DoubleVerify (DV)

We’re wary of DoubleVerify. Its decelerating growth and falling profitability suggest it’s struggling to scale down costs as demand fades.― StockStory Analyst Team

1. News

2. Summary

Why We Think DoubleVerify Will Underperform

Using advanced analytics to evaluate over 17 billion digital ad transactions daily, DoubleVerify (NYSE:DV) provides AI-powered technology that verifies digital ads are viewable, fraud-free, brand-suitable, and displayed in the intended geographic location.

- Efficiency has decreased over the last year as its operating margin fell by 2 percentage points

- Customer acquisition costs take a while to recoup, making it difficult to justify sales and marketing investments that could increase revenue

- A bright spot is that its software is difficult to replicate at scale and leads to a top-tier gross margin of 82.2%

DoubleVerify is in the penalty box. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than DoubleVerify

High Quality

Investable

Underperform

Why There Are Better Opportunities Than DoubleVerify

DoubleVerify’s stock price of $10.17 implies a valuation ratio of 2.1x forward price-to-sales. This sure is a cheap multiple, but you get what you pay for.

Our advice is to pay up for elite businesses whose advantages are tailwinds to earnings growth. Don’t get sucked into lower-quality businesses just because they seem like bargains. These mediocre businesses often never achieve a higher multiple as hoped, a phenomenon known as a “value trap”.

3. DoubleVerify (DV) Research Report: Q4 CY2025 Update

Digital ad verification company DoubleVerify (NYSE:DV) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 7.9% year on year to $205.6 million. On the other hand, the company expects next quarter’s revenue to be around $180 million, close to analysts’ estimates. Its GAAP profit of $0.18 per share was 10.3% above analysts’ consensus estimates.

DoubleVerify (DV) Q4 CY2025 Highlights:

- Revenue: $205.6 million vs analyst estimates of $208.8 million (7.9% year-on-year growth, 1.5% miss)

- EPS (GAAP): $0.18 vs analyst estimates of $0.16 (10.3% beat)

- Adjusted EBITDA: $77.8 million vs analyst estimates of $78.94 million (37.8% margin, 1.4% miss)

- Revenue Guidance for Q1 CY2026 is $180 million at the midpoint, roughly in line with what analysts were expecting

- EBITDA guidance for Q1 CY2026 is $50 million at the midpoint, in line with analyst expectations

- Operating Margin: 18.4%, down from 20.3% in the same quarter last year

- Free Cash Flow Margin: 30.2%, up from 20.7% in the previous quarter

- Market Capitalization: $1.54 billion

Company Overview

Using advanced analytics to evaluate over 17 billion digital ad transactions daily, DoubleVerify (NYSE:DV) provides AI-powered technology that verifies digital ads are viewable, fraud-free, brand-suitable, and displayed in the intended geographic location.

DoubleVerify's software platform acts as a critical intermediary in the digital advertising ecosystem, helping brands ensure their ad dollars aren't wasted on fraudulent or inappropriate placements. The company's technology integrates across the entire digital advertising landscape, including programmatic platforms, social media channels, and digital publishers, measuring ads across all key digital media channels like social, video, mobile apps, and connected TV.

The core of DoubleVerify's offering is the DV Authentic Ad metric, which evaluates multiple quality factors for digital advertisements. Beyond fraud detection, the company's solutions analyze content for brand suitability, ensuring ads don't appear alongside potentially harmful content across over 40 languages. The platform also measures viewability (whether ads can actually be seen by users) and confirms geographic targeting requirements are met.

Additional offerings include DV Authentic Attention, which measures how users engage with ads, and Custom Contextual solutions that help advertisers match their content to relevant environments without relying on third-party cookies. Following its acquisition of Scibids in 2023, DoubleVerify also provides AI-powered campaign optimization tools.

The company generates revenue based on the volume of media transactions it measures, serving over 1,800 customers including many global brands across industries like consumer packaged goods, financial services, telecommunications, and technology.

4. Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

DoubleVerify's competitors include Integral Ad Science (NASDAQ:IAS), Oracle's Moat (NYSE:ORCL), Human Security (formerly White Ops), and Google's Active View (NASDAQ:GOOGL).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Luckily, DoubleVerify’s sales grew at a solid 25.1% compounded annual growth rate over the last five years. Its growth beat the average software company and shows its offerings resonate with customers.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. DoubleVerify’s recent performance shows its demand has slowed as its annualized revenue growth of 14.3% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, DoubleVerify’s revenue grew by 7.9% year on year to $205.6 million, missing Wall Street’s estimates. Company management is currently guiding for a 9.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.5% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

6. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

DoubleVerify’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between DoubleVerify’s products and its peers.

7. Gross Margin & Pricing Power

For software companies like DoubleVerify, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

DoubleVerify’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an excellent 82.2% gross margin over the last year. That means DoubleVerify only paid its providers $17.84 for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. DoubleVerify has seen gross margins improve by 0.8 percentage points over the last 2 year, which is slightly better than average for software.

