Fastly (FSLY)

Fastly keeps us up at night. Its underwhelming revenue growth and failure to generate meaningful free cash flow is a concerning trend.― StockStory Analyst Team

1. News

2. Summary

Why We Think Fastly Will Underperform

Taking its name from the core advantage it delivers to customers, Fastly (NYSE:FSLY) operates an edge cloud platform that processes, secures, and delivers web content as close to end users as possible, enabling faster digital experiences.

- Bad unit economics and steep infrastructure costs are reflected in its gross margin of 55%, one of the worst among software companies

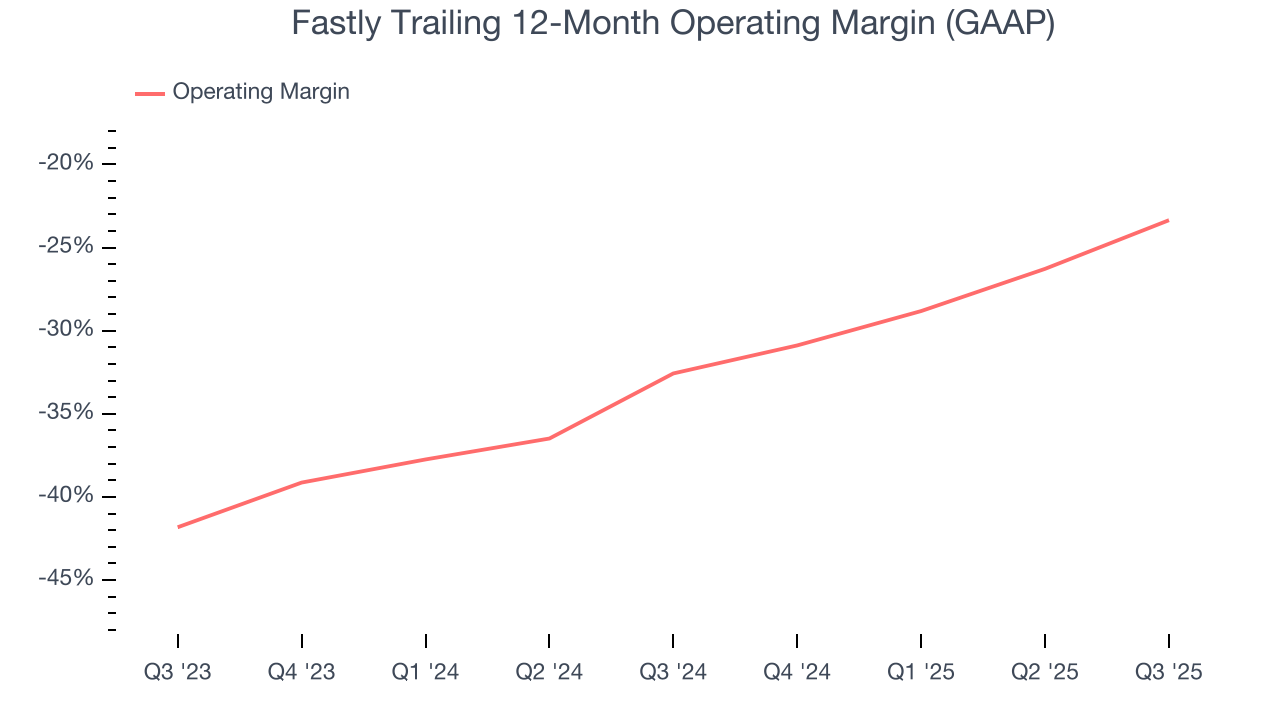

- Suboptimal cost structure is highlighted by its history of operating margin losses

- Below-average net revenue retention rate of 103% suggests it has some trouble expanding within existing accounts

Fastly doesn’t live up to our standards. There’s a wealth of better opportunities.

