PubMatic (PUBM)

PubMatic is up against the odds. Its revenue growth has decelerated and its historical operating losses don’t give us confidence in a turnaround.― StockStory Analyst Team

1. News

2. Summary

Why We Think PubMatic Will Underperform

Powering billions of daily ad impressions across the open internet, PubMatic (NASDAQ:PUBM) operates a technology platform that helps publishers maximize revenue from their digital advertising inventory while giving advertisers more control and transparency.

- Projected sales decline of 6.8% for the next 12 months points to a tough demand environment ahead

- Day-to-day expenses have swelled compared to its revenue over the last year as its operating margin fell by 7.1 percentage points

- Extended payback periods on sales investments suggest the company’s platform isn’t resonating enough to drive efficient sales conversions

PubMatic is in the doghouse. We believe there are better businesses elsewhere.

Why There Are Better Opportunities Than PubMatic

High Quality

Investable

Underperform

Why There Are Better Opportunities Than PubMatic

PubMatic is trading at $6.54 per share, or 1.1x forward price-to-sales. This sure is a cheap multiple, but you get what you pay for.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. PubMatic (PUBM) Research Report: Q3 CY2025 Update

Digital advertising technology company PubMatic (NASDAQ:PUBM) reported Q3 CY2025 results topping the market’s revenue expectations, but sales fell by 5.3% year on year to $67.96 million. The company expects next quarter’s revenue to be around $75 million, close to analysts’ estimates. Its non-GAAP profit of $0.03 per share was significantly above analysts’ consensus estimates.

PubMatic (PUBM) Q3 CY2025 Highlights:

- Revenue: $67.96 million vs analyst estimates of $64.02 million (5.3% year-on-year decline, 6.1% beat)

- Adjusted EPS: $0.03 vs analyst estimates of -$0.01 (significant beat)

- Adjusted EBITDA: $11.15 million vs analyst estimates of $8.61 million (16.4% margin, 29.5% beat)

- Revenue Guidance for Q4 CY2025 is $75 million at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for Q4 CY2025 is $20 million at the midpoint, below analyst estimates of $20.14 million

- Operating Margin: -12.4%, down from -1.9% in the same quarter last year

- Free Cash Flow Margin: 33.5%, up from 13% in the previous quarter

- Market Capitalization: $338.4 million

Company Overview

Powering billions of daily ad impressions across the open internet, PubMatic (NASDAQ:PUBM) operates a technology platform that helps publishers maximize revenue from their digital advertising inventory while giving advertisers more control and transparency.

PubMatic serves as a critical intermediary in the complex digital advertising ecosystem through its supply-side platform (SSP). The company works directly with publishers—websites, apps, and other digital content creators—giving them tools to sell their advertising space programmatically through real-time auctions. When someone visits a website or app that uses PubMatic's technology, the platform instantly analyzes the available ad space and matches it with appropriate advertisers willing to bid for that impression.

The company's platform processes enormous volumes of data in milliseconds to optimize these transactions. For publishers, this means higher revenue by ensuring their ad inventory reaches the most relevant and highest-paying advertisers. For advertisers and their agencies, PubMatic provides access to quality publisher inventory with transparency into where their ads appear and the ability to target specific audiences effectively.

PubMatic offers specialized solutions including OpenWrap (a header bidding tool that increases competition for ad space), Activate (for direct deals between publishers and advertisers), and Convert (focused on commerce media). The company generates revenue primarily by charging publishers a percentage of the value of advertising impressions sold through its platform.

PubMatic differentiates itself by owning and operating its technology infrastructure rather than relying on public cloud services, which it claims provides cost efficiencies and performance advantages. The company serves both premium individual publishers and channel partners who aggregate inventory from smaller publishers across the Americas, Europe, and Asia-Pacific regions.

4. Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

PubMatic competes with other supply-side platforms including Magnite (NASDAQ:MGNI), Google's Ad Manager (NASDAQ:GOOGL), and various smaller private SSPs operating in different global markets. The company also faces indirect competition from divisions of larger tech companies that offer advertising solutions across the digital ad ecosystem.

