Cybersecurity software maker Rapid7 (NASDAQ:RPD) will be reporting earnings tomorrow after the bell. Here's what you need to know.

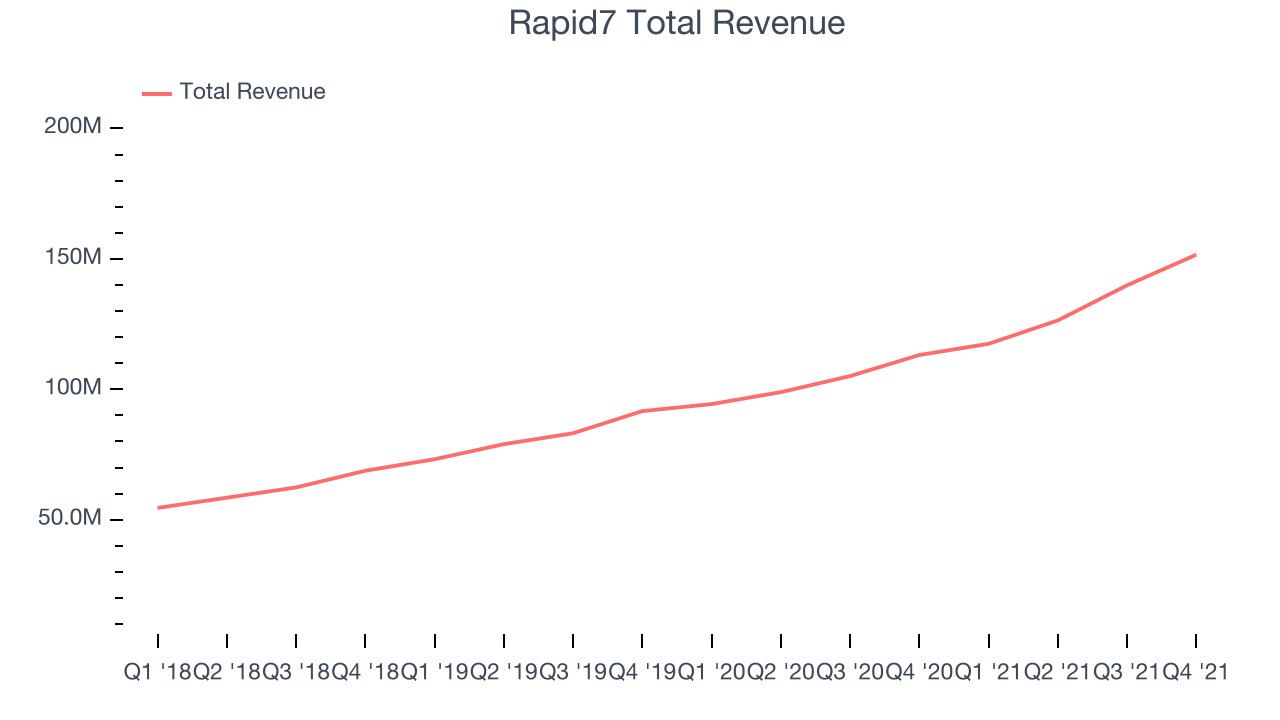

Last quarter Rapid7 reported revenues of $151.6 million, up 34% year on year, beating analyst revenue expectations by 3.94%. It was a solid quarter for the company, with a full year guidance beating analysts' expectations and a very optimistic guidance for the next quarter. The company added 374 customers to a total of 10,283.

Is Rapid7 buy or sell heading into the earnings? Read our full analysis here, it's free.

This quarter analysts are expecting Rapid7's revenue to grow 31.2% year on year to $154.1 million, improving on the 24.4% year-over-year increase in revenue the company had recorded in the same quarter last year. Adjusted loss is expected to come in at -$0.16 per share.

Majority of analysts covering the company have reconfirmed their estimates over the last thirty days, suggesting they are expecting the business to stay the course heading into the earnings. The company has a history of exceeding Wall St's expectations, beating revenue estimates every single time over the past two years on average by 3.16%.

Looking at Rapid7's peers in the cybersecurity segment, only Tenable has so far reported results, delivering top-line growth of 29.3% year on year, and beating analyst estimates by 3.82%. The stock traded slightly down on the results. Read our full analysis of Tenable's earnings results here.

Tech stocks have been facing declining investor sentiment in 2022 and software stocks have been swept alongside with it, with share price down on average 16.9% over the last month. Rapid7 is down 15% during the same time, and is heading into the earnings with analyst price target of $131.1, compared to share price of $96.8.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.