PubMatic’s (NASDAQ:PUBM) Q3: Beats On Revenue, Provides Optimistic Full-Year Guidance

Adam Hejl /

November 12, 2024

Programmatic advertising platform Pubmatic (NASDAQ: PUBM) reported Q3 CY2024 results topping the market’s revenue expectations, with sales up 12.7% year on year to $71.79 million. Revenue guidance for the full year exceeded analysts’ estimates, but next quarter’s guidance of $88 million was less impressive, coming in 2.2% below expectations. Its non-GAAP profit of $0.12 per share was also 36.4% above analysts’ consensus estimates.

Is now the time to buy PubMatic? Find out in our full research report.

PubMatic (PUBM) Q3 CY2024 Highlights:

- Revenue: $71.79 million vs analyst estimates of $66.04 million (8.7% beat)

- Adjusted EPS: $0.12 vs analyst estimates of $0.09 (36.4% beat)

- EBITDA: $18.55 million vs analyst estimates of $15.87 million (16.9% beat)

- Revenue Guidance for Q4 CY2024 is $88 million at the midpoint, below analyst estimates of $89.93 million

- EBITDA guidance for the full year is $90.5 million at the midpoint, above analyst estimates of $88.83 million

- Gross Margin (GAAP): 64.5%, up from 59% in the same quarter last year

- Operating Margin: -1.9%, down from -0.9% in the same quarter last year

- EBITDA Margin: 25.8%, down from 28.6% in the same quarter last year

- Free Cash Flow Margin: 4%, down from 10.3% in the previous quarter

- Net Revenue Retention Rate: 112%, up from 108% in the previous quarter

- Market Capitalization: $811.7 million

Company Overview

Founded in 2006 as an online ad platform helping ad sellers, Pubmatic (NASDAQ: PUBM) is a fully integrated cloud-based programmatic advertising platform.

Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

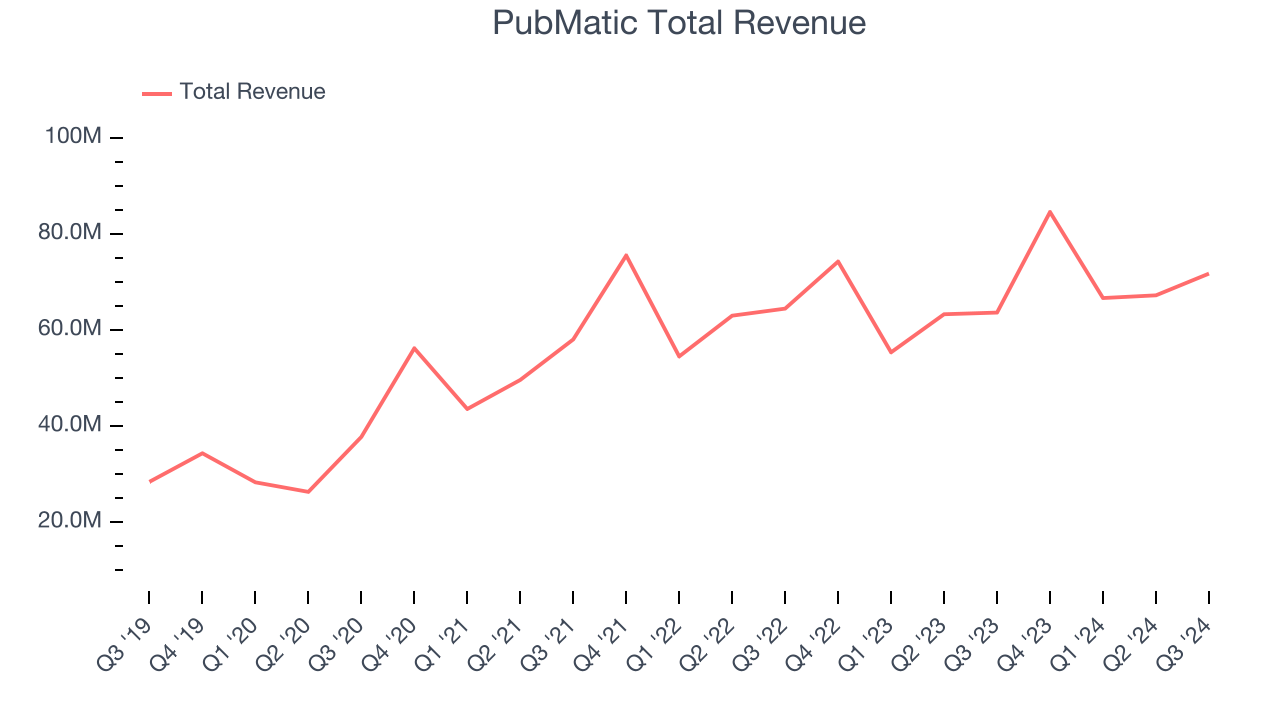

Sales Growth

A company’s long-term performance can indicate its business quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, PubMatic’s 11.8% annualized revenue growth over the last three years was sluggish. This fell short of our expectations.

