Microchip Technology (MCHP)

Microchip Technology is in for a bumpy ride. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Microchip Technology Will Underperform

Spun out from General Instrument in 1987, Microchip Technology (NASDAQ: MCHP) is a leading provider of microcontrollers and integrated circuits used mainly in the automotive world, especially in electric vehicles and their charging devices.

- Sales tumbled by 3.8% annually over the last five years, showing market trends are working against its favor during this cycle

- Earnings per share decreased by more than its revenue over the last five years, showing each sale was less profitable

- ROIC of 11.1% reflects management’s challenges in identifying attractive investment opportunities, and its decreasing returns suggest its historical profit centers are aging

Microchip Technology’s quality is insufficient. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Microchip Technology

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Microchip Technology

Microchip Technology is trading at $76.58 per share, or 31.7x forward P/E. This multiple rich for the business quality. Not a great combination.

It’s better to pay up for high-quality businesses with strong long-term earnings potential rather than to buy lower-quality companies with open questions and big downside risks.

3. Microchip Technology (MCHP) Research Report: Q4 CY2025 Update

Analog chipmaker Microchip Technology (NASDAQ:MCHP) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 15.6% year on year to $1.19 billion. Guidance for next quarter’s revenue was optimistic at $1.26 billion at the midpoint, 2.4% above analysts’ estimates. Its non-GAAP profit of $0.44 per share was 2.7% above analysts’ consensus estimates.

Microchip Technology (MCHP) Q4 CY2025 Highlights:

- Revenue: $1.19 billion vs analyst estimates of $1.18 billion (15.6% year-on-year growth, 0.6% beat)

- Adjusted EPS: $0.44 vs analyst estimates of $0.43 (2.7% beat)

- Adjusted Operating Income: $337.8 million vs analyst estimates of $324.7 million (28.5% margin, 4% beat)

- Revenue Guidance for Q1 CY2026 is $1.26 billion at the midpoint, above analyst estimates of $1.23 billion

- Adjusted EPS guidance for Q1 CY2026 is $0.50 at the midpoint, above analyst estimates of $0.49

- Operating Margin: 12.8%, up from 3% in the same quarter last year

- Free Cash Flow Margin: 26.9%, up from 24.7% in the same quarter last year

- Inventory Days Outstanding: 201, up from 198 in the previous quarter

- Market Capitalization: $42.28 billion

Company Overview

Spun out from General Instrument in 1987, Microchip Technology (NASDAQ: MCHP) is a leading provider of microcontrollers and integrated circuits used mainly in the automotive world, especially in electric vehicles and their charging devices.

Microchip is a leading provider of microprocessors (MPUs) which are made up of microcontrollers (MCUs) and Digital Signal Controllers (DSCs). Microcontrollers are effectively mini computers on a chip, they consist of a CPU, some memory, an analog chip, and a simple, application specific software that tells the chip what to do.

Microchip’s microcontrollers are low cost customized chips that are in thousands of products. Examples would be automobile engine control systems, implantable medical devices, remote controls, office machines, appliances, power tools, or toys.

Digital Signal Controllers are a variation of microcontroller that measures, filters and/or compresses digital or analog signals. They are used in motor control, power conversion, and sensor processing applications, often in the same types of systems as a microcontroller.

Microchip has a design ecosystem and library of off-the-shelf components that allows its customers to design any kind of custom microprocessor they can think of.

Microchips’ peers and competitors include Texas Instruments (NASDAQ:TXN), Skyworks (NASDAQ:SWKS), and Infineon (XTRA:IFX), among others.

4. Analog Semiconductors

Longer manufacturing duration allows analog chip makers to generate greater efficiencies, leading to structurally higher gross margins than their fabless digital peers. The downside of vertical integration is that cyclicality can be more pronounced for analog chipmakers, as capacity utilization upsides work in reverse during down periods.

