Box (BOX)

We’re wary of Box. Its revenue growth has been weak and its profitability has caved, showing it’s struggling to adapt.― StockStory Analyst Team

1. News

2. Summary

Why We Think Box Will Underperform

Known as the "Content Cloud" for managing the 90% of business data that exists as unstructured files and documents, Box (NYSE:BOX) provides a cloud-based platform that enables organizations to securely manage, share, and collaborate on their content from anywhere on any device.

- Costs have risen faster than its revenue over the last year, causing its operating margin to decline by 1.6 percentage points

- Estimated sales growth of 7.7% for the next 12 months is soft and implies weaker demand

- On the plus side, its fast payback periods on sales and marketing expenses allow the company to invest heavily and onboard many customers concurrently

Box doesn’t live up to our standards. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than Box

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Box

Box is trading at $21.97 per share, or 2.8x forward price-to-sales. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Box (BOX) Research Report: Q3 CY2025 Update

Cloud content management platform Box (NYSE:BOX) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 9.1% year on year to $301.1 million. The company expects next quarter’s revenue to be around $304 million, close to analysts’ estimates. Its non-GAAP profit of $0.31 per share was in line with analysts’ consensus estimates.

Box (BOX) Q3 CY2025 Highlights:

- Revenue: $301.1 million vs analyst estimates of $299 million (9.1% year-on-year growth, 0.7% beat)

- Adjusted EPS: $0.31 vs analyst estimates of $0.31 (in line)

- Adjusted Operating Income: $86.1 million vs analyst estimates of $83.82 million (28.6% margin, 2.7% beat)

- Revenue Guidance for Q4 CY2025 is $304 million at the midpoint, roughly in line with what analysts were expecting

- Management slightly raised its full-year Adjusted EPS guidance to $1.28 at the midpoint

- Operating Margin: 8.3%, in line with the same quarter last year

- Free Cash Flow Margin: 20.4%, up from 12.1% in the previous quarter

- Billings: $296 million at quarter end, up 11.8% year on year

- Market Capitalization: $4.25 billion

Company Overview

Known as the "Content Cloud" for managing the 90% of business data that exists as unstructured files and documents, Box (NYSE:BOX) provides a cloud-based platform that enables organizations to securely manage, share, and collaborate on their content from anywhere on any device.

Box serves as the secure foundation for an organization's documents, images, videos, and other unstructured content throughout its lifecycle—from creation to retention. The platform offers advanced security features like encryption, information rights management, threat detection through Box Shield, and governance capabilities for compliance requirements across various industries. These tools allow administrators to set granular permissions and controls while maintaining easy access for authorized users.

Organizations use Box for a wide range of scenarios: facilitating secure external collaboration, creating specialized content portals, streamlining document workflows, and implementing electronic signature processes. The platform integrates with over 1,500 business applications including Microsoft 365, Google Workspace, Salesforce, and Slack, allowing content to flow securely between systems while maintaining consistent security policies.

Beyond basic file storage, Box offers productivity features like Box Notes for real-time document collaboration, Box Canvas for visual whiteboarding, and Box Relay for automating content-centric workflows without coding. Recently, Box has expanded into AI capabilities that allow users to summarize documents, generate content, and extract insights while maintaining enterprise security controls.

Box generates revenue through subscription plans sold to organizations ranging from small teams to Fortune 500 enterprises. The company focuses particularly on industries with complex content needs and compliance requirements, such as financial services, healthcare, life sciences, and government sectors.

4. Document Management

The catch phrase "digital transformation" originally referred to the digitization of documents within enterprises. The growth of digital documents has spurred an explosion of collaboration within and between businesses, which in turn is driving the demand for e-signature and content management platforms.

Box competes primarily with Microsoft SharePoint and OneDrive, Google Drive, OpenText Documentum, and to a lesser extent Dropbox in the content management and enterprise file sync-and-share markets.

