Matthews (MATW)

We wouldn’t recommend Matthews. Not only are its sales cratering but also its low returns on capital suggest it struggles to generate profits.― StockStory Analyst Team

1. News

2. Summary

Why We Think Matthews Will Underperform

Originally a death care company, Matthews International (NASDAQ:MATW) is a diversified company offering ceremonial services, brand solutions and industrial technologies.

- Annual revenue declines of 1.9% over the last five years indicate problems with its market positioning

- Sales are projected to tank by 26.4% over the next 12 months as its demand continues evaporating

- Subpar operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

Matthews falls short of our expectations. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than Matthews

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Matthews

At $25.65 per share, Matthews trades at 0.6x trailing 12-month price-to-sales. The market typically values companies like Matthews based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

Paying a premium for high-quality companies with strong long-term earnings potential is preferable to owning challenged businesses with questionable prospects.

3. Matthews (MATW) Research Report: Q4 CY2025 Update

Diversified solutions provider Matthews International (NASDAQ:MATW) reported Q4 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 29.1% year on year to $284.8 million. Its non-GAAP loss of $0.19 per share was significantly below analysts’ consensus estimates.

Matthews (MATW) Q4 CY2025 Highlights:

- Revenue: $284.8 million vs analyst estimates of $282.5 million (29.1% year-on-year decline, 0.8% beat)

- Adjusted EPS: -$0.19 vs analyst estimates of $0.05 (significant miss)

- Adjusted EBITDA: $35.24 million vs analyst estimates of $32.4 million (12.4% margin, 8.8% beat)

- EBITDA guidance for the full year is $180 million at the midpoint, in line with analyst expectations

- Operating Margin: 34.2%, up from 1.7% in the same quarter last year

- Free Cash Flow was -$57.25 million compared to -$34.54 million in the same quarter last year

- Market Capitalization: $820.7 million

Company Overview

Originally a death care company, Matthews International (NASDAQ:MATW) is a diversified company offering ceremonial services, brand solutions and industrial technologies.

Matthews International offers memorialization products for families wanting to honor and remember their loved ones. The company also provides brand initiatives for companies looking to increase brand recognition. Lastly, the company provides products and services for companies seeking to optimize their manufacturing process.

Some products the company offers in the ceremonial industry include caskets, urns, and memorials. In the brand solutions industry, Matthews International develops, manages, and initiates effective branding initiatives for companies desiring increased brand recognition. The company tops these offerings off by providing marking, coding, and automation systems and services to all types of companies seeking to increase productivity.

Matthews International generates revenue from three main sources: the selling of the aforementioned ceremonial products to funeral homes, cemeteries, and individuals; service revenue from brand design, strategy, and implementation services to commercial companies; and service revenue from the optimization of companies’ production facilities.

4. Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

Competitors offering ceremonial products include Service Corporation International (NYSE:SCI) and private company Aurora Casket. Competitors offering brand solution services include private company Interbrand while competitors in the industrial technologies sector include Hitachi Construction Machinery (TSE:6305).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Matthews struggled to consistently generate demand over the last five years as its sales dropped at a 1.9% annual rate. This was below our standards and suggests it’s a low quality business.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Matthews’s recent performance shows its demand remained suppressed as its revenue has declined by 14.3% annually over the last two years.

This quarter, Matthews’s revenue fell by 29.1% year on year to $284.8 million but beat Wall Street’s estimates by 0.8%.

Looking ahead, sell-side analysts expect revenue to decline by 21.4% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Matthews’s operating margin has been trending up over the last 12 months and averaged 7% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

In Q4, Matthews generated an operating margin profit margin of 34.2%, up 32.6 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

