Alarm.com (ALRM)

Alarm.com is in for a bumpy ride. Its weak revenue growth and gross margin show it not only lacks demand but also decent unit economics.― StockStory Analyst Team

1. News

2. Summary

Why We Think Alarm.com Will Underperform

Processing over 325 billion data points annually from more than 150 million connected devices, Alarm.com (NASDAQ:ALRM) provides cloud-based platforms that enable residential and commercial property owners to remotely monitor and control their security, video, energy, and other connected devices.

- Estimated sales growth of 3.7% for the next 12 months implies demand will slow from its two-year trend

- Operating profits increased over the last year as the company gained some leverage on its fixed costs and became more efficient

- Products, pricing, or go-to-market strategy may need some adjustments as its 7% average billings growth over the last year was weak

Alarm.com fails to meet our quality criteria. More profitable opportunities exist elsewhere.

Why There Are Better Opportunities Than Alarm.com

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Alarm.com

Alarm.com is trading at $49.35 per share, or 2.9x forward price-to-sales. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Alarm.com (ALRM) Research Report: Q3 CY2025 Update

Smart property technology provider Alarm.com (NASDAQ:ALRM) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 6.6% year on year to $256.4 million. Its non-GAAP profit of $0.76 per share was 24.3% above analysts’ consensus estimates.

Alarm.com (ALRM) Q3 CY2025 Highlights:

- Revenue: $256.4 million vs analyst estimates of $251 million (6.6% year-on-year growth, 2.2% beat)

- Adjusted EPS: $0.76 vs analyst estimates of $0.61 (24.3% beat)

- Adjusted EBITDA: $59.16 million vs analyst estimates of $50.46 million (23.1% margin, 17.2% beat)

- Management raised its full-year Adjusted EPS guidance to $2.53 at the midpoint, a 5.4% increase

- Operating Margin: 14.4%, in line with the same quarter last year

- Free Cash Flow Margin: 25.7%, up from 7.1% in the previous quarter

- Billings: $257.1 million at quarter end, up 6.4% year on year

- Market Capitalization: $2.38 billion

Company Overview

Processing over 325 billion data points annually from more than 150 million connected devices, Alarm.com (NASDAQ:ALRM) provides cloud-based platforms that enable residential and commercial property owners to remotely monitor and control their security, video, energy, and other connected devices.

Alarm.com operates through a network of trusted service provider partners who sell, install, and support its solutions. These partners range from local providers to large national companies, creating a widespread distribution channel for Alarm.com's technology. The company primarily generates revenue through monthly SaaS and license fees paid by these service providers, who typically maintain multi-year contracts with end users.

The company's technology ecosystem includes interactive security systems with professional monitoring, video surveillance with advanced analytics, energy management solutions, access control, water leak detection, and wellness monitoring for aging adults. For businesses, Alarm.com offers specialized solutions ranging from small business security to enterprise-scale commercial applications through its OpenEye subsidiary, which provides video surveillance as a service for national retail chains, universities, and other large organizations.

A homeowner using Alarm.com might receive a smartphone notification when their security system detects unexpected activity, view live video of their property while away, automatically adjust their thermostat to save energy when the system is armed, or receive an alert if water leakage is detected. Commercial customers might use the platform to monitor multiple business locations, analyze customer traffic patterns, or detect potential security threats.

Beyond hardware and software, Alarm.com also provides its service provider partners with business intelligence tools, marketing resources, and technical support to help them grow their businesses effectively. The company's EnergyHub subsidiary works with utilities to create "virtual power plants" by coordinating connected thermostats and other devices to reduce energy demand during peak periods.

4. Vertical Software

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

Alarm.com competes with other smart property technology platforms including Resideo Technologies (NYSE: RESI), Honeywell (NASDAQ: HON), and privately-held companies like SecureNet and Brivo. The company also faces competition from direct-to-consumer security providers such as SimpliSafe and Ring (owned by Amazon), as well as broader smart home offerings from tech giants like Google's Nest and integrated security services from telecom companies like Comcast (NASDAQ: CMCSA).

