Construction management software maker Procore Technologies (NYSE:PCOR) beat analysts' expectations in Q3 FY2023, with revenue up 33% year on year to $247.9 million. The company also expects next quarter's revenue to be around $248 million, slightly below analysts' estimates. Turning to EPS, Procore Technologies made a GAAP loss of $0.31 per share, improving from its loss of $0.52 per share in the same quarter last year.

Is now the time to buy Procore Technologies? Find out by accessing our full research report, it's free.

Procore Technologies (PCOR) Q3 FY2023 Highlights:

- Revenue: $247.9 million vs analyst estimates of $233.7 million (6.06% beat)

- EPS (non-GAAP): $0.09 vs analyst estimates of -$0.05 ($0.14 beat)

- Revenue Guidance for Q4 2023 is $248 million at the midpoint (small miss)

- Free Cash Flow of $22.5 million is up from -$23.6 million in the previous quarter

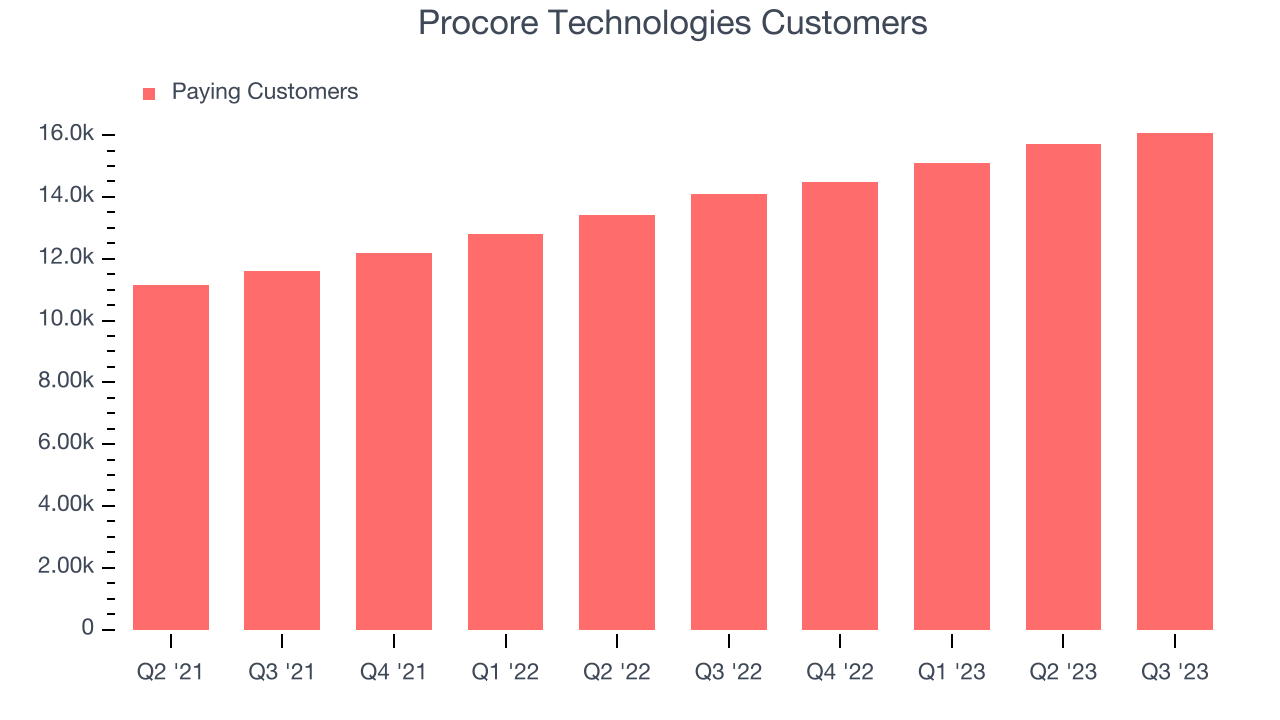

- Customers: 16,067, up from 15,704 in the previous quarter

- Gross Margin (GAAP): 82.2%, up from 79.8% in the same quarter last year

Used to manage the multi-year expansion of the Panama Canal that began in 2007, Procore Technologies (NYSE:PCOR) offers a software-as-service project, finance and quality management platform for the construction industry.

Design Software

The demand for rich, interactive 2D, 3D, VR and AR experiences is growing, and while the ubiquitous metaverse might still be more of a buzzword than a real thing, what is real is the demand for the tools to create these experiences, whether they are games, 3D tours or interactive movies.

