Zscaler (ZS)

Zscaler is a great business. Its ARR growth highlights the stickiness of its business model and suggests it’s winning market share.― StockStory Analyst Team

1. News

2. Summary

Why We Like Zscaler

Pioneering the "zero trust" approach that has fundamentally changed enterprise network security, Zscaler (NASDAQ:ZS) provides a cloud-based security platform that connects users, devices, and applications securely without traditional network-based security hardware.

- Winning new contracts that can potentially increase in value as its billings growth has averaged 26.3% over the last year

- Strong free cash flow margin of 29.9% gives it the option to reinvest, repurchase shares, or pay dividends

- Forecasted revenue growth of 21.7% for the next 12 months indicates its momentum over the last two years is sustainable

We see a bright future for Zscaler. The valuation looks fair in light of its quality, so this might be a favorable time to buy some shares.

Why Is Now The Time To Buy Zscaler?

Why Is Now The Time To Buy Zscaler?

Zscaler is trading at $159.89 per share, or 7.8x forward price-to-sales. Most companies in the software sector may feature a cheaper multiple, but we think Zscaler is priced fairly given its fundamentals.

Our work shows, time and again, that buying high-quality companies and holding them routinely leads to market outperformance. Over a multi-year investment horizon, entry price doesn’t matter nearly as much as business quality.

3. Zscaler (ZS) Research Report: Q3 CY2025 Update

Cloud security platform Zscaler (NASDAQ:ZS) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 25.5% year on year to $788.1 million. The company expects next quarter’s revenue to be around $798 million, close to analysts’ estimates. Its non-GAAP profit of $0.96 per share was 11.4% above analysts’ consensus estimates.

Zscaler (ZS) Q3 CY2025 Highlights:

- Revenue: $788.1 million vs analyst estimates of $773.6 million (25.5% year-on-year growth, 1.9% beat)

- Adjusted EPS: $0.96 vs analyst estimates of $0.86 (11.4% beat)

- Adjusted Operating Income: $171.9 million vs analyst estimates of $167.9 million (21.8% margin, 2.4% beat)

- The company slightly lifted its revenue guidance for the full year to $3.29 billion at the midpoint from $3.27 billion

- Management raised its full-year Adjusted EPS guidance to $3.80 at the midpoint, a 3.8% increase

- Operating Margin: -4.6%, in line with the same quarter last year

- Free Cash Flow Margin: 52.4%, up from 23.9% in the previous quarter

- Billings: $597 million at quarter end, up 15.5% year on year

- Market Capitalization: $44.38 billion

Company Overview

Pioneering the "zero trust" approach that has fundamentally changed enterprise network security, Zscaler (NASDAQ:ZS) provides a cloud-based security platform that connects users, devices, and applications securely without traditional network-based security hardware.

The company's Zero Trust Exchange platform processes over 500 billion transactions daily through more than 160 data centers across 185 countries. This distributed cloud architecture eliminates the need for businesses to route traffic through central data centers for security scanning, instead functioning as an intelligent "switchboard" that uses business policies to securely connect users and applications regardless of location.

Zscaler offers three core products: Zscaler for Users enables secure access to internet and internal applications; Zscaler for Workloads secures cloud-based applications and data; and Zscaler for IoT/OT protects connected devices in industrial environments. These solutions incorporate capabilities like advanced threat protection, data loss prevention, cloud sandbox testing, and zero trust network access that would traditionally require multiple separate security appliances.

A typical enterprise might use Zscaler to allow employees to securely access cloud applications like Microsoft 365 or Salesforce from any location without compromising security, while simultaneously protecting sensitive corporate data. This enables companies to phase out expensive MPLS networks and VPN infrastructure while improving security posture. The platform also helps organizations migrate applications to public cloud environments by securing workload communications and identifying misconfigurations or vulnerabilities.

Zscaler operates on a subscription model, with pricing based on the number of users, applications, and specific services deployed. The company focuses primarily on larger enterprises, with approximately 35% of the Forbes Global 2000 among its customer base spanning industries like financial services, healthcare, manufacturing, and government.

4. Network Security

Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks. The migration of businesses to the cloud and employees working remotely in insecure environments is increasing demand modern cloud-based network security software, which offers better performance at lower cost than maintaining the traditional on-premise solutions, such as expensive specialized firewall hardware.

Zscaler competes with traditional network security vendors like Palo Alto Networks (NASDAQ:PANW), Cisco Systems (NASDAQ:CSCO), and Fortinet (NASDAQ:FTNT), as well as cloud security specialists such as Cloudflare (NYSE:NET) and CrowdStrike (NASDAQ:CRWD). Microsoft (NASDAQ:MSFT) also offers competing capabilities through its Defender platform.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Zscaler grew its sales at an incredible 42.6% compounded annual growth rate. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Zscaler’s annualized revenue growth of 26.9% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Zscaler reported robust year-on-year revenue growth of 25.5%, and its $788.1 million of revenue topped Wall Street estimates by 1.9%. Company management is currently guiding for a 23.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 21.1% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is commendable and suggests the market is forecasting success for its products and services.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Zscaler’s billings punched in at $597 million in Q3, and over the last four quarters, its growth was impressive as it averaged 22.7% year-on-year increases. This performance aligned with its total sales growth, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Zscaler is efficient at acquiring new customers, and its CAC payback period checked in at 36.8 months this quarter. The company’s relatively fast recovery of its customer acquisition costs gives it the option to accelerate growth by increasing its sales and marketing investments.

8. Gross Margin & Pricing Power

What makes the software-as-a-service model so attractive is that once the software is developed, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

Zscaler’s gross margin is good for a software business and points to its solid unit economics, competitive products and services, and lack of meaningful pricing pressure. As you can see below, it averaged an impressive 76.7% gross margin over the last year. Said differently, Zscaler paid its providers $23.26 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Zscaler has seen gross margins decline by 0.7 percentage points over the last 2 year, which is slightly worse than average for software.