DoubleVerify’s gross profit margin came in at 82.5% this quarter, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

8. Operating Margin

DoubleVerify has been an efficient company over the last year. It was one of the more profitable businesses in the software sector, boasting an average operating margin of 10.6%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, DoubleVerify’s operating margin decreased by 2 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, DoubleVerify generated an operating margin profit margin of 18.4%, down 2 percentage points year on year. Since DoubleVerify’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

DoubleVerify has shown robust cash profitability, driven by its attractive business model that enables it to reinvest or return capital to investors while maintaining a cash cushion. The company’s free cash flow margin averaged 23.1% over the last year, quite impressive for a software business.

DoubleVerify’s free cash flow clocked in at $62.15 million in Q4, equivalent to a 30.2% margin. This result was good as its margin was 14.5 percentage points higher than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

Over the next year, analysts predict DoubleVerify’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 23.1% for the last 12 months will decrease to 18.4%.

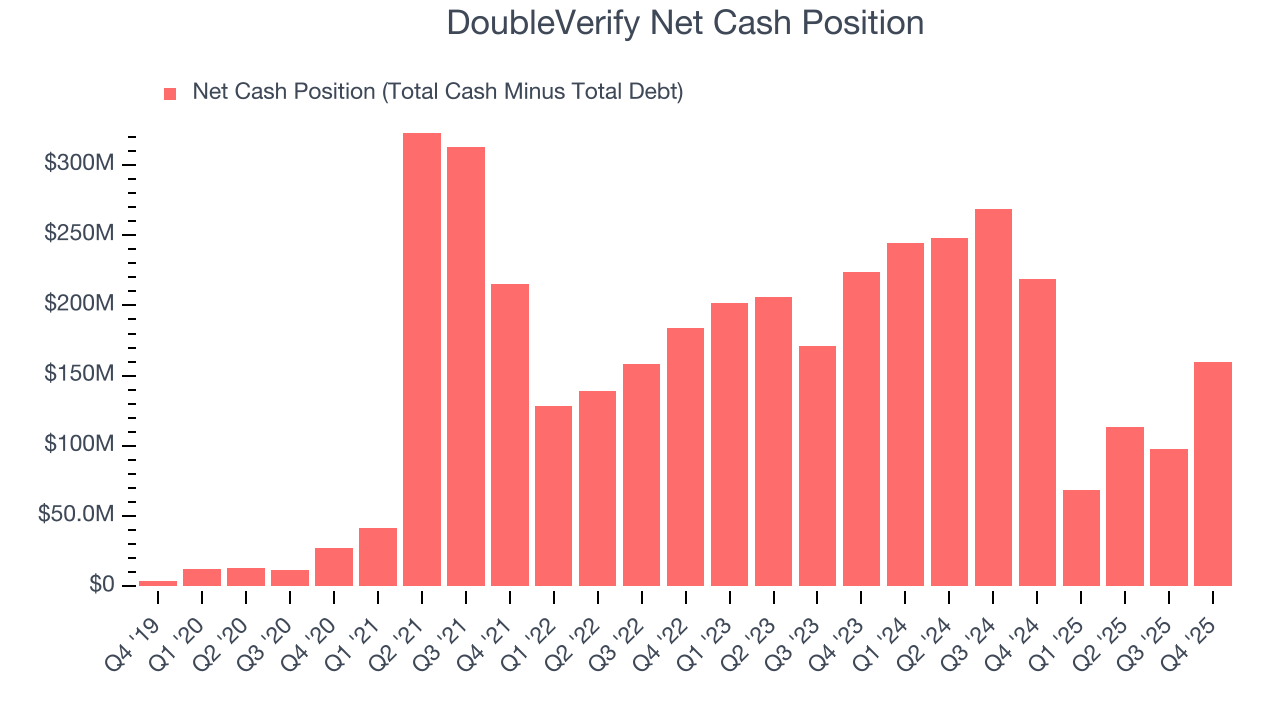

10. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

DoubleVerify is a profitable, well-capitalized company with $259 million of cash and $99.55 million of debt on its balance sheet. This $159.5 million net cash position is 10.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from DoubleVerify’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EBITDA fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.2% to $9.33 immediately following the results.

12. Is Now The Time To Buy DoubleVerify?

Updated: March 4, 2026 at 9:36 PM EST

Before making an investment decision, investors should account for DoubleVerify’s business fundamentals and valuation in addition to what happened in the latest quarter.

DoubleVerify’s business quality ultimately falls short of our standards. Although its revenue growth was strong over the last five years, it’s expected to deteriorate over the next 12 months and its declining operating margin shows it’s becoming less efficient at building and selling its software. And while the company’s admirable gross margin indicates excellent unit economics, the downside is its customer acquisition is less efficient than many comparable companies.

DoubleVerify’s price-to-sales ratio based on the next 12 months is 2x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're pretty confident there are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $12.86 on the company (compared to the current share price of $10.30).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.