5. Revenue Growth

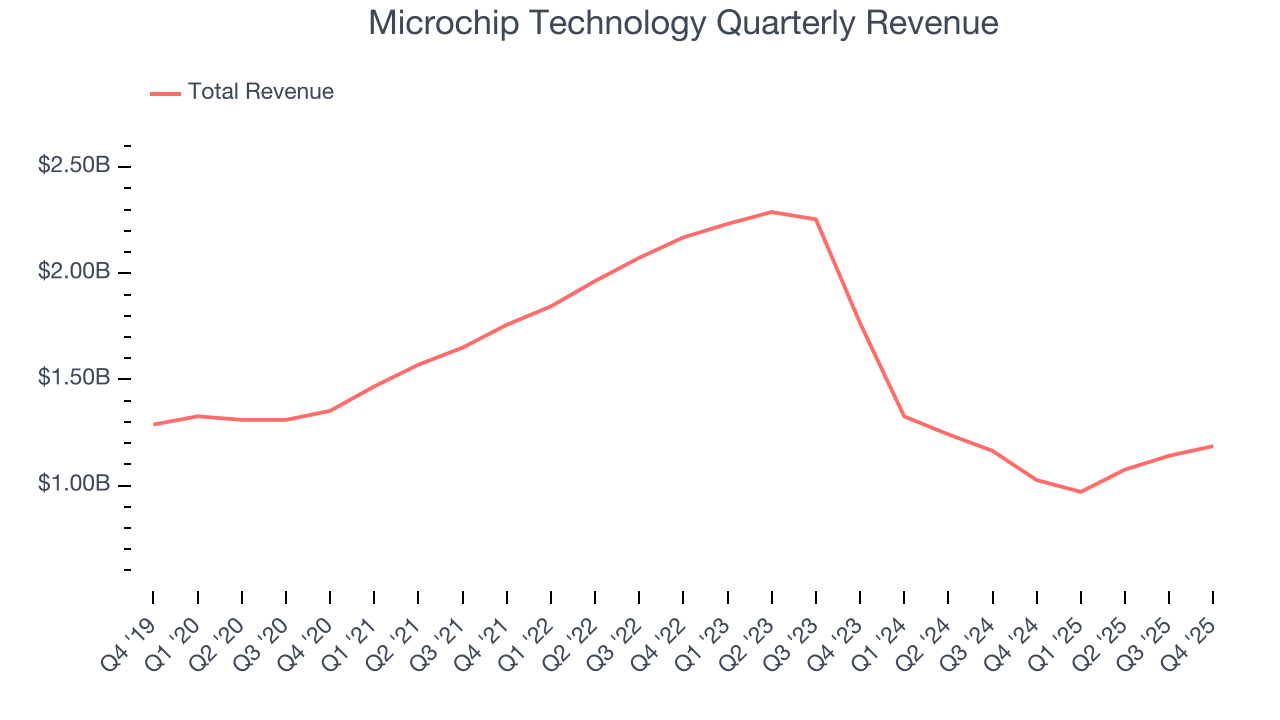

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Microchip Technology struggled to consistently generate demand over the last five years as its sales dropped at a 3.8% annual rate. This was below our standards and suggests it’s a low quality business. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Microchip Technology’s recent performance shows its demand remained suppressed as its revenue has declined by 28.5% annually over the last two years.

This quarter, Microchip Technology reported year-on-year revenue growth of 15.6%, and its $1.19 billion of revenue exceeded Wall Street’s estimates by 0.6%. Adding to the positive news, Microchip Technology’s growth inflected positively this quarter, news that will likely give some shareholders hope. Company management is currently guiding for a 29.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 21.9% over the next 12 months, an improvement versus the last two years. This projection is admirable and implies its newer products and services will fuel better top-line performance.

