Looking back on semiconductors stocks' Q3 earnings, we examine the quarters’ best and worst performers, including Seagate Technology (NASDAQ:STX) and its peers.

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, Internet of Things and smart cars are creating a next wave of secular growth for the industry.

The 20 semiconductors stocks we track reported a solid Q3; on average, revenues beat analyst consensus estimates by 1.92%, while on average next quarter revenue guidance was 1.97% above consensus. The technology sell-off has been putting pressure on stocks since November , but semiconductors stocks held their ground better than the software stocks, with share price down 2.59% since earnings, on average.

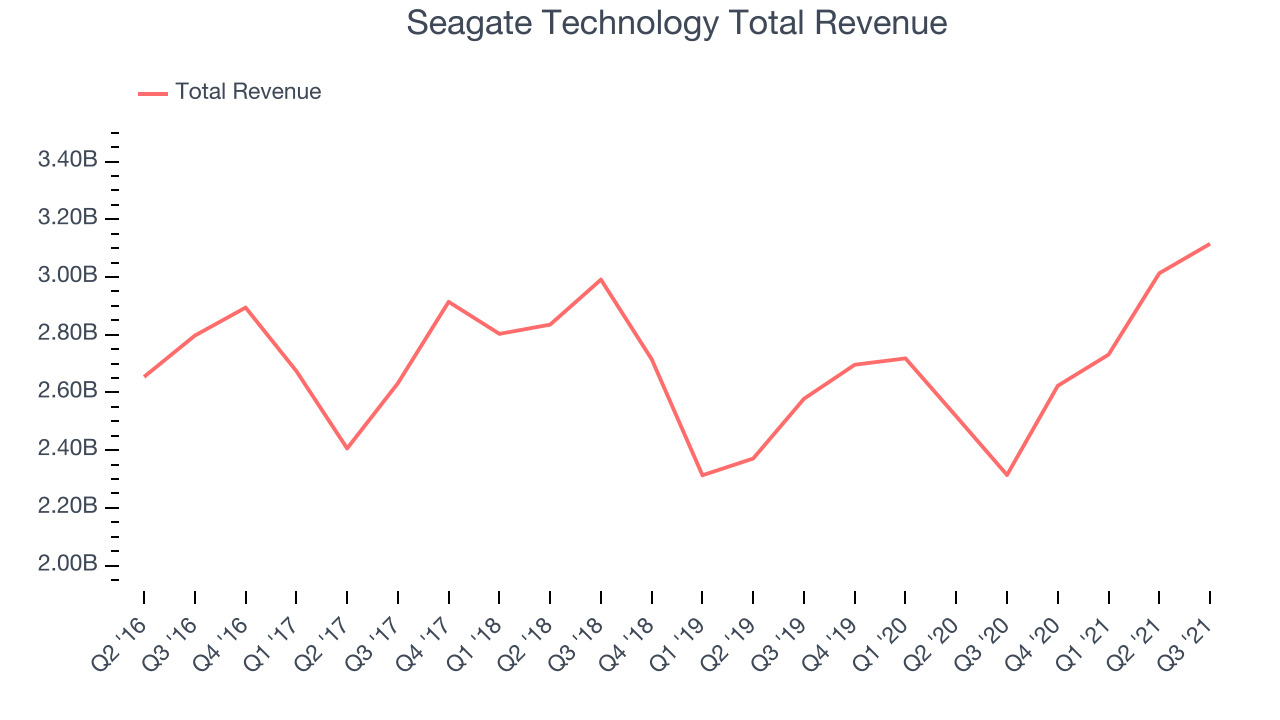

Seagate Technology (NASDAQ:STX)

The developer of the original 5.25 inch hard disk drive, Seagate (NASDAQ:STX) is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

Seagate Technology reported revenues of $3.11 billion, up 34.6% year on year, in line with analyst expectations. It was a solid quarter for the company, with a significant improvement in gross margin and revenue guidance for the next quarter above analyst estimates.

“Seagate had an exceptional start to the fiscal year with solid revenue growth, significant profit expansion and higher free cash flow generation in the September quarter. Mass capacity revenue topped the $2 billion mark for the first time, led by ongoing demand from cloud data center customers and strength in the video and image applications markets. Our results demonstrate consistent execution, a sustained healthy demand environment and positive structural change in storage industry dynamics. Collectively these factors led to achieving margin levels consistent with our long-term targets and support our increased revenue growth outlook for fiscal 2022,” said Dave Mosley, Seagate’s chief executive officer.

The stock is up 17.3% since the results and currently trades at $96.50.

Is now the time to buy Seagate Technology? Access our full analysis of the earnings results here, it's free.

