Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at Microchip Technology (NASDAQ:MCHP), and the best and worst performers in the analog semiconductors group.

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 15 analog semiconductors stocks we track reported a weaker Q4; on average, revenues beat analyst consensus estimates by 1.69%, while on average next quarter revenue guidance was 2.68% under consensus. Increasing interest rates hurt growth companies as investors search for near-term cash flows, but analog semiconductors stocks held their ground better than others, with the share prices up 0.11% since the previous earnings results, on average.

Best Q4: Microchip Technology (NASDAQ:MCHP)

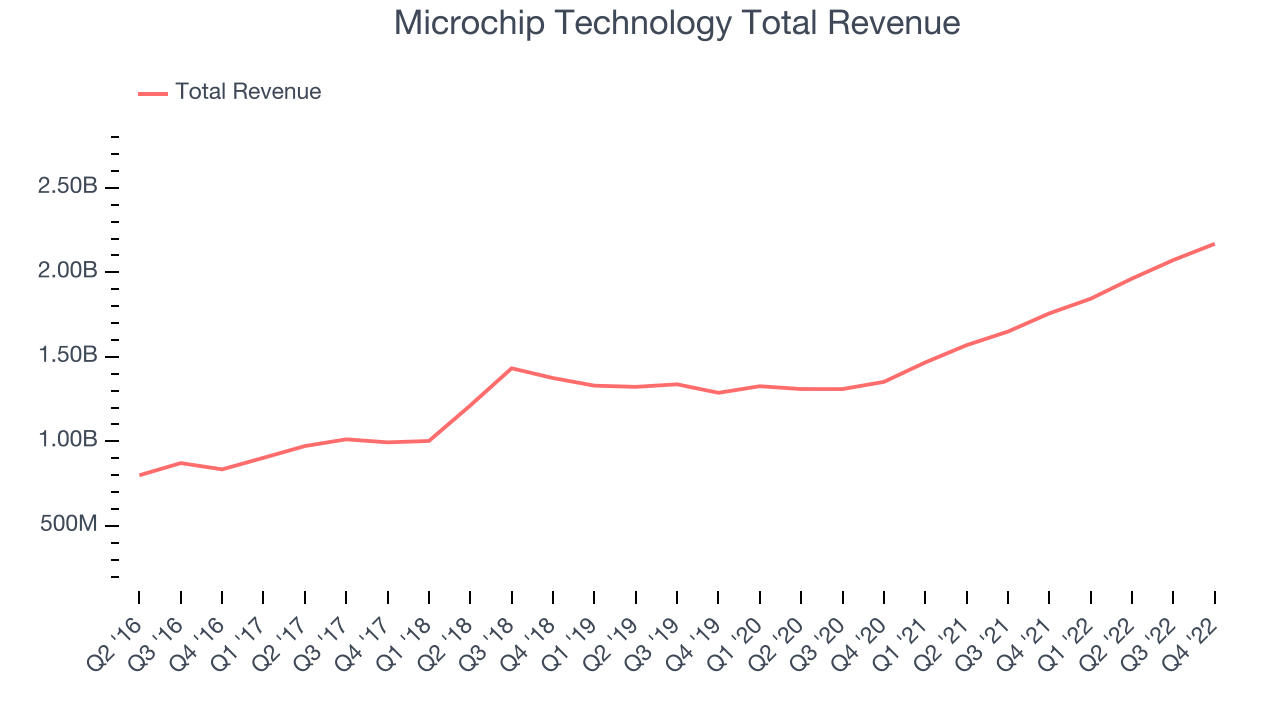

Spun out from General Instrument in 1987, Microchip Technology (NASDAQ: MCHP) is a leading provider of microcontrollers and integrated circuits used mainly in the automotive world, especially in electric vehicles and their charging devices.

Microchip Technology reported revenues of $2.17 billion, up 23.4% year on year, in line with analyst expectations. It was a mixed quarter for the company, with a meaningful improvement in gross margin but an increase in inventory levels.

"We are pleased to report our 9th consecutive revenue growth quarter and another quarter of record operating profit and net income," said Ganesh Moorthy, President and Chief Executive Officer.

The stock is down 2.67% since the results and currently trades at $82.3.

Is now the time to buy Microchip Technology? Access our full analysis of the earnings results here, it's free.

