As Q2 earnings season comes to a close, it’s time to take stock of this quarters’ best and worst performers amongst the cybersecurity stocks, including Rapid7 (NASDAQ:RPD) and its peers.

The demand for cybersecurity is growing as more and more businesses are moving their data and processes into the cloud, which along with a major increase in employees working remotely, has increased their exposure to attacks and malware. Additionally, the growing array of corporate IT systems, applications and internet connected devices has increased the complexity of network security, all of which has substantially increased the demand for software meant to protect data breaches.

The 9 cybersecurity stocks we track reported a a solid Q2; on average, revenues beat analyst consensus estimates by 4.76%, while on average next quarter revenue guidance was 2.73% above consensus. The market rewarded the results with the average return the day after earnings coming in at 1.73%.

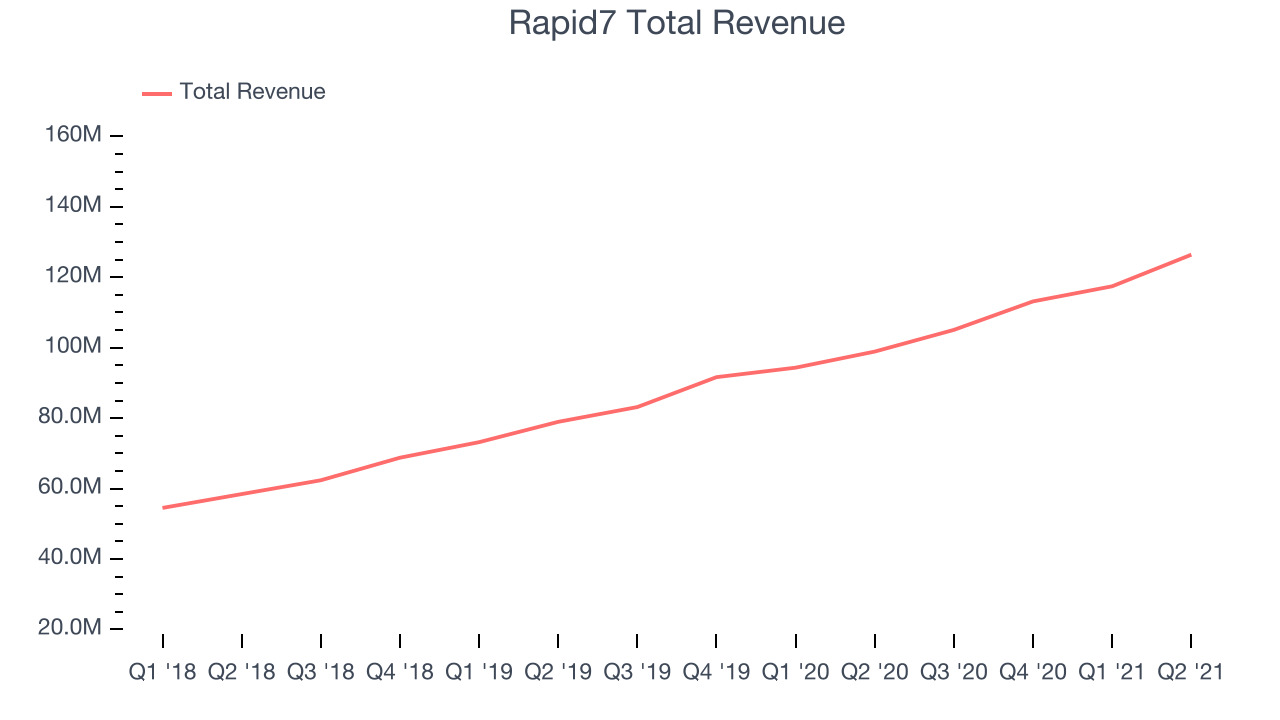

Rapid7 (NASDAQ:RPD)

Founded in 2000 with the idea that network security comes before endpoint security, Rapid7 (NASDAQ:RPD) provides software as a service that helps companies understand where they are exposed to cyber security risks, quickly detect breaches and respond to them.

Rapid7 reported revenues of $126.4 million, up 27.8% year on year, beating analyst expectations by 2.7%. It was a very strong quarter for the company, with accelerating customer growth and a very optimistic guidance for the next quarter.

"Strong demand across Rapid7's Insight Platform drove second quarter ending ARR of approximately $489 million, growth of 29% year-over-year, validating both our strategy and execution as we continue on our journey to make the best in security operations accessible and achievable for all," said Corey Thomas, Chairman and CEO of Rapid7.

The stock is up 4.75% since the results and currently trades at $122.

Is now the time to buy Rapid7? Access our full analysis of the earnings results here, it's free.

