Earnings results often give us a good indication of what direction the company will take in the months ahead. With Q1 now behind us, let’s have a look at ON Semiconductor (NASDAQ:ON) and its peers.

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. The biggest secular growth drivers currently are the adoption of electric vehicles, 5G networks and Internet of Things connectivity, and demand for chips that reduce power consumption. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 9 analog semiconductors stocks we track reported a decent Q1; on average, revenues beat analyst consensus estimates by 2.29%, while on average next quarter revenue guidance was 1.65% above consensus. The technology sell-off has been putting pressure on stocks since November, but analog semiconductors stocks held their ground better than others, with share price down 9.78% since earnings, on average.

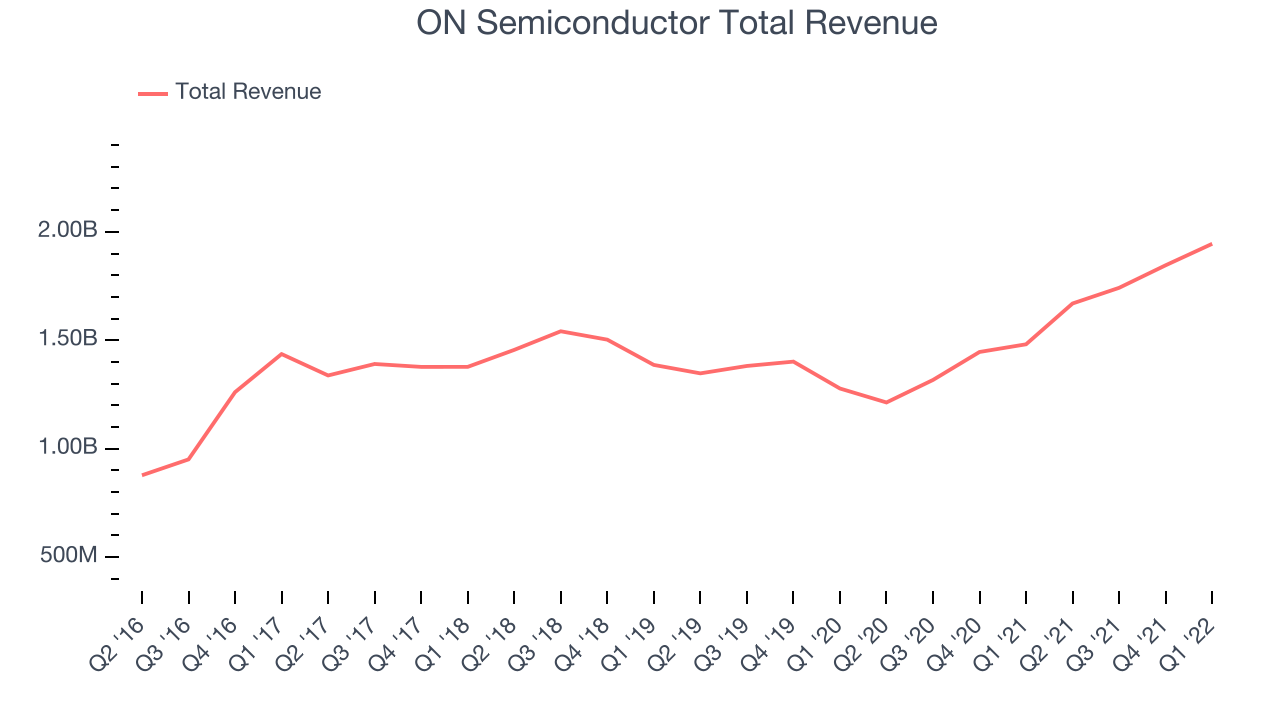

ON Semiconductor (NASDAQ:ON)

Spun out of Motorola in 1999, and built through a series of acquisitions, ON Semiconductor (NASDAQ: ON) is a global provider of analog chips with specialization in autos, industrial applications, and power management in cloud data centers.

ON Semiconductor reported revenues of $1.94 billion, up 31.2% year on year, beating analyst expectations by 2.01%. It was a very strong quarter for the company, with a significant improvement in gross margin and a beat on the bottom line.

“Our focused strategy has delivered sustainable results in onsemi’s margin and growth profile with the automotive and industrial end-markets now representing 65% of our revenue. Our record quarterly results with year-over-year growth of 31% in our first quarter revenue, and gross margin expansion of 1,420 bps to a record of 49.4% highlight the strength of our business and the value of our products as we continue our transformation. With a highly differentiated portfolio of intelligent power and sensing products, strong visibility driven by long-term supply agreements, and exposure to secular megatrends of vehicle electrification, ADAS, energy infrastructure, and factory automation, we are well positioned to sustain our momentum,” said Hassane El-Khoury, president and CEO of onsemi.

The stock is up 3.74% since the results and currently trades at $54.03.

Is now the time to buy ON Semiconductor? Access our full analysis of the earnings results here, it's free.

