Advanced Energy (AEIS)

We’re cautious of Advanced Energy. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why Advanced Energy Is Not Exciting

Pioneering technologies for radio frequency power delivery, Advanced Energy (NASDAQ:AEIS) provides power supplies, thermal management systems, and measurement and control instruments for various manufacturing processes.

- Earnings per share lagged its peers over the last five years as they only grew by 4.1% annually

- Annual revenue growth of 4.9% over the last five years was below our standards for the industrials sector

- One positive is that its projected revenue growth of 19.5% for the next 12 months is above its two-year trend, pointing to accelerating demand

Advanced Energy is skating on thin ice. There are superior opportunities elsewhere.

Why There Are Better Opportunities Than Advanced Energy

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Advanced Energy

Advanced Energy’s stock price of $346.25 implies a valuation ratio of 39.2x forward P/E. Not only does Advanced Energy trade at a premium to companies in the industrials space, but this multiple is also high for its top-line growth.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. Advanced Energy (AEIS) Research Report: Q4 CY2025 Update

Manufacturing equipment and systems provider Advanced Energy (NASDAQ:AEIS) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 17.8% year on year to $489.4 million. On top of that, next quarter’s revenue guidance ($500 million at the midpoint) was surprisingly good and 5.3% above what analysts were expecting. Its non-GAAP profit of $1.94 per share was 8.8% above analysts’ consensus estimates.

Advanced Energy (AEIS) Q4 CY2025 Highlights:

- Revenue: $489.4 million vs analyst estimates of $473.7 million (17.8% year-on-year growth, 3.3% beat)

- Adjusted EPS: $1.94 vs analyst estimates of $1.78 (8.8% beat)

- Revenue Guidance for Q1 CY2026 is $500 million at the midpoint, above analyst estimates of $474.8 million

- Adjusted EPS guidance for Q1 CY2026 is $1.94 at the midpoint, above analyst estimates of $1.68

- Operating Margin: 11.6%, up from 8.2% in the same quarter last year

- Free Cash Flow was -$82.77 million, down from $69.76 million in the same quarter last year

- Market Capitalization: $10.54 billion

Company Overview

Pioneering technologies for radio frequency power delivery, Advanced Energy (NASDAQ:AEIS) provides power supplies, thermal management systems, and measurement and control instruments for various manufacturing processes.

Founded in 1981, Advanced Energy originally focused on developing power conversion technologies but has since expanded through acquisitions. As of recent, the acquisitions of Artesyn Embedded Power and LumaSense were particularly pivotal for entering into new markets and improving its technological capabilities. Today, Advanced Energy provides products and services that enable manufacturing processes.

The company offers power supplies, thermal management systems, and measure and control instruments. These products are crucial for manufacturing industrial products, telecommunications, and data centers. For example, its power supplies ensure that machines run smoothly to prevent costly downtime. In addition, its thermal management systems keep electronic devices from overheating by regulating their temperature, thereby preventing damage and increasing machine productivity.

The company has a business model encompassing product sales and service agreements. It maintains long-term contracts with OEMs (original equipment manufacturers) and end-users, providing consistent revenue streams that are brought in via its direct sales team and a network of distributors. Offered as part of these long-term contracts with major OEMs are volume discounts to incentivize larger quantity orders.

4. Electronic Components

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

Competitors offering similar products include MKS Instruments (NASDAQ:MKSI), AMETEK (NYSE:AME), and Veeco Instruments (NASDAQ:VECO).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, Advanced Energy’s sales grew at a tepid 4.9% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Advanced Energy’s annualized revenue growth of 4.2% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

We can better understand the company’s revenue dynamics by analyzing its most important segments, Semiconductor Equipment and Industrial and Medical Equipment, which are 43.2% and 16% of revenue. Over the last two years, Advanced Energy’s Semiconductor Equipment revenue (i.e., plasma power) averaged 6.8% year-on-year growth. On the other hand, its Industrial and Medical Equipment revenue (i.e., robotics) averaged 21.8% declines.

