Akamai Technologies (AKAM)

Akamai Technologies keeps us up at night. Its weak revenue growth and gross margin show it not only lacks demand but also decent unit economics.― StockStory Analyst Team

1. News

2. Summary

Why We Think Akamai Technologies Will Underperform

With a massive distributed network spanning 4,100+ points of presence in nearly 130 countries, Akamai Technologies (NASDAQ:AKAM) provides a global distributed cloud platform that helps businesses deliver, secure, and optimize their digital experiences online.

- Sky-high servicing costs result in an inferior gross margin of 59.1% that must be offset through increased usage

- Extended payback periods on sales investments suggest the company’s platform isn’t resonating enough to drive efficient sales conversions

- Muted 5.1% annual revenue growth over the last two years shows its demand lagged behind its software peers

Akamai Technologies’s quality doesn’t meet our expectations. There are superior opportunities elsewhere.

Why There Are Better Opportunities Than Akamai Technologies

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Akamai Technologies

At $96.62 per share, Akamai Technologies trades at 3.2x forward price-to-sales. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. Akamai Technologies (AKAM) Research Report: Q3 CY2025 Update

Cloud technology company Akamai Technologies (NASDAQ:AKAM) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 5% year on year to $1.05 billion. The company expects next quarter’s revenue to be around $1.08 billion, close to analysts’ estimates. Its non-GAAP profit of $1.86 per share was 13.7% above analysts’ consensus estimates.

Akamai Technologies (AKAM) Q3 CY2025 Highlights:

- Revenue: $1.05 billion vs analyst estimates of $1.04 billion (5% year-on-year growth, 1% beat)

- Adjusted EPS: $1.86 vs analyst estimates of $1.64 (13.7% beat)

- Adjusted Operating Income: $322 million vs analyst estimates of $291.1 million (30.5% margin, 10.6% beat)

- Revenue Guidance for Q4 CY2025 is $1.08 billion at the midpoint, roughly in line with what analysts were expecting

- Management raised its full-year Adjusted EPS guidance to $7.03 at the midpoint, a 4.9% increase

- Operating Margin: 15.7%, up from 7% in the same quarter last year

- Free Cash Flow Margin: 31.2%, up from 22.6% in the previous quarter

- Market Capitalization: $10.46 billion

Company Overview

With a massive distributed network spanning 4,100+ points of presence in nearly 130 countries, Akamai Technologies (NASDAQ:AKAM) provides a global distributed cloud platform that helps businesses deliver, secure, and optimize their digital experiences online.

Akamai's platform, known as Akamai Connected Cloud, operates at a vast scale that gives it unique visibility into internet traffic patterns, congestion, and security threats worldwide. The company offers solutions in three core areas: security, content delivery, and compute services.

In security, Akamai provides protection against cyberattacks including DDoS mitigation, web application and API security, bot management, and zero trust solutions that help enterprises defend their digital assets. For content delivery, Akamai enables businesses to optimize website performance and media streaming, ensuring fast load times regardless of user location, device, or connection quality. These services are particularly valuable for companies delivering high-definition video, large software downloads, or operating global websites.

The compute services, enhanced by Akamai's 2022 acquisition of Linode, allow customers to build and deploy applications and workloads across the distributed platform. Unlike centralized cloud providers, Akamai's distributed architecture places computing resources closer to end users, reducing latency for time-sensitive applications.

A major e-commerce retailer might use Akamai to ensure their website loads quickly during a holiday sales event while simultaneously protecting it from DDoS attacks and credit card fraud attempts. Similarly, a streaming media company could use Akamai to deliver high-quality video content to millions of viewers worldwide while maintaining performance even during peak viewership periods.

4. Content Delivery

The amount of content on the internet is exploding, whether it is music, movies and or e-commerce stores. Consumer demand for this content creates network congestion, much like a digital traffic jam which drives demand for specialized content delivery networks (CDN) services that alleviate potential network bottlenecks.

Akamai competes with cloud and content delivery network providers like Cloudflare (NYSE:NET), Fastly (NYSE:FSLY), and Limelight Networks (NASDAQ:LLNW), along with major cloud providers such as Amazon Web Services (NASDAQ:AMZN), Microsoft Azure (NASDAQ:MSFT), and Google Cloud (NASDAQ:GOOGL).