5. Revenue Growth

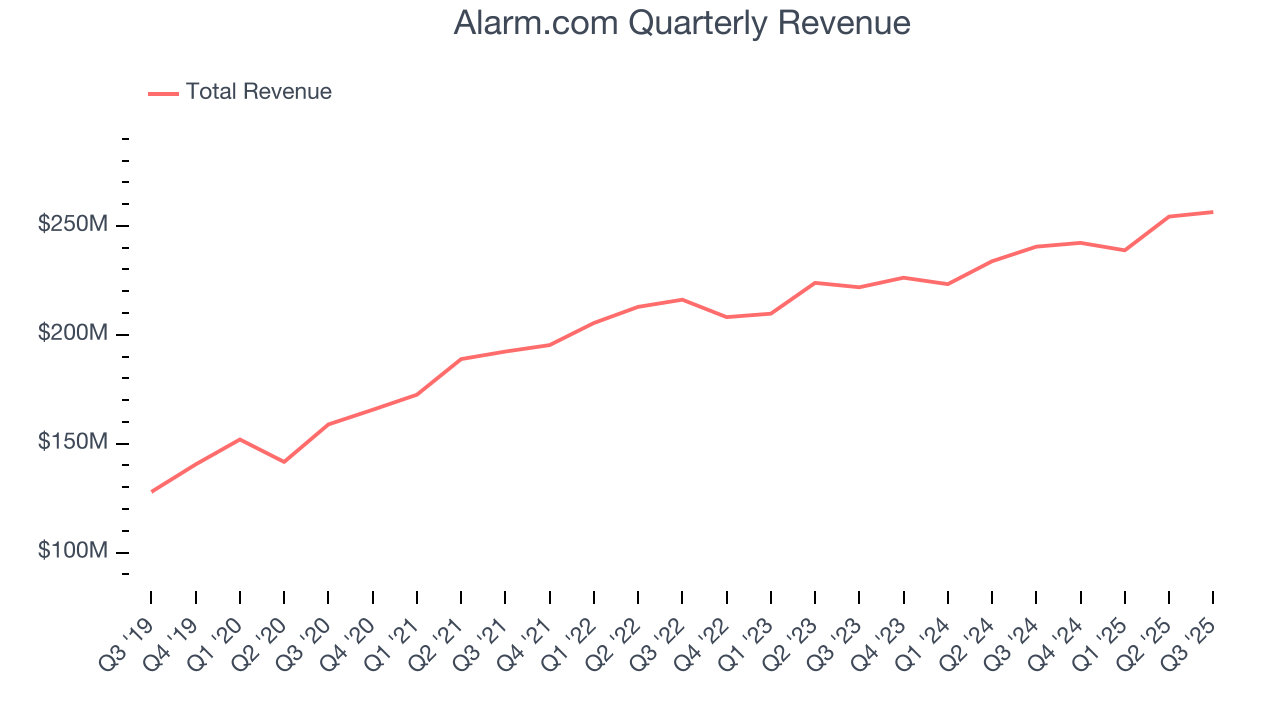

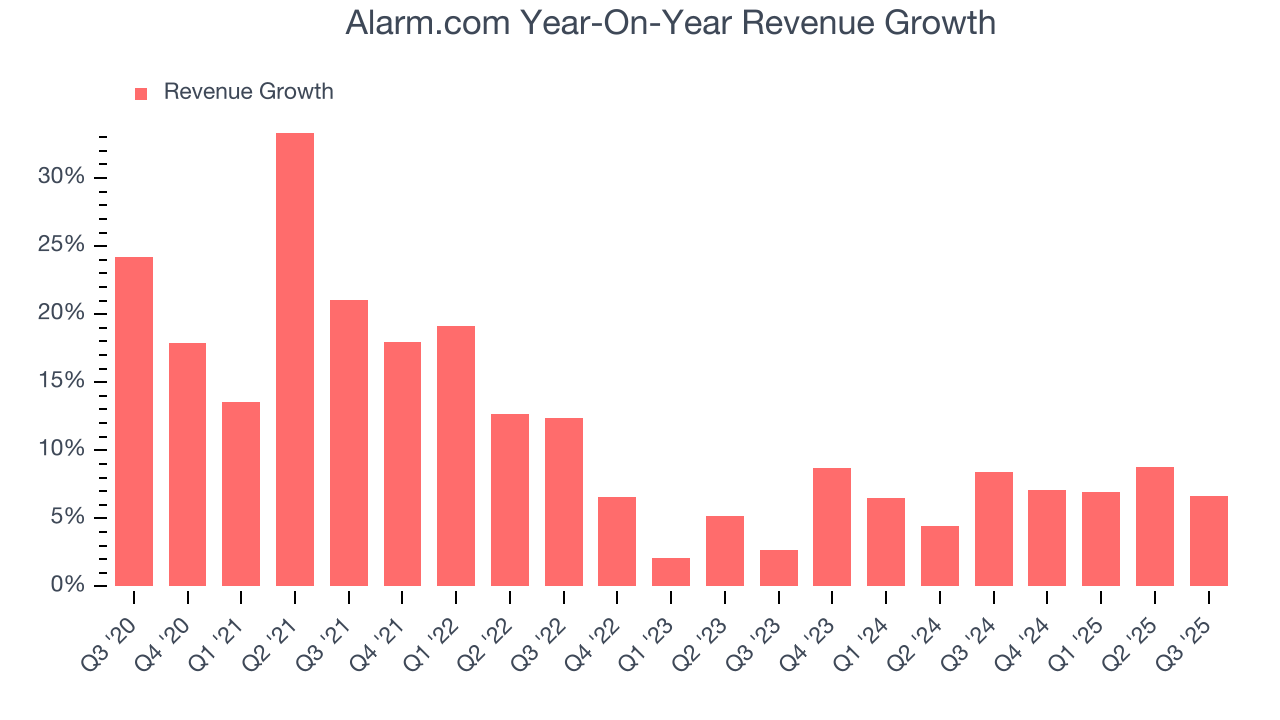

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Alarm.com grew its sales at a 10.8% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Alarm.com’s recent performance shows its demand has slowed as its annualized revenue growth of 7.2% over the last two years was below its five-year trend.

This quarter, Alarm.com reported year-on-year revenue growth of 6.6%, and its $256.4 million of revenue exceeded Wall Street’s estimates by 2.2%.

Looking ahead, sell-side analysts expect revenue to grow 3.1% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and suggests its products and services will face some demand challenges.