5. Revenue Growth

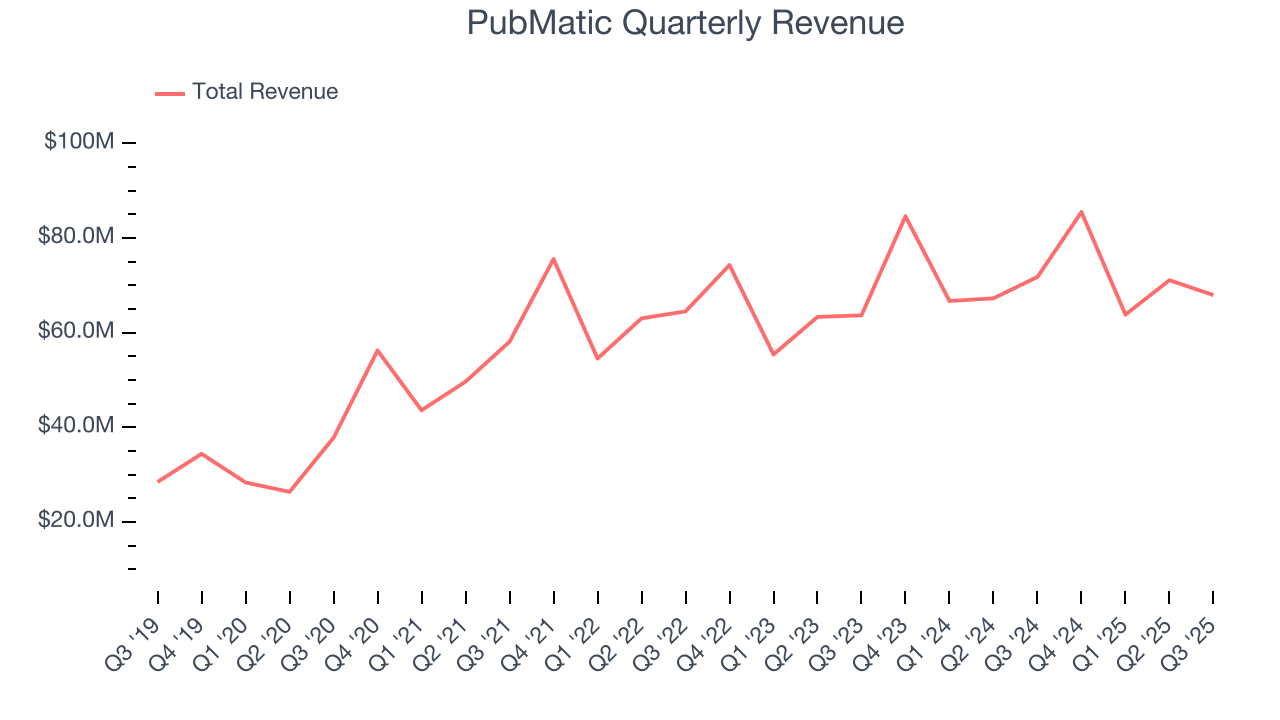

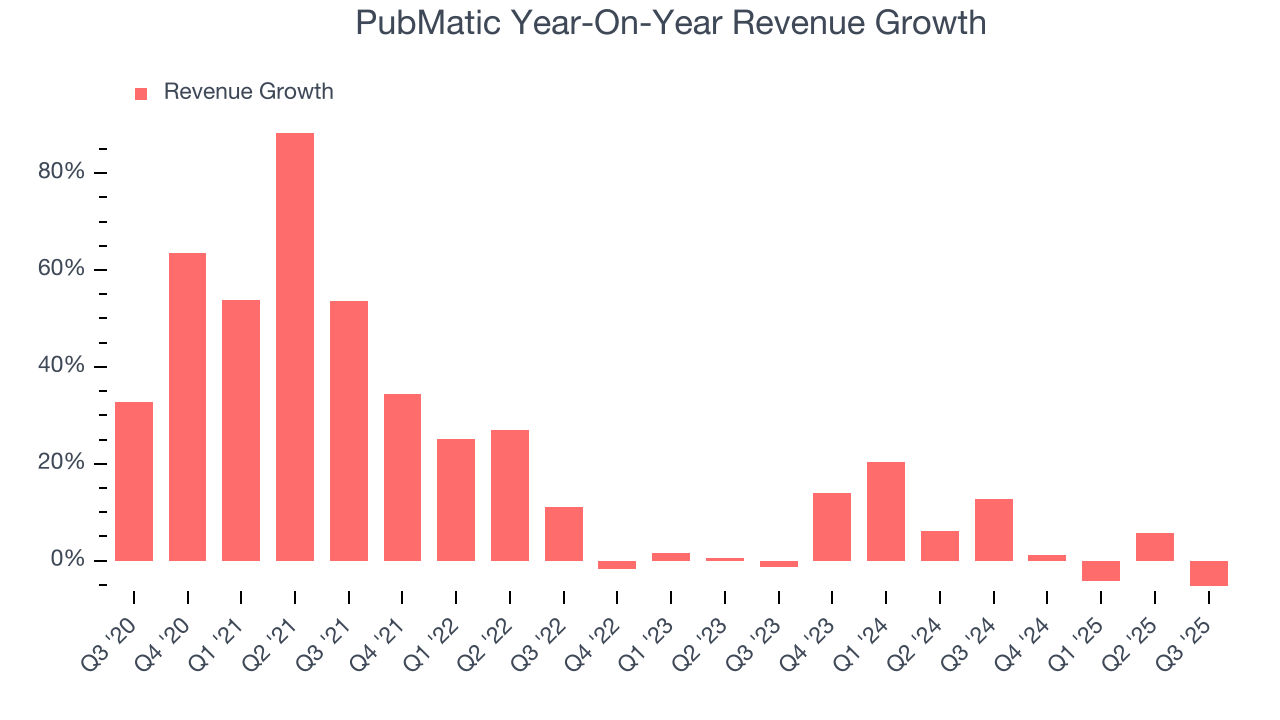

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, PubMatic grew its sales at a decent 17.8% compounded annual growth rate. Its growth was slightly above the average software company and shows its offerings resonate with customers.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. PubMatic’s recent performance shows its demand has slowed as its annualized revenue growth of 6% over the last two years was below its five-year trend.

This quarter, PubMatic’s revenue fell by 5.3% year on year to $67.96 million but beat Wall Street’s estimates by 6.1%. Company management is currently guiding for a 12.3% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 6% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

6. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

PubMatic’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between PubMatic’s products and its peers.

7. Gross Margin & Pricing Power

For software companies like PubMatic, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

