Okta (OKTA)

We’re skeptical of Okta. Its decelerating revenue growth and expected decline in cash profitability will make it tough to beat the market.― StockStory Analyst Team

1. News

2. Summary

Why We Think Okta Will Underperform

Named after the meteorological measurement for cloud cover, Okta (NASDAQ:OKTA) provides cloud-based identity management solutions that help organizations securely connect their employees, partners, and customers to the right applications and services.

- Estimated sales growth of 9% for the next 12 months implies demand will slow from its two-year trend

- Offerings struggled to generate meaningful interest as its average billings growth of 9.8% over the last year did not impress

- A bright spot is that its robust free cash flow profile gives it the flexibility to invest in growth initiatives or return capital to shareholders

Okta doesn’t live up to our standards. Better businesses are for sale in the market.

Why There Are Better Opportunities Than Okta

Why There Are Better Opportunities Than Okta

Okta’s stock price of $80.72 implies a valuation ratio of 4.5x forward price-to-sales. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Okta (OKTA) Research Report: Q4 CY2025 Update

Identity management company Okta (NASDAQ:OKTA) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 11.6% year on year to $761 million. On the other hand, next quarter’s revenue guidance of $751 million was less impressive, coming in 0.5% below analysts’ estimates. Its non-GAAP profit of $0.90 per share was 6.3% above analysts’ consensus estimates.

Okta (OKTA) Q4 CY2025 Highlights:

- Revenue: $761 million vs analyst estimates of $749.1 million (11.6% year-on-year growth, 1.6% beat)

- Adjusted EPS: $0.90 vs analyst estimates of $0.85 (6.3% beat)

- Adjusted Operating Income: $202 million vs analyst estimates of $189.9 million (26.5% margin, 6.4% beat)

- Revenue Guidance for Q1 CY2026 is $751 million at the midpoint, below analyst estimates of $754.9 million

- Adjusted EPS guidance for the upcoming financial year 2027 is $3.78 at the midpoint, beating analyst estimates by 2.9%

- Operating Margin: 6%, up from 1.2% in the same quarter last year

- Free Cash Flow Margin: 33.1%, up from 28.4% in the previous quarter

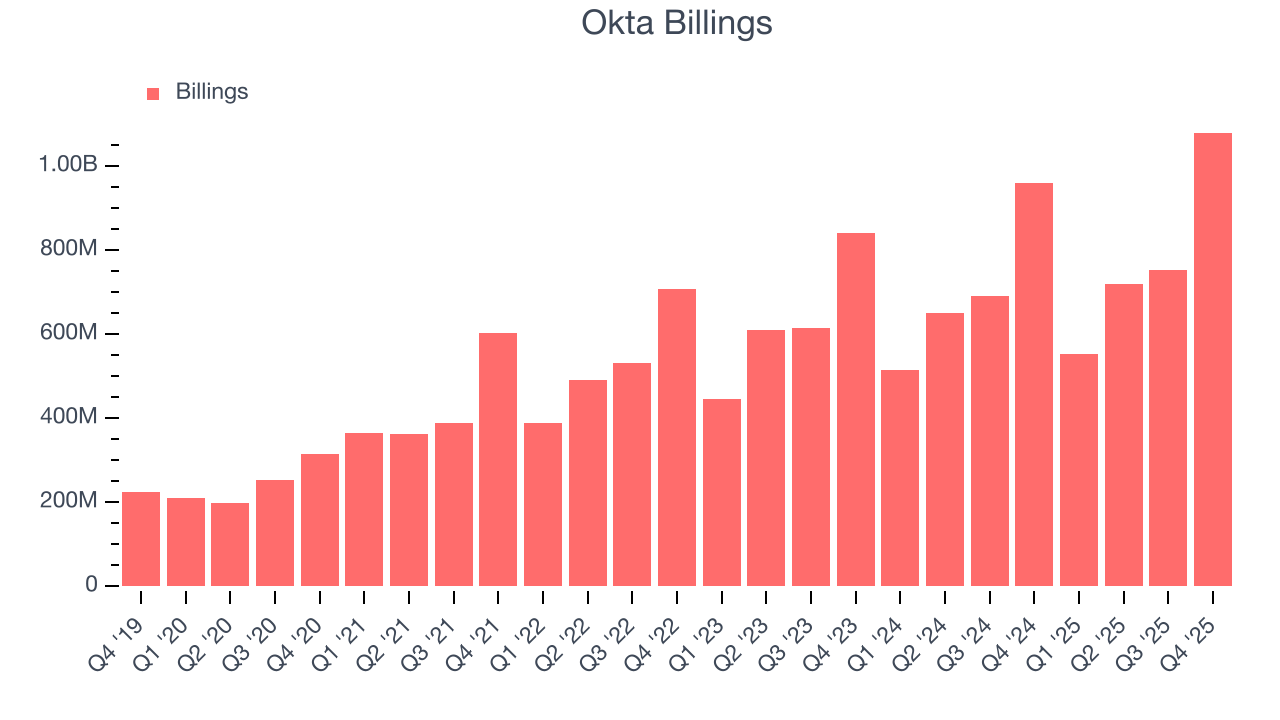

- Billings: $1.08 billion at quarter end, up 12.5% year on year

- Market Capitalization: $12.85 billion

Company Overview

Named after the meteorological measurement for cloud cover, Okta (NASDAQ:OKTA) provides cloud-based identity management solutions that help organizations securely connect their employees, partners, and customers to the right applications and services.