6. Product Demand & Outstanding Inventory

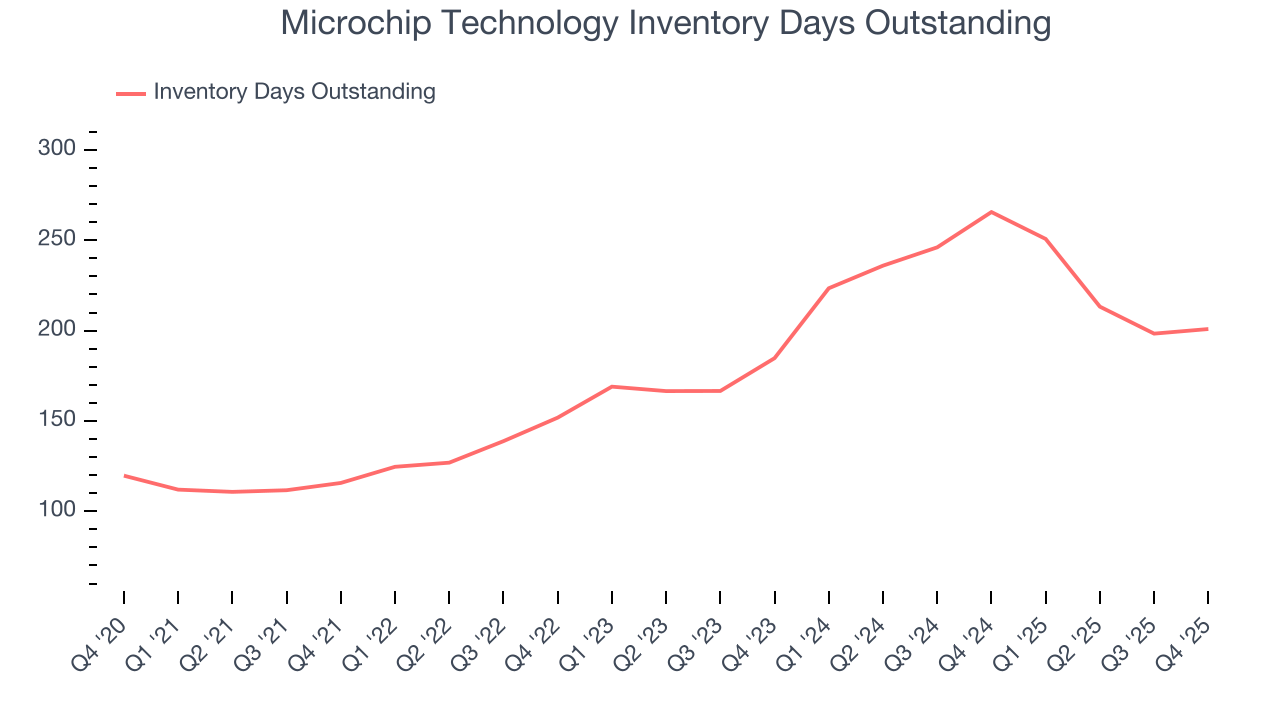

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Microchip Technology’s DIO came in at 201, which is 25 days above its five-year average, suggesting that the company’s inventory has grown to higher levels than we’ve seen in the past.

7. Gross Margin & Pricing Power

In the semiconductor industry, a company’s gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Microchip Technology’s gross margin is well ahead of its semiconductor peers, and its strong pricing power is an output of its differentiated, value-add products. As you can see below, it averaged an excellent 56.7% gross margin over the last two years. That means Microchip Technology only paid its suppliers $43.27 for every $100 in revenue.

Microchip Technology produced a 59.6% gross profit margin in Q4, marking a 4.9 percentage point increase from 54.7% in the same quarter last year. On a wider time horizon, however, Microchip Technology’s full-year margin has been trending down over the past 12 months, decreasing by 2.5 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs (such as raw materials and manufacturing expenses).

