MACOM (MTSI)

MACOM piques our interest. Its annual EPS growth of 22.2% over the last five years has topped its peer group.― StockStory Analyst Team

1. News

2. Summary

Why MACOM Is Interesting

Founded in the 1950s as Microwave Associates, a communications supplier to the US Army Signal Corp, today MACOM Technology Solutions (NASDAQ: MTSI) is a provider of analog chips used in optical, wireless, and satellite networks.

- Earnings growth has easily exceeded the peer group average over the last five years as its EPS has compounded at 22.2% annually

- Offerings are difficult to replicate at scale and result in a top-tier gross margin of 54.5%

- The stock is trading at a reasonable price if you like its story and growth prospects

MACOM has some noteworthy aspects. If you’re a believer, the price seems reasonable.

Why Is Now The Time To Buy MACOM?

High Quality

Investable

Underperform

Why Is Now The Time To Buy MACOM?

MACOM is trading at $207.86 per share, or 48.3x forward P/E. When viewed through the lens of top-line growth, we think the company’s multiple is reasonable. Just remember that the lofty valuation could mean some near-term stock swings as the market ebbs and flows.

Now could be a good time to invest if you believe in the story.

3. MACOM (MTSI) Research Report: Q4 CY2025 Update

Network chips maker MACOM Technology Solutions (NASDAQ: MTSI) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 24.5% year on year to $271.6 million. On top of that, next quarter’s revenue guidance ($285 million at the midpoint) was surprisingly good and 3.4% above what analysts were expecting. Its non-GAAP profit of $1.02 per share was 2.2% above analysts’ consensus estimates.

MACOM (MTSI) Q4 CY2025 Highlights:

- Revenue: $271.6 million vs analyst estimates of $269 million (24.5% year-on-year growth, 1% beat)

- Adjusted EPS: $1.02 vs analyst estimates of $1.00 (2.2% beat)

- Revenue Guidance for Q1 CY2026 is $285 million at the midpoint, above analyst estimates of $275.6 million

- Adjusted EPS guidance for Q1 CY2026 is $1.07 at the midpoint, above analyst estimates of $1.03