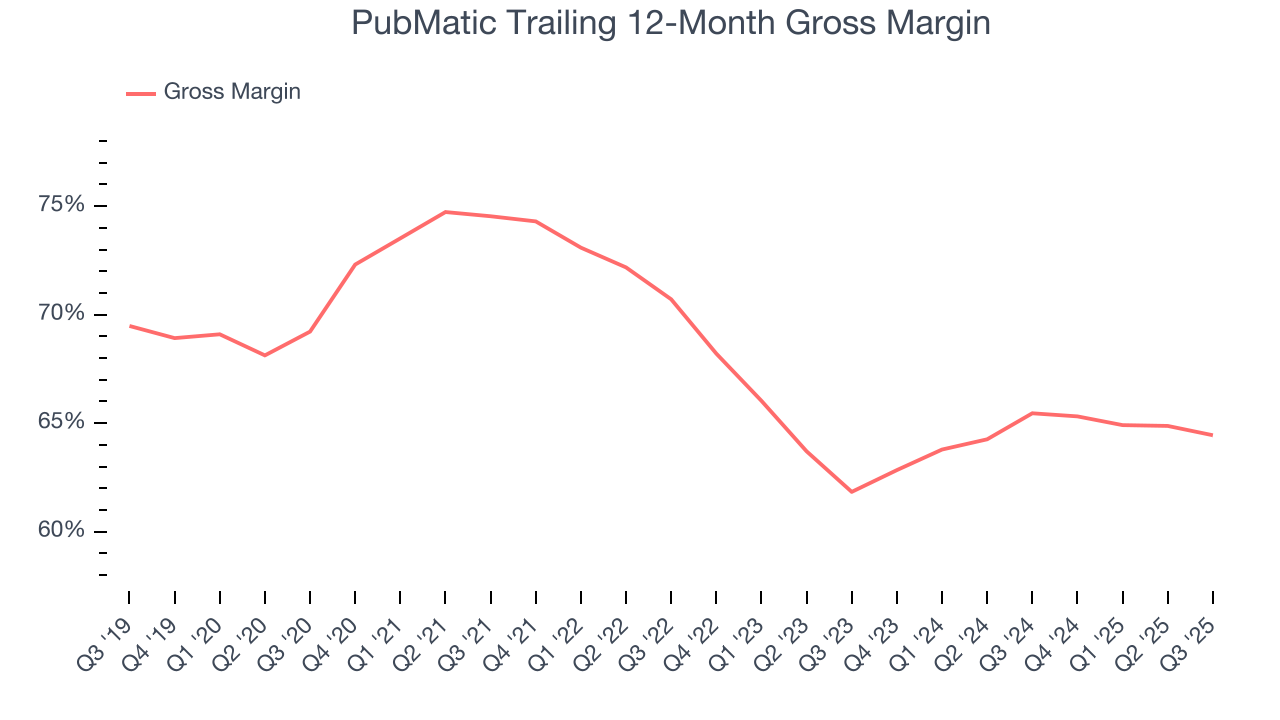

PubMatic’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 64.4% gross margin over the last year. That means PubMatic paid its providers a lot of money ($35.56 for every $100 in revenue) to run its business.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. PubMatic has seen gross margins improve by 2.6 percentage points over the last 2 year, which is very good in the software space.

PubMatic produced a 62.6% gross profit margin in Q3, marking a 1.8 percentage point decrease from 64.5% in the same quarter last year. PubMatic’s full-year margin has also been trending down over the past 12 months, decreasing by 1 percentage points. If this move continues, it could suggest a more competitive environment with some pressure to lower prices and higher input costs.

