hosts can earn money by organizing activities such as a city tour or wine tasting.

Airbnb generates revenue by taking a cut of each transaction, or booking, on its platform. This marketplace model is quite lucrative because it is asset-lite, meaning few capital expenditures are necessary to maintain the quality of its offerings.

4. Online Travel

Because of the enormous number of flights, hotels, and accommodations available, travel is a natural fit for marketplaces that aggregate suppliers, simplifying the shopping process for consumers. Online travel platforms today make up over 50% of the industry’s bookings, a percentage that has been rising for 20 years, and will likely continue in the years ahead.

Airbnb (NASDAQ:ABNB) competes with a range of online travel companies such as Booking Holdings (NASDAQ:BKNG), Expedia (NASDAQ:EXPE), TripAdvisor (NASDAQ:TRIP), Trivago (NASDAQ:TRIV) and Alphabet (NASDAQ:GOOG.L).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, Airbnb’s sales grew at a decent 13.4% compounded annual growth rate over the last three years. Its growth was slightly above the average consumer internet company and shows its offerings resonate with customers.

This quarter, Airbnb reported year-on-year revenue growth of 12%, and its $2.78 billion of revenue exceeded Wall Street’s estimates by 2.3%. Company management is currently guiding for a 14.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.5% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and indicates its products and services will face some demand challenges. At least the company is tracking well in other measures of financial health.

6. Nights And Experiences Booked

Booking Growth

As an online travel company, Airbnb generates revenue growth by increasing both the number of stays (or experiences) booked and the commission charged on those bookings.

Over the last two years, Airbnb’s nights and experiences booked, a key performance metric for the company, increased by 9.1% annually to 121.9 million in the latest quarter. This growth rate is solid for a consumer internet business and indicates people are excited about its offerings.

In Q4, Airbnb added 10.9 million nights and experiences booked, leading to 9.8% year-on-year growth. The quarterly print isn’t too different from its two-year result, suggesting its new initiatives aren’t accelerating booking growth just yet.

Revenue Per Booking

Average revenue per booking (ARPB) is a critical metric to track because it not only measures how much users book on its platform but also the commission that Airbnb can charge.

Airbnb’s ARPB growth has been subpar over the last two years, averaging 2%. This isn’t great, but the increase in nights and experiences booked is more relevant for assessing long-term business potential. We’ll monitor the situation closely; if Airbnb tries boosting ARPB by taking a more aggressive approach to monetization, it’s unclear whether bookings can continue growing at the current pace.

This quarter, Airbnb’s ARPB clocked in at $22.79. It grew by 2% year on year, slower than its booking growth.

7. Gross Margin & Pricing Power

A company’s gross profit margin has a significant impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors can determine the winner in a competitive market.

For online travel businesses like Airbnb, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include customer support, payment processing, fulfillment fees (paid to the airlines, hotels, or car rental companies), and data center expenses to keep the app or website online.

Airbnb’s gross margin is one of the best in the consumer internet sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 83% gross margin over the last two years. That means Airbnb only paid its providers $16.98 for every $100 in revenue.

This quarter, Airbnb’s gross profit margin was 82.5%, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

8. User Acquisition Efficiency

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like Airbnb grow from a combination of product virality, paid advertisement, and incentives.

Airbnb is very efficient at acquiring new users, spending only 26.8% of its gross profit on sales and marketing expenses over the last year. This efficiency indicates that it has a highly differentiated product offering and strong brand reputation from scale, giving Airbnb the freedom to invest its resources into new growth initiatives while maintaining optionality.

9. EBITDA

Airbnb’s EBITDA margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 35.7% over the last two years. This profitability was elite for a consumer internet business thanks to its efficient cost structure and economies of scale. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Airbnb’s EBITDA margin might fluctuated slightly but has generally stayed the same over the last few years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Airbnb generated an EBITDA margin profit margin of 28.3%, down 2.6 percentage points year on year. Since Airbnb’s EBITDA margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

10. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Airbnb’s solid 13.2% annual EPS growth over the last three years aligns with its revenue performance. This tells us its incremental sales were profitable.

In Q4, Airbnb reported EPS of $0.56, down from $0.72 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Airbnb’s full-year EPS of $4.04 to grow 19.1%.

11. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Airbnb has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging an eye-popping 39% over the last two years.

Taking a step back, we can see that Airbnb’s margin dropped by 2.9 percentage points over the last few years. Rising cash conversion would be ideal, but we’re willing to live with Airbnb’s performance for now because it’s still one of the more cash generative and investable businesses in its space. If its declines continue, it could signal increasing investment needs and capital intensity.

