Carriage Services (CSV)

We wouldn’t recommend Carriage Services. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Carriage Services Will Underperform

Established in 1991, Carriage Services (NYSE:CSV) is a provider of funeral and cemetery services in the United States.

- Lackluster 4.8% annual revenue growth over the last five years indicates the company is losing ground to competitors

- Earnings growth over the last five years fell short of the peer group average as its EPS only increased by 11.2% annually

- Poor free cash flow generation means it has few chances to reinvest for growth, repurchase shares, or distribute capital

Carriage Services doesn’t live up to our standards. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than Carriage Services

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Carriage Services

At $43.45 per share, Carriage Services trades at 13x forward P/E. Carriage Services’s multiple may seem like a great deal among consumer discretionary peers, but we think there are valid reasons why it’s this cheap.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Carriage Services (CSV) Research Report: Q4 CY2025 Update

Funeral services company Carriage Services (NYSE:CSV) reported Q4 CY2025 results beating Wall Street’s revenue expectations, with sales up 8% year on year to $105.5 million. The company’s full-year revenue guidance of $445 million at the midpoint came in 3.7% above analysts’ estimates. Its non-GAAP profit of $0.75 per share was 7.2% below analysts’ consensus estimates.

Carriage Services (CSV) Q4 CY2025 Highlights:

- Revenue: $105.5 million vs analyst estimates of $103.6 million (8% year-on-year growth, 1.8% beat)

- Adjusted EPS: $0.75 vs analyst expectations of $0.81 (7.2% miss)

- Adjusted EBITDA: $32.5 million vs analyst estimates of $33.03 million (30.8% margin, 1.6% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $3.45 at the midpoint

- EBITDA guidance for the upcoming financial year 2026 is $137.5 million at the midpoint, in line with analyst expectations

- Operating Margin: 23.3%, up from 22.2% in the same quarter last year

- Free Cash Flow Margin: 5.9%, down from 9.1% in the same quarter last year

- Market Capitalization: $701 million

Company Overview

Established in 1991, Carriage Services (NYSE:CSV) is a provider of funeral and cemetery services in the United States.

The company provides personalized services to families experiencing a loss. Carriage Services's offerings include traditional funeral arrangements, cremations, memorial services, and cemetery property sales and maintenance. The company prides itself on offering compassionate care and support, coupled with professional and dignified service.

Carriage Services utilizes a decentralized operating model where it is hands-off regarding the day-to-day management responsibilities of individual funeral homes and cemeteries in its network. Instead, it takes a back seat and supports partners with resources and knowledge of best practices across the larger organization. This strategy has enabled Carriage Services to grow its network effectively through tuck-in acquisitions of independent funeral homes and cemeteries.

To improve efficiency, the company invests in training its staff and adopting new technologies to enhance the customer experience. This includes digitalizing aspects of funeral planning and memorialization, offering online obituaries, and providing live streaming services for funeral services.

4. Consumer Discretionary - Specialized Consumer Services

The Consumer Discretionary sector, by definition, is made up of companies selling non-essential goods and services. When economic conditions deteriorate or tastes shift, consumers can easily cut back or eliminate these purchases. For long-term investors with five-year holding periods, this creates a structural challenge: the sector is inherently hit-driven, with low switching costs and fickle customers. As a result, only a handful of companies can reliably grow demand and compound earnings over long periods, which is why our bar is high and High Quality ratings are rare.

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

Carriage Services' primary competitors include Service Corporation International (NYSE:SCI), StoneMor (NYSE:STON), Park Lawn Corporation (TSX:PLC), Matthews International (NASDAQ:MATW), and Dignity Plc (LSE:DTY).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Carriage Services’s 4.8% annualized revenue growth over the last five years was weak. This fell short of our benchmark for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Carriage Services’s annualized revenue growth of 4.5% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

This quarter, Carriage Services reported year-on-year revenue growth of 8%, and its $105.5 million of revenue exceeded Wall Street’s estimates by 1.8%.

Looking ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not lead to better top-line performance yet.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Carriage Services’s operating margin has been trending up over the last 12 months and averaged 22.3% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports lousy profitability for a consumer discretionary business.