8. Operating Margin

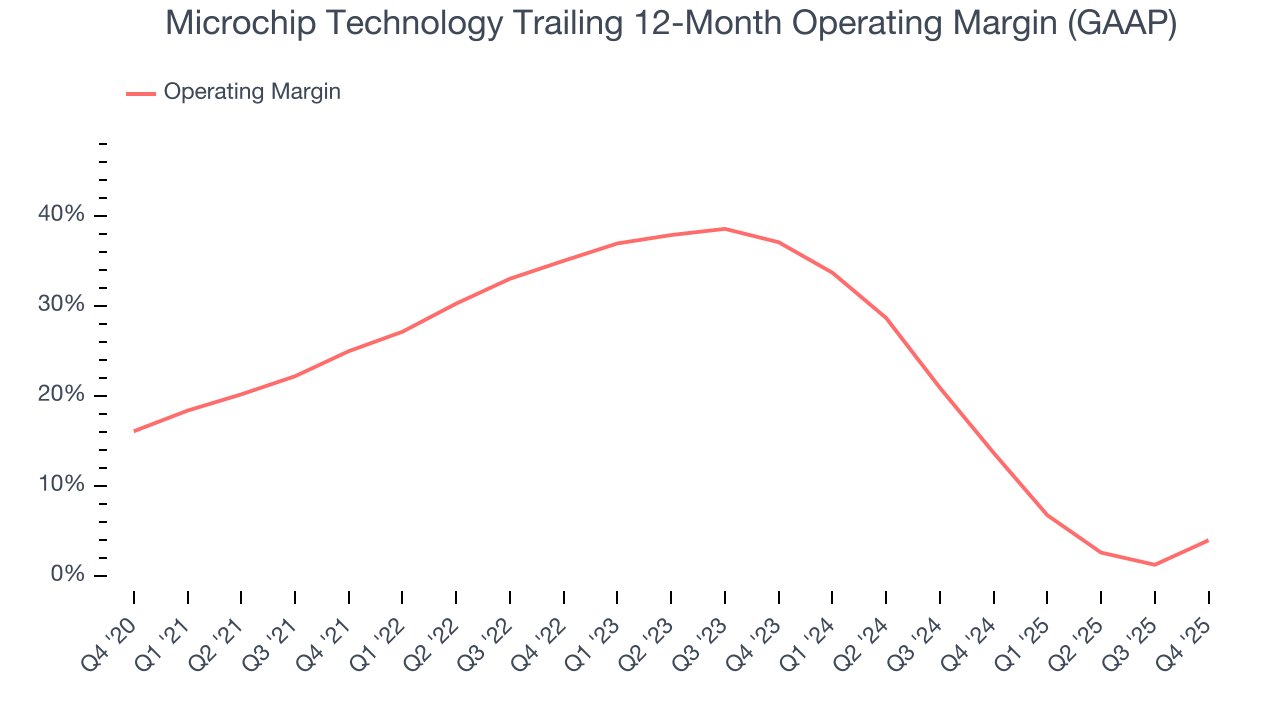

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Microchip Technology was profitable over the last two years but held back by its large cost base. Its average operating margin of 9% was weak for a semiconductor business. This result is surprising given its high gross margin as a starting point.

Analyzing the trend in its profitability, Microchip Technology’s operating margin decreased by 21 percentage points over the last five years. Microchip Technology’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

In Q4, Microchip Technology generated an operating margin profit margin of 12.8%, up 9.8 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

