Semiconductor Manufacturing Stocks Q1 Recap: Benchmarking FormFactor (NASDAQ:FORM)

Petr Huřťák /

June 26, 2023

As semiconductor manufacturing stocks’ Q1 earnings season wraps, let's dig into this quarter's best and worst performers, including FormFactor (NASDAQ:FORM) and its peers.

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers and data storage. The growth of data and technologies like artificial intelligence, 5G networks and smart cars are also creating a next wave of growth for the industry. To keep up with ever changing customer needs requires new tools that can design, fabricate and test at ever smaller sizes and more complex architectures, and that is driving the demand for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 3.16%, while on average next quarter revenue guidance was 1.49% under consensus. Investors abandoned cash burning companies since high interest rates will make it harder to raise capital, but semiconductor manufacturing stocks held their ground better than others, with the share prices up 17.3% since the previous earnings results, on average.

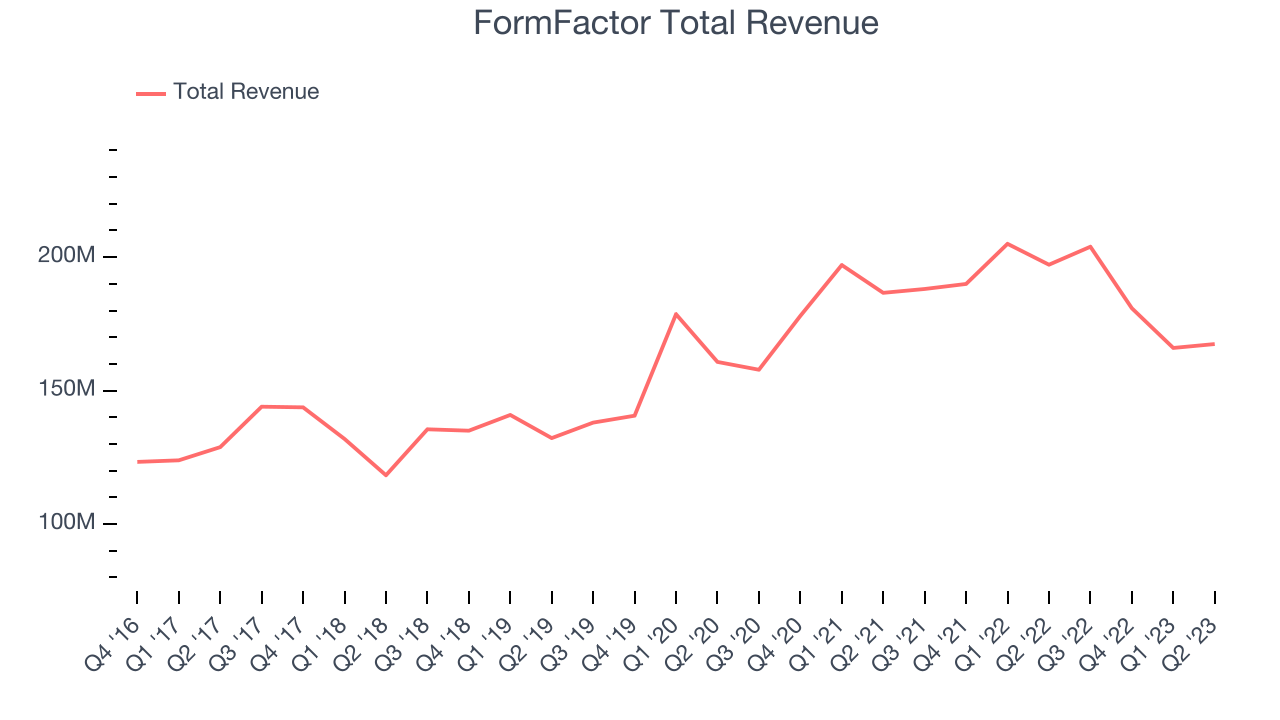

FormFactor (NASDAQ:FORM)

With customers across the foundry and fabless markets, FormFactor (NASDAQ:FORM) is a US-based provider of test and measurement technologies for semiconductors.

FormFactor reported revenues of $167.4 million, down 15.1% year on year, beating analyst expectations by 2.96%. It was a weaker quarter for the company, with underwhelming revenue guidance for the next quarter and a decline in operating margin.

“FormFactor’s first quarter revenue was similar to the fourth quarter’s, exceeding our outlook range due to timing of shipments, as we delivered significant sequential improvement in gross margins and profitability,” said Mike Slessor, CEO of FormFactor,

The stock is up 9.27% since the results and currently trades at $29.93.

Read our full report on FormFactor here, it's free.

