Identity management software maker Okta (NASDAQ:OKTA) announced better-than-expected results in the Q1 FY2022 quarter, with revenue up 37.2% year on year to $251 million. Okta made a GAAP loss of $109.2 million, down on its loss of $57.6 million, in the same quarter last year.

What do these results signal for the future of Okta? Get early access our full analysis here

Okta (NASDAQ:OKTA) Q1 FY2022 Highlights:

- Revenue: $251 million vs analyst estimates of $239.1 million (4.95% beat)

- EPS (non-GAAP): -$0.10 vs analyst estimates of -$0.20 ($0.10 miss)

- Revenue guidance for Q2 2022 is $296 million at the midpoint, above analyst estimates of $260.2 million

- The company lifted revenue guidance for the full year, from $1.08 billion to $1.22 billion at the midpoint, a 12.4% increase

- Free cash flow of $52.8 million, up 62.5% from previous quarter

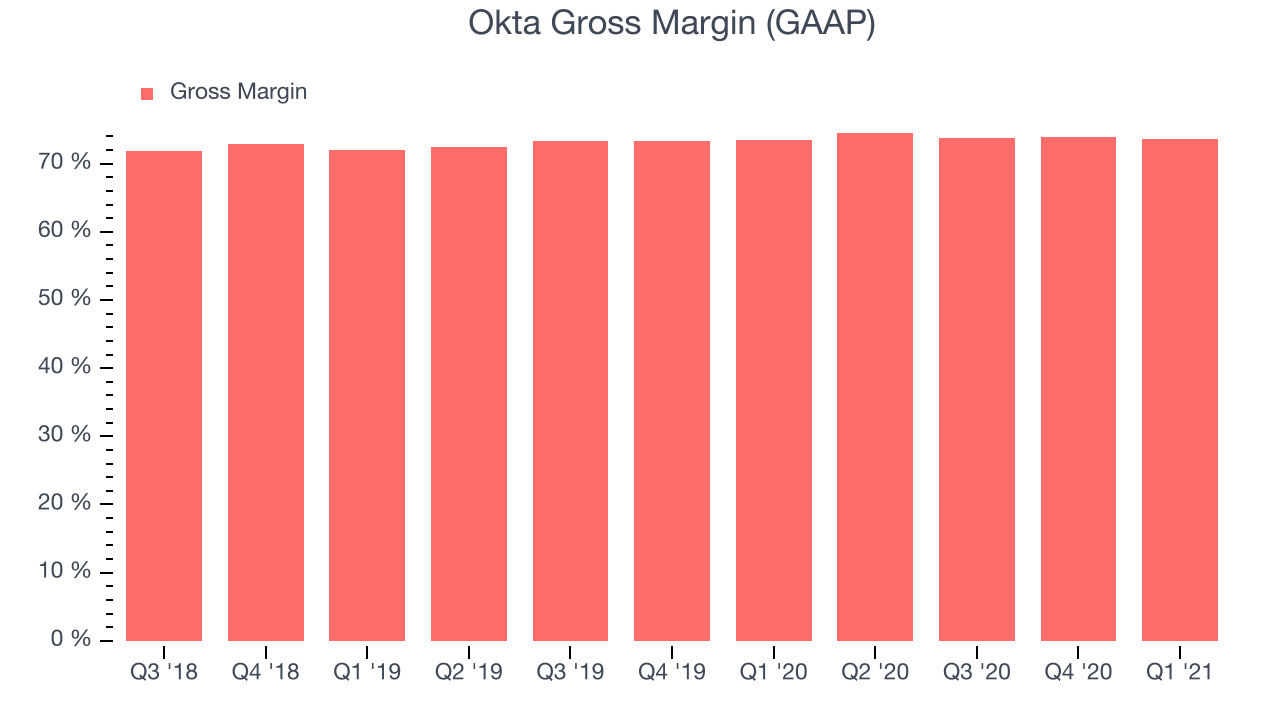

- Gross Margin (GAAP): 73.6%, in line with previous quarter

- Updated valuation: Okta is up at $252 and now trades at 36x price-to-sales (LTM), compared to 38.4x just before the results.

"Broad-based demand for both our customer and workforce identity solutions led to another quarter of strong financial results and an excellent start to the fiscal year," said Todd McKinnon, Chief Executive Officer and co-founder of Okta.

Identity As A Service

Similar to many other great tech businesses, Okta was founded during the aftermath of the financial crisis in 2009. The founders Todd McKinnon and Frederic Kerrest were working at Salesforce at that time and saw how cloud is changing the world of enterprise software but also how companies struggle to keep track of all the logins for the new services they just subscribed to. Okta (NASDAQ:OKTA) is a cloud-based software as a service platform that helps companies manage identity for their employees and customers.