5. Revenue Growth

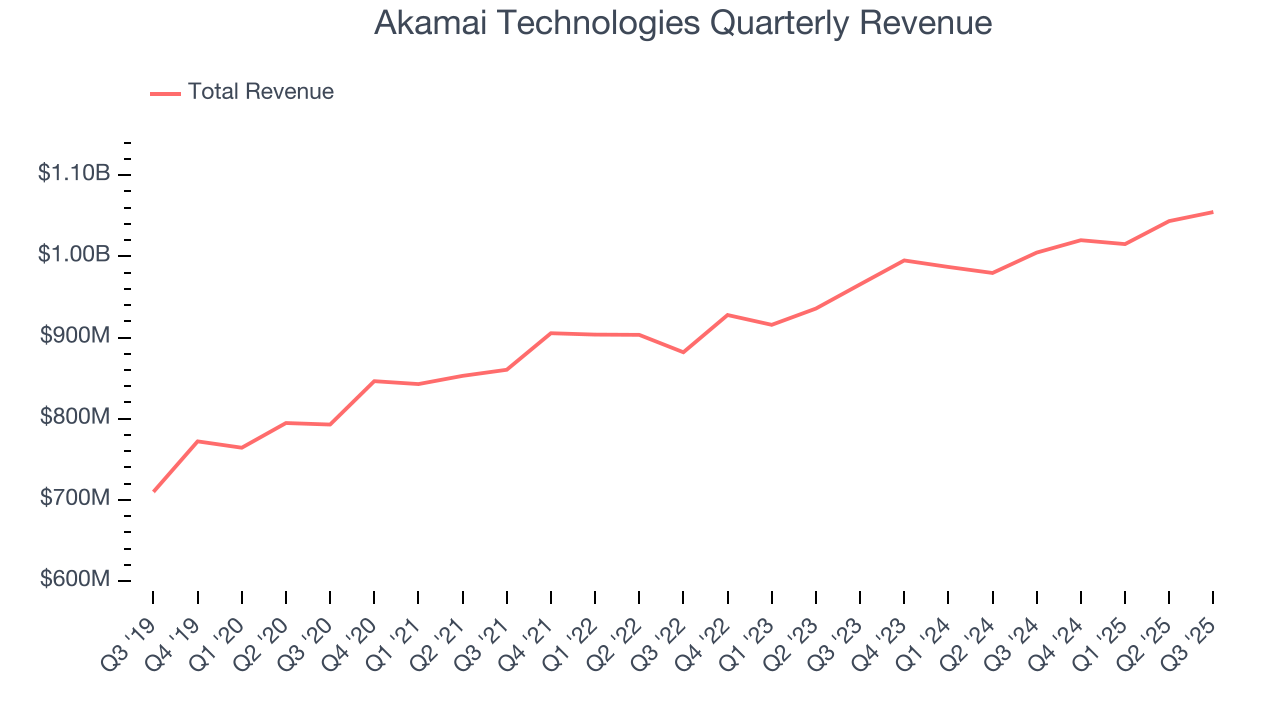

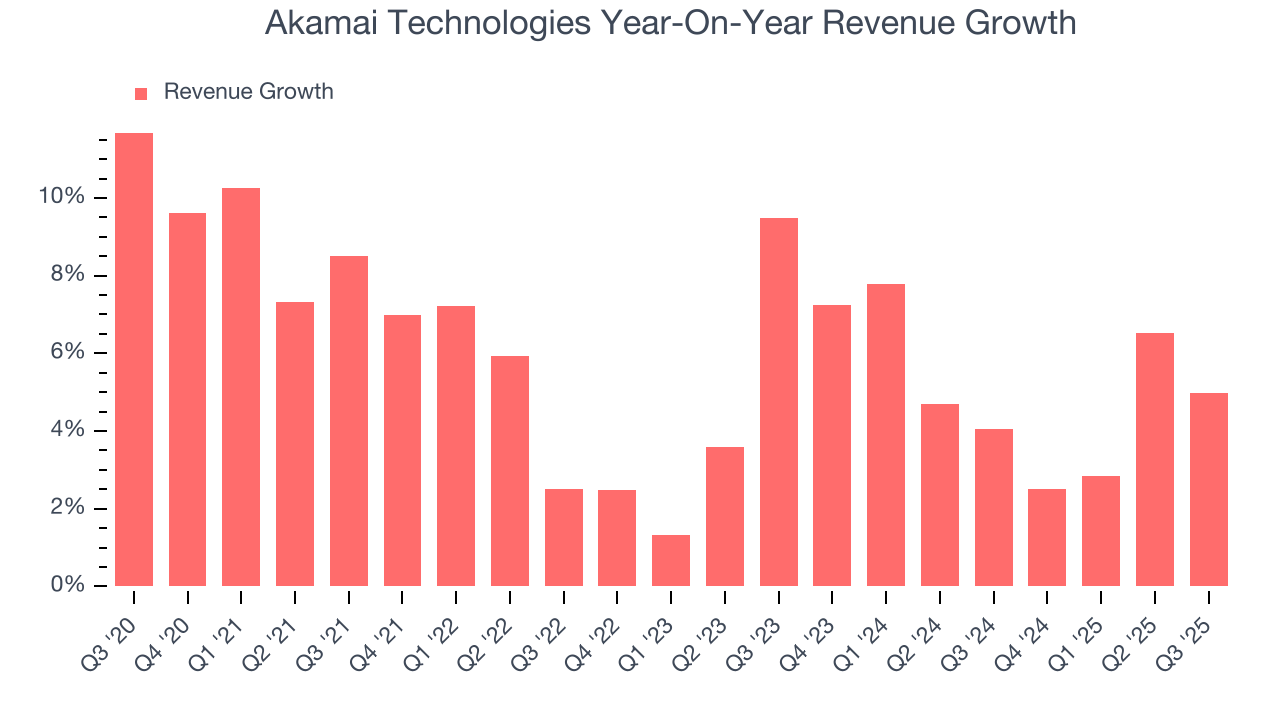

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Akamai Technologies’s 5.8% annualized revenue growth over the last five years was weak. This was below our standard for the software sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Akamai Technologies’s annualized revenue growth of 5.1% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Akamai Technologies reported modest year-on-year revenue growth of 5% but beat Wall Street’s estimates by 1%. Company management is currently guiding for a 5.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.6% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not accelerate its top-line performance yet.

6. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Akamai Technologies’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Akamai Technologies’s products and its peers.

7. Gross Margin & Pricing Power

For software companies like Akamai Technologies, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