8. Operating Margin

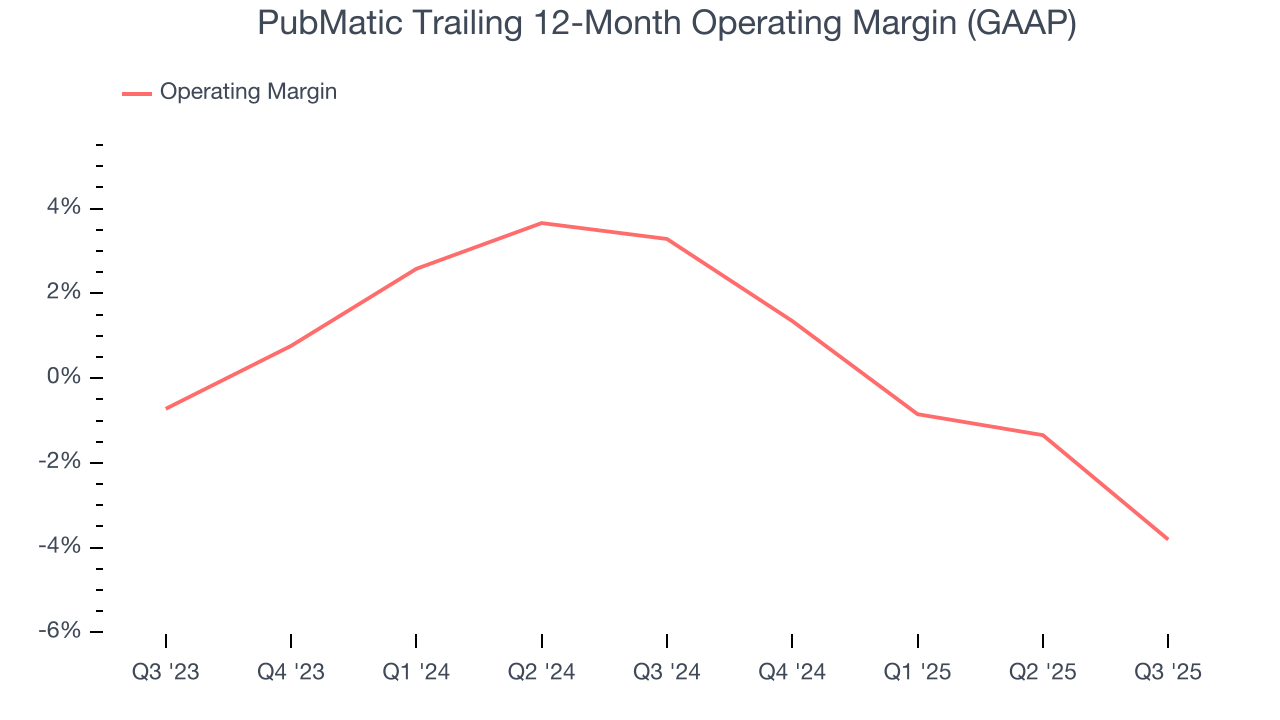

PubMatic’s expensive cost structure has contributed to an average operating margin of negative 3.8% over the last year. Unprofitable, high-growth software companies require extra attention because they spend heaps of money to capture market share. As seen in its fast historical revenue growth, this strategy seems to have worked so far, but it’s unclear what would happen if PubMatic reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

Looking at the trend in its profitability, PubMatic’s operating margin decreased by 7.1 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. PubMatic’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