This quarter, Advanced Energy reported year-on-year revenue growth of 17.8%, and its $489.4 million of revenue exceeded Wall Street’s estimates by 3.3%. Company management is currently guiding for a 23.6% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 11.8% over the next 12 months, an improvement versus the last two years. This projection is commendable and indicates its newer products and services will catalyze better top-line performance.

6. Gross Margin & Pricing Power

Advanced Energy’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 36.9% gross margin over the last five years. That means Advanced Energy only paid its suppliers $63.10 for every $100 in revenue.

This quarter, Advanced Energy’s gross profit margin was 38.6%, in line with the same quarter last year. Zooming out, Advanced Energy’s full-year margin has been trending up over the past 12 months, increasing by 2.2 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

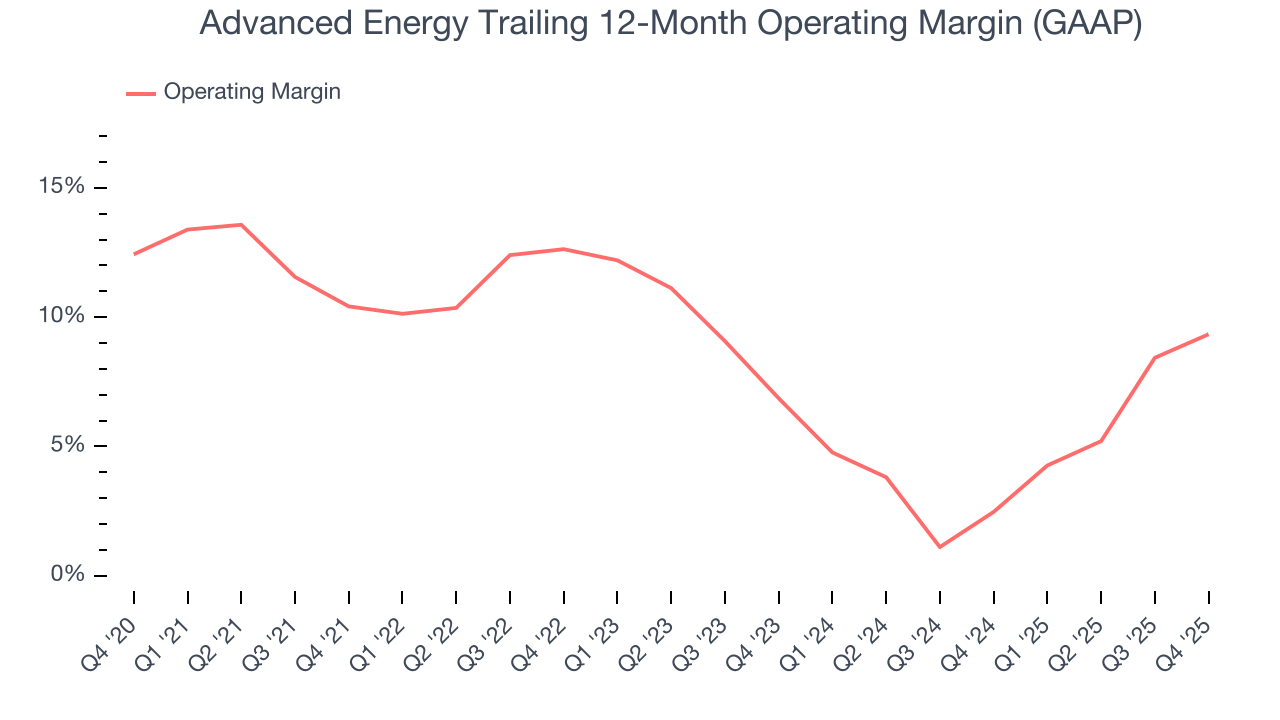

7. Operating Margin

Advanced Energy has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 8.5%, higher than the broader industrials sector.

