GitLab's (NASDAQ:GTLB) Q1 Sales Beat Estimates

Max Juang /

June 3, 2024

Software development tools maker GitLab (NASDAQ:GTLB) reported Q1 CY2024 results topping analysts' expectations, with revenue up 33.3% year on year to $169.2 million. The company expects next quarter's revenue to be around $176.5 million, in line with analysts' estimates. It made a non-GAAP profit of $0.03 per share, improving from its loss of $0.06 per share in the same quarter last year.

Is now the time to buy GitLab? Find out in our full research report.

GitLab (GTLB) Q1 CY2024 Highlights:

- Revenue: $169.2 million vs analyst estimates of $166.1 million (1.9% beat)

- EPS (non-GAAP): $0.03 vs analyst estimates of -$0.04 ($0.07 beat)

- Revenue Guidance for Q2 CY2024 is $176.5 million at the midpoint, roughly in line with what analysts were expecting

- The company lifted its revenue guidance for the full year from $728 million to $735 million at the midpoint, a 1% increase (lifted non-GAAP operating profit guidance even more meaningfully)

- Gross Margin (GAAP): 88.9%, in line with the same quarter last year

- Free Cash Flow of $37.44 million, up 52.7% from the previous quarter

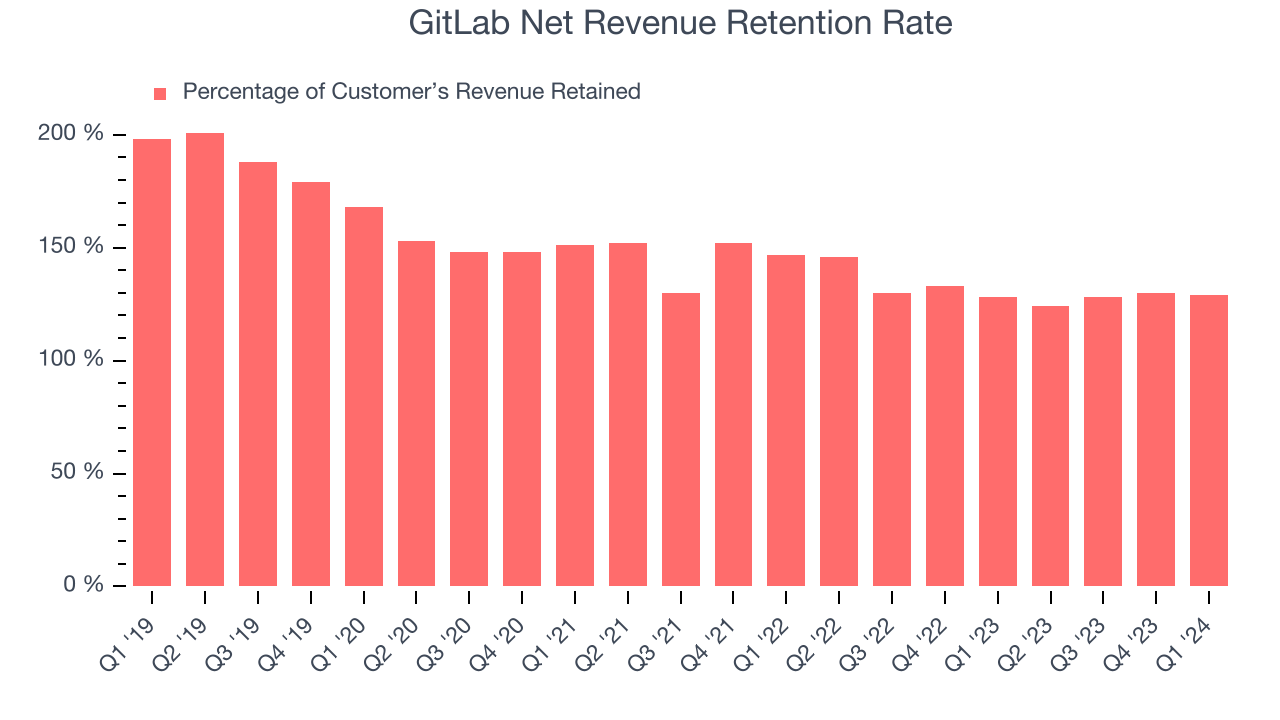

- Net Revenue Retention Rate: 129%, down from 130% in the previous quarter

- Market Capitalization: $7.50 billion

“GitLab continues to differentiate our platform with AI-driven software innovations that are streamlining how customers build, test, secure, and deploy software,” said Sid Sijbrandij, GitLab CEO and co-founder.

Founded as an open-source project in 2011, GitLab (NASDAQ:GTLB) is a leading software development tools platform.