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Box grew its sales at a sluggish 8.8% compounded annual growth rate. This fell short of our benchmark for the software sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Box’s recent performance shows its demand has slowed as its annualized revenue growth of 5.6% over the last two years was below its five-year trend.

This quarter, Box reported year-on-year revenue growth of 9.1%, and its $301.1 million of revenue exceeded Wall Street’s estimates by 0.7%. Company management is currently guiding for a 8.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.3% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Box’s billings came in at $296 million in Q3, and over the last four quarters, its growth was underwhelming as it averaged 11.9% year-on-year increases. However, this alternate topline metric grew faster than total sales, meaning the company collects cash upfront and then recognizes the revenue over the length of its contracts - a boost for its liquidity and future revenue prospects.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Box is extremely efficient at acquiring new customers, and its CAC payback period checked in at 15.3 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

8. Gross Margin & Pricing Power

For software companies like Box, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Box’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an excellent 79% gross margin over the last year. Said differently, roughly $78.99 was left to spend on selling, marketing, and R&D for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Box has seen gross margins improve by 4.1 percentage points over the last 2 year, which is very good in the software space.

This quarter, Box’s gross profit margin was 79.6%, in line with the same quarter last year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

9. Operating Margin

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

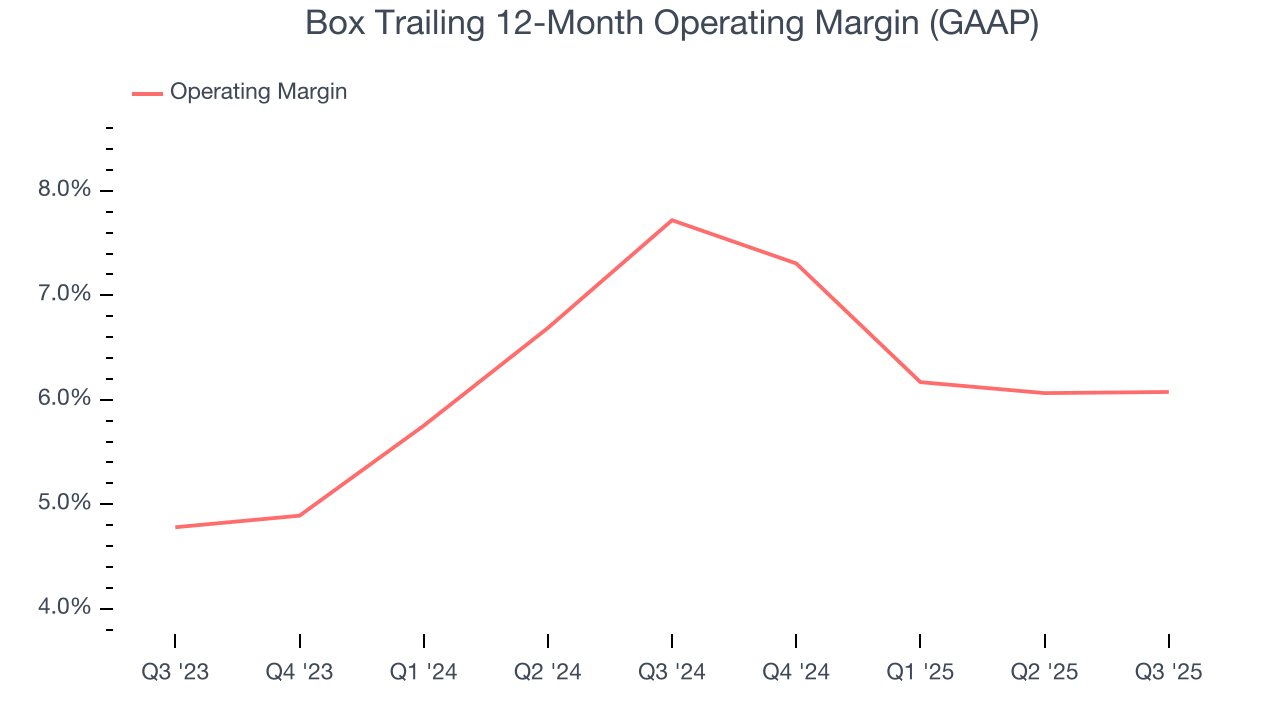

Box has managed its cost base well over the last year. It demonstrated solid profitability for a software business, producing an average operating margin of 6.1%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Box’s operating margin decreased by 1.6 percentage points over the last two years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Box generated an operating margin profit margin of 8.3%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

10. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

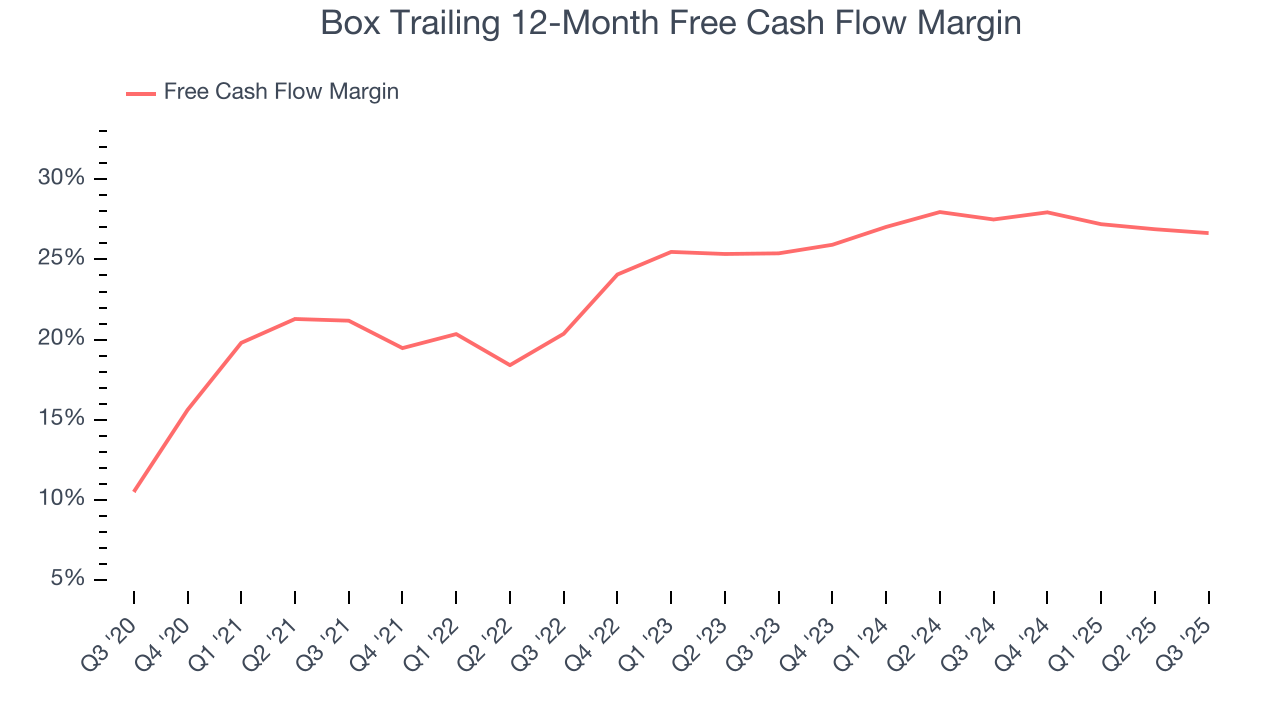

Box has shown robust cash profitability, driven by its attractive business model and cost-effective customer acquisition strategy that enable it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 26.6% over the last year, quite impressive for a software business.

Box’s free cash flow clocked in at $61.36 million in Q3, equivalent to a 20.4% margin. This cash profitability was in line with the comparable period last year but below its one-year average. In a silo, this isn’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict Box’s cash conversion will slightly improve. Their consensus estimates imply its free cash flow margin of 26.6% for the last 12 months will increase to 28.3%, giving it more flexibility for investments, share buybacks, and dividends.