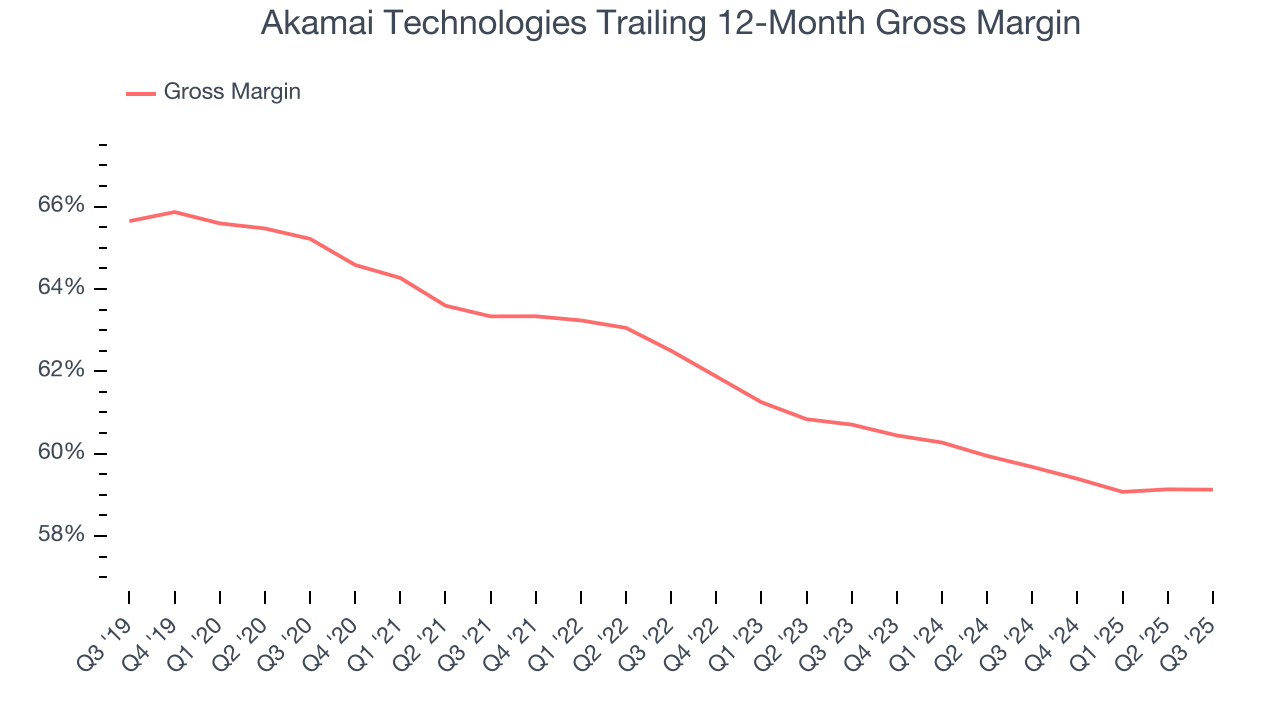

Akamai Technologies’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 59.1% gross margin over the last year. That means Akamai Technologies paid its providers a lot of money ($40.87 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Akamai Technologies has seen gross margins decline by 1.6 percentage points over the last 2 year, which is poor compared to software peers.

In Q3, Akamai Technologies produced a 59.3% gross profit margin, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

