GitLab (GTLB)

GitLab is a great business. Its combination of extraordinary growth and impressive unit economics makes it a beloved asset.― StockStory Analyst Team

1. News

2. Summary

Why We Like GitLab

With its all-remote workforce pioneering a new approach to software development, GitLab (NASDAQ:GTLB) provides a single-application DevSecOps platform that helps development, operations, and security teams collaborate to build, secure, and deploy software faster.

- Annual revenue growth of 46.9% over the last five years was superb and indicates its market share is rising

- ARR trends over the last year show it’s maintaining a steady flow of long-term contracts that contribute positively to its revenue predictability

- Software is difficult to replicate at scale and leads to a best-in-class gross margin of 88%

We’re optimistic about GitLab. The price seems fair when considering its quality, so this could be a prudent time to buy some shares.

Why Is Now The Time To Buy GitLab?

High Quality

Investable

Underperform

Why Is Now The Time To Buy GitLab?

GitLab’s stock price of $25.77 implies a valuation ratio of 3.9x forward price-to-sales. This multiple is cheap, and we think the stock is a bargain considering its quality characteristics.

We jump for joy when high-quality companies trade at bargain prices because shareholders can benefit from both earnings growth and a positive re-rating - a powerful one-two punch.

3. GitLab (GTLB) Research Report: Q3 CY2025 Update

DevSecOps platform provider GitLab (NASDAQ:GTLB) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 24.6% year on year to $244.4 million. The company expects next quarter’s revenue to be around $251.5 million, close to analysts’ estimates. Its non-GAAP profit of $0.25 per share was 24% above analysts’ consensus estimates.

GitLab (GTLB) Q3 CY2025 Highlights:

- Revenue: $244.4 million vs analyst estimates of $239.1 million (24.6% year-on-year growth, 2.2% beat)

- Adjusted EPS: $0.25 vs analyst estimates of $0.20 (24% beat)

- Adjusted Operating Income: $43.68 million vs analyst estimates of $32.16 million (17.9% margin, 35.8% beat)

- Revenue Guidance for Q4 CY2025 is $251.5 million at the midpoint, roughly in line with what analysts were expecting

- Management raised its full-year Adjusted EPS guidance to $0.96 at the midpoint, a 15.8% increase

