Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at Box (NYSE:BOX), and the best and worst performers in the productivity software group.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 16 productivity software stocks we track reported a mixed Q2; on average, revenues beat analyst consensus estimates by 2.6%, while on average next quarter revenue guidance was 0.56% under consensus. Tech stocks have been hit the hardest as investors start to value profits over growth and while some of the productivity software stocks have fared somewhat better than others, they have not been spared, with share price declining 7.83% since the previous earnings results, on average.

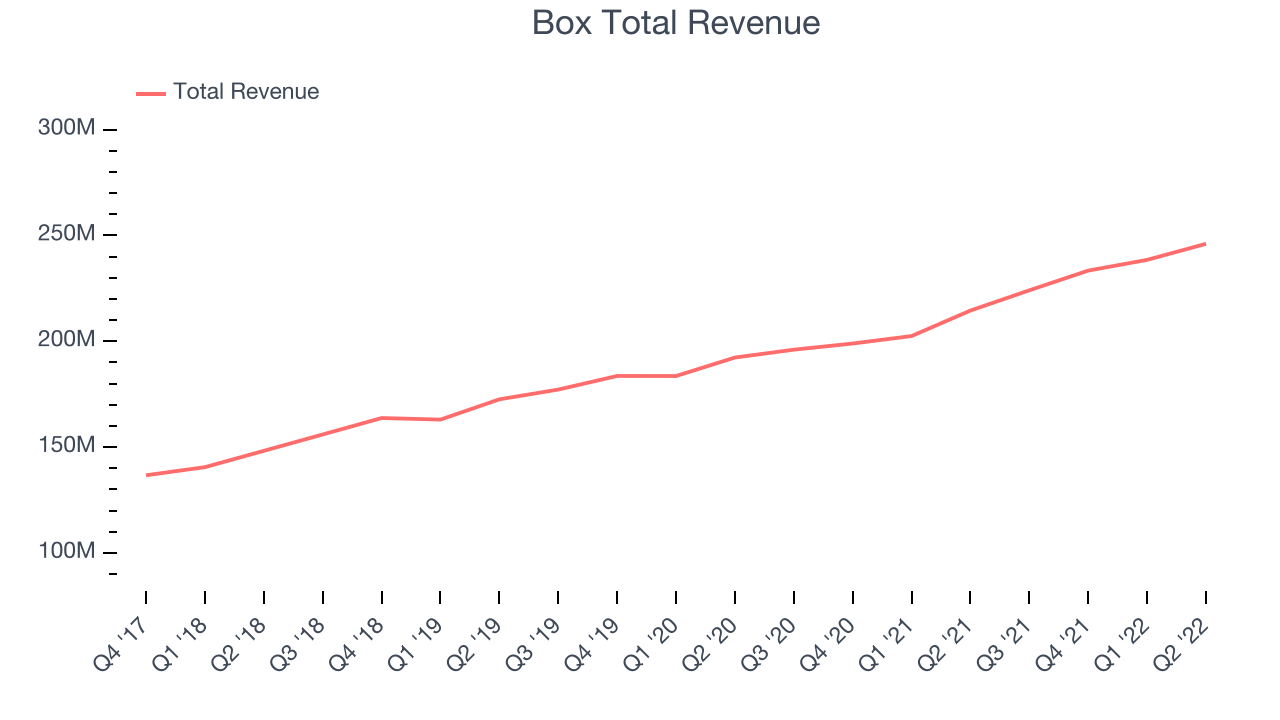

Box (NYSE:BOX)

Founded in 2005 by Aaron Levie and Dylan Smith, Box (NYSE:BOX) provides organizations with software to securely store, share and collaborate around work documents in the cloud.

Box reported revenues of $246 million, up 14.6% year on year, in line with analyst expectations. It was an ok quarter for the company with revenue guidance for the next quarter roughly in line with analysts' expectations.

“As enterprises look to reduce the cost and complexity of their IT environments, they are turning to Box’s Content Cloud to simplify their technology stack, lower their spend and keep their information secure,” said Aaron Levie, co-founder and CEO of Box.

The stock is down 13.2% since the results and currently trades at $25.38.

Read our full report on Box here, it's free.

