Wrapping up Q4 earnings, we look at the numbers and key takeaways for the data analytics stocks, including Palantir (NYSE:PLTR) and its peers.

Organizations generate a lot of data that is stored in silos, often in incompatible formats, making it slow and costly to extract actionable insights, which in turn drives demand for modern cloud-based data analysis platforms that can efficiently analyze the silo-ed data.

The 4 data analytics stocks we track reported a mixed Q4; on average, revenues beat analyst consensus estimates by 3.89%, while on average next quarter revenue guidance was 0.23% above consensus. The whole tech sector has been facing a sell-off since late last year and while some of the data analytics stocks have fared somewhat better, they have not been spared, with share price declining 16.7% since earnings, on average.

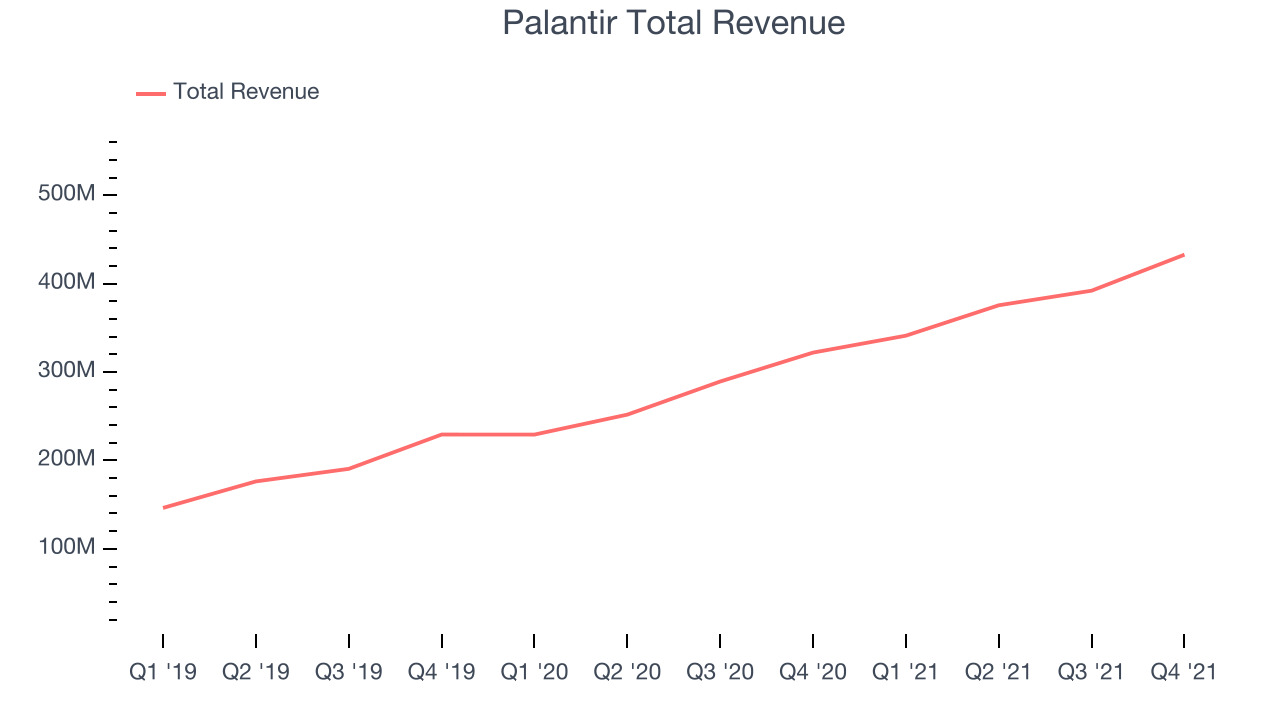

Palantir (NYSE:PLTR)

Started by Peter Thiel after seeing US defence agencies struggle in the aftermath of the 2001 terrorist attacks, Palantir (NYSE:PLTR) offers software as a service platform that helps government agencies and large enterprises use data to make better decisions.

Palantir reported revenues of $432.8 million, up 34.3% year on year, beating analyst expectations by 3.54%. It was a strong quarter for the company, with a solid top line growth and a meaningful improvement in gross margin.

The stock is down 8.08% since the results and currently trades at $12.83.

We think Palantir is a good business, but is it a buy today? Read our full report here, it's free.