11. Balance Sheet Assessment

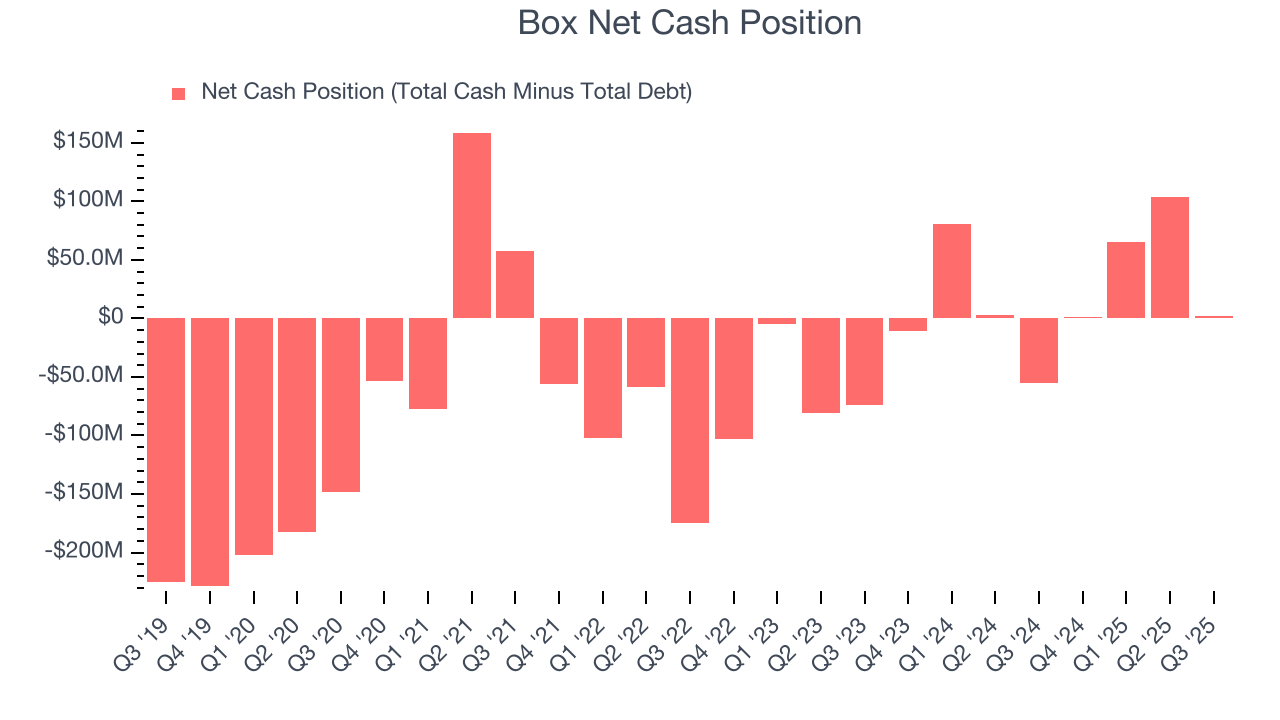

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Box is a profitable, well-capitalized company with $729.6 million of cash and $727.6 million of debt on its balance sheet. This $2.05 million net cash position gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Box’s Q3 Results

It was encouraging to see Box beat analysts’ billings expectations this quarter. On the other hand, its EPS guidance for next quarter missed and its full-year EPS guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 3.5% to $29.24 immediately following the results.

13. Is Now The Time To Buy Box?

Updated: February 23, 2026 at 9:17 PM EST

Before investing in or passing on Box, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

Box’s business quality ultimately falls short of our standards. To begin with, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while Box’s efficient sales strategy allows it to target and onboard new users at scale, its declining operating margin shows it’s becoming less efficient at building and selling its software.

Box’s price-to-sales ratio based on the next 12 months is 2.8x. This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $35.63 on the company (compared to the current share price of $21.97).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.