8. Operating Margin

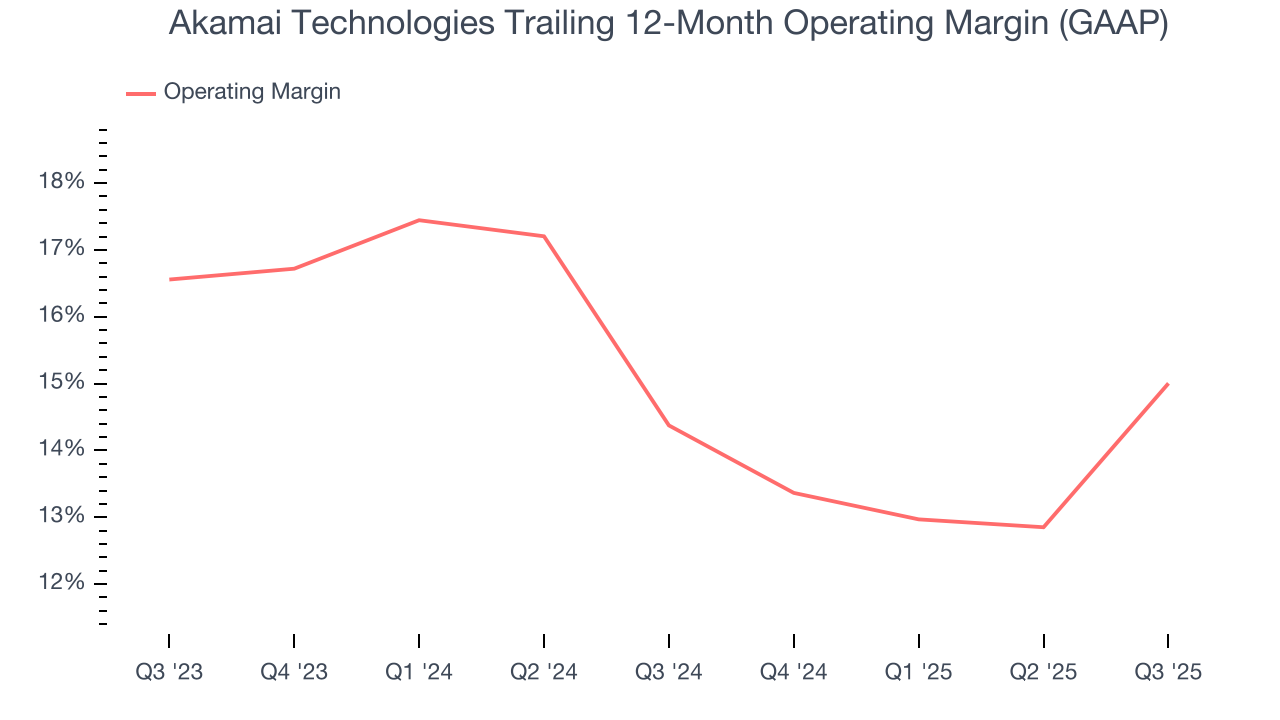

Akamai Technologies has been an efficient company over the last year. It was one of the more profitable businesses in the software sector, boasting an average operating margin of 15%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Akamai Technologies’s operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Akamai Technologies generated an operating margin profit margin of 15.7%, up 8.7 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