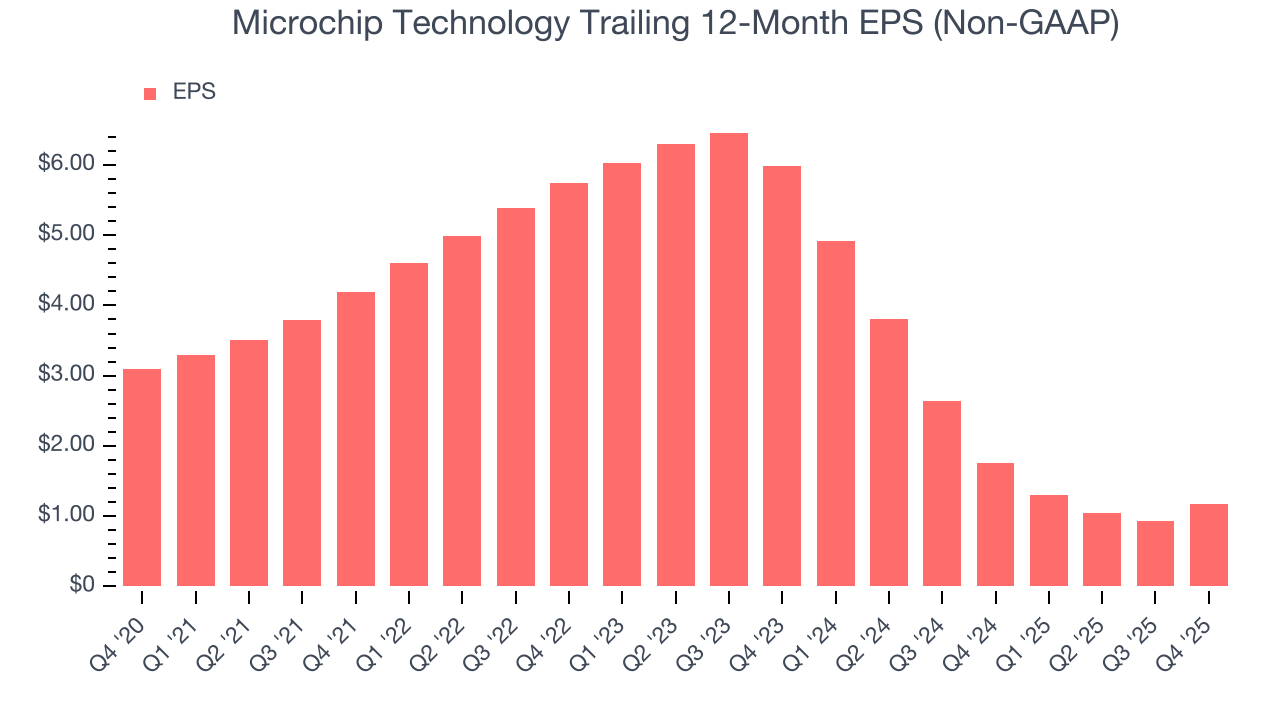

9. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Microchip Technology, its EPS declined by 17.7% annually over the last five years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Diving into the nuances of Microchip Technology’s earnings can give us a better understanding of its performance. As we mentioned earlier, Microchip Technology’s operating margin expanded this quarter but declined by 21 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Microchip Technology reported adjusted EPS of $0.44, up from $0.20 in the same quarter last year. This print beat analysts’ estimates by 2.7%. Over the next 12 months, Wall Street expects Microchip Technology’s full-year EPS of $1.17 to grow 105%.

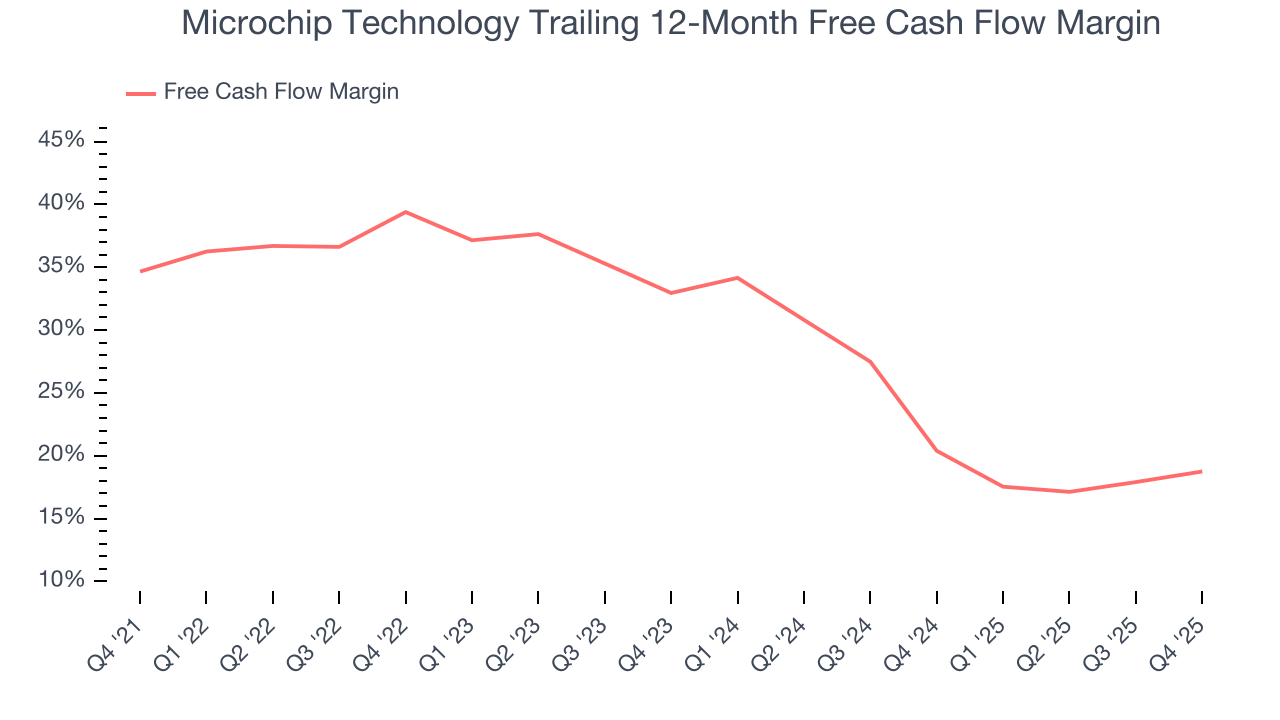

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Microchip Technology has shown impressive cash profitability, and if maintainable, will be in a position to ride out cyclical downturns more easily while continuing to invest in new and existing products. The company’s free cash flow margin averaged 19.6% over the last two years, better than the broader semiconductor sector.

Taking a step back, we can see that Microchip Technology’s margin dropped by 15.9 percentage points over the last five years. Continued declines could signal it is in the middle of an investment cycle.