Analyzing the trend in its profitability, Advanced Energy’s operating margin decreased by 1.1 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Advanced Energy generated an operating margin profit margin of 11.6%, up 3.4 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

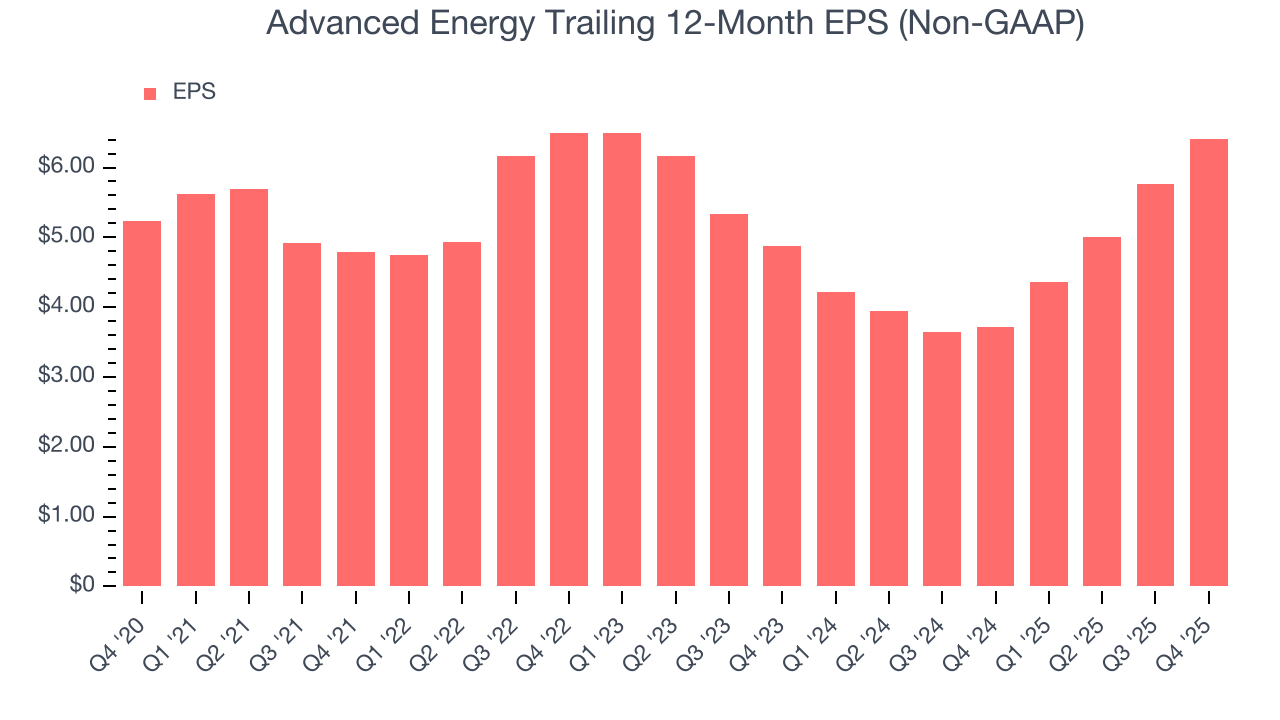

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Advanced Energy’s unimpressive 4.1% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Advanced Energy’s two-year annual EPS growth of 14.7% was great and topped its 4.2% two-year revenue growth.

Diving into the nuances of Advanced Energy’s earnings can give us a better understanding of its performance. Advanced Energy’s operating margin has expanded over the last two years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q4, Advanced Energy reported adjusted EPS of $1.94, up from $1.30 in the same quarter last year. This print beat analysts’ estimates by 8.8%. Over the next 12 months, Wall Street expects Advanced Energy’s full-year EPS of $6.41 to grow 25.3%.