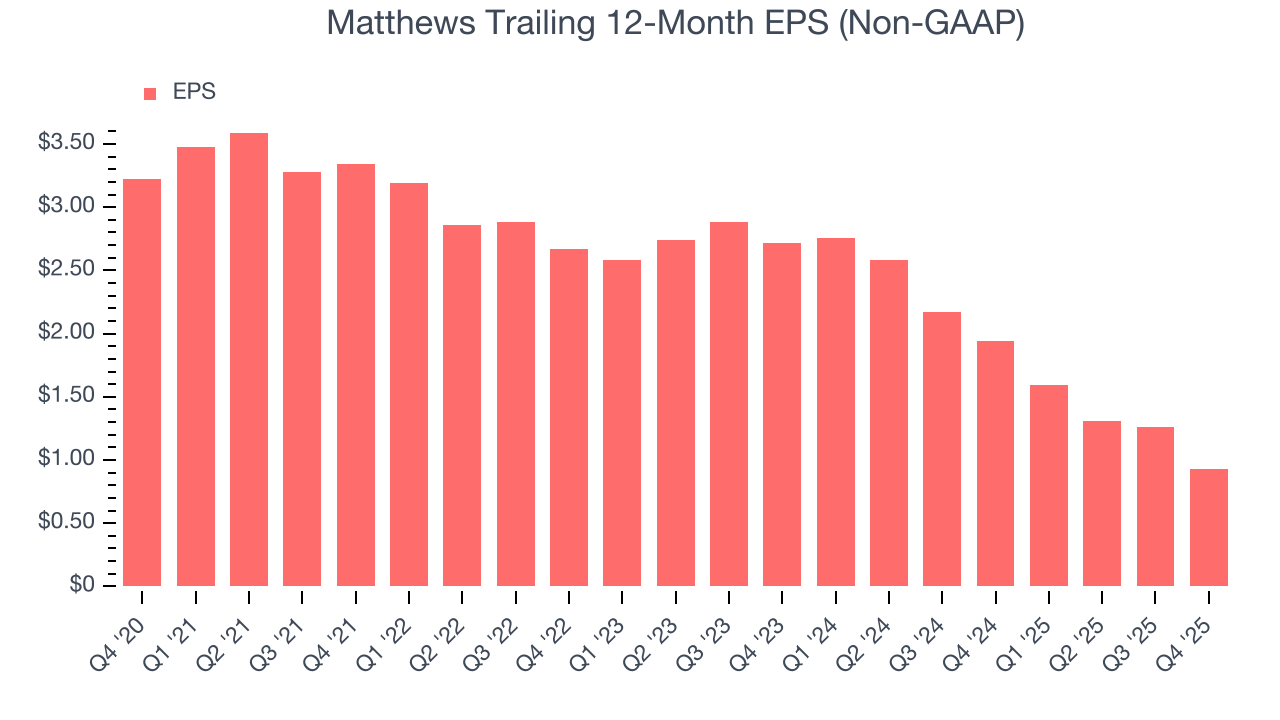

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Matthews, its EPS declined by 22% annually over the last five years, more than its revenue. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

In Q4, Matthews reported adjusted EPS of negative $0.19, down from $0.14 in the same quarter last year. This print missed analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Over the last two years, Matthews’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.3%, meaning it lit $1.32 of cash on fire for every $100 in revenue.

Matthews burned through $57.25 million of cash in Q4, equivalent to a negative 20.1% margin. The company’s cash burn increased from $34.54 million of lost cash in the same quarter last year.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Matthews historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.3%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Matthews’s ROIC averaged 4.9 percentage point increases over the last few years. This is a good sign, and we hope the company can continue improving.

10. Balance Sheet Assessment

Matthews reported $31.36 million of cash and $537 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $182.8 million of EBITDA over the last 12 months, we view Matthews’s 2.8× net-debt-to-EBITDA ratio as safe. We also see its $58.23 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Matthews’s Q4 Results

It was encouraging to see Matthews beat analysts’ EBITDA expectations this quarter. We were also happy its revenue narrowly outperformed Wall Street’s estimates. On the other hand, its EPS missed. Overall, this was a weaker quarter. The stock remained flat at $26.46 immediately after reporting.

12. Is Now The Time To Buy Matthews?

Updated: March 8, 2026 at 11:17 PM EDT

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Matthews.

We see the value of companies helping consumers, but in the case of Matthews, we’re out. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its relatively low ROIC suggests management has struggled to find compelling investment opportunities. On top of that, its cash burn raises the question of whether it can sustainably maintain growth.

Matthews’s price-to-sales ratio based on the trailing 12 months is 0.6x. The market typically values companies like Matthews based on their anticipated profits for the next 12 months, but there aren’t enough published estimates to arrive at a reliable number. You should avoid this stock for now - better opportunities lie elsewhere.

Wall Street analysts have a consensus one-year price target of $38 on the company (compared to the current share price of $25.65).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.