Why There Are Better Opportunities Than Fastly

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Fastly

At $9.27 per share, Fastly trades at 2.1x forward price-to-sales. Fastly’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Fastly (FSLY) Research Report: Q3 CY2025 Update

Edge cloud platform Fastly (NYSE:FSLY) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 15.3% year on year to $158.2 million. On top of that, next quarter’s revenue guidance ($161 million at the midpoint) was surprisingly good and 4.7% above what analysts were expecting. Its non-GAAP profit of $0.07 per share was significantly above analysts’ consensus estimates.

Fastly (FSLY) Q3 CY2025 Highlights:

- Revenue: $158.2 million vs analyst estimates of $151.1 million (15.3% year-on-year growth, 4.7% beat)

- Adjusted EPS: $0.07 vs analyst estimates of $0 (significant beat)

- Adjusted EBITDA: $25.71 million vs analyst estimates of $14.12 million (16.2% margin, 82.1% beat)

- Revenue Guidance for Q4 CY2025 is $161 million at the midpoint, above analyst estimates of $153.8 million

- Management raised its full-year Adjusted EPS guidance to $0.05 at the midpoint, a 171% increase

- Operating Margin: -18.2%, up from -29.6% in the same quarter last year

- Free Cash Flow Margin: 11.4%, up from 7.3% in the previous quarter

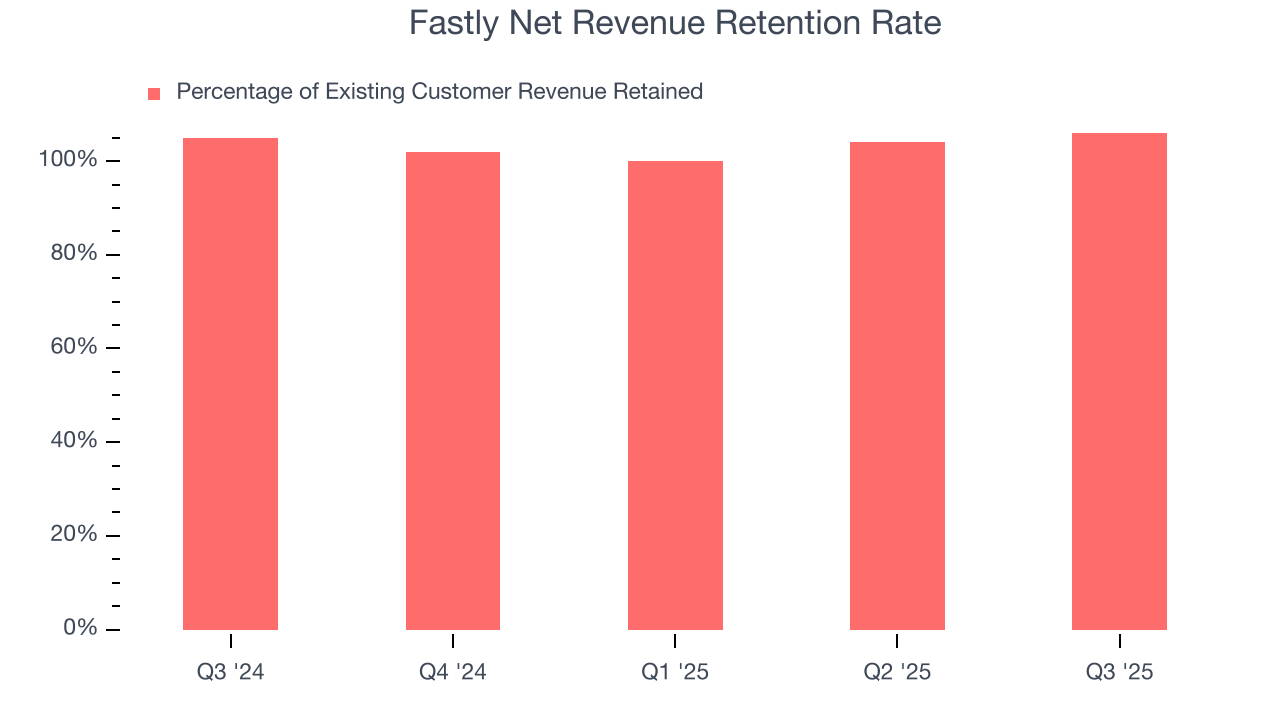

- Net Revenue Retention Rate: 106%, up from 104% in the previous quarter

- Market Capitalization: $1.17 billion

Company Overview

Taking its name from the core advantage it delivers to customers, Fastly (NYSE:FSLY) operates an edge cloud platform that processes, secures, and delivers web content as close to end users as possible, enabling faster digital experiences.