PubMatic’s operating margin was negative 12.4% this quarter.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

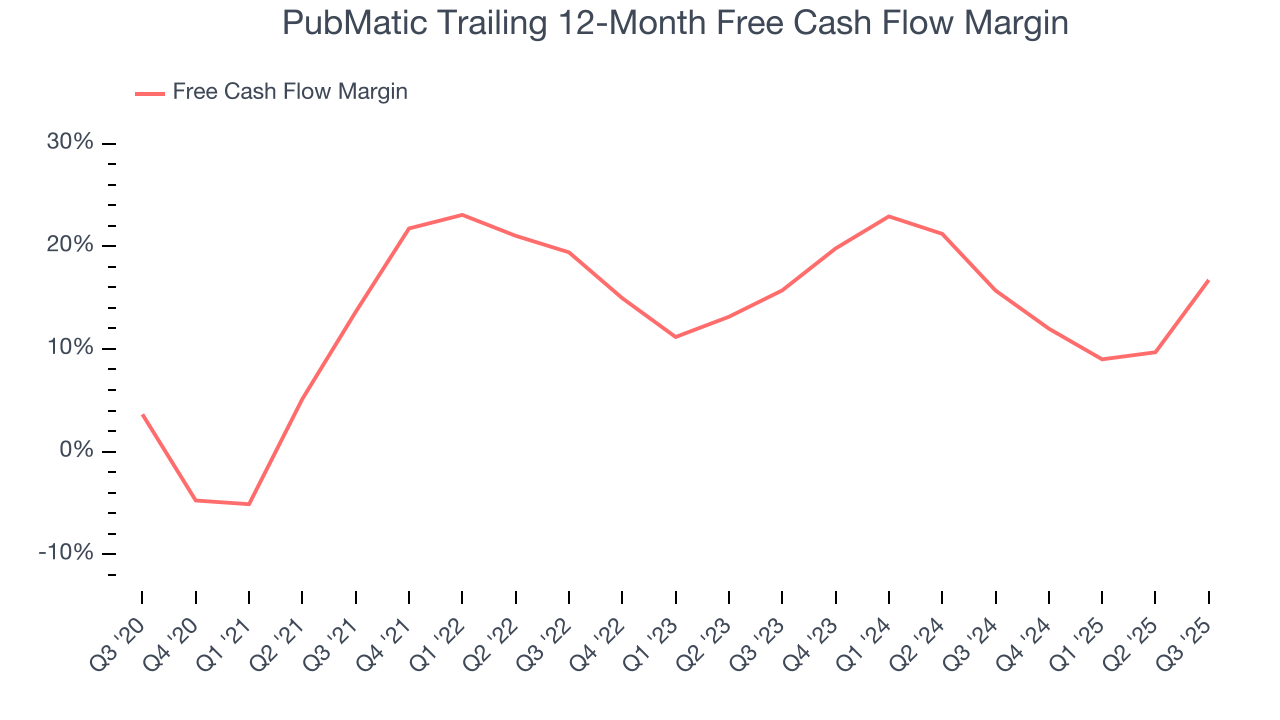

PubMatic has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 16.7% over the last year, slightly better than the broader software sector.

PubMatic’s free cash flow clocked in at $22.79 million in Q3, equivalent to a 33.5% margin. This result was good as its margin was 29.5 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts predict PubMatic’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 16.7% for the last 12 months will decrease to 14.7%.