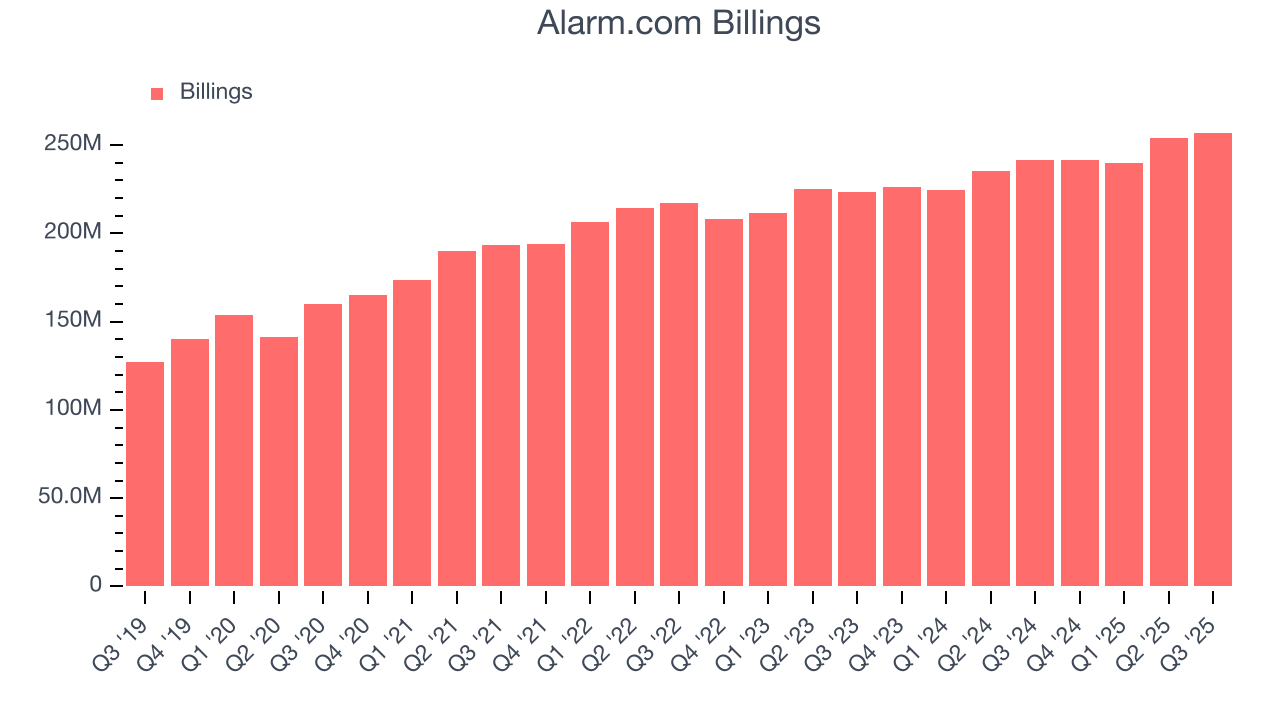

6. Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Alarm.com’s billings came in at $257.1 million in Q3, and over the last four quarters, its growth was underwhelming as it averaged 7% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in acquiring/retaining customers.

7. Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Alarm.com is very efficient at acquiring new customers, and its CAC payback period checked in at 26.7 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

8. Gross Margin & Pricing Power

For software companies like Alarm.com, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