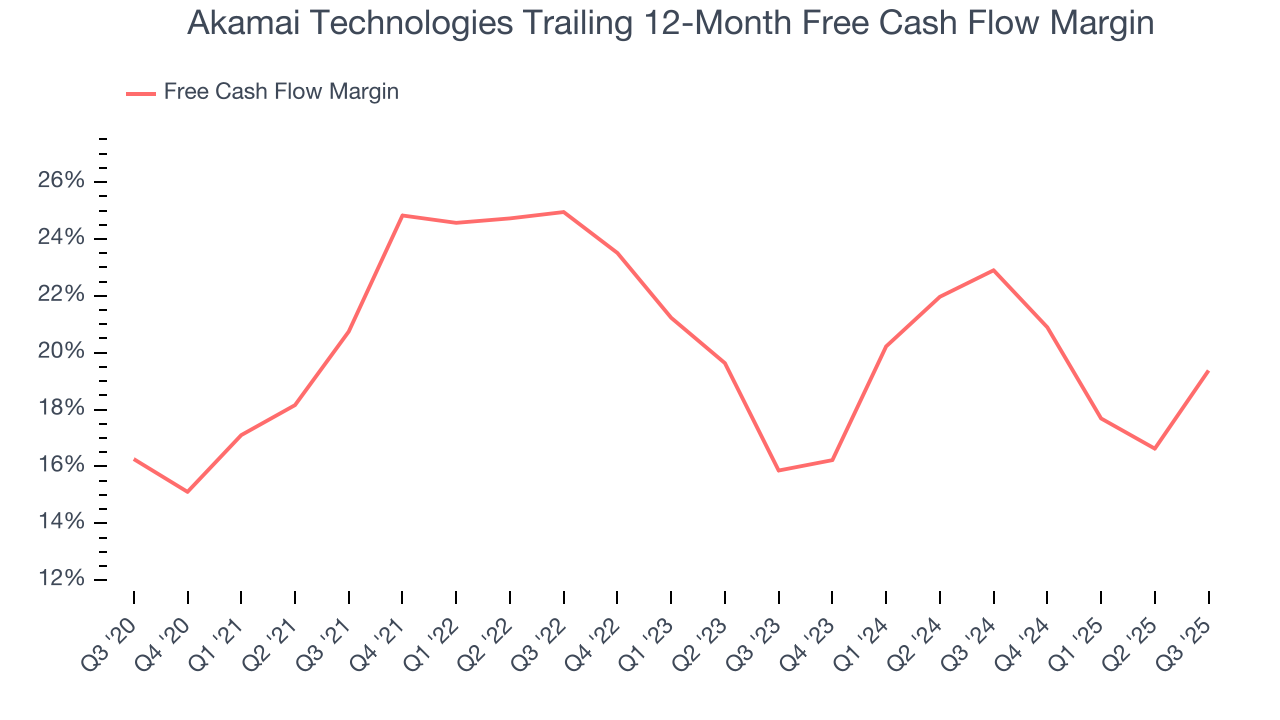

Akamai Technologies has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 19.4% over the last year, better than the broader software sector.

Akamai Technologies’s free cash flow clocked in at $329.3 million in Q3, equivalent to a 31.2% margin. This result was good as its margin was 10.6 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts’ consensus estimates show they’re expecting Akamai Technologies’s free cash flow margin of 19.4% for the last 12 months to remain the same.