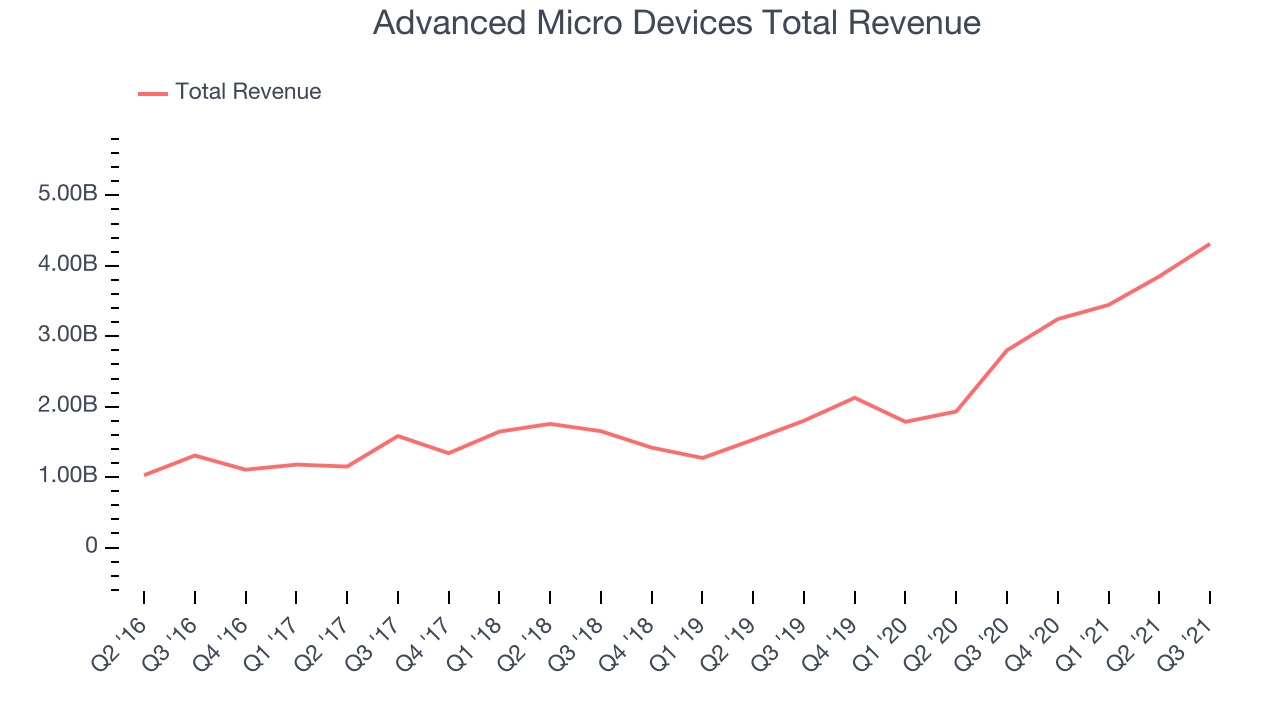

Best Q3: AMD (NASDAQ:AMD)

Founded in 1969 by a group of former Fairchild semiconductor executives led by Jerry Sanders, Advanced Micro Devices or AMD (NASDAQ:AMD) is one of the leading designers of computer processors and graphics chips used in PCs and data centers.

Advanced Micro Devices reported revenues of $4.31 billion, up 53.9% year on year, beating analyst expectations by 4.85%. It was a stunning quarter for the company, with a significant improvement in gross margin and strong revenue growth.

The stock is down 4.24% since the results and currently trades at $117.71.

Is now the time to buy Advanced Micro Devices? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Applied Materials (NASDAQ:AMAT)

Founded in 1967 as the first company that built the tools for other companies to use to make semiconductors, Applied Materials (NASDAQ:AMAT) is the largest provider of semiconductor wafer fabrication equipment.

Applied Materials reported revenues of $6.12 billion, up 30.6% year on year, missing analyst expectations by 3.33%. It was a weaker quarter for the company, with an underwhelming revenue guidance for the next quarter and a miss of the top line analyst estimates.

Applied Materials had the weakest performance against analyst estimates in the group. The stock is down 15.2% since the results and currently trades at $134.50.

Read our full analysis of Applied Materials's results here.

Qorvo (NASDAQ:QRVO)

Formed by the merger of TriQuint and RF Micro Devices, Qorvo (NASDAQ: QRVO) is a designer and manufacturer of RF chips used in almost all smartphones globally, along with a variety of chips used in networking equipment and infrastructure.

Qorvo reported revenues of $1.25 billion, up 18.3% year on year, in line with analyst expectations. It was a decent quarter for the company, with a significant improvement in inventory levels but an underwhelming revenue guidance for the next quarter.

The stock is down 25% since the results and currently trades at $133.51.

Read our full, actionable report on Qorvo here, it's free.

NVIDIA Corporation (NASDAQ:NVDA)

Founded in 1993 by Jensen Huang and two former Sun Microsystems engineers, Nvidia (NASDAQ:NVDA) is a leading fabless designer of chips used in gaming, PCs, data centers, automotive, and a variety of end markets.

NVIDIA Corporation reported revenues of $7.1 billion, up 50.2% year on year, beating analyst expectations by 4.25%. It was an impressive quarter for the company, with a very optimistic guidance for the next quarter.

The stock is down 20.9% since the results and currently trades at $231.25.

Read our full, actionable report on NVIDIA Corporation here, it's free.

The author has no position in any of the stocks mentioned