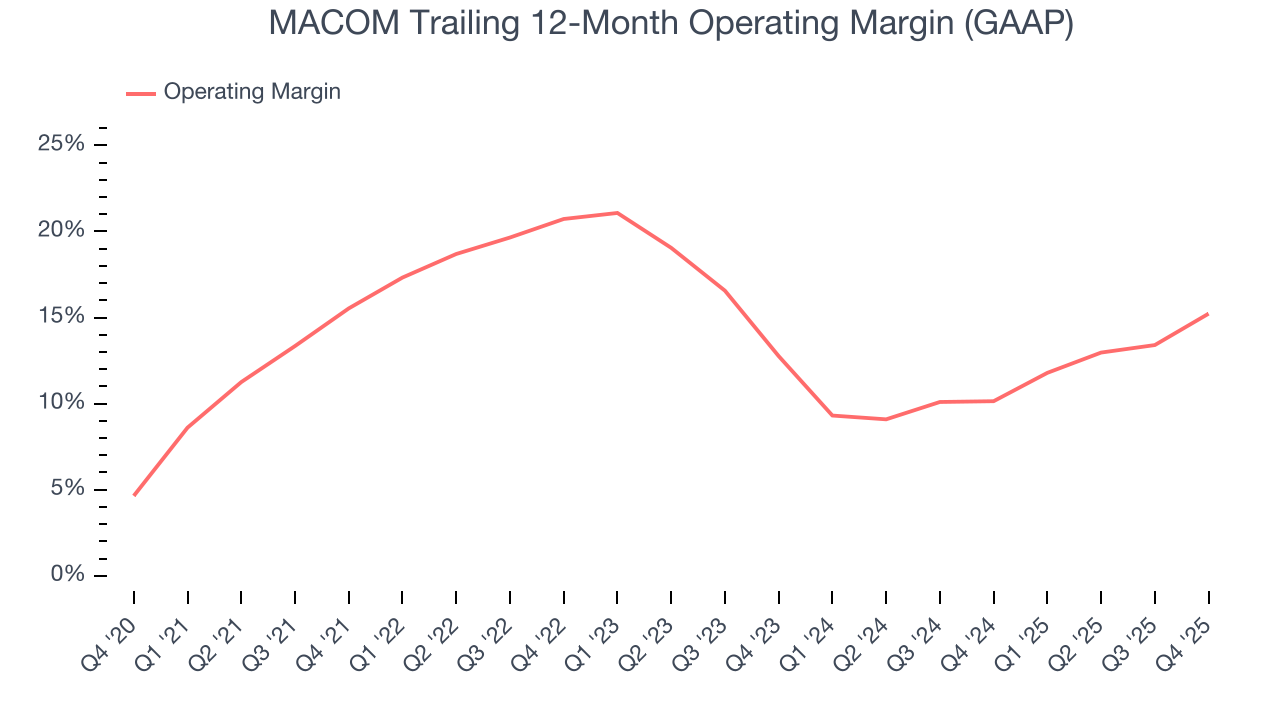

- Operating Margin: 15.9%, up from 8% in the same quarter last year

- Free Cash Flow Margin: 11%, down from 28.1% in the same quarter last year

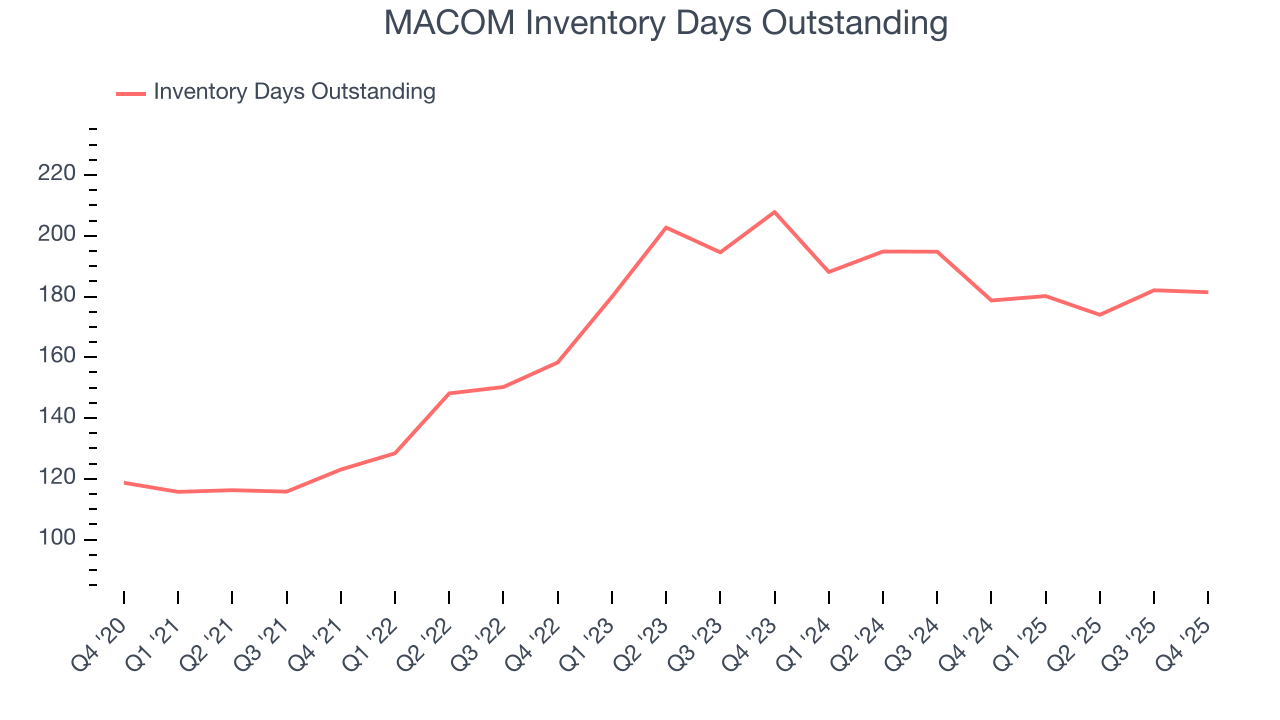

- Inventory Days Outstanding: 181, in line with the previous quarter

- Market Capitalization: $16.13 billion

Company Overview

Founded in the 1950s as Microwave Associates, a communications supplier to the US Army Signal Corp, today MACOM Technology Solutions (NASDAQ: MTSI) is a provider of analog chips used in optical, wireless, and satellite networks.

