More than a decade ago, the inventor of the web browser and famous tech investor Marc Andreessen declared that "Software is Eating the World." What did he mean? Andreessen’s short but prescient statement spoke to software’s increasing ubiquity and its ability to drive innovation that would disrupt traditional business models and processes.

Fast forward to 2024 and software has made a huge mark on businesses across all industries and on the overall global economy. Salesforce (CRM) has digitized customer relationship management. ServiceNow (NOW) has unified and removed manual bottlenecks from IT workflows. Adobe (ADBE) has moved document management and multiple creative endeavors to the cloud.

Ten years ago, the combined market cap of these three software companies was around $80 billion. Today? $650 billion, up more than 800%. We’d say that constitutes eating the world.

Software doesn’t just grow on trees or appear out of thin air, though. It must be designed, coded, tested, and deployed. Software developers are the brains behind these steps, and we think that companies providing tools to make their lives easier can be great, market-beating investments. Not only do these platforms benefit from the massive secular trend we just detailed, but they also boast defensive competitive moats and great unit economics.

The cherry on top is that with the proliferation of AI in development, these tools will be even more mission-critical and more often used. When aided by artificial intelligence, each software engineer will be more productive and able to write, test, and deploy more code.

Engineering teams will be able to develop more applications, push out updates more quickly, and quicken the pace of innovation. Higher velocities in these areas will lead to more need and more touch points with platforms that serve as systems of record, repositories, and monitoring solutions for code and IT environments.

Now, software's magnificent run anywhere isn’t close to over yet. In fact, the global enterprise software market is projected to grow roughly 10% annually over the next decade. This means that the current $800+ billion pie could double in size by 2031. If you, like us, believe that the future means technology, these are the stocks that we believe are the best positioned to help you profit from this trend.

JFrog (NASDAQ:FROG)

Source code written by developers is the blueprint for software, but it can’t be instantly deployed the same way architectural blueprints don’t miraculously turn into functional houses with plumbing and electricity.

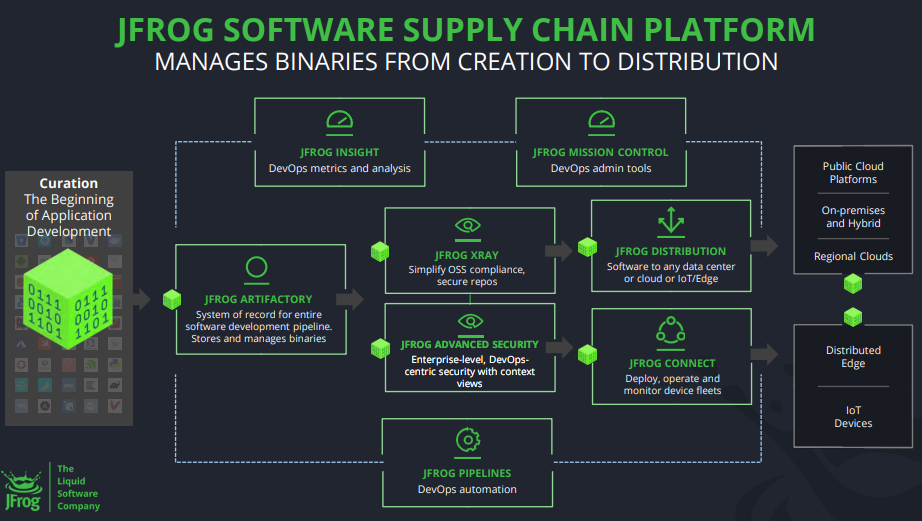

Source code must first be transformed into executable files that can be read by a server or device. This process requires tools to store, manage, and secure the code so that it can be worked on and deployed by engineering teams. That’s where JFrog’s flagship product–JFrog Artifactory–comes in. This product is a repository for software packages (or executable code in layman’s terms), allowing teams to manage and work fluidly with their in-process software.

Over the years, JFrog has evolved from just offering Artifactory to a more robust development platform, enabling the safe bundling of additional external assets like images, documents, and AI models into software packages (JFrog Curation). There are obviously security concerns with all this bundling, so the platform can also identify vulnerabilities and policy violations in software packages in the repository (JFrog Xray).