Vishay Intertechnology (NYSE:VSH)

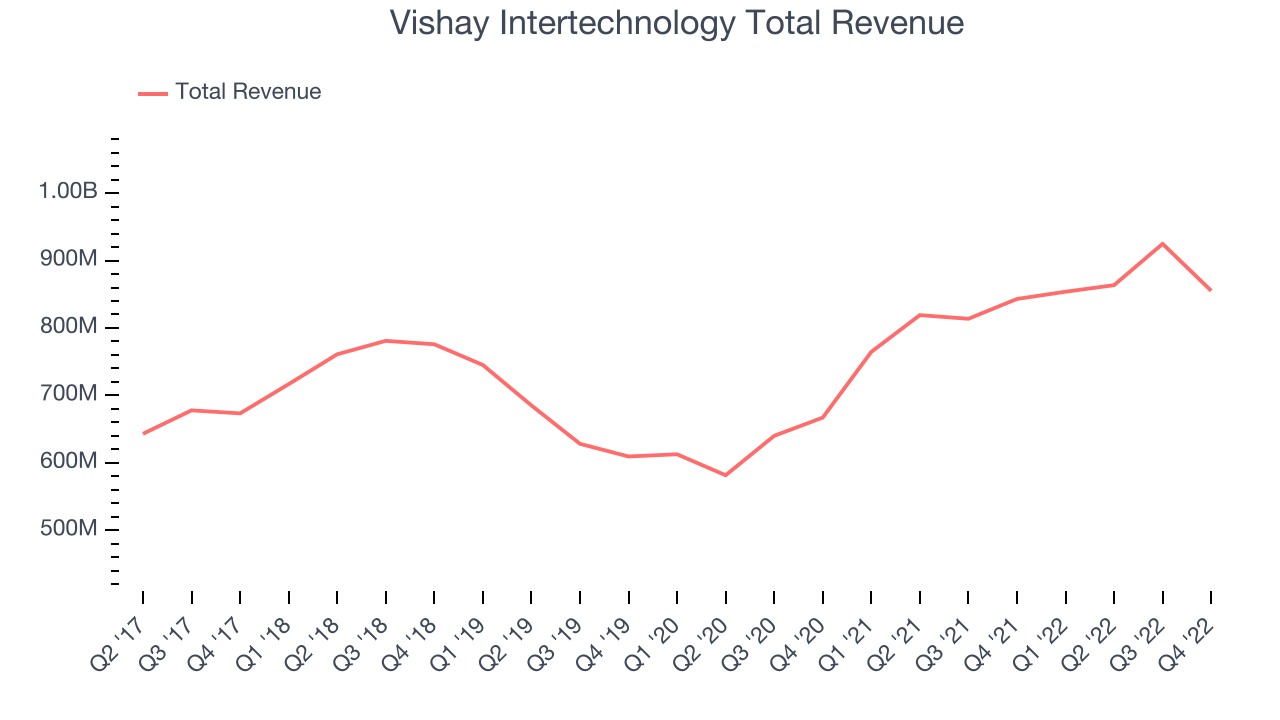

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE:VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

Vishay Intertechnology reported revenues of $855.3 million, up 1.45% year on year, missing analyst expectations by 3.1%. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and a miss of top-line analyst estimates.

Vishay Intertechnology had the weakest performance against analyst estimates among its peers. The stock is down 9.95% since the results and currently trades at $21.62.

Is now the time to buy Vishay Intertechnology? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Magnachip (NYSE:MX)

With its technology found in common consumer electronics such as TVs and smartphones, Magnachip Semiconductor (NYSE:MX) is a provider of analog and mixed-signal semiconductors.

Magnachip reported revenues of $61 million, down 44.7% year on year, beating analyst expectations by 2.22%. It was a weak quarter for the company, with declining revenue and underwhelming guidance for the next quarter.

Magnachip had the slowest revenue growth in the group. The stock is down 11.5% since the results and currently trades at $9.09.

Read our full analysis of Magnachip's results here.

Impinj (NASDAQ:PI)

Founded by Caltech professor Carver Mead and one of his students Chris Diorio, Impinj (NASDAQ:PI) is a maker of radio-frequency identification (RFID) hardware and software.

Impinj reported revenues of $76.6 million, up 45.7% year on year, in line with analyst expectations. It was a solid quarter for the company, with a significant improvement in operating margin and revenue guidance for the next quarter above analysts' estimates.

Impinj pulled off the fastest revenue growth among the peers. The stock is up 4.25% since the results and currently trades at $130.47.

Read our full, actionable report on Impinj here, it's free.

Analog Devices (NASDAQ:ADI)

Founded by two MIT graduates, Ray Stata and Matthew Lorber in 1965, Analog Devices (NASDAQ:ADI) is one of the largest providers of high performance analog integrated circuits used mainly in industrial end markets, along with communications, autos, and consumer devices.

Analog Devices reported revenues of $3.25 billion, up 21.1% year on year, beating analyst expectations by 3.16%. It was a strong quarter for the company, with very optimistic guidance for the next quarter.

The stock is up 2.49% since the results and currently trades at $187.01.

Read our full, actionable report on Analog Devices here, it's free.

The author has no position in any of the stocks mentioned