Airbnb’s free cash flow clocked in at $521 million in Q4, equivalent to a 18.8% margin. This cash profitability was in line with the comparable period last year but below its two-year average. We wouldn’t put too much weight on it because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

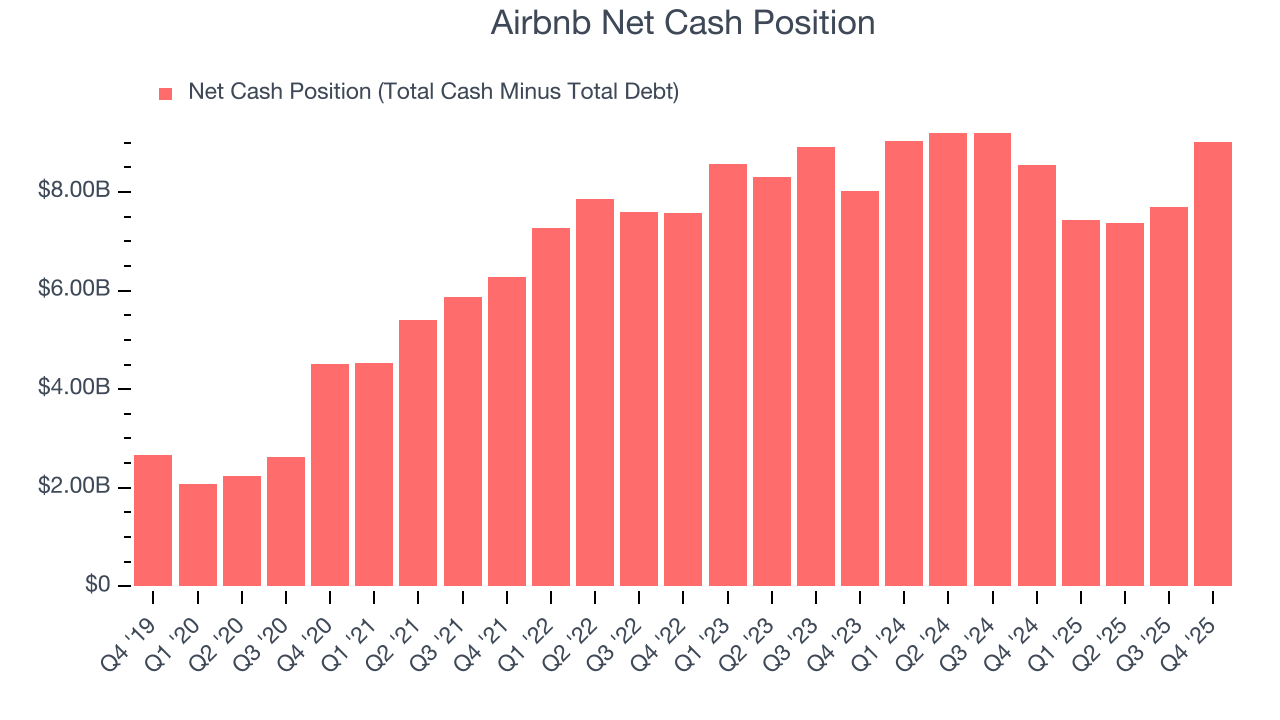

12. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Airbnb is a profitable, well-capitalized company with $11.01 billion of cash and $2.00 billion of debt on its balance sheet. This $9.02 billion net cash position is 12.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from Airbnb’s Q4 Results

It was encouraging to see Airbnb’s revenue guidance for next quarter beat analysts’ expectations. We were also happy its Nights & Experiences book, revenue, and EBITDA outperformed Wall Street’s estimates in the quarter. Overall, we think this was a decent good with some key metrics above expectations. The stock traded up 2.2% to $118.54 immediately after reporting.

14. Is Now The Time To Buy Airbnb?

Updated: February 27, 2026 at 9:27 PM EST

Before investing in or passing on Airbnb, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

There are multiple reasons why we think Airbnb is an amazing business. First of all, the company’s revenue growth was good over the last three years. On top of that, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, and its impressive EBITDA margins show it has a highly efficient business model.

Airbnb’s EV/EBITDA ratio based on the next 12 months is 15.6x. Scanning the consumer internet space today, Airbnb’s fundamentals really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $144.31 on the company (compared to the current share price of $134.44), implying they see 7.3% upside in buying Airbnb in the short term.