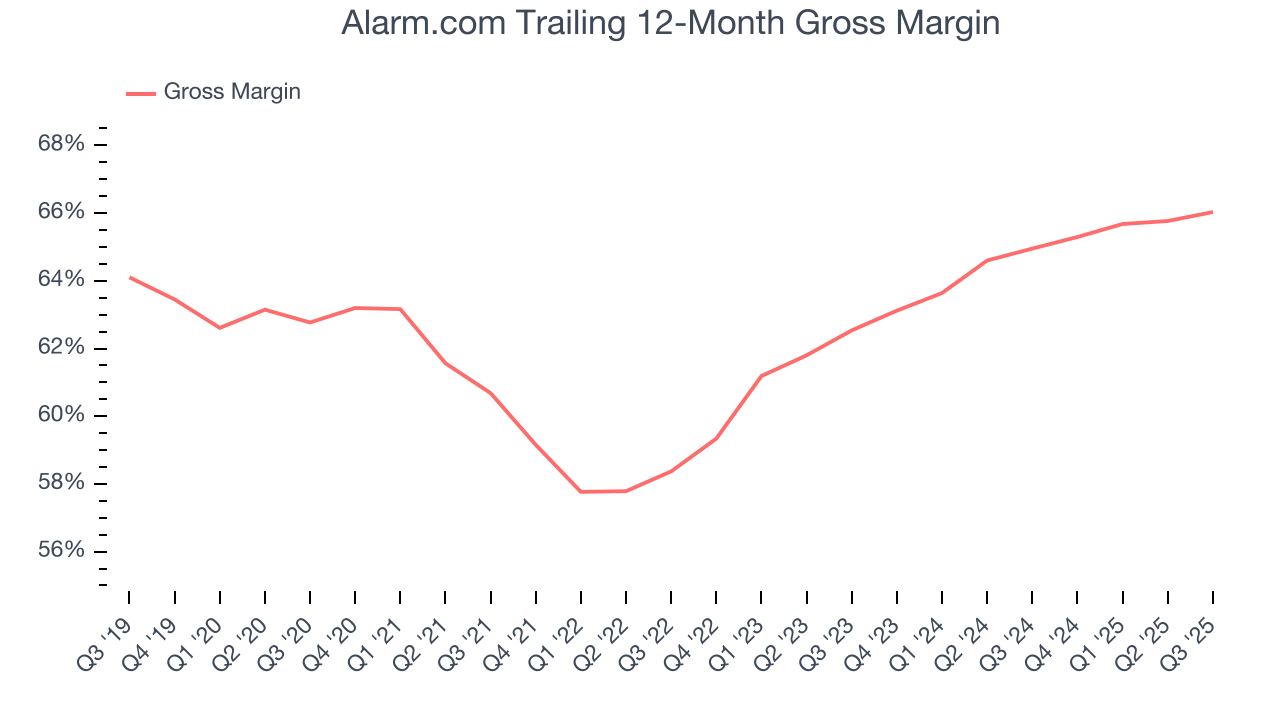

Alarm.com’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 66% gross margin over the last year. Said differently, Alarm.com had to pay a chunky $33.97 to its service providers for every $100 in revenue.

The market not only cares about gross margin levels but also how they change over time because expansion creates firepower for profitability and free cash generation. Alarm.com has seen gross margins improve by 3.5 percentage points over the last 2 year, which is very good in the software space.

This quarter, Alarm.com’s gross profit margin was 65.8%, marking a 1.1 percentage point increase from 64.8% in the same quarter last year. Alarm.com’s full-year margin has also been trending up over the past 12 months, increasing by 1.1 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as servers).

