As we reflect back on the just completed Q4 consumer internet sector earnings season, we dig into the relative performance of Revolve (NYSE:RVLV) and its peers.

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 17 consumer internet stocks we track reported a decent Q4; on average, revenues beat analyst consensus estimates by 2.91%, while on average next quarter revenue guidance was 0.08% under consensus. Technology stocks have been hit hard on fears of higher interest rates, but consumer internet stocks held their ground better than others, with share price down 8.67% since earnings, on average.

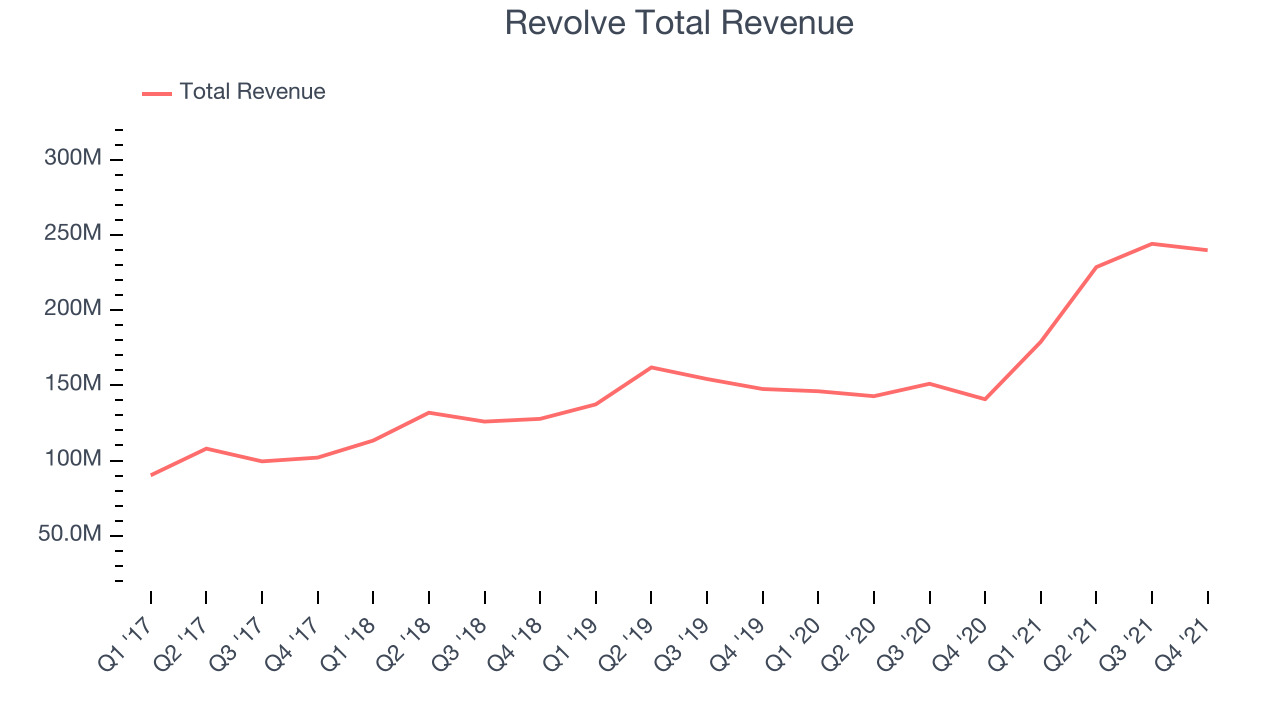

Revolve (NYSE:RVLV)

Launched in 2003 by software engineers Michael Mente and Mike Karanikolas, Revolve Group (NASDAQ: RVLV) is a next generation fashion retailer that leverages social media and a community of fashion influencers to drive its merchandising strategy.

Revolve reported revenues of $239.8 million, up 70.3% year on year, beating analyst expectations by 7.99%. It was a very strong quarter for the company, with an exceptional revenue growth and an impressive beat of analyst estimates.

“Our exceptional fourth quarter results demonstrate the power of our brands and our connection with the next generation consumer, highlighted by further acceleration of our net sales growth to 70% over the prior year and 63% over the fourth quarter of 2019,“ said co-founder and co-CEO Mike Karanikolas.

The company reported 1.84 million active customers, up 25% year on year. The stock is up 7.49% since the results and currently trades at $53.92.

Is now the time to buy Revolve? Access our full analysis of the earnings results here, it's free.