MACOM's semiconductor components serve as critical building blocks in complex electronic systems across multiple industries. The company's products include integrated circuits, multi-chip modules, amplifiers, switches, diodes, and various RF and optical subsystems that enable high-performance signal transmission and processing.

In the Industrial and Defense sector, MACOM provides components for military radar systems, electronic countermeasures, satellite communications, and tactical radios. The company's "Trusted Foundry" status from the U.S. Department of Defense gives it a competitive advantage for military applications requiring domestic supply chains. Beyond defense, MACOM serves industrial applications like test equipment, scientific instruments, and medical imaging systems where precise signal handling is essential.

For Data Centers, MACOM delivers optical and photonic components that enable high-speed data transmission at 100G, 400G, 800G and beyond. These products help solve the challenge of moving massive amounts of data quickly and efficiently between and within data centers. The company offers a comprehensive portfolio including PAM-4 physical layers, transimpedance amplifiers, lasers, and photodetectors.

In the Telecommunications market, MACOM supports infrastructure for cellular networks, fiber optic systems, and satellite communications. Its components help telecom providers expand bandwidth to meet growing demands for data-intensive applications. The company's manufacturing model combines internal fabrication facilities in Massachusetts, Michigan, and France with external foundry partnerships, giving it flexibility in production while maintaining quality control.

MACOMs peers and competitors include Analog Devices (NASDAQ:ADI), Texas Instruments (NASDAQ:TXN), Skyworks (NASDAQ:SWKS), Infineon (XTRA:IFX), NXP Semiconductors NV (NASDAQ:NXPI), Monolithic Power Systems (NASDAQ: MPWR), Marvell Technology (NASDAQ:MRVL), and Microchip (NASDAQ:MCHP).

4. Analog Semiconductors

Longer manufacturing duration allows analog chip makers to generate greater efficiencies, leading to structurally higher gross margins than their fabless digital peers. The downside of vertical integration is that cyclicality can be more pronounced for analog chipmakers, as capacity utilization upsides work in reverse during down periods.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, MACOM grew its sales at a solid 12.8% compounded annual growth rate. Its growth beat the average semiconductor company and shows its offerings resonate with customers, a helpful starting point for our analysis. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a half-decade historical view may miss new demand cycles or industry trends like AI. MACOM’s annualized revenue growth of 27.8% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, MACOM reported robust year-on-year revenue growth of 24.5%, and its $271.6 million of revenue topped Wall Street estimates by 1%. Beyond the beat, this marks 8 straight quarters of growth, showing that the current upcycle has had a good run - a typical upcycle usually lasts 8-10 quarters. Company management is currently guiding for a 20.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.1% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above the sector average and indicates the market sees some success for its newer products and services.

6. Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, MACOM’s DIO came in at 181, which is 16 days above its five-year average. These numbers suggest that despite the recent decrease, the company’s inventory levels are higher than what we’ve seen in the past.

7. Gross Margin & Pricing Power

In the semiconductor industry, a company’s gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

MACOM’s gross margin is well ahead of its semiconductor peers, and its strong pricing power is an output of its differentiated, value-add products. As you can see below, it averaged an excellent 54.5% gross margin over the last two years. That means MACOM only paid its suppliers $45.50 for every $100 in revenue.

This quarter, MACOM’s gross profit margin was 55.9%, up 2.2 percentage points year on year. MACOM’s full-year margin has also been trending up over the past 12 months, increasing by 1.6 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

8. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

MACOM was profitable over the last two years but held back by its large cost base. Its average operating margin of 13% was weak for a semiconductor business. This result is surprising given its high gross margin as a starting point.

Analyzing the trend in its profitability, MACOM’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, MACOM generated an operating margin profit margin of 15.9%, up 7.9 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