10. Balance Sheet Assessment

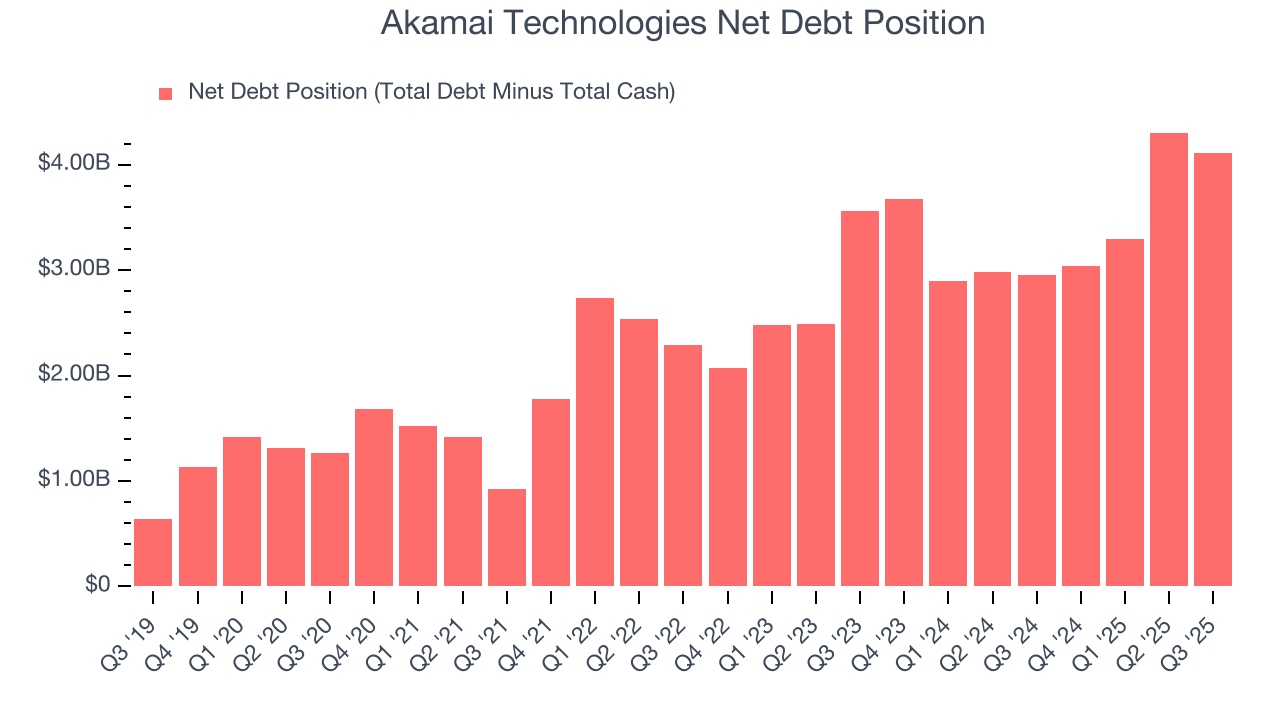

Akamai Technologies reported $1.12 billion of cash and $5.23 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.77 billion of EBITDA over the last 12 months, we view Akamai Technologies’s 2.3× net-debt-to-EBITDA ratio as safe. We also see its $42.63 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Akamai Technologies’s Q3 Results

We were impressed by Akamai Technologies’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 6.6% to $77.84 immediately after reporting.

12. Is Now The Time To Buy Akamai Technologies?

Updated: February 2, 2026 at 9:16 PM EST

Before making an investment decision, investors should account for Akamai Technologies’s business fundamentals and valuation in addition to what happened in the latest quarter.

Akamai Technologies falls short of our quality standards. First off, its revenue growth was weak over the last five years, and analysts don’t see anything changing over the next 12 months. And while its impressive operating margins show it has a highly efficient business model, the downside is its customer acquisition is less efficient than many comparable companies. On top of that, its gross margins show its business model is much less lucrative than other companies.

Akamai Technologies’s price-to-sales ratio based on the next 12 months is 3.2x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $101.64 on the company (compared to the current share price of $96.62).