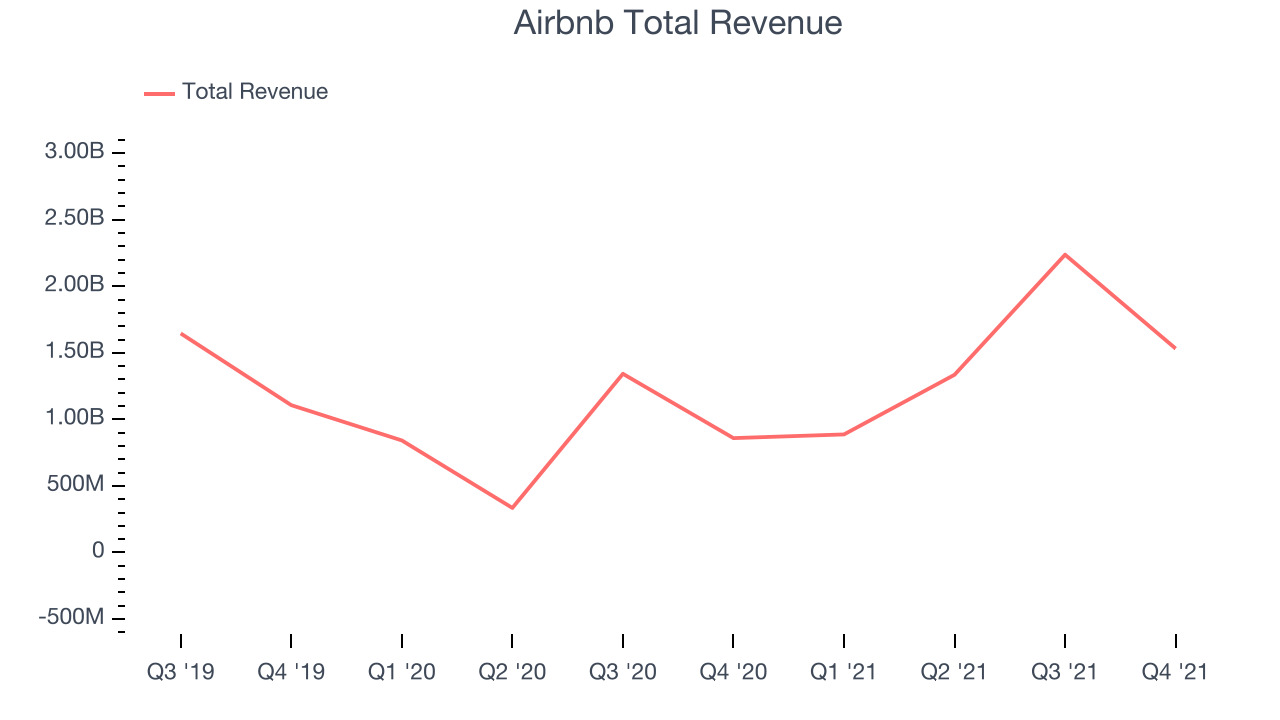

Best Q4: Airbnb (NASDAQ:ABNB)

Founded by Joe Gebbia and Brian Chesky by renting out a blowup bed on the floor of their San Francisco apartment, Airbnb (NASDAQ: ABNB) is the world’s largest online marketplace for lodging, primarily homestays.

Airbnb reported revenues of $1.53 billion, up 78.3% year on year, beating analyst expectations by 5.02%. It was a stunning quarter for the company, with a very optimistic guidance for the next quarter and an exceptional revenue growth.

The company reported 73.4 million nights booked, up 58.5% year on year. The stock is down 5.2% since the results and currently trades at $170.70.

Is now the time to buy Airbnb? Access our full analysis of the earnings results here, it's free.

Slowest Q4: Wayfair (NYSE:W)

Launched in 2002 by founder Niraj Shah, Wayfair (NYSE: W) is a leading online retailer for mass market home goods in the US, UK, Canada, and Germany.

Wayfair reported revenues of $3.25 billion, down 11.5% year on year, missing analyst expectations by 0.75%. It was a weak quarter for the company, with declining number of users and a slow revenue growth.

Wayfair had the slowest revenue growth in the group. The company reported 27.3 million active buyers, down 12.5% year on year. The stock is down 9.78% since the results and currently trades at $109.51.

Read our full analysis of Wayfair's results here.

Farfetch (NYSE:FTCH)

Inspired by the idea of allowing anyone to buy clothes from landmark boutiques of cities like Paris or Milan without having to leave their couch, Farfetch (NYSE: FTCH) is a global marketplace for luxury fashion, connecting boutiques, brands and consumers.

Farfetch reported revenues of $665.6 million, up 23.2% year on year, missing analyst expectations by 1.13%. It was a slower quarter for the company, with a miss of the top line analyst estimates.

The company reported 3.68 million active buyers, up 21.9% year on year. The stock is down 9.13% since the results and currently trades at $13.63.

Read our full, actionable report on Farfetch here, it's free.

Booking (NASDAQ:BKNG)

Formerly known as The Priceline Group, Booking Holdings (NASDAQ: BKNG) is the world’s largest online travel agency.

Booking reported revenues of $2.98 billion, up 140% year on year, beating analyst expectations by 4.49%. It was a good quarter for the company, with an exceptional revenue growth and growing number of users.

The company reported 151 million nights booked, up 98.6% year on year. The stock is down 9.87% since the results and currently trades at $2,230.

Read our full, actionable report on Booking here, it's free.

The author has no position in any of the stocks mentioned