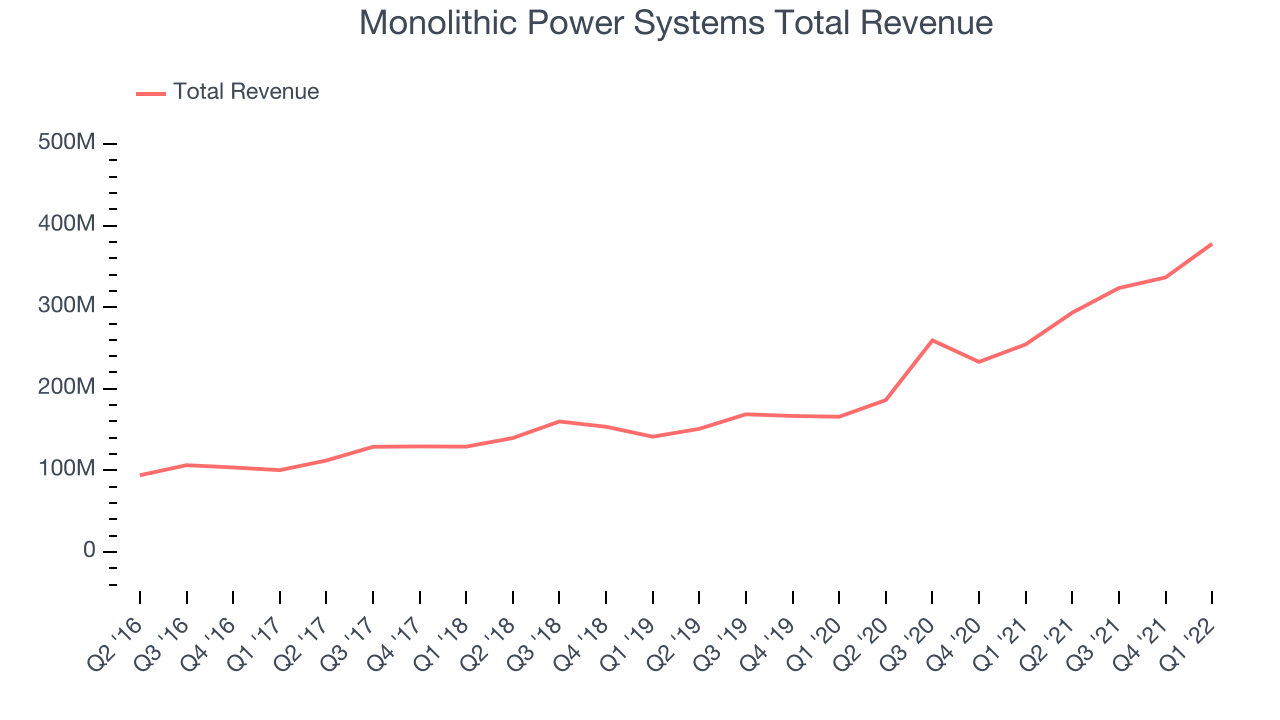

Best Q1: Monolithic Power Systems (NASDAQ:MPWR)

Founded in 1997 by its longtime CEO Michael Hsing, Monolithic Power Systems (NASDAQ: MPWR) is an analog and mixed signal chipmaker that specializes in power management chips meant to minimize total energy consumption.

Monolithic Power Systems reported revenues of $377.7 million, up 48.4% year on year, beating analyst expectations by 4.8%. It was a very strong quarter for the company, with a beat on the bottom line and a very optimistic guidance for the next quarter.

The stock is down 3.07% since the results and currently trades at $398.56.

Is now the time to buy Monolithic Power Systems? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Skyworks Solutions (NASDAQ:SWKS)

Result of a merger of Alpha Industries and the wireless communications division of Conexant, Skyworks Solutions (NASDAQ: SWKS) is a designer and manufacturer of chips used in smartphones, autos, and industrial applications to amplify, filter, and process wireless signals.

Skyworks Solutions reported revenues of $1.33 billion, up 13.9% year on year, in line with analyst expectations. It was a weak quarter for the company, with an underwhelming revenue guidance for the next quarter and an increase in inventory levels.

Skyworks Solutions had the weakest performance against analyst estimates in the group. The stock is down 21.9% since the results and currently trades at $93.13.

Read our full analysis of Skyworks Solutions's results here.

NXP Semiconductors (NASDAQ:NXPI)

Spun off from Dutch electronics giant Philips in 2006, NXP Semiconductors (NASDAQ: NXPI) is a designer and manufacturer of chips used in autos, industrial manufacturing, mobile devices, and communications infrastructure.

NXP Semiconductors reported revenues of $3.13 billion, up 22.1% year on year, beating analyst expectations by 1.04%. It was a solid quarter for the company, with a significant improvement in operating margin.

The stock is down 9.12% since the results and currently trades at $160.85.

Read our full, actionable report on NXP Semiconductors here, it's free.

Microchip Technology (NASDAQ:MCHP)

Spun out from General Instrument in 1987, Microchip Technology (NASDAQ: MCHP) is a leading provider of microcontrollers and integrated circuits used mainly in the automotive world, especially in electric vehicles and their charging devices.

Microchip Technology reported revenues of $1.84 billion, up 25.7% year on year, beating analyst expectations by 1.29%. It was a strong quarter for the company, with a beat on the bottom line.

The stock is down 9.82% since the results and currently trades at $58.07.

Read our full, actionable report on Microchip Technology here, it's free.

The author has no position in any of the stocks mentioned