Fastly's edge cloud platform functions as a crucial part of modern internet infrastructure by positioning computing resources closer to users rather than relying solely on centralized data centers. This approach significantly reduces latency—the time it takes for data to travel from servers to users—which is particularly important for content-heavy websites, streaming media, and e-commerce platforms where speed directly impacts user engagement and conversion rates.

The company's technology combines content delivery network capabilities with advanced functionality traditionally provided by hardware appliances, such as security tools and application delivery controllers. What makes Fastly unique is its programmability—developers can write and deploy custom code at the network edge using WebAssembly, allowing for real-time content manipulation, personalization, and security filtering without routing requests back to origin servers.

For example, an e-commerce customer might use Fastly to dynamically adjust product recommendations based on user behavior, while a media company could use it to serve region-specific content or implement paywall authentication at the edge. Fastly's security offerings include protection against distributed denial-of-service attacks, bot detection, and web application firewalls that shield customers' infrastructure from malicious traffic.

Fastly generates revenue through a usage-based model, charging customers based on the amount of data transferred through its network and the computational resources used. The company's platform spans 79 markets worldwide with points of presence (POPs) strategically located near major internet exchange points and cloud providers to optimize performance.

4. Content Delivery

The amount of content on the internet is exploding, whether it is music, movies and or e-commerce stores. Consumer demand for this content creates network congestion, much like a digital traffic jam which drives demand for specialized content delivery networks (CDN) services that alleviate potential network bottlenecks.

Fastly competes with legacy CDN providers like Akamai and Edgio, security-focused vendors such as Cloudflare and F5, as well as cloud giants AWS, Google Cloud, and Microsoft Azure which offer their own content delivery and edge computing capabilities.