Instead of managing separate login details for each of the many software tools an employee is using, Okta provides them with a single account (Single Sign-On) which employees then use to login into any service. That makes it a lot easier for companies to then through a centralized system manage who has access to what, setup automated rules to make sure that when employees leave access is withdrawn, and enforce policies around passwords and account security. Okta also provides companies with software that in similar fashion handles authentication and account details storage of their customers.

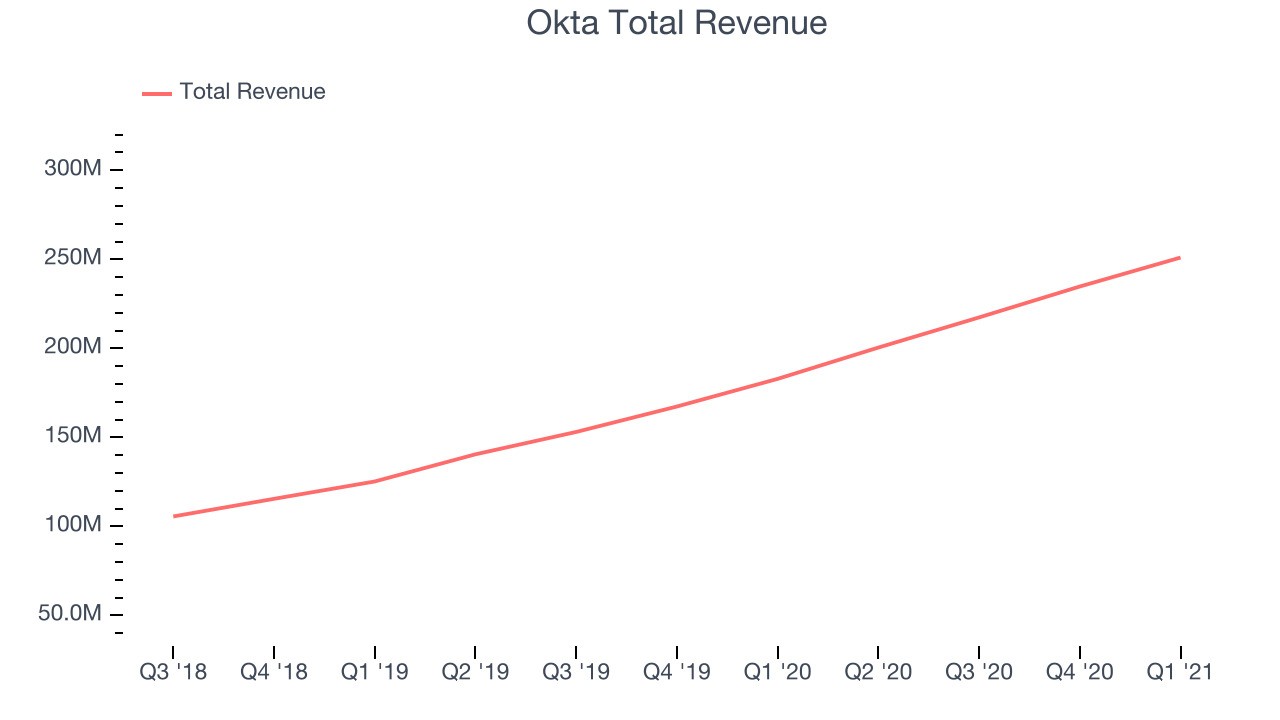

As you can see below, Okta's revenue growth has been impressive over the last twelve months, growing from $182.8 million to $251 million.

And unsurprisingly, this was another great quarter for Okta with revenue up an absolutely stunning 37.2% year on year. Quarter on quarter the revenue increased by $16.2 million in Q1, which was in line with Q4 2021. This steady quarter-on-quarter growth shows the company is able to maintain a strong growth trajectory.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers.

Okta's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 73.6% in Q1. That means that for every $1 in revenue the company had $0.73 left to spend on developing new products, marketing & sales and the general administrative overhead. This is around the average what we typically see in SaaS businesses, but it is good to see that the gross margin is staying stable which indicates that Okta is doing a good job controlling costs and is not under a pressure from competition to lower prices.

Key Takeaways from Okta's Q1 Results

Sporting a market capitalisation of $37.3 billion, more than $2.69 billion in cash and operating free cash flow positive over the last twelve months, we're confident that Okta has the resources it needs to pursue a high growth business strategy.

We were impressed by the very optimistic revenue guidance Okta provided for the next quarter. And we were also glad that the revenue guidance for the rest of the year was upgraded. Zooming out, we think this was a great quarter and we have no doubt shareholders will feel excited about the results. Therefore, we think Okta will continue to stand out as a compelling growth stock, arguably even more so than before.

PS. If you found this analysis useful, you will love our earnings alerts! We publish so fast, you often have the opportunity to buy or sell before the market has fully absorbed the information. Never miss out on the right time to invest again. Signup here for free early access.

The author has no position in any of the stocks mentioned.