This quarter, PubMatic reported year-on-year revenue growth of 12.7%, and its $71.79 million of revenue exceeded Wall Street’s estimates by 8.7%. Company management is currently guiding for a 4% year-on-year increase next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 5.8% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products and services will face some demand challenges.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

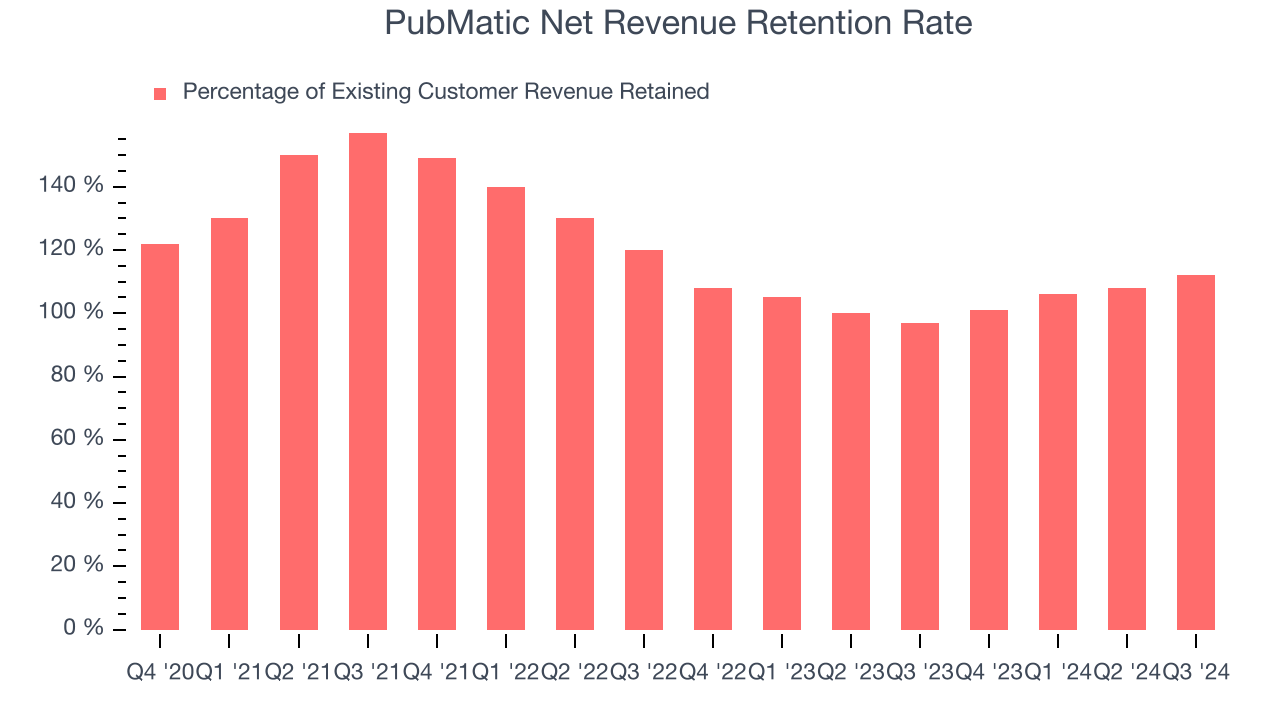

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

PubMatic’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 107% in Q3. This means that even if PubMatic didn’t win any new customers over the last 12 months, it would’ve grown its revenue by 6.8%.

Trending up over the last year, PubMatic has a decent net retention rate, showing us that its customers not only tend to stick around but also get increasing value from its software over time.

Key Takeaways from PubMatic’s Q3 Results

We were impressed by how significantly PubMatic blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed analysts’ expectations and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this quarter was mixed. The stock traded up 2.3% to $16.80 immediately after reporting.

Big picture, is PubMatic a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.