- Operating Margin: -5.1%, up from -14.7% in the same quarter last year

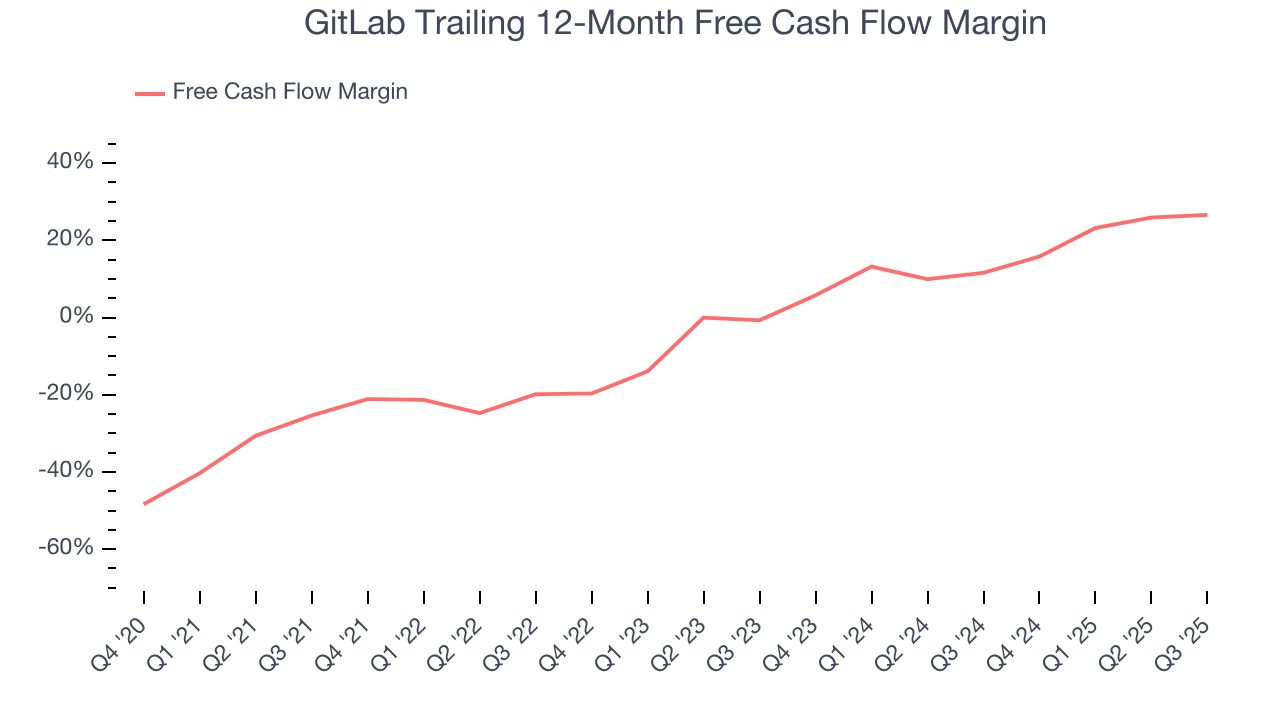

- Free Cash Flow Margin: 11.6%, down from 19.7% in the previous quarter

- Net Revenue Retention Rate: 119%, down from 121% in the previous quarter

- Market Capitalization: $6.86 billion

Company Overview

With its all-remote workforce pioneering a new approach to software development, GitLab (NASDAQ:GTLB) provides a single-application DevSecOps platform that helps development, operations, and security teams collaborate to build, secure, and deploy software faster.

The company's platform eliminates the need for multiple disconnected tools by integrating the entire software development lifecycle into a unified application with a common interface and data model. This approach addresses the fragmentation challenges of traditional "DIY DevOps" environments where teams use separate tools for each development stage, creating integration complexities and inefficiencies.

GitLab's platform spans the complete DevSecOps lifecycle - from planning and coding to testing, security scanning, deployment, and monitoring. For example, a financial services company might use GitLab to develop a mobile banking application, with developers collaborating on code, security teams automatically scanning for vulnerabilities, and operations teams deploying the tested application to production - all within the same platform.

Operating on an open-core business model, GitLab allows its community of users to contribute improvements to the platform. Customers can choose between self-managed installations in their own environments or GitLab's Software-as-a-Service (SaaS) offering hosted in public or private clouds. The company monetizes through tiered subscription plans (Free, Premium, and Ultimate) with increasing functionality tailored to individual contributors, team managers, and enterprise-wide needs, respectively.

With over 30 million registered users and more than half of Fortune 100 companies as customers, GitLab serves organizations of all sizes across industries globally, helping them accelerate software delivery and innovation.

4. Developer Operations

As Marc Andreessen says, "software is eating the world" which means the volume of software produced is exploding. But building software is complex and difficult work which drives demand for software tools that help increase the speed, quality, and security of software deployment.

GitLab's primary competitor is Microsoft GitHub, following Microsoft's acquisition of GitHub. The company also competes with Atlassian's suite of development tools, as well as point solutions from companies like JFrog, Sonatype, and other DevOps tooling providers.