JFrog Artifactory, Curation, and Xray cover most use cases, and if customers seek further functionality, there are additional offerings to manage distribution and automate steps in the development process. The cherry on top is that all JFrog products are wrapped in a God’s-eye view admin platform with robust analytical tools.

We believe JFrog wins because of technical expertise and flexibility.

JFrog established a reputation with developers nearly two decades ago when its core Artifactory product pioneered a new software category called ‘Continuous Software Release Management’ or CSRM. The platform won over customers not only because of its efficiency gains but also its low barriers to adoption. It supports all programming languages, source code repositories, and development technologies that developers and software engineering teams use. It also supports any production environment to which customers deploy (on-premise, hybrid cloud, pure cloud, multi-cloud). This means ease-of-use is high and friction is low.

JFrog also exhibits cream-of-the-crop business quality.

Not only do 7,400+ enterprises and organizations count themselves as FROG customers, but they’re happy customers. Over the last four quarters, net revenue retention has averaged 119%, meaning that FROG turns $100 of revenue into $119 over the next year because the vast majority of customers not only stay but spend more over time.

Because its software is already written, the incremental cost of bringing on a new customer is low. That’s why FROG boasted roughly 84% gross margins in each of the last three years (85% in the latest quarter), a stellar starting point for ultimate operating profits and cash flow. From there, FROG generated a 14% adjusted operating margin and a 24% free cash flow margin on just $370 million of revenue in the last year. The company’s profitability is unsurprising as it has generated positive free cash flow in each of the last nine years.

A bet on JFrog is a bet that demand for software and the tools that enable software development will continue growing at a healthy clip. Betting on JFrog is betting on the increasing importance of software itself.

It’s also an opportune time to buy the stock. JFrog is coming off of Q1’24 results (reported on May 9, 2024) where objectively, the quarter was solid and demonstrated a healthy combination of growth and operating leverage. However, high expectations and–at the time–skittishness around enterprise software dragged the share price down on these results. There hasn’t been a full recovery, and we think the current price is a nice discount to JFrog’s intrinsic value.

Click here to read our full, regularly updated research report on JFROG

GitLab (NASDAQ:GTLB)

