What a time it’s been for Carriage Services. In the past six months alone, the company’s stock price has increased by a massive 50.3%, reaching $41.08 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Carriage Services, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.We’re happy investors have made money, but we're sitting this one out for now. Here are three reasons why CSV doesn't excite us and a stock we'd rather own.

Why Is Carriage Services Not Exciting?

Established in 1991, Carriage Services (NYSE:CSV) is a provider of funeral and cemetery services in the United States.

1. Long-Term Revenue Growth Disappoints

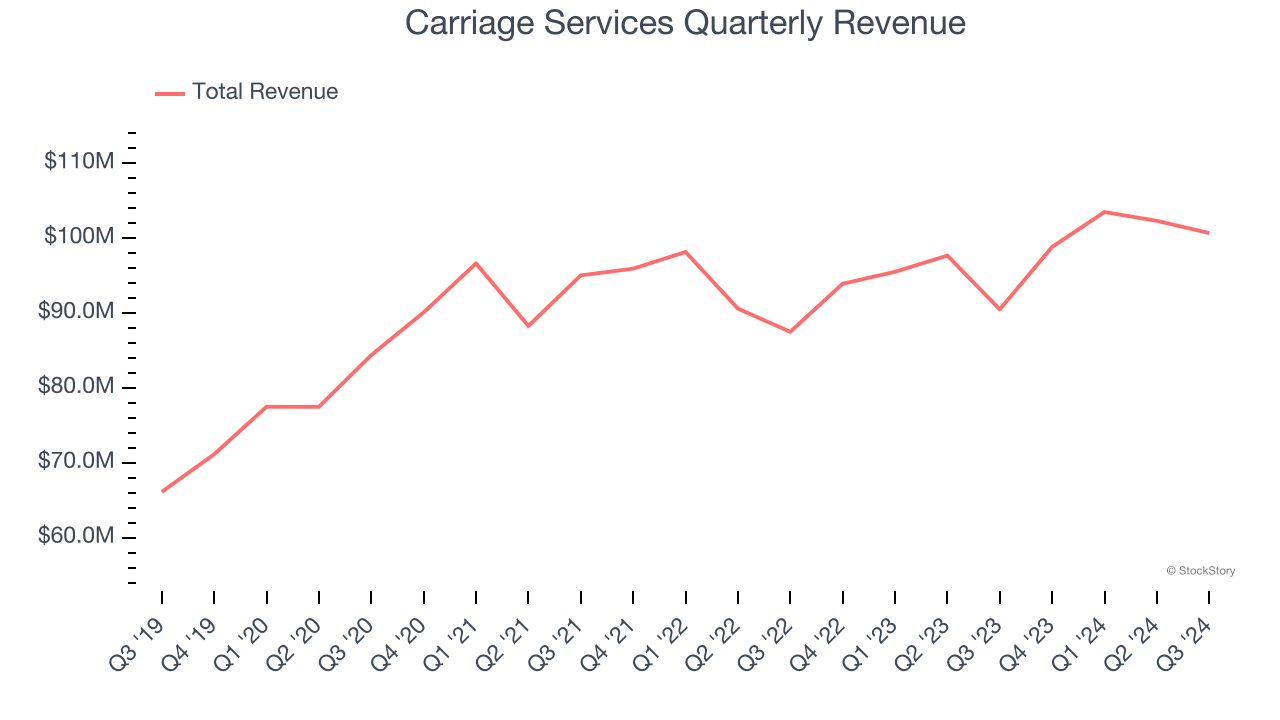

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Carriage Services’s 8.5% annualized revenue growth over the last five years was sluggish. This was below our standard for the consumer discretionary sector.

2. Previous Growth Initiatives Haven’t Paid Off Yet

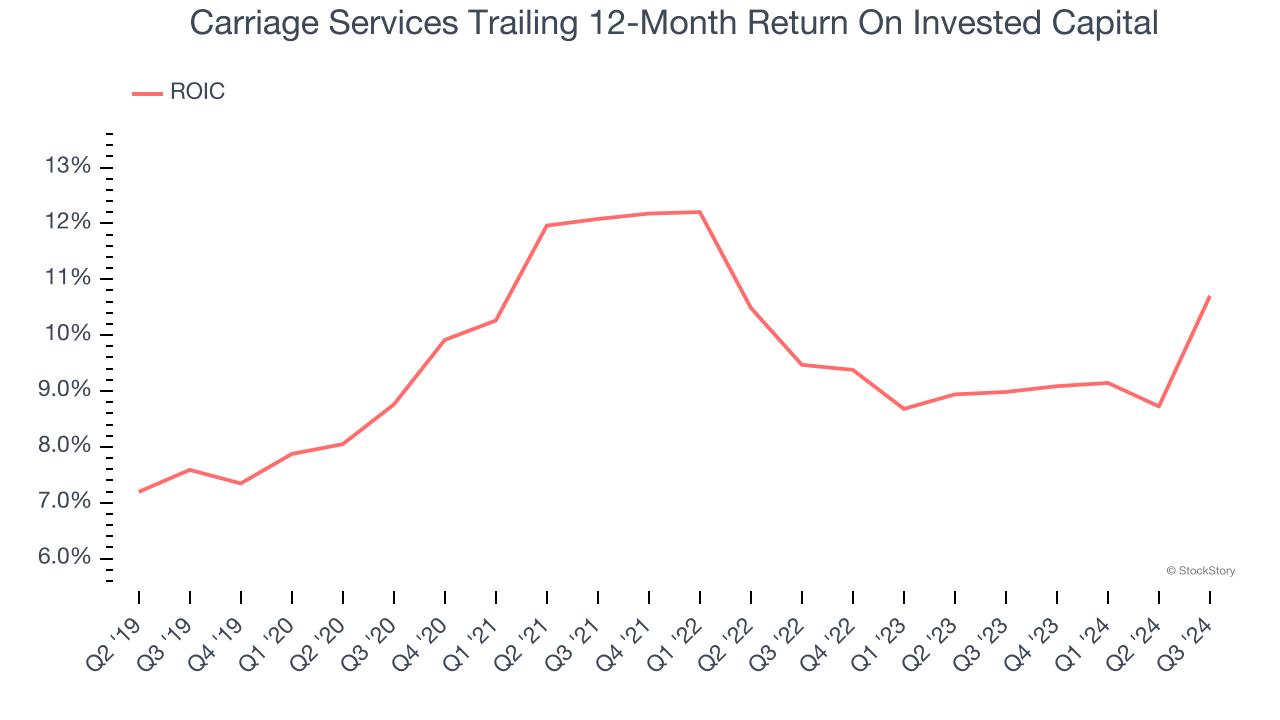

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Carriage Services historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 10%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

3. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Carriage Services’s revenue to stall, a deceleration versus its 4.4% annualized growth for the past two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

Final Judgment

Carriage Services isn’t a terrible business, but it isn’t one of our picks. After the recent rally, the stock trades at 16.5× forward price-to-earnings (or $41.08 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at FTAI Aviation, an aerospace company benefiting from Boeing and Airbus’s struggles.

Stocks We Like More Than Carriage Services

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,691% between September 2019 and September 2024) as well as under-the-radar businesses like Comfort Systems (+783% five-year return). Find your next big winner with StockStory today for free.