5. Revenue Growth

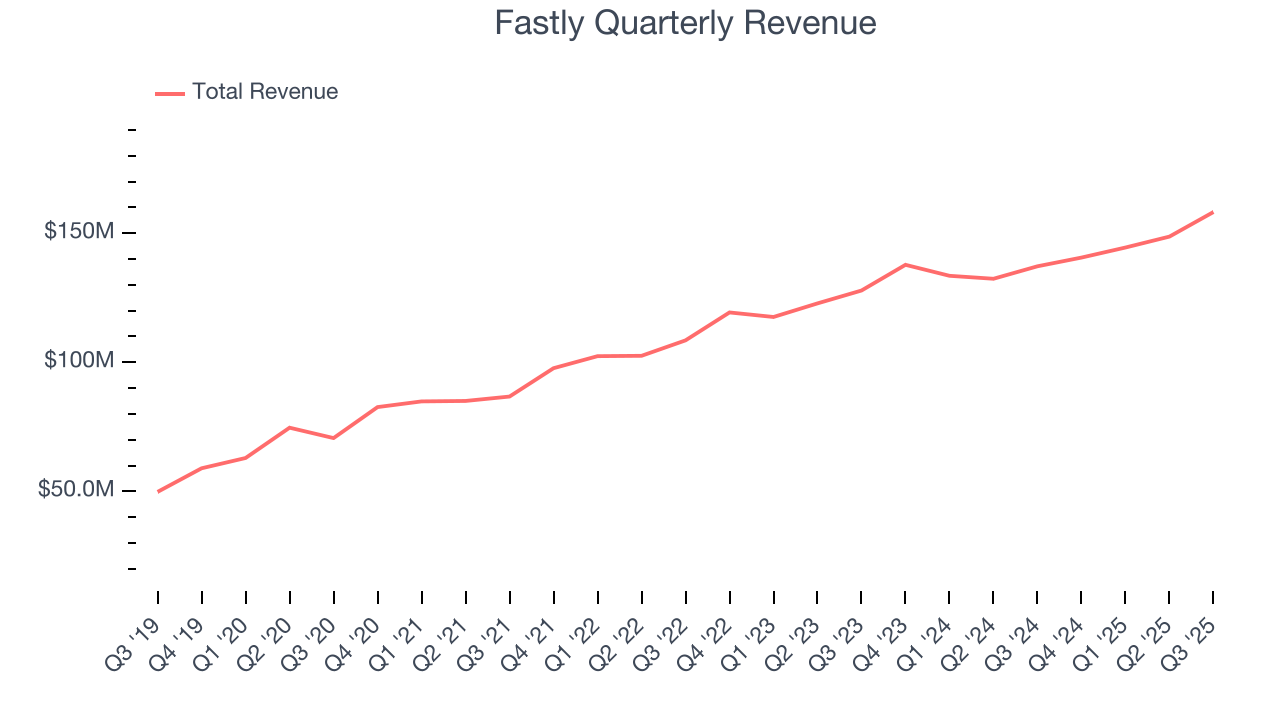

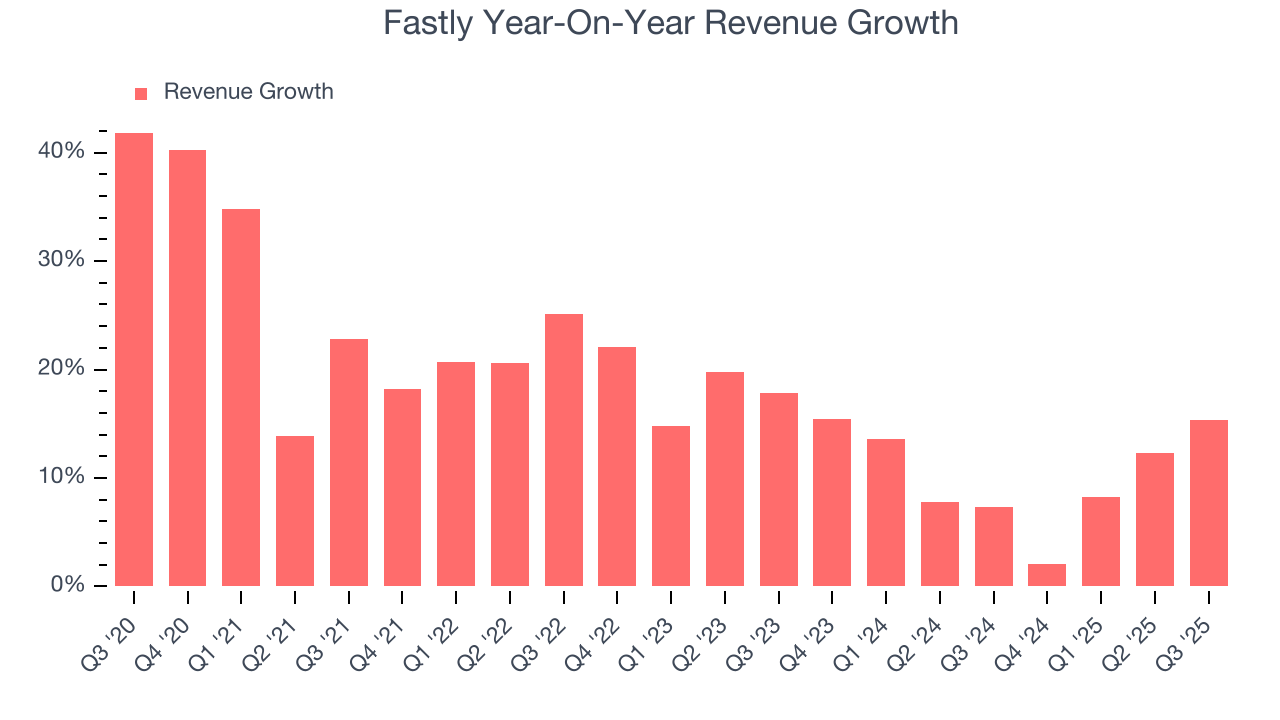

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Fastly grew its sales at a 17.2% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Fastly’s recent performance shows its demand has slowed as its annualized revenue growth of 10.2% over the last two years was below its five-year trend.