10. Balance Sheet Assessment

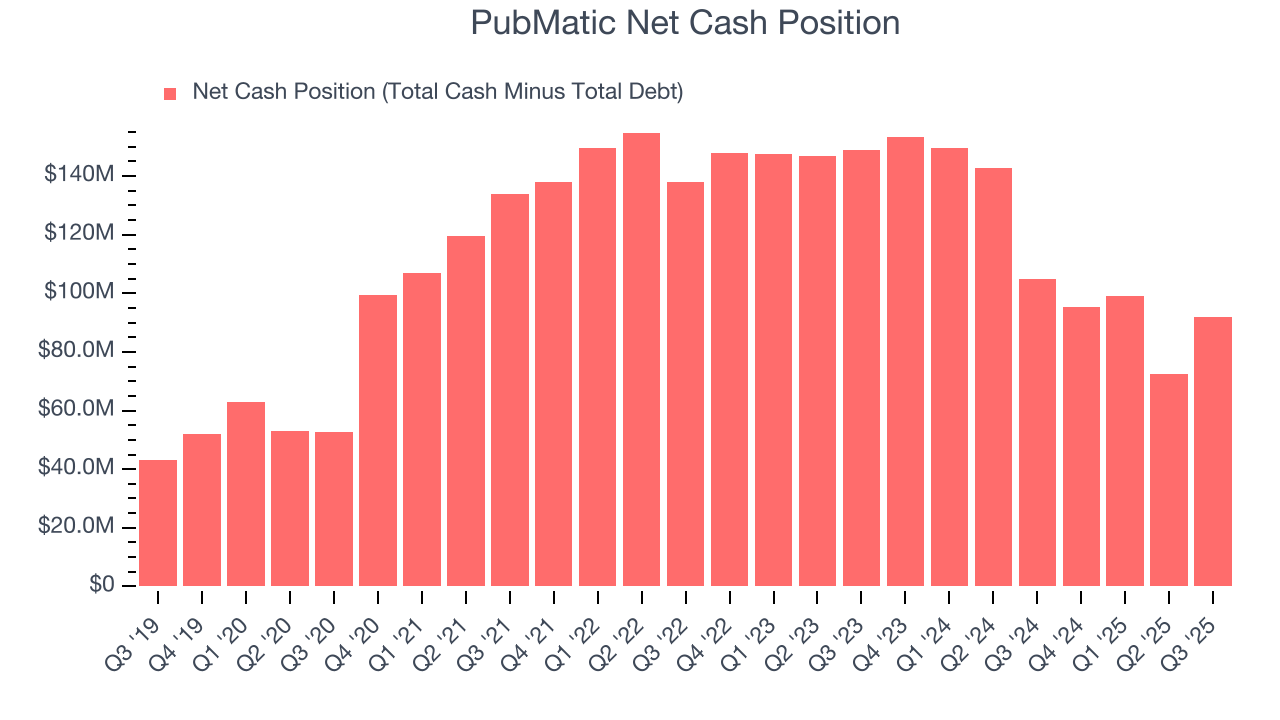

Companies with more cash than debt have lower bankruptcy risk.

PubMatic is a well-capitalized company with $136.5 million of cash and $44.59 million of debt on its balance sheet. This $91.96 million net cash position is 27.2% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from PubMatic’s Q3 Results

We were impressed by how significantly PubMatic blew past analysts’ EBITDA expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its EBITDA guidance for next quarter slightly missed and its revenue guidance for next quarter was in line with Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 15.2% to $8.80 immediately following the results.

12. Is Now The Time To Buy PubMatic?

Updated: February 16, 2026 at 9:21 PM EST

When considering an investment in PubMatic, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

PubMatic falls short of our quality standards. Although its revenue growth was solid over the last five years, it’s expected to deteriorate over the next 12 months and its declining operating margin shows it’s becoming less efficient at building and selling its software. On top of that, the company’s customer acquisition is less efficient than many comparable companies.

PubMatic’s price-to-sales ratio based on the next 12 months is 1.1x. This multiple tells us a lot of good news is priced in - we think other companies feature superior fundamentals at the moment.

Wall Street analysts have a consensus one-year price target of $12.06 on the company (compared to the current share price of $6.54).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.