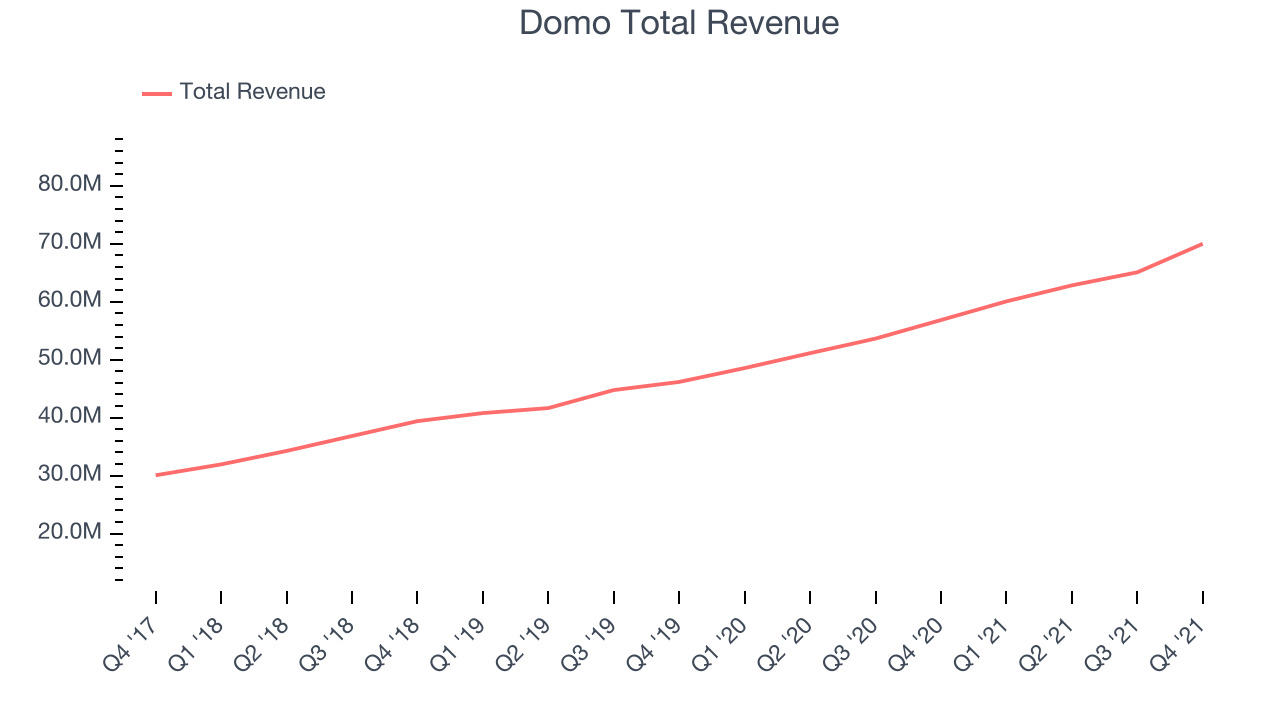

Best Q4: Domo (NASDAQ:DOMO)

Founded by Josh James after selling his former business Omniture to Adobe, Domo (NASDAQ:DOMO) provides business intelligence software that allows managers to access and visualize critical business metrics in real-time, using their smartphones.

Domo reported revenues of $69.9 million, up 23.1% year on year, beating analyst expectations by 4.31%. It was a very strong quarter for the company, with guidance for the next quarter and full-year above analysts' expectations.

Domo scored the highest full year guidance raise among its peers. The stock is up 8.75% since the results and currently trades at $47.70.

Is now the time to buy Domo? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Amplitude (NASDAQ:AMPL)

Born out of a failed voice recognition startup by founder Spenser Skates, Amplitude (NASDAQ:AMPL) is data analytics software helping companies improve and optimize their digital products.

Amplitude reported revenues of $49.4 million, up 75.1% year on year, beating analyst expectations by 5.26%. It was a weak quarter for the company, with the guidance for both the next quarter and the full year below analyst estimates.

Amplitude achieved the strongest analyst estimates beat and fastest revenue growth, but had the weakest full year guidance update in the group. The company added 180 customers to a total of 1,597. The stock is down 58.1% since the results and currently trades at $17.40.

Read our full analysis of Amplitude's results here.

Health Catalyst (NASDAQ:HCAT)

Founded by healthcare professionals Tom Burton and Steve Barlow in 2008, Health Catalyst (NASDAQ:HCAT) provides data and analytics technology to healthcare organizations, enabling them to improve care and lower costs.

Health Catalyst reported revenues of $64.7 million, up 21.4% year on year, beating analyst expectations by 2.45%. It was a weaker quarter for the company, with a decline in gross margin compared to the previous year and underwhelming revenue guidance for the next quarter.

Health Catalyst had the weakest performance against analyst estimates and slowest revenue growth among the peers. The stock is down 9.22% since the results and currently trades at $24.01.

Read our full, actionable report on Health Catalyst here, it's free.

The author has no position in any of the stocks mentioned