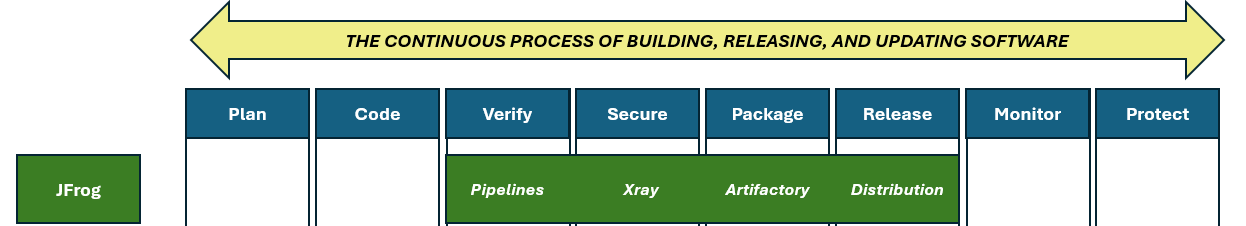

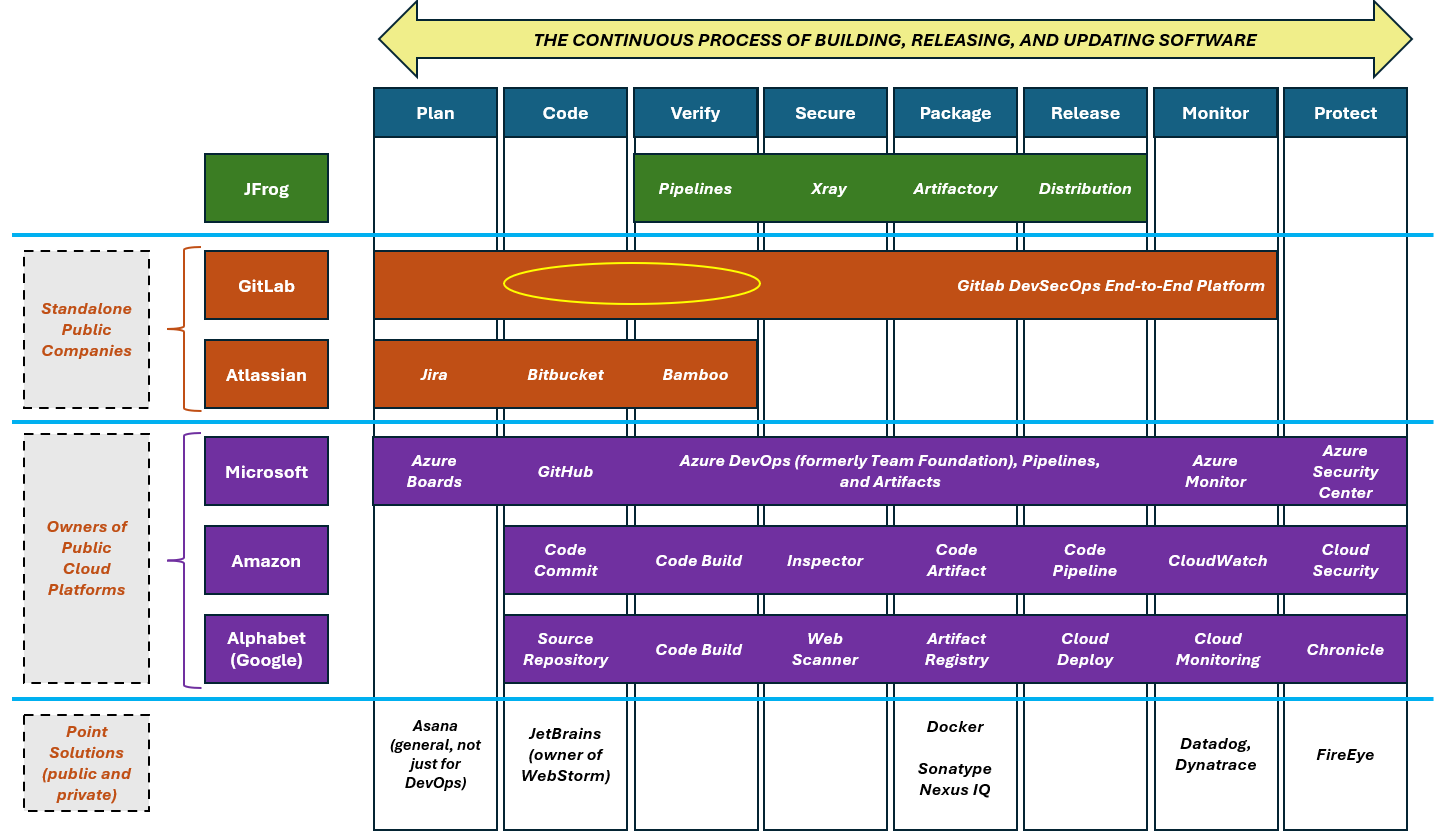

GitLab is a direct competitor to JFrog. Where JFrog made its name in as a repository for software packages (executable code), GitLab makes its name in Source Code Management (SCM) as well as Continuous Integration and Continuous Delivery (CI/CD) (the ‘Code’ and ‘Verify’ workflows in the graphic below). SCM and CI/CD aim to improve the quality and reliability of software releases via best practices around early detection of errors and automated testing.

Developers use GitLab’s bread-and-butter solutions to collaborate on the same code base without conflicting or accidentally overwriting each other's additions and edits. Gitlab also excels at maintaining a history of software contributions from each collaborator to enable detailed version control.

The company’s platform also ensures that changes to the source code go through defined quality standards with automated testing. Combined, GitLab serves as an indispensable system of record for code.

GitLab doesn’t just facilitate the coding and verification steps, though. The company’s ‘DevSecOps’ platform is actually broader than that of JFrog, encompassing everything from the planning stages of software development to the release and monitoring of finished software.

Like JFrog, GitLab’s numbers shine.

There are the nearly 9,000 customer organizations as well as the wonderful 128% net revenue retention average over the last four quarters. Gross margins approached 90% and the company generated positive free cash flow in the last year. With healthy demand and a cost structure that leads to cash generation, GitLab has sufficient capital to grow its competitive position by investing in existing products, launching new products, and strengthening its customer acquisition through sales or brand-building.

Like JFrog, a bet on GitLab is broadly a bet that demand for software and the tools that enable software development will increase in value and importance. Both are high-quality companies with strong financial profiles, and we think long-term investors excited about software can own both. We have a slight preference for JFrog over Gitlab for two reasons.