This quarter, Fastly reported year-on-year revenue growth of 15.3%, and its $158.2 million of revenue exceeded Wall Street’s estimates by 4.7%. Company management is currently guiding for a 14.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

6. Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Fastly’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 103% in Q3. This means Fastly would’ve grown its revenue by 3% even if it didn’t win any new customers over the last 12 months.

Fastly has an adequate net retention rate, showing us that it generally keeps customers but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

7. Gross Margin & Pricing Power

For software companies like Fastly, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

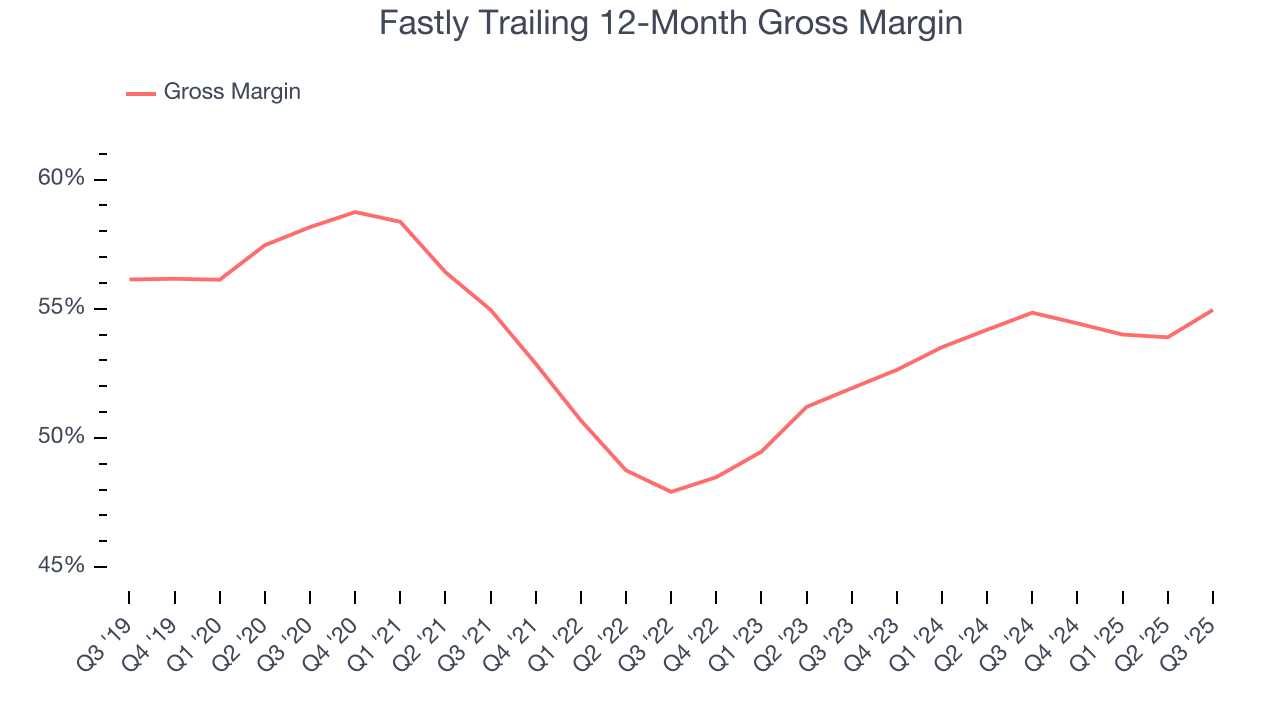

Fastly’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 55% gross margin over the last year. That means Fastly paid its providers a lot of money ($45.05 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Fastly has seen gross margins improve by 3 percentage points over the last 2 year, which is very good in the software space.