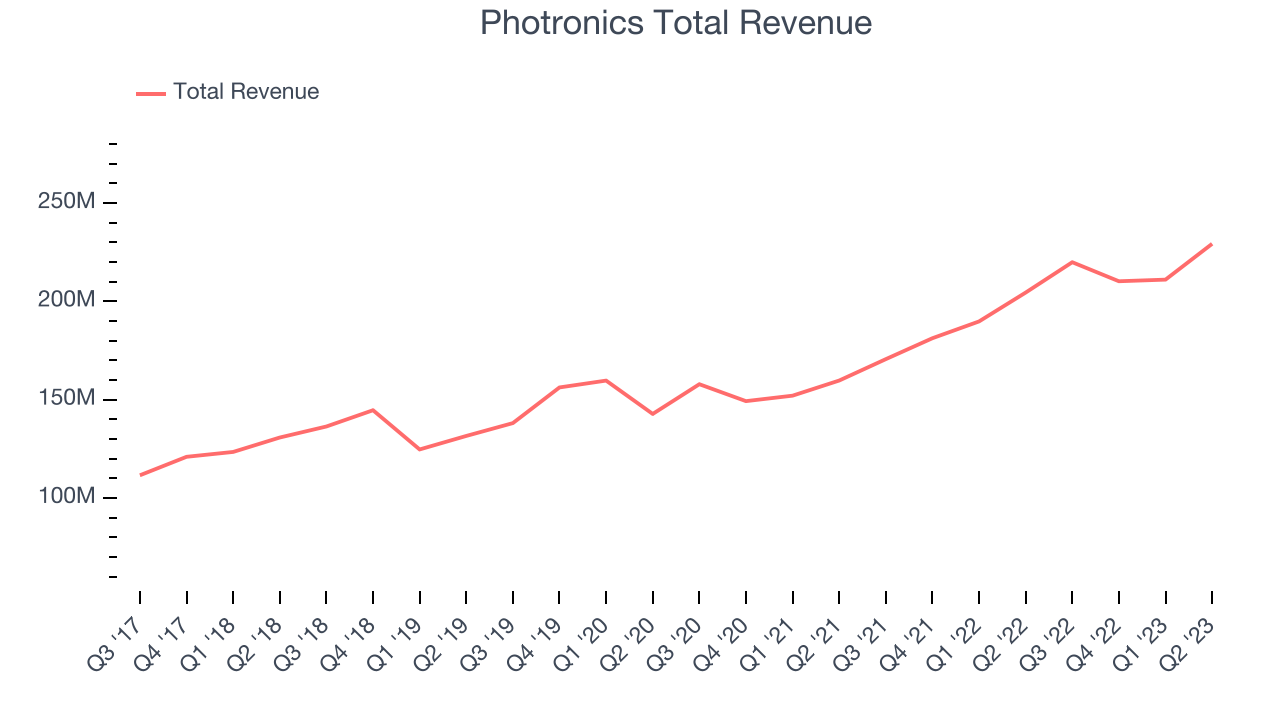

Best Q1: Photronics (NASDAQ:PLAB)

Sporting a global footprint of facilities, Photronics (NASDAQ:PLAB) is a manufacturer of photomasks, templates used to transfer patterns onto semiconductor wafers.

Photronics reported revenues of $229.3 million, up 12.1% year on year, beating analyst expectations by 8.68%. It was an exceptional quarter for the company, with a significant improvement in gross margin and strong revenue guidance for the next quarter.

Photronics delivered the strongest analyst estimates beat among its peers. The stock is up 33.3% since the results and currently trades at $22.95.

Is now the time to buy Photronics? Access our full analysis of the earnings results here, it's free.

Weakest Q1: IPG Photonics (NASDAQ:IPGP)

Both a designer and manufacturer of most of its products, IPG Photonics (NASDAQ:IPGP) is a provider of high-performance fiber lasers that are used for cutting, welding and processing raw materials.

IPG Photonics reported revenues of $347.2 million, down 6.16% year on year, beating analyst expectations by 5.01%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and an increase in inventory levels.

The stock is up 10.8% since the results and currently trades at $130.8.

Read our full analysis of IPG Photonics's results here.

Entegris (NASDAQ:ENTG)

With fabs representing the company’s largest customer type, Entegris (NASDAQ:ENTG) supplies products that purify, protect, and generally ensure the integrity of raw materials needed for advanced semiconductor manufacturing.

Entegris reported revenues of $922.4 million, up 42% year on year, beating analyst expectations by 3.33%. It was a mixed quarter for the company, with a decline in operating margin but strong revenue guidance for the next quarter.

Entegris achieved the fastest revenue growth among the peers. The stock is up 32.4% since the results and currently trades at $103.54.

Read our full, actionable report on Entegris here, it's free.

Marvell Technology (NASDAQ:MRVL)

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

Marvell Technology reported revenues of $1.32 billion, down 8.65% year on year, beating analyst expectations by 1.67%. It was a mixed quarter for the company, with a significant improvement in inventory levels but a decline in operating margin.

The stock is up 16.5% since the results and currently trades at $57.58.

Read our full, actionable report on Marvell Technology here, it's free.

The author has no position in any of the stocks mentioned