This quarter, Zscaler’s gross profit margin was 76.6%, marking a 1 percentage point decrease from 77.6% in the same quarter last year. Zscaler’s full-year margin has also been trending down over the past 12 months, decreasing by 1.3 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

9. Operating Margin

Zscaler’s expensive cost structure has contributed to an average operating margin of negative 4.7% over the last year. This happened because the company spent loads of money to capture market share. As seen in its fast revenue growth, the aggressive strategy has paid off so far, and Wall Street’s estimates suggest the party will continue. We tend to agree and believe the business has a good chance of reaching profitability upon scale.

Analyzing the trend in its profitability, Zscaler’s operating margin might fluctuated slightly but has generally stayed the same over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

Zscaler’s operating margin was negative 4.6% this quarter.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Zscaler has shown robust cash profitability, driven by its attractive business model and cost-effective customer acquisition strategy that enable it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 29.9% over the last year, quite impressive for a software business. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Zscaler’s free cash flow clocked in at $413.3 million in Q3, equivalent to a 52.4% margin. This result was good as its margin was 6 percentage points higher than in the same quarter last year. Its cash profitability was also above its one-year level, and we hope the company can build on this trend.

Over the next year, analysts predict Zscaler’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 29.9% for the last 12 months will decrease to 26.9%.

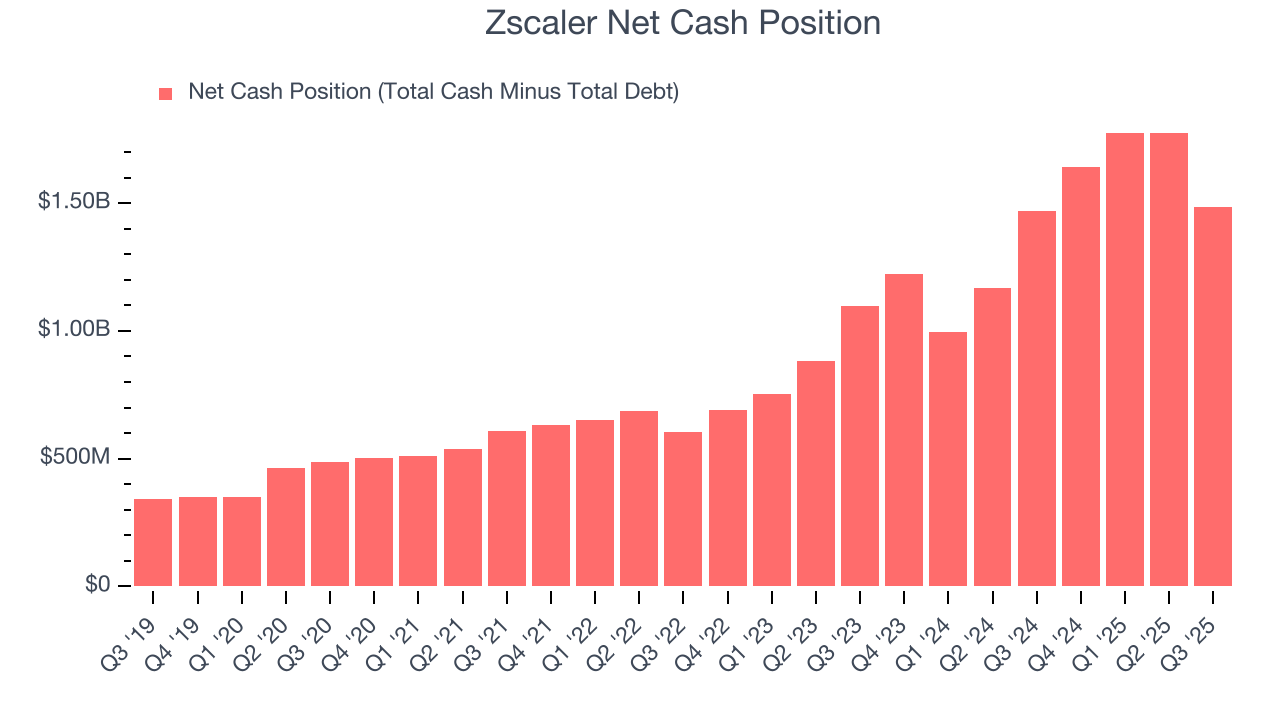

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Zscaler is a well-capitalized company with $3.32 billion of cash and $1.84 billion of debt on its balance sheet. This $1.48 billion net cash position is 3.7% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Zscaler’s Q3 Results

We were impressed by Zscaler’s optimistic full-year EPS guidance, which blew past analysts’ expectations. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its billings missed. Zooming out, we think this was a mixed quarter. The market seemed to be hoping for more, and the stock traded down 10.9% to $260.72 immediately following the results.

13. Is Now The Time To Buy Zscaler?

Updated: February 22, 2026 at 9:20 PM EST

Are you wondering whether to buy Zscaler or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

There are several reasons why we think Zscaler is a great business. First of all, the company’s revenue growth was exceptional over the last five years. And while its operating margin hasn't moved over the last year, its surging ARR shows its fundamentals and revenue predictability are improving. Additionally, Zscaler’s bountiful generation of free cash flow empowers it to invest in growth initiatives.

Zscaler’s price-to-sales ratio based on the next 12 months is 7.8x. Looking at the software landscape today, Zscaler’s fundamentals really stand out, and we like it at this price.

Wall Street analysts have a consensus one-year price target of $300.96 on the company (compared to the current share price of $159.89), implying they see 88.2% upside in buying Zscaler in the short term.