Microchip Technology’s free cash flow clocked in at $318.9 million in Q4, equivalent to a 26.9% margin. This result was good as its margin was 2.2 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Microchip Technology historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 11.1%, somewhat low compared to the best semiconductor companies that consistently pump out 35%+.

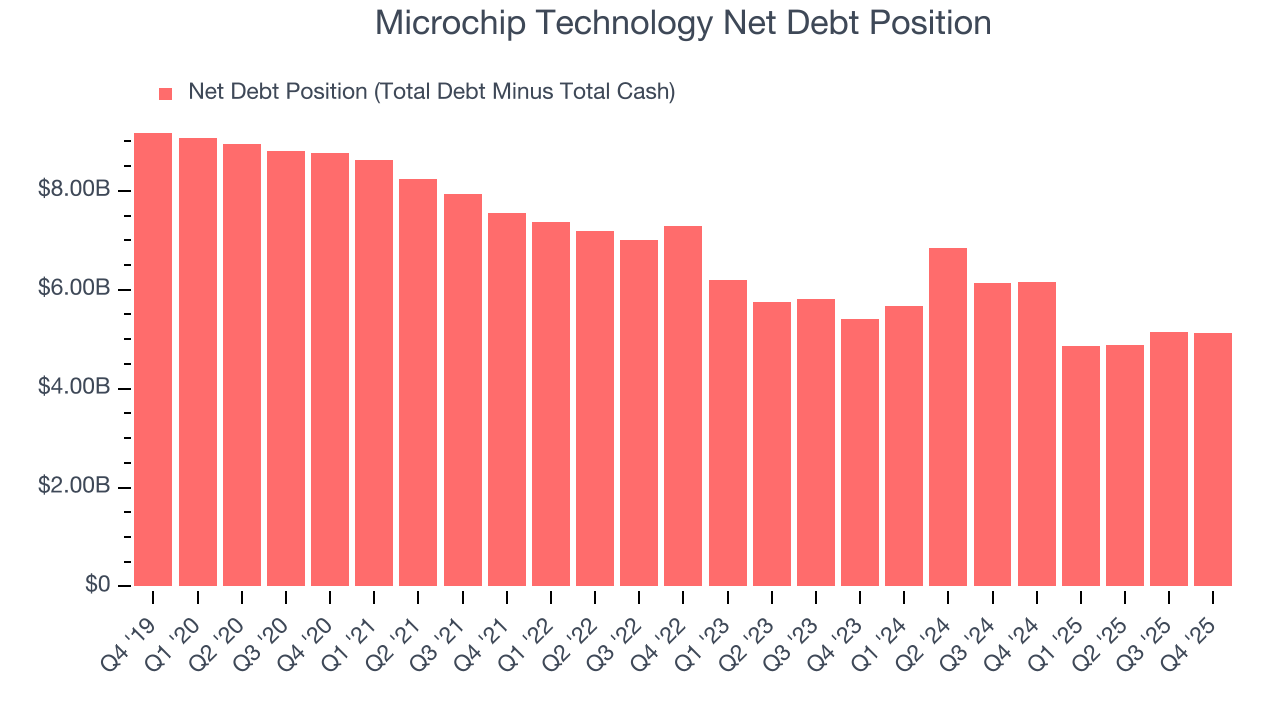

12. Balance Sheet Assessment

Microchip Technology reported $250.7 million of cash and $5.37 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $1.23 billion of EBITDA over the last 12 months, we view Microchip Technology’s 4.2× net-debt-to-EBITDA ratio as safe. We also see its $172.1 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Microchip Technology’s Q4 Results

We enjoyed seeing Microchip Technology beat analysts’ adjusted operating income expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Overall, this print had some key positives. The market seemed to be hoping for more, and the stock traded down 4% to $75.03 immediately after reporting.

14. Is Now The Time To Buy Microchip Technology?

Updated: February 20, 2026 at 9:32 PM EST

A common mistake we notice when investors are deciding whether to buy a stock or not is that they simply look at the latest earnings results. Business quality and valuation matter more, so we urge you to understand these dynamics as well.

Microchip Technology doesn’t pass our quality test. To kick things off, its revenue has declined over the last five years. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last five years makes it a less attractive asset to the public markets. On top of that, its cash profitability fell over the last five years.

Microchip Technology’s P/E ratio based on the next 12 months is 31.7x. At this valuation, there’s a lot of good news priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $86.60 on the company (compared to the current share price of $76.58).