In Q3, Fastly produced a 58.4% gross profit margin, up 3.9 percentage points year on year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

8. Operating Margin

Fastly’s expensive cost structure has contributed to an average operating margin of negative 23.4% over the last year. Unprofitable software companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if Fastly reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

Over the last two years, Fastly’s expanding sales gave it operating leverage as its margin rose by 9.2 percentage points. Still, it will take much more for the company to reach long-term profitability.

In Q3, Fastly generated a negative 18.2% operating margin. The company's consistent lack of profits raise a flag.

9. Cash Is King

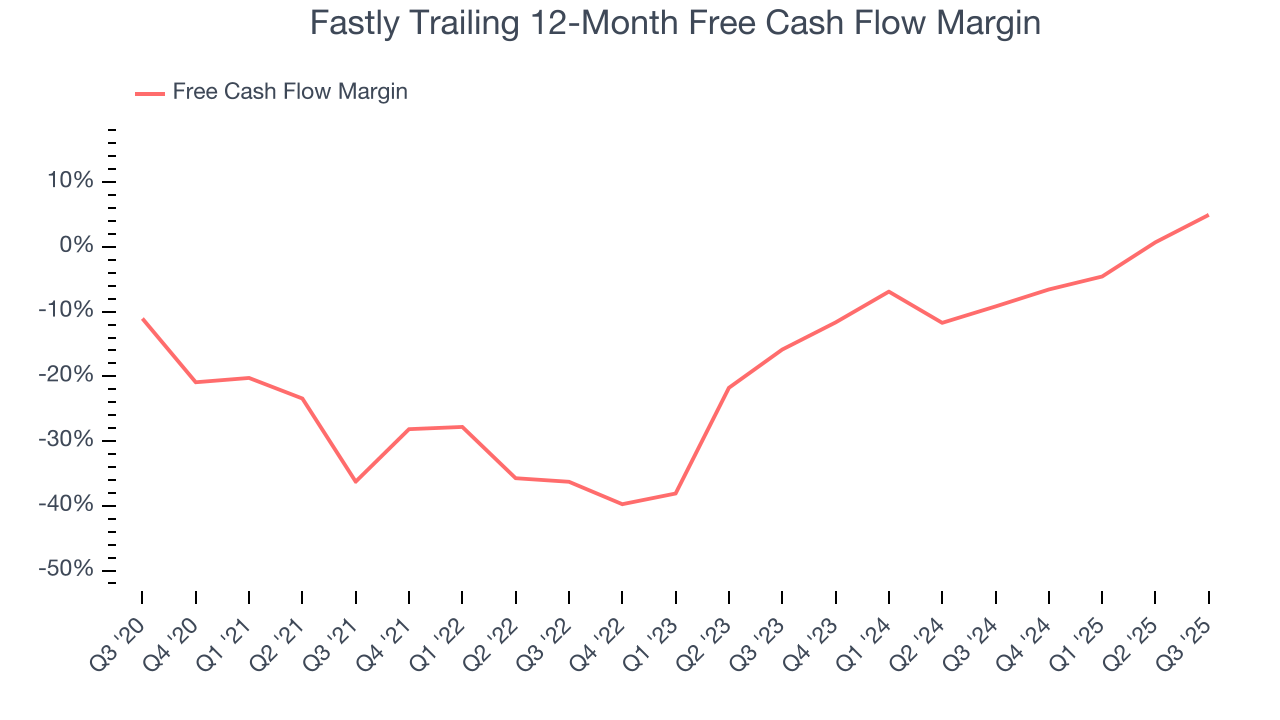

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Fastly has shown poor cash profitability over the last year, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 5%, lousy for a software business.

Fastly’s free cash flow clocked in at $18.09 million in Q3, equivalent to a 11.4% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict Fastly’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 5% for the last 12 months will decrease to 2.1%.