5. Revenue Growth

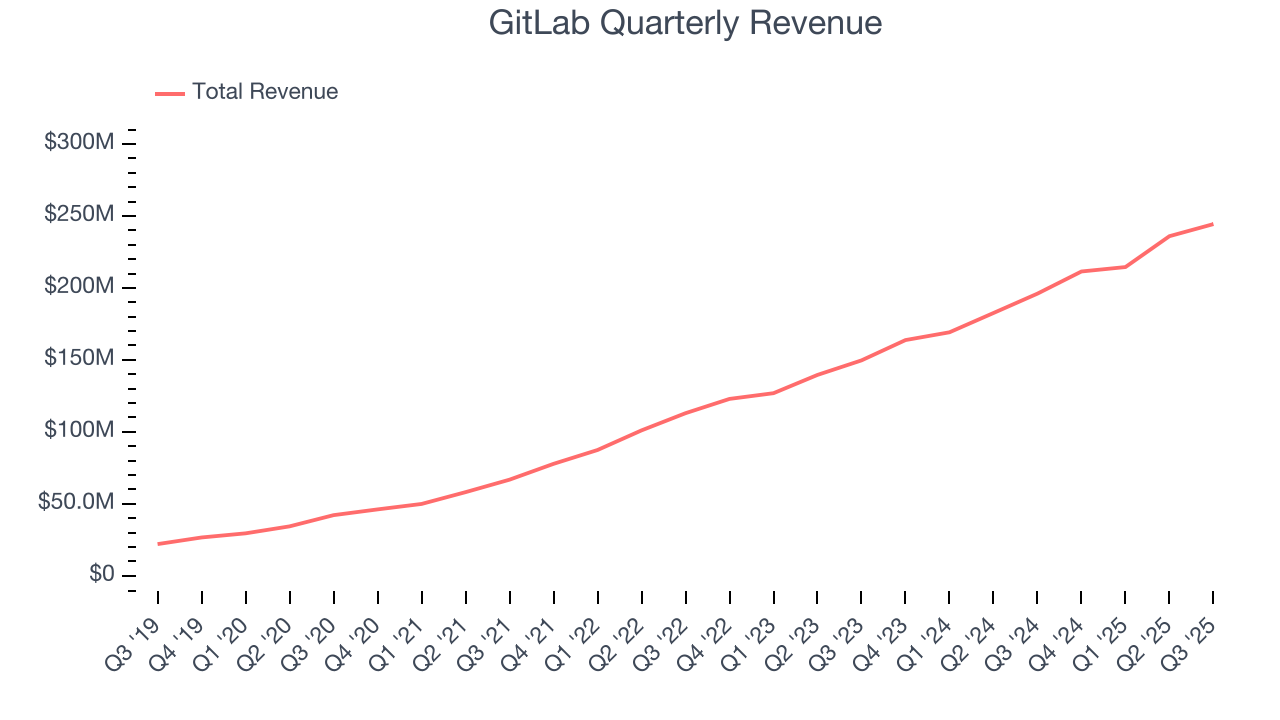

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, GitLab’s 46.9% annualized revenue growth over the last five years was incredible. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. GitLab’s annualized revenue growth of 29.7% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, GitLab reported robust year-on-year revenue growth of 24.6%, and its $244.4 million of revenue topped Wall Street estimates by 2.2%. Company management is currently guiding for a 19% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 18.9% over the next 12 months, a deceleration versus the last two years. Still, this projection is commendable and indicates the market sees success for its products and services.

6. Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

GitLab’s ARR punched in at $893 million in Q3, and over the last four quarters, its growth was fantastic as it averaged 29.3% year-on-year increases. This performance aligned with its total sales growth and shows that customers are willing to take multi-year bets on the company’s technology. Its growth also makes GitLab a more predictable business, a tailwind for its valuation as investors typically prefer businesses with recurring revenue.