Firstly we think there is more misunderstanding around JFrog’s offering. The market is still wrestling with whether the company is a point solution that only excels in one area (a repository for software packages via its Artifactory product). We think it’s well on its way to becoming an end-to-end platform.

Secondly, JFrog trades at a nearly 20% discount to GitLab on a forward sales multiple basis. When considering each’s company’s growth, margin, and free cash flow profile, we think JFrog is more attractively priced for what you get.

Click here to read our full, regularly updated research report on GTLB

Datadog (NASDAQ:DDOG)

Named after a database that the founders had to painstakingly look after at their previous company, Datadog makes it easier to monitor cloud infrastructure and applications.

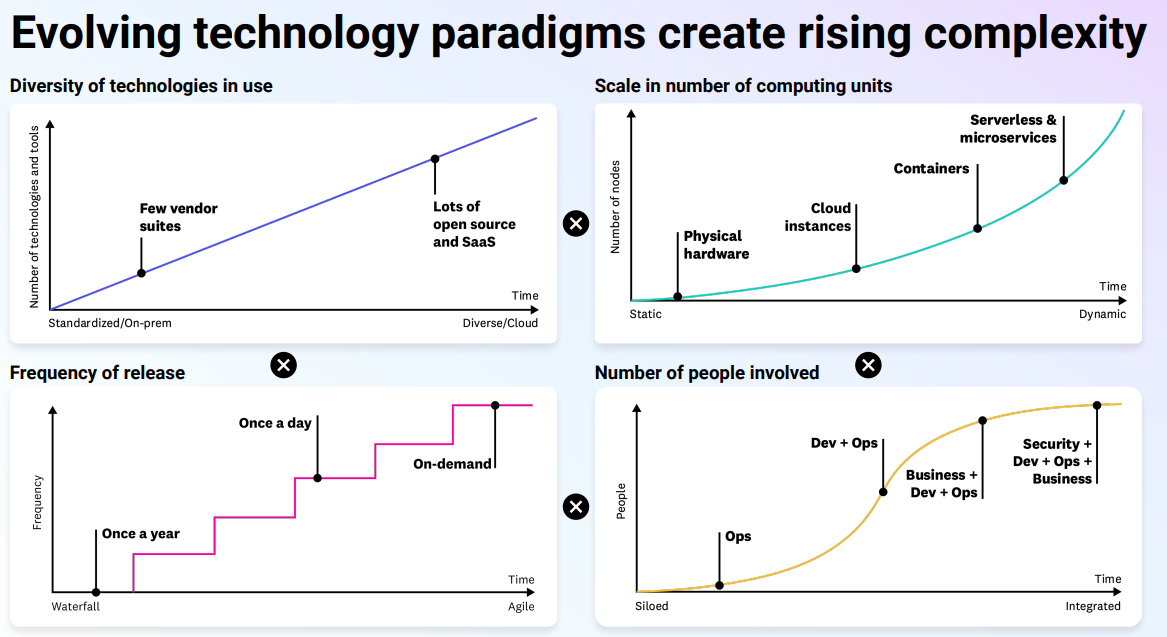

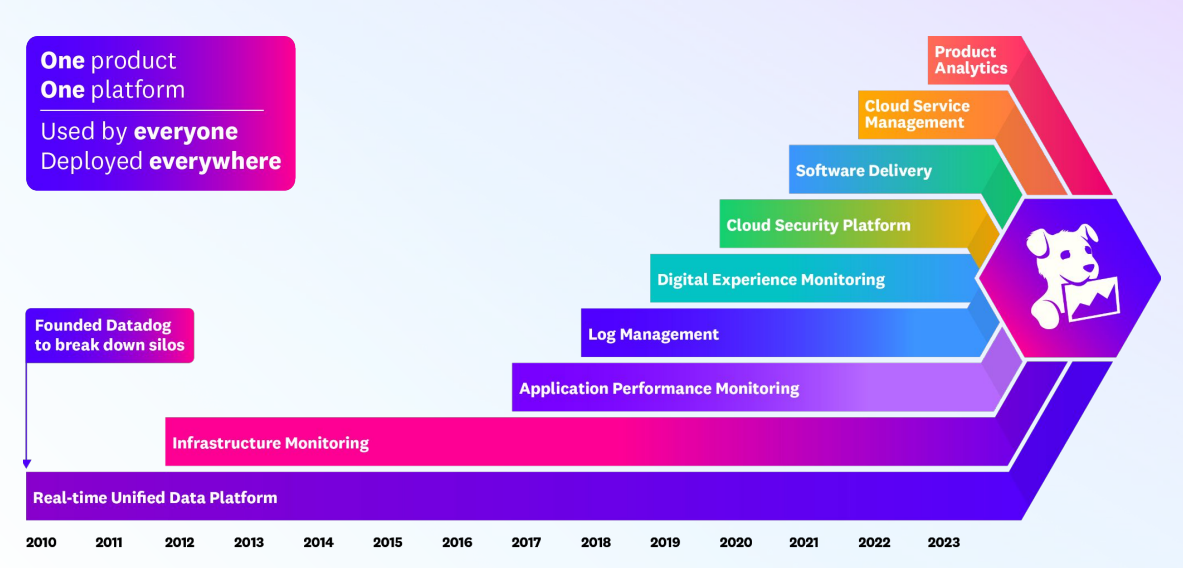

Founded in 2010, Datadog was designed to help companies embark on a journey to move from legacy on-premise servers to hosting their systems in the cloud. This journey modernized enterprises but also increased the complexity and diversity of the IT stack. It also accelerated the number of computing units (physical hardware to microservices) and the number of teams involved.

The result was velocity–software deployment increased from weeks to days and hours. The engineering, operations, and security teams therefore needed a unified way to observe their cloud infrastructure in real-time.

Customers love Datadog’s platform because it’s a one-stop shop, as a key aim of the company since its founding has been to unify separate tools into an integrated monitoring and analytics platform. In 2020, the company launched products in cloud security, and in 2021, developer-focused products followed. The result today is a cloud-agnostic platform that combines metrics, traces, logs, user sessions, security signals, and over 700 integrations with outside technologies commonly used by enterprises of all types and sizes.

Topline momentum over the years speaks to the power of Datadog’s product portfolio evolution.

From fiscal 2019 to when the dust settles on 2024, the company will have grown its customer count at an impressive 23% annualized rate–from 10,500 to an estimated nearly 29,000+. However, revenue growth over that time will be more than double that rate, roughly 48% annualized. Wow. This shows that not only is Datadog growing its customer base, but the company is readily convincing each customer to buy more of its products.