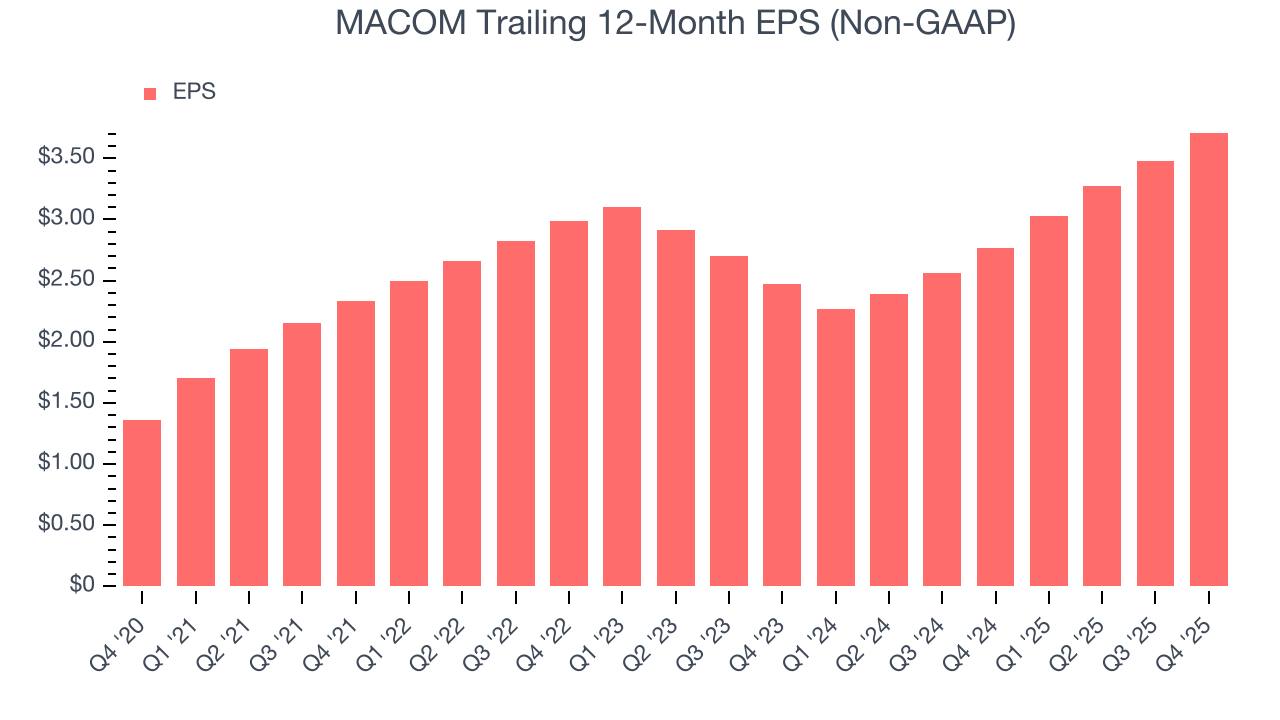

9. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

MACOM’s EPS grew at a remarkable 22.2% compounded annual growth rate over the last five years, higher than its 12.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

In Q4, MACOM reported adjusted EPS of $1.02, up from $0.79 in the same quarter last year. This print beat analysts’ estimates by 2.2%. Over the next 12 months, Wall Street expects MACOM’s full-year EPS of $3.71 to grow 19.8%.

10. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

MACOM has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 18.5% over the last two years, slightly better than the broader semiconductor sector.

Taking a step back, we can see that MACOM’s margin dropped by 4.8 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity.

MACOM’s free cash flow clocked in at $29.99 million in Q4, equivalent to a 11% margin. The company’s cash profitability regressed as it was 17.1 percentage points lower than in the same quarter last year, suggesting its historical struggles have dragged on.

11. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although MACOM has shown solid business quality lately, it historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 12%, somewhat low compared to the best semiconductor companies that consistently pump out 35%+.

12. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

MACOM is a profitable, well-capitalized company with $768.5 million of cash and $567.7 million of debt on its balance sheet. This $200.8 million net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

13. Key Takeaways from MACOM’s Q4 Results

It was encouraging to see MACOM’s revenue guidance for next quarter beat analysts’ expectations. We were also happy its adjusted operating income outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $215.10 immediately following the results.

14. Is Now The Time To Buy MACOM?

Updated: March 6, 2026 at 9:23 PM EST

When considering an investment in MACOM, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

There are things to like about MACOM. First off, its revenue growth was solid over the last five years and is expected to accelerate over the next 12 months. And while its cash profitability fell over the last five years, its remarkable EPS growth over the last five years shows its profits are trickling down to shareholders. On top of that, its gross margins indicate it has pricing power.

MACOM’s P/E ratio based on the next 12 months is 48.3x. When scanning the semiconductor space, MACOM trades at a fair valuation. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $261.14 on the company (compared to the current share price of $207.86), implying they see 25.6% upside in buying MACOM in the short term.