7. Customer Acquisition Efficiency

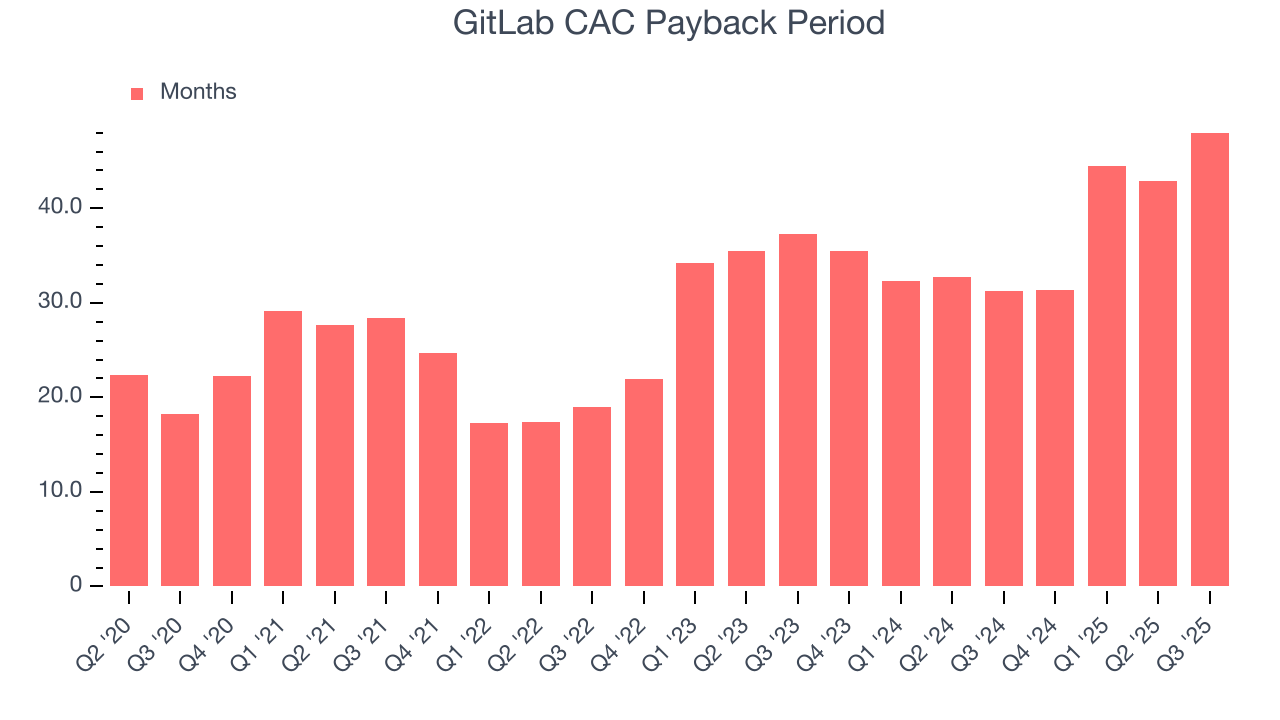

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

GitLab does a decent job acquiring new customers, and its CAC payback period checked in at 48 months this quarter. The company’s relatively fast recovery of its customer acquisition costs gives it the option to accelerate growth by increasing its sales and marketing investments.

8. Customer Retention

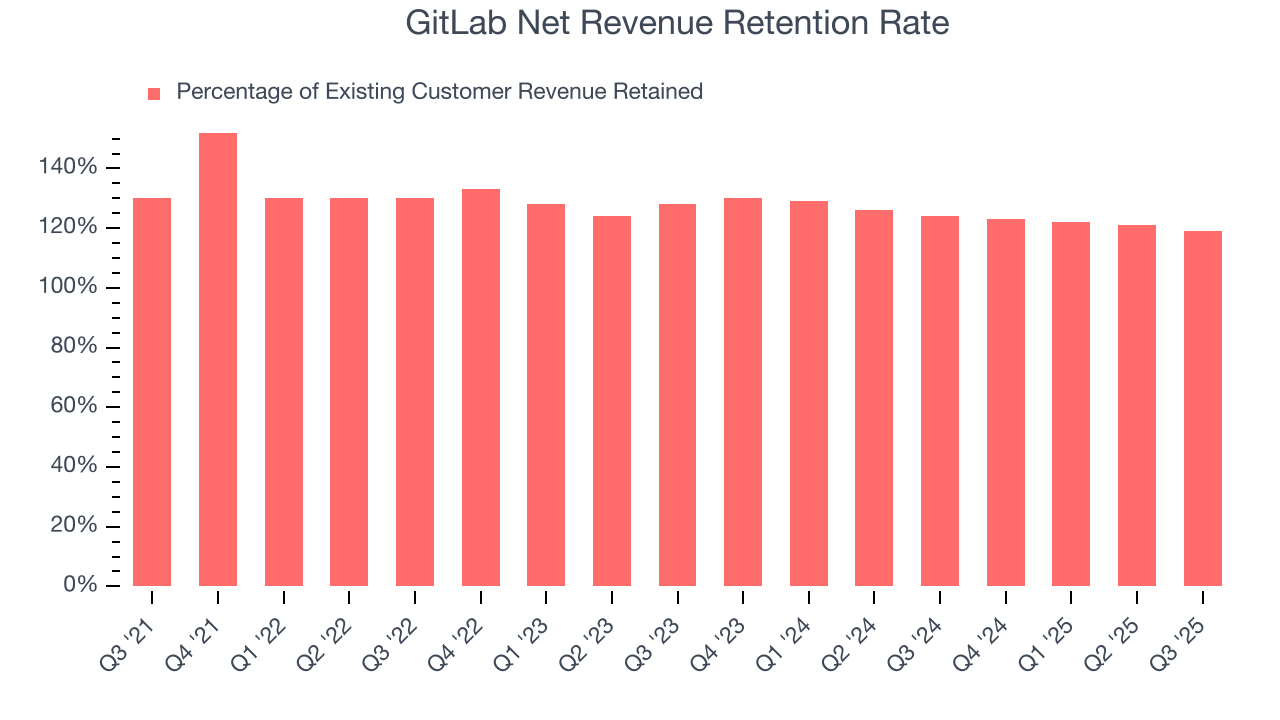

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

GitLab’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 121% in Q3. This means GitLab would’ve grown its revenue by 21.2% even if it didn’t win any new customers over the last 12 months.