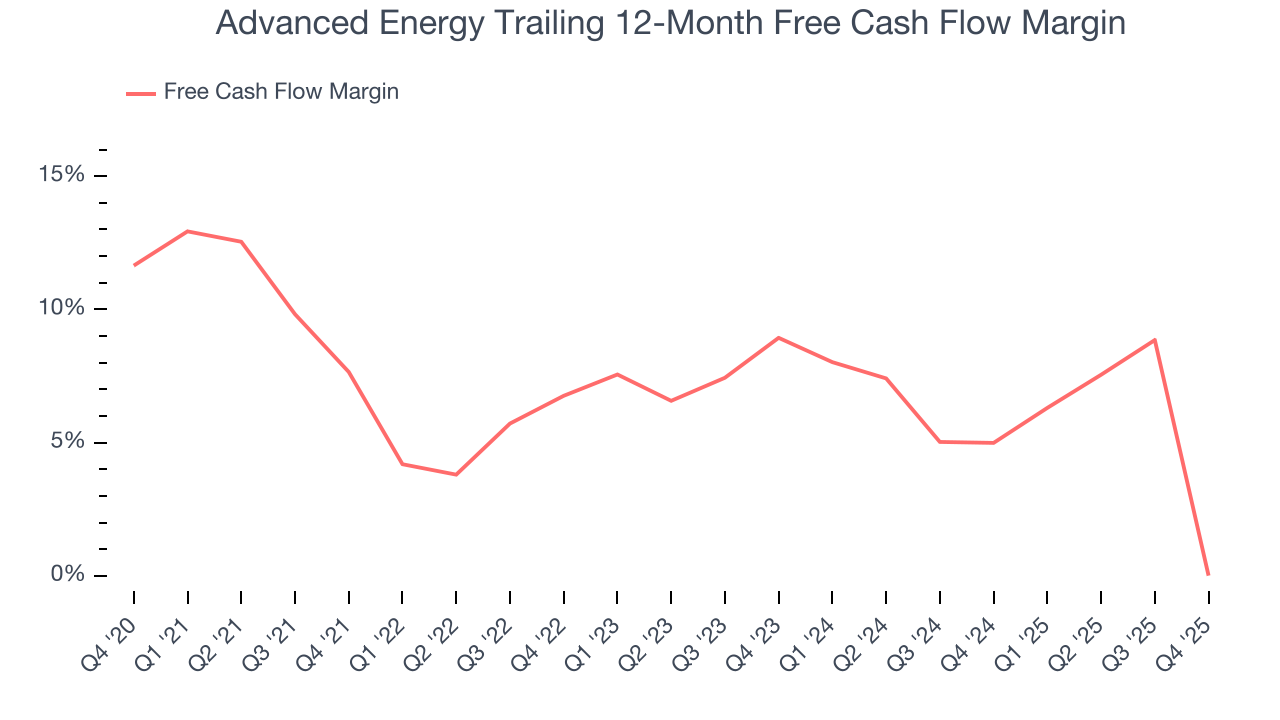

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Advanced Energy has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 5.6%, subpar for an industrials business.

Taking a step back, we can see that Advanced Energy’s margin dropped by 7.6 percentage points during that time. This along with its unexciting margin put the company in a tough spot, and shareholders are likely hoping it can reverse course. If the trend continues, it could signal it’s becoming a more capital-intensive business.

Advanced Energy burned through $82.77 million of cash in Q4, equivalent to a negative 16.9% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Although Advanced Energy hasn’t been the highest-quality company lately because of its poor bottom-line (EPS) performance, it historically found a few growth initiatives that worked. Its five-year average ROIC was 12.6%, higher than most industrials businesses.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Advanced Energy’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