Okta operates through two main product lines: Workforce Identity Cloud and Customer Identity Cloud. The Workforce Identity Cloud enables organizations to securely manage access for employees, contractors, and partners across applications, devices, and infrastructure. Features include single sign-on capabilities, multi-factor authentication, and automated user provisioning and de-provisioning as employees join or leave organizations.

The Customer Identity Cloud, powered by Auth0 (acquired by Okta), helps companies build secure login experiences for their own customers. Developers use this platform to embed authentication, authorization, and user management into websites and applications without building these complex security features themselves. For example, a streaming service might use Okta's Customer Identity Cloud to manage user logins across devices while protecting against account takeover attempts.

Okta follows a subscription-based SaaS business model, with revenue primarily coming from multi-year contracts. The company serves thousands of organizations across virtually every industry, from small businesses to Fortune 50 enterprises. Its platform integrates with over 7,000 applications and services, including major providers like Microsoft, Google, Salesforce, and Amazon Web Services. This extensive integration network creates powerful network effects—as Okta adds more applications and customers to its ecosystem, the platform becomes increasingly valuable to existing and potential users.

4. Identity Management

As software penetrates corporate life, employees are using more apps every day, on more devices, in more locations. This drives the need for identity and access management software that help companies efficiently manage who has access to what, and ensure that access privileges are secure from cyber criminals.

Okta's primary competitor is Microsoft with its Entra ID (formerly Azure Active Directory) product. Other competitors include Ping Identity, ForgeRock, CyberArk, OneLogin, and cloud service providers offering their own identity management solutions.

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Okta grew its sales at an impressive 28.4% compounded annual growth rate. Its growth beat the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Okta’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 13.6% over the last two years was well below its five-year trend.

This quarter, Okta reported year-on-year revenue growth of 11.6%, and its $761 million of revenue exceeded Wall Street’s estimates by 1.6%. Company management is currently guiding for a 9.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.6% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Okta’s billings came in at $1.08 billion in Q4, and over the last four quarters, its growth was underwhelming as it averaged 9.8% year-on-year increases. This alternate topline metric grew slower than total sales, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for Okta to acquire new customers as its CAC payback period checked in at 74.5 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

8. Gross Margin & Pricing Power

For software companies like Okta, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Okta’s gross margin is good for a software business and points to its solid unit economics, competitive products and services, and lack of meaningful pricing pressure. As you can see below, it averaged an impressive 77.4% gross margin over the last year. Said differently, Okta paid its providers $22.64 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Okta has seen gross margins improve by 3 percentage points over the last 2 year, which is very good in the software space.

Okta’s gross profit margin came in at 77.9% this quarter , marking a 1.1 percentage point increase from 76.8% in the same quarter last year. Okta’s full-year margin has also been trending up over the past 12 months, increasing by 1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

9. Operating Margin

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Okta has managed its cost base well over the last year. It demonstrated solid profitability for a software business, producing an average operating margin of 5.1%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Okta’s operating margin rose by 7.9 percentage points over the last two years, as its sales growth gave it operating leverage.

In Q4, Okta generated an operating margin profit margin of 6%, up 4.9 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Okta has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors while maintaining a cash cushion. The company’s free cash flow margin averaged 29.6% over the last year, quite impressive for a software business. Okta has shown robust cash profitability relative to peers over the last year, giving the company fewer opportunities to return capital to shareholders.

Okta’s free cash flow clocked in at $252 million in Q4, equivalent to a 33.1% margin. The company’s cash profitability regressed as it was 8.5 percentage points lower than in the same quarter last year, but it’s still above its one-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, causing short-term swings. Long-term trends are more important.

Over the next year, analysts’ consensus estimates show they’re expecting Okta’s free cash flow margin of 29.6% for the last 12 months to remain the same.

11. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Okta is a profitable, well-capitalized company with $2.55 billion of cash and $422 million of debt on its balance sheet. This $2.13 billion net cash position is 16.8% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Okta’s Q4 Results

It was great to see Okta’s full-year EPS guidance top analysts’ expectations. We were also glad its billings outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed and its revenue guidance for next quarter fell slightly short of Wall Street’s estimates. Overall, this print was mixed but still had some key positives. The stock remained flat at $71.09 immediately after reporting.

13. Is Now The Time To Buy Okta?

Updated: March 7, 2026 at 9:09 PM EST

Before deciding whether to buy Okta or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Okta isn’t a terrible business, but it doesn’t pass our quality test. Although its revenue growth was strong over the last five years, it’s expected to deteriorate over the next 12 months and its ARR has disappointed and shows the company is having difficulty retaining customers and their spending. And while the company’s bountiful generation of free cash flow empowers it to invest in growth initiatives, the downside is its expanding operating margin shows it’s becoming more efficient at building and selling its software.

Okta’s price-to-sales ratio based on the next 12 months is 4.5x. While this valuation is fair, the upside isn’t great compared to the potential downside. We're fairly confident there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $101.07 on the company (compared to the current share price of $80.72).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.