Sales Growth

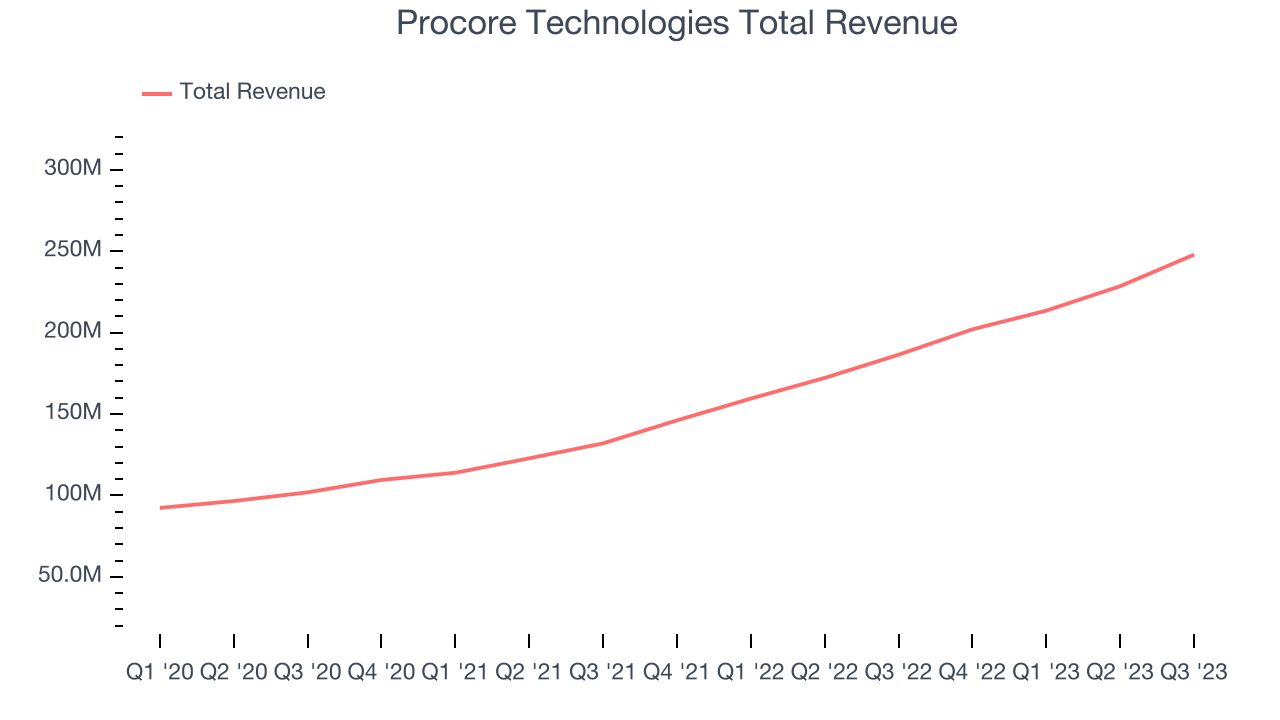

As you can see below, Procore Technologies's revenue growth has been very strong over the last two years, growing from $132 million in Q3 FY2021 to $247.9 million this quarter.

Unsurprisingly, this was another great quarter for Procore Technologies with revenue up 33% year on year. On top of that, its revenue increased $19.4 million quarter on quarter, a very strong improvement from the $15 million increase in Q2 2023. This is a sign of re-acceleration of growth and great to see.

Next quarter's guidance suggests that Procore Technologies is expecting revenue to grow 22.7% year on year to $248 million, slowing down from the 38.3% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 21.2% over the next 12 months before the earnings results announcement.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

Customer Growth

Procore Technologies reported 16,067 customers at the end of the quarter, an increase of 363 from the previous quarter. That's a little slower customer growth than what we've observed in past quarters, suggesting that the company's customer acquisition momentum is slowing.

Key Takeaways from Procore Technologies's Q3 Results

With a market capitalization of $8.7 billion, Procore Technologies is among smaller companies, but its $626.5 million cash balance and positive free cash flow over the last 12 months give us confidence that it has the resources needed to pursue a high-growth business strategy.

We enjoyed seeing Procore Technologies exceed analysts' revenue expectations this quarter. We were also glad its full-year revenue guidance came in higher than Wall Street's estimates. On the other hand, its customer growth slowed and its revenue guidance for next quarter came in slightly below Wall Street's estimates. Overall, the results could have been better. The company is down 6.1% on the results and currently trades at $56.5 per share.

So should you invest in Procore Technologies right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.