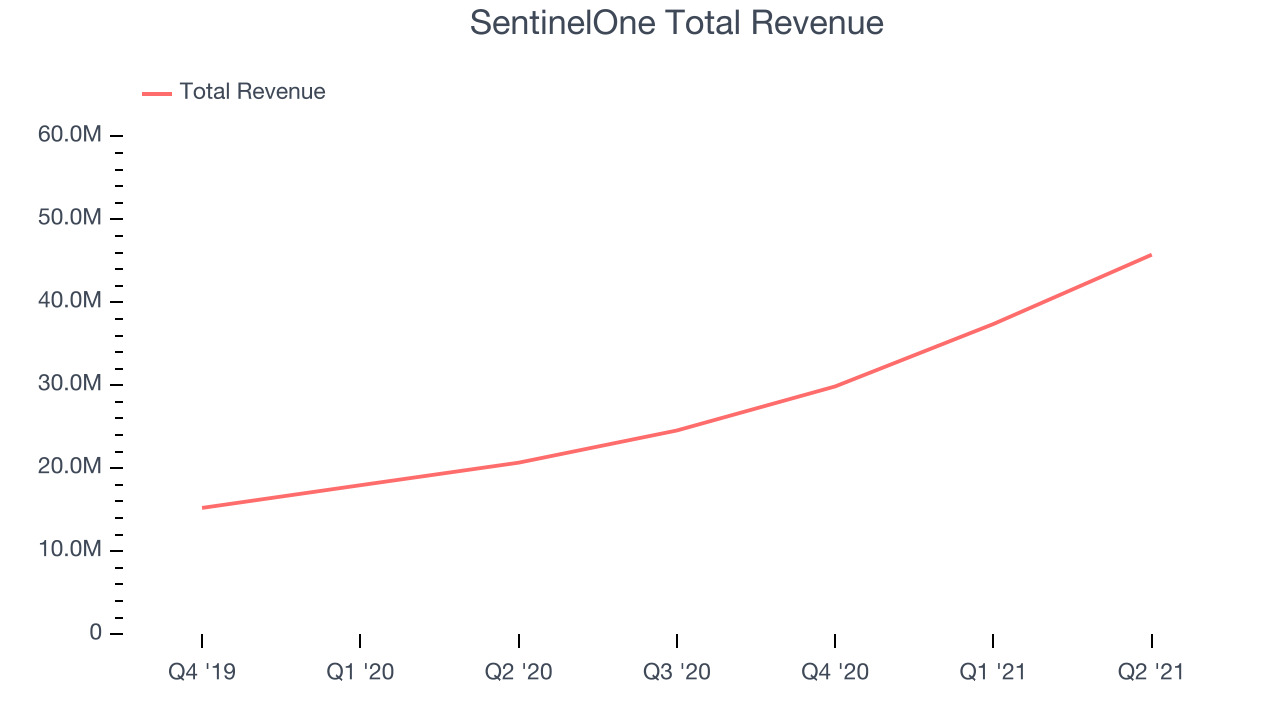

Best Q2: SentinelOne (NYSE:S)

With roots in the Israeli cyber intelligence community, SentinelOne (NYSE:S) provides software to help organizations efficiently detect, prevent, and investigate cyber attacks.

SentinelOne reported revenues of $45.7 million, up 121% year on year, beating analyst expectations by 13.3%. It was a stunning quarter for the company, with an impressive beat of analyst estimates and an exceptional revenue growth.

SentinelOne scored the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. But with the sky-high valuation, some investors might have expected even more as the stock is down 11.9% since the results and currently trades at $60.

Is now the time to buy SentinelOne? Access our full analysis of the earnings results here, it's free.

Weakest Q2: SailPoint (NYSE:SAIL)

Started by Mark McClain after his previous identity management company got acquired by Sun Microsystems, SailPoint (NYSE:SAIL) provides software for organizations to manage the digital identity of employees, customers, and partners.

SailPoint reported revenues of $102.4 million, up 10.8% year on year, beating analyst expectations by 3.2%. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and a slow revenue growth.

SailPoint had the slowest revenue growth and weakest full year guidance update in the group. The stock is down 6.74% since the results and currently trades at $46.19.

Read our full analysis of SailPoint's results here.

CrowdStrike (NASDAQ:CRWD)

Founded by George Kurtz, the former CTO of the antivirus company McAfee, CrowdStrike (NASDAQ:CRWD) provides cybersecurity software that protects companies from breaches and helps them detect and respond to cyber attacks.

CrowdStrike reported revenues of $337.6 million, up 69.7% year on year, beating analyst expectations by 4.37%. It was a strong quarter for the company, with an exceptional revenue growth.

The stock is down 1.22% since the results and currently trades at $277.50.

Read our full, actionable report on CrowdStrike here, it's free.

Palo Alto Networks (NYSE:PANW)

Founded in 2005 by a cybersecurity engineer Nir Zuk, Palo Alto Networks makes hardware and software cybersecurity products that protect companies from cyberattacks, breaches and malware threats.

Palo Alto Networks reported revenues of $1.21 billion, up 28.2% year on year, beating analyst expectations by 3.95%. It was an impressive quarter for the company, with a very strong guidance for the next year.

The stock is up 35.9% since the results and currently trades at $506.40.

Read our full, actionable report on Palo Alto Networks here, it's free.

The author has no position in any of the stocks mentioned