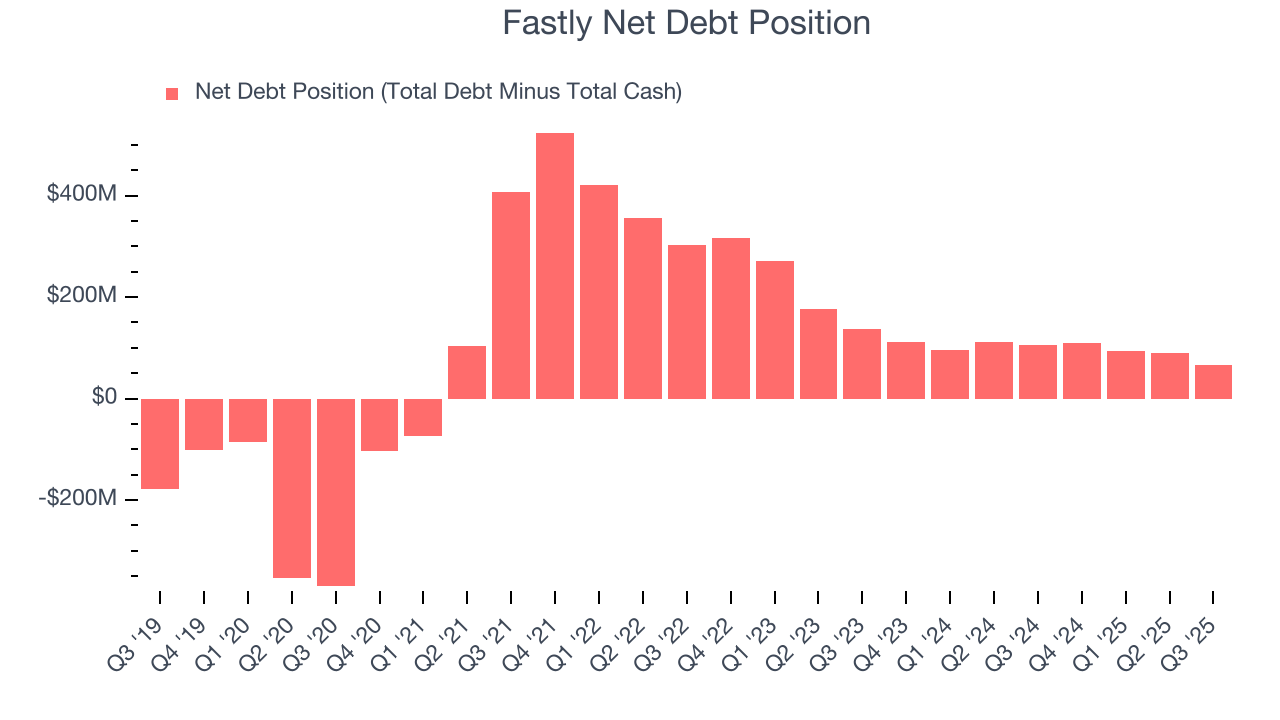

10. Balance Sheet Assessment

Fastly reported $342.9 million of cash and $408.9 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $56.52 million of EBITDA over the last 12 months, we view Fastly’s 1.2× net-debt-to-EBITDA ratio as safe. We also see its $1.84 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Fastly’s Q3 Results

We were impressed by Fastly’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 12.8% to $9.10 immediately after reporting.

12. Is Now The Time To Buy Fastly?

Updated: November 24, 2025 at 11:14 PM EST

Before deciding whether to buy Fastly or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Fastly falls short of our quality standards. First off, its revenue growth was mediocre over the last five years, and analysts expect its demand to deteriorate over the next 12 months. On top of that, Fastly’s operating margins reveal poor profitability compared to other software companies, and its gross margins show its business model is much less lucrative than other companies.

Fastly’s price-to-sales ratio based on the next 12 months is 2.5x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $10.42 on the company (compared to the current share price of $11.77).