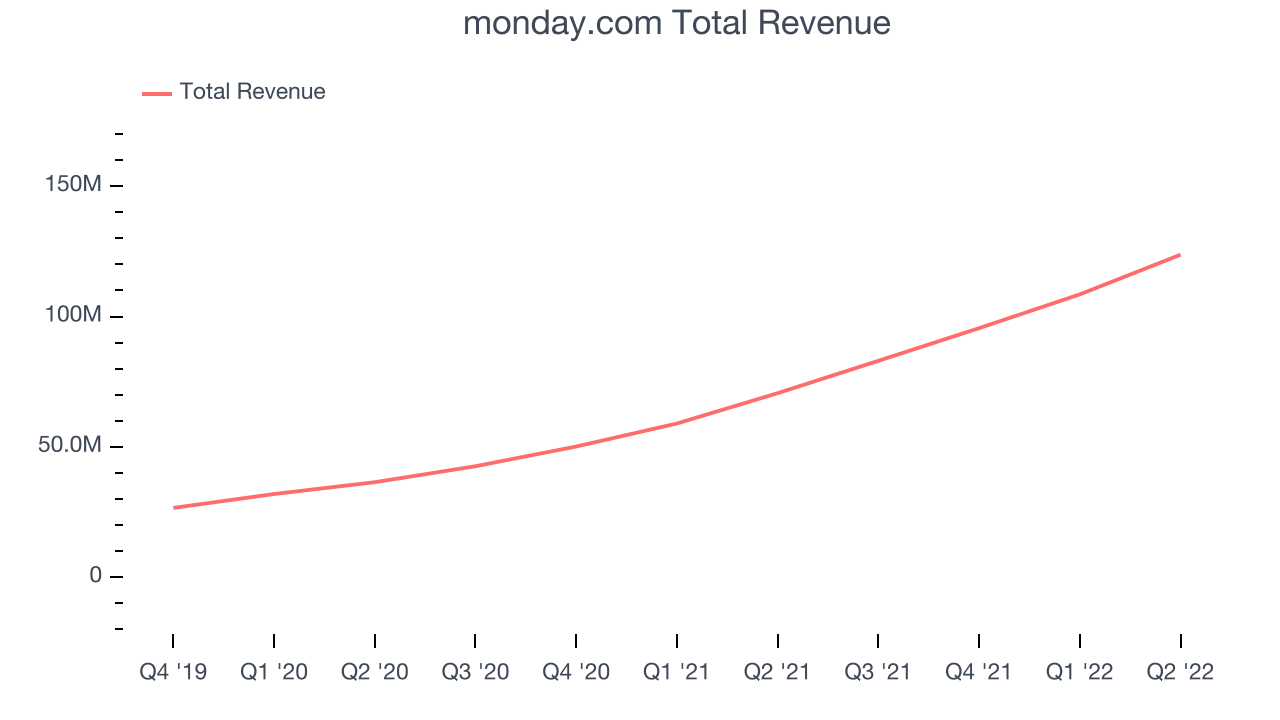

Best Q2: monday.com (NASDAQ:MNDY)

Founded in Israel in 2014, and named after the dreaded first day of the work week, Monday.com (NASDAQ:MNDY) makes software as a service platforms that helps teams plan and track work efficiently.

monday.com reported revenues of $123.7 million, up 75.2% year on year, beating analyst expectations by 4.65%. It was a strong quarter for the company, with an exceptional revenue growth and a very optimistic guidance for the next quarter.

monday.com delivered the fastest revenue growth among its peers. The company added 200 enterprise customers paying more than $50,000 annually to a total of 1,160. The stock is up 1.57% since the results and currently trades at $129.90.

Is now the time to buy monday.com? Access our full analysis of the earnings results here, it's free.

Weakest Q2: Zoom Video (NASDAQ:ZM)

Started by Eric Yuan who once ran engineering for Cisco’s video conferencing business, Zoom (NASDAQ:ZM) offers an easy to use, cloud-based platform for video conferencing, audio conferencing and screen sharing.

Zoom Video reported revenues of $1.09 billion, up 7.63% year on year, missing analyst expectations by 1.57%. It was a weak quarter for the company, with revenue guidance for both the next quarter and the full year missing analysts' expectations.

Zoom Video had the weakest performance against analyst estimates and slowest revenue growth in the group. The company added 200 enterprise customers paying more than $100,000 annually to a total of 3,116. The stock is down 23% since the results and currently trades at $75.05.

Read our full analysis of Zoom Video's results here.

Five9 (NASDAQ:FIVN)

Started in 2001, Five9 (NASDAQ: FIVN) offers software as a service that makes it easier for companies to set up and efficiently run call centers, and offer more tailored customer support.

Five9 reported revenues of $189.3 million, up 31.7% year on year, beating analyst expectations by 5.16%. It was a strong quarter for the company, with a significant improvement in gross margin compared to the previous quarter and a solid beat of analyst estimates.

The stock is down 19.4% since the results and currently trades at $79.28.

Read our full, actionable report on Five9 here, it's free.

Appian (NASDAQ:APPN)

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ:APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

Appian reported revenues of $110 million, up 32.6% year on year, beating analyst expectations by 5.85%. It was a decent quarter for the company, with a solid beat of analyst estimates and revenue guidance for the next quarter above expectations.

Appian pulled off the highest full year guidance raise among the peers. The stock is down 14.3% since the results and currently trades at $47.45.

Read our full, actionable report on Appian here, it's free.

The author has no position in any of the stocks mentioned