It is far easier to convince existing customers–who are getting tons of value from the product–to buy more products than to convince new customers to adopt their first Datadog product. As such, Datadog’s sales & market expense has gone from nearly 40% of revenue in fiscal 2019 to a projected 23% in 2024. This operating leverage in the business model is key to long-term profits and free cash flow that will allow Datadog to further its lead by investing in product, technology, and customer experience.

In short, Datadog makes the lives of the all-important software developers and their engineering teams easier. The company’s platform makes work more frictionless by offering a unified platform so engineers are not wasting time and resources switching from one point solution to another, none of which talk to and share information outside of the silo. Additionally, the Datadog platform makes the increasingly-common collaboration between engineering, security, and operations teams more seamless.

That the financials are resilient and profitable means that there is a margin of safety here. Long-term investors can own a rock-solid business buoyed by a groundbreaking trend that has legs for years. That’s a good recipe for beating the market.

Click here to read our full, regularly updated research report on DDOG

Closing Thoughts

We hope you enjoyed this abridged version of our research.

You can get so much value from StockStory!

AI-enabled research is revolutionizing stock investing, but so far only large institutions and funds have benefitted from it. But we believe everyday investors deserve to have access to the same tools as the Wall St bigwigs.

StockStory is a new service that uses AI to help individual investors like you grow your wealth and beat the market. Since launching in 2020, some of our top picks have returned 259%, 436%, and even 794% to date –crushing the S&P 500 by 3x, 5x, and nearly 9x. We recommended Nvidia to our users already in November 2022 – well BEFORE the generative AI burst onto the scene.

And now we’re on a hunt to add to those winners.

Harnessing the power of AI, the StockStory team has identified 6 top stocks that we believe everyday investors should buy right now.

And you can get the name of these stocks with full research reports for FREE by clicking here!