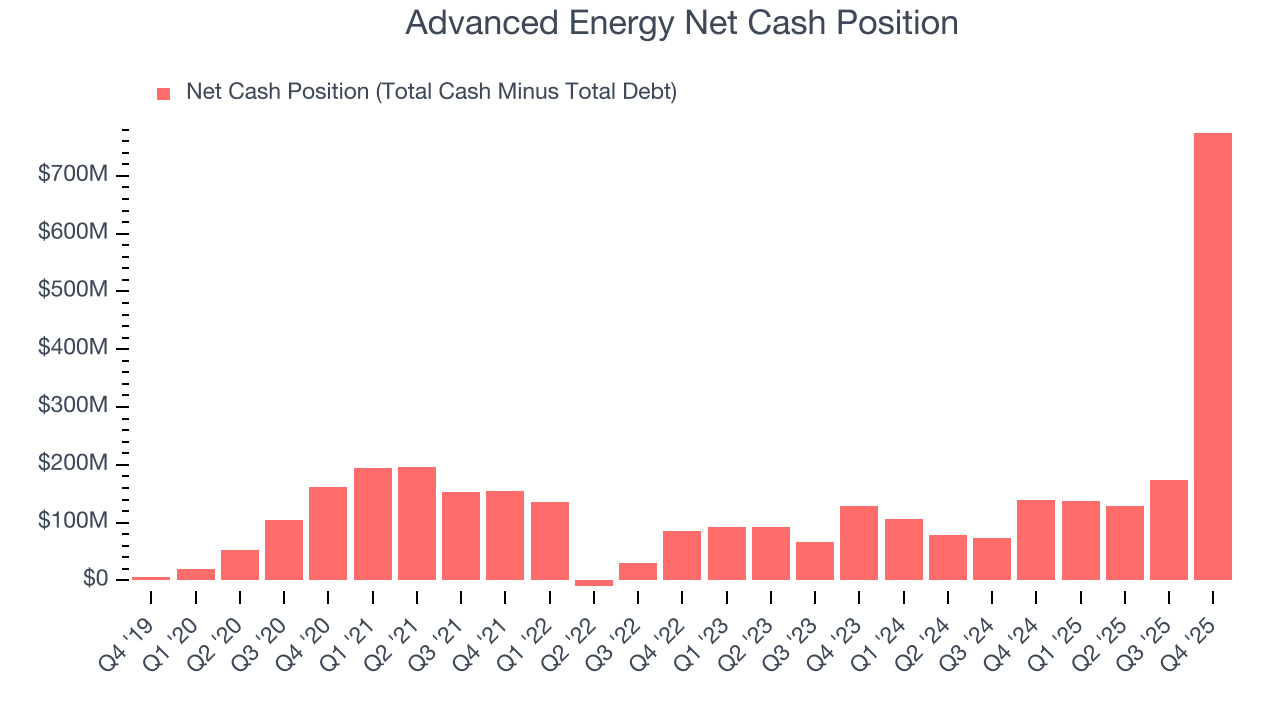

11. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Advanced Energy is a profitable, well-capitalized company with $791.2 million of cash and $16.37 million of debt on its balance sheet. This $774.8 million net cash position is 7.4% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Advanced Energy’s Q4 Results

We were impressed by Advanced Energy’s optimistic EPS guidance for next quarter, which blew past analysts’ expectations. We were also excited its adjusted operating income outperformed Wall Street’s estimates by a wide margin. Overall, we think this was a decent quarter with some key metrics above expectations. The stock traded up 1.7% to $284.00 immediately after reporting.

13. Is Now The Time To Buy Advanced Energy?

Updated: March 1, 2026 at 10:46 PM EST

Are you wondering whether to buy Advanced Energy or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Advanced Energy isn’t a terrible business, but it doesn’t pass our bar. To kick things off, its revenue growth was uninspiring over the last five years. While its projected EPS for the next year implies the company’s fundamentals will improve, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its unimpressive EPS growth over the last five years shows it’s failed to produce meaningful profits for shareholders.

Advanced Energy’s P/E ratio based on the next 12 months is 39.2x. This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $326.11 on the company (compared to the current share price of $346.25), implying they don’t see much short-term potential in Advanced Energy.