Developer Operations

As Marc Andreessen says, "software is eating the world" which means the volume of software produced is exploding. But building software is complex and difficult work which drives demand for software tools that help increase the speed, quality, and security of software deployment.

Sales Growth

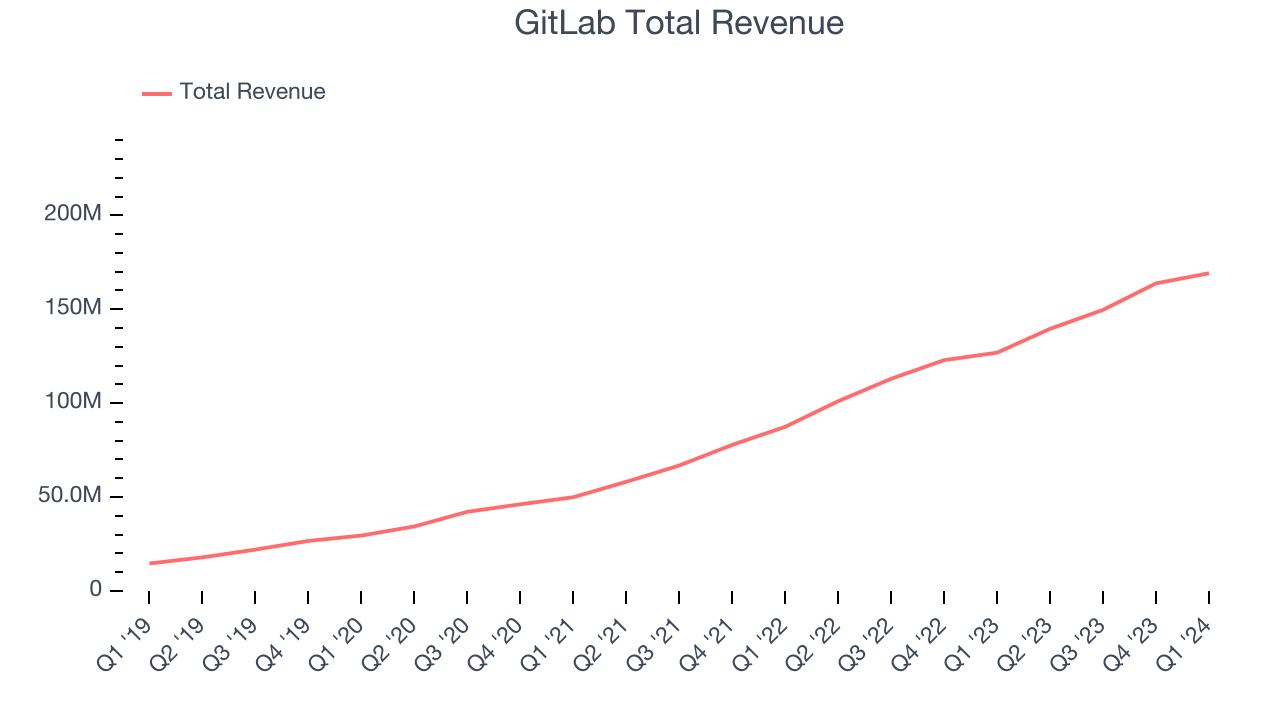

As you can see below, GitLab's revenue growth has been exceptional over the last three years, growing from $49.93 million in Q1 2022 to $169.2 million this quarter.

Unsurprisingly, this was another great quarter for GitLab with revenue up 33.3% year on year. However, its growth did slow down compared to last quarter as the company's revenue increased by just $5.41 million in Q1 compared to $14.11 million in Q4 CY2023. While we'd like to see revenue increase by a greater amount each quarter, a one-off fluctuation is usually not concerning.

Next quarter's guidance suggests that GitLab is expecting revenue to grow 26.4% year on year to $176.5 million, slowing down from the 38.1% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 24.5% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Product Success

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

GitLab's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 129% in Q1. This means that even if GitLab didn't win any new customers over the last 12 months, it would've grown its revenue by 29%.

GitLab has an excellent net retention rate. This data point proves that the company sells useful products, and we can see that its customers are satisfied and increasing their usage over time.

Key Takeaways from GitLab's Q1 Results

It was encouraging to see GitLab narrowly top analysts' revenue expectations this quarter. We also liked that the company raised its full year guidance for revenue and adjusted operating profit, the latter raised by an impressive amount that signals even more profitable growth than expected. On the other hand, its revenue guidance for next quarter underwhelmed and its gross margin decreased. Overall, this was a mixed quarter for GitLab. The company is down 1.7% on the results--with next quarter's revenue guidance souring sentiment on the stock for now--and currently trades at $46.30 per share.

So should you invest in GitLab right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.