Despite falling over the last year, GitLab still has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

9. Gross Margin & Pricing Power

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

GitLab’s gross margin is one of the best in the software sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in new products and sales during periods of rapid growth to achieve outsized profits at scale. As you can see below, it averaged an elite 88% gross margin over the last year. Said differently, roughly $88.01 was left to spend on selling, marketing, and R&D for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. GitLab has seen gross margins decline by 1.3 percentage points over the last 2 year, which is poor compared to software peers.

GitLab’s gross profit margin came in at 86.8% this quarter, down 1.9 percentage points year on year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

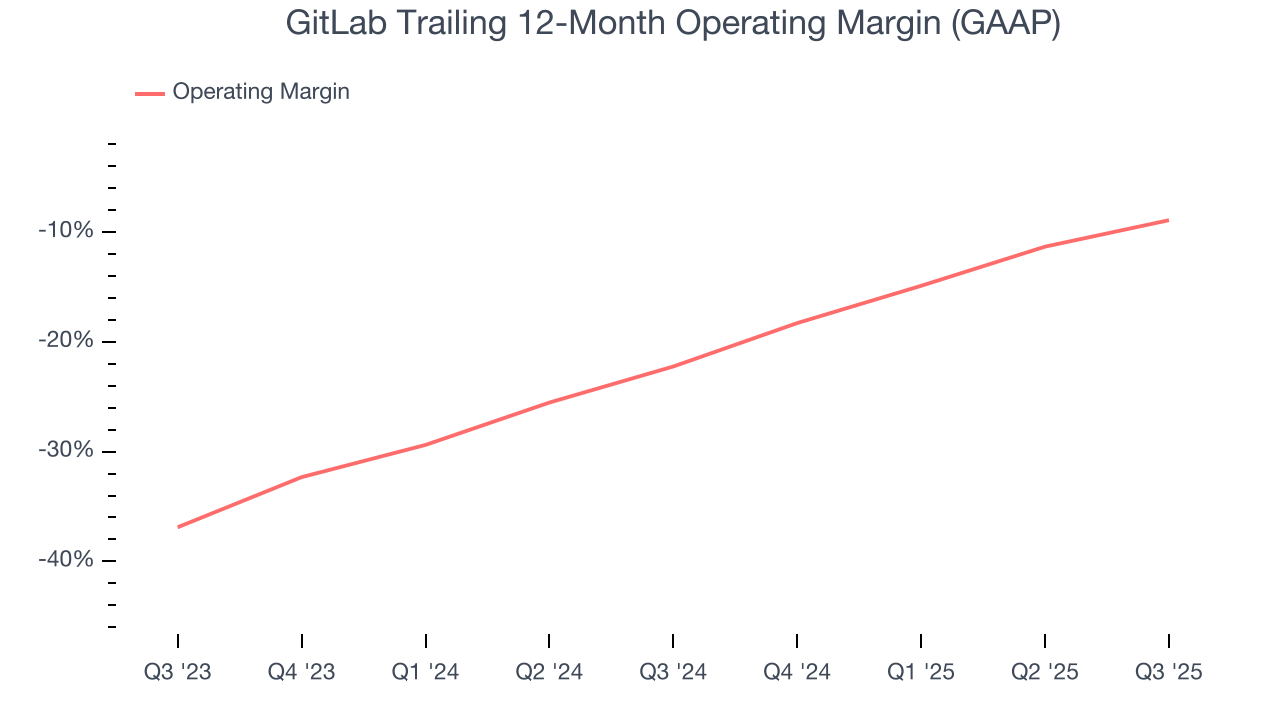

10. Operating Margin

GitLab’s expensive cost structure has contributed to an average operating margin of negative 8.9% over the last year. This happened because the company spent loads of money to capture market share. As seen in its fast revenue growth, the aggressive strategy has paid off so far, and Wall Street’s estimates suggest the party will continue. We tend to agree and believe the business has a good chance of reaching profitability upon scale.

Over the last two years, GitLab’s expanding sales gave it operating leverage as its margin rose by 13.3 percentage points. Still, it will take much more for the company to reach long-term profitability.

GitLab’s operating margin was negative 5.1% this quarter.

11. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

GitLab has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors while maintaining a cash cushion. The company’s free cash flow margin averaged 26.6% over the last year, quite impressive for a software business. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

GitLab’s free cash flow clocked in at $28.39 million in Q3, equivalent to a 11.6% margin. This result was good as its margin was 6.7 percentage points higher than in the same quarter last year, but we note it was lower than its one-year cash profitability. Nevertheless, we wouldn’t read too much into a single quarter because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Over the next year, analysts predict GitLab’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 26.6% for the last 12 months will decrease to 21%.

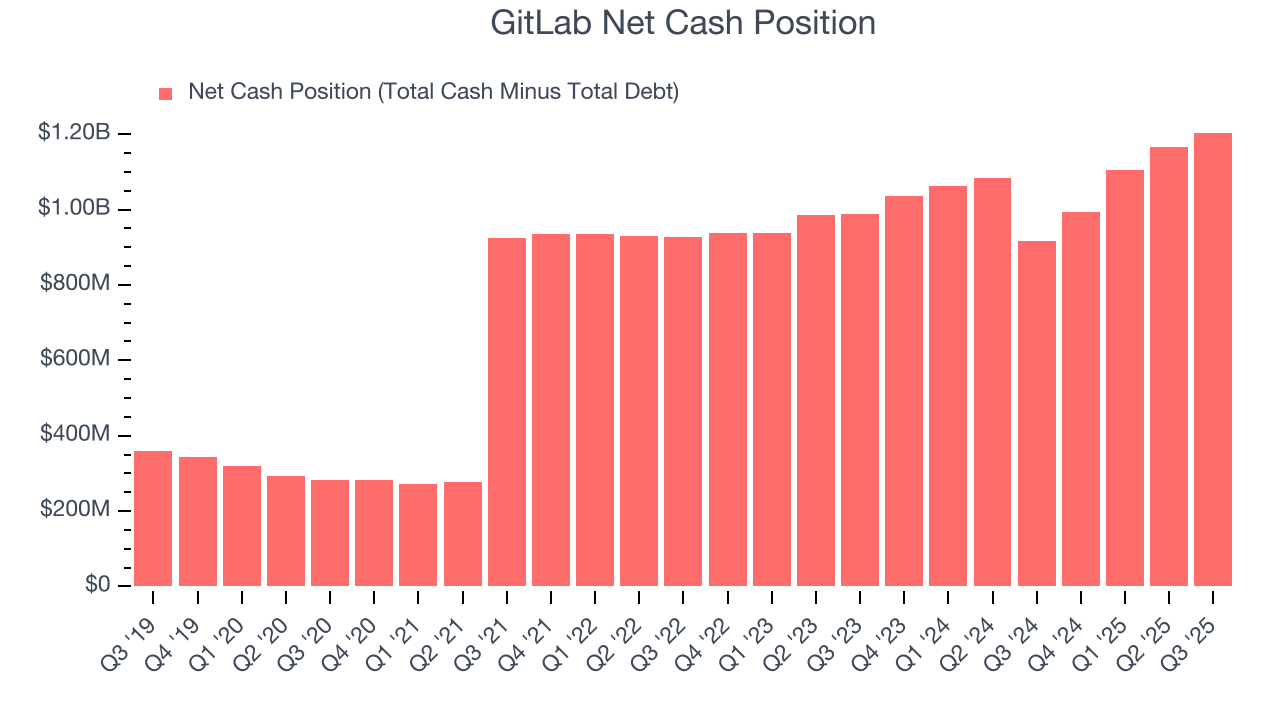

12. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

GitLab is a well-capitalized company with $1.20 billion of cash and no debt. This position is 19.1% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from GitLab’s Q3 Results

We were impressed by GitLab’s optimistic full-year EPS guidance, which blew past analysts’ expectations. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its net revenue retention declined. Overall, this print had some key positives. Investors were likely hoping for more, and shares traded down 9.6% to $39.33 immediately after reporting.

14. Is Now The Time To Buy GitLab?

Updated: February 26, 2026 at 9:40 PM EST

Before deciding whether to buy GitLab or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

There are multiple reasons why we think GitLab is an amazing business. For starters, its revenue growth was exceptional over the last five years. And while its operating margins reveal poor profitability compared to other software companies, its admirable gross margin indicates excellent unit economics. Additionally, GitLab’s surging ARR shows its fundamentals and revenue predictability are improving.

GitLab’s price-to-sales ratio based on the next 12 months is 4.1x. Looking across the spectrum of software companies today, GitLab’s fundamentals shine bright. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $48.50 on the company (compared to the current share price of $27.11), implying they see 78.9% upside in buying GitLab in the short term.