This quarter, Carriage Services generated an operating margin profit margin of 23.3%, up 1.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

7. Earnings Per Share

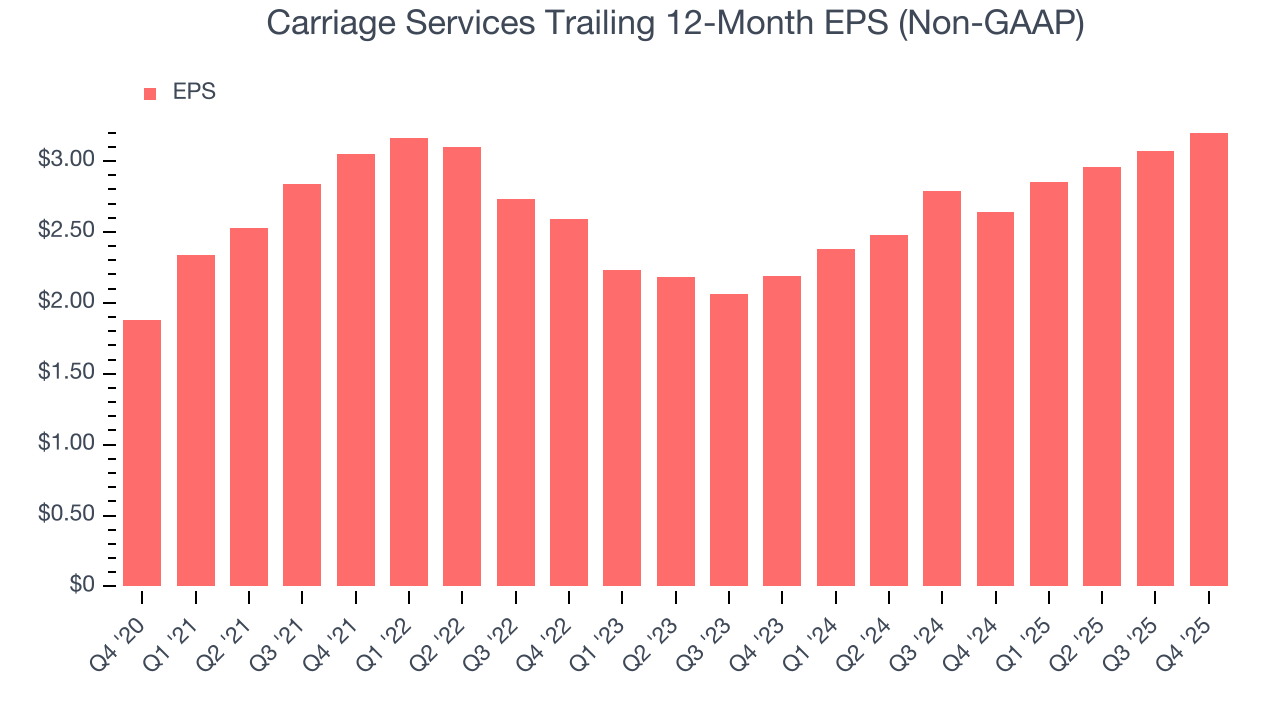

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Carriage Services’s EPS grew at a weak 11.2% compounded annual growth rate over the last five years. This performance was better than its flat revenue but doesn’t tell us much about its business quality because its operating margin didn’t improve.

In Q4, Carriage Services reported adjusted EPS of $0.75, up from $0.62 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects Carriage Services’s full-year EPS of $3.20 to grow 7.4%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Carriage Services has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 11.7%, lousy for a consumer discretionary business.

Carriage Services’s free cash flow clocked in at $6.21 million in Q4, equivalent to a 5.9% margin. The company’s cash profitability regressed as it was 3.2 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts predict Carriage Services’s cash conversion will slightly improve. Their consensus estimates imply its free cash flow margin of 10.7% for the last 12 months will increase to 12.9%, it options for capital deployment (investments, share buybacks, etc.).

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Carriage Services historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 10%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Carriage Services’s ROIC has stayed the same over the last few years. If the company wants to become an investable business, it must improve its returns by generating more profitable growth.

10. Balance Sheet Assessment

Carriage Services reported $1.69 million of cash and $548.2 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $130.6 million of EBITDA over the last 12 months, we view Carriage Services’s 4.2× net-debt-to-EBITDA ratio as safe. We also see its $14.19 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Carriage Services’s Q4 Results

We were impressed by Carriage Services’s optimistic full-year revenue guidance, which blew past analysts’ expectations. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its EBITDA and EPS both missed. Overall, this print was mixed. The market seemed to be hoping for more, and the stock traded down 2.2% to $43.22 immediately after reporting.

12. Is Now The Time To Buy Carriage Services?

Updated: February 26, 2026 at 9:23 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Carriage Services.

Carriage Services falls short of our quality standards. On top of that, Carriage Services’s Forecasted free cash flow margin suggests the company will have more capital to invest or return to shareholders next year, and its weak EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Carriage Services’s P/E ratio based on the next 12 months is 12.8x. While this valuation is fair, the upside isn’t great compared to the potential downside. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $60 on the company (compared to the current share price of $45.17).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.