9. Operating Margin

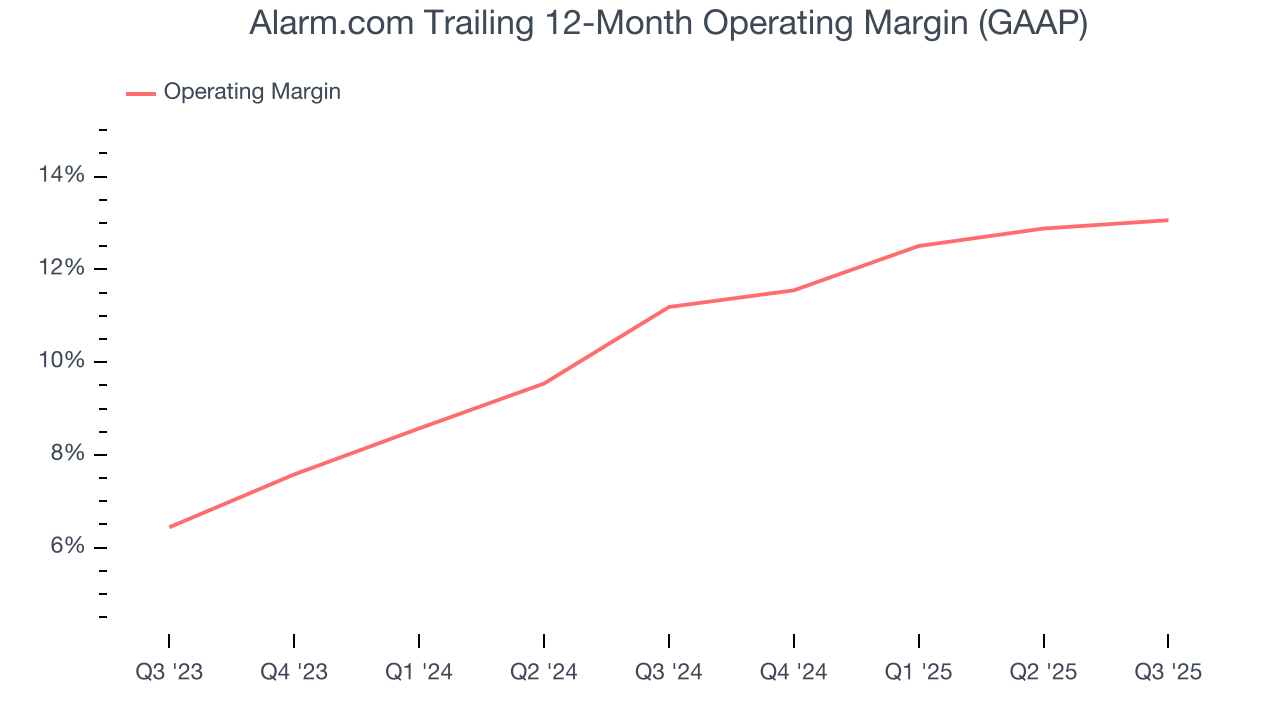

Alarm.com has been an efficient company over the last year. It was one of the more profitable businesses in the software sector, boasting an average operating margin of 13.1%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Alarm.com’s operating margin rose by 1.9 percentage points over the last two years, as its sales growth gave it operating leverage.

This quarter, Alarm.com generated an operating margin profit margin of 14.4%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

10. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

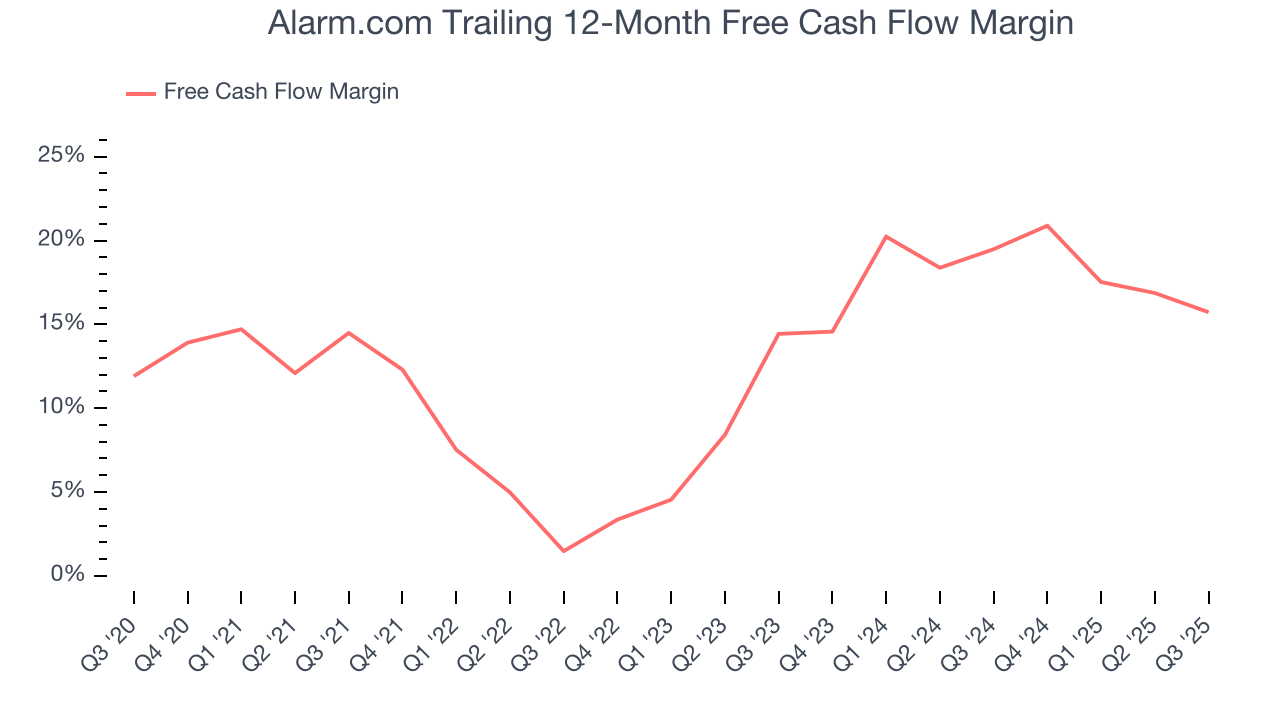

Alarm.com has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 15.7% over the last year, slightly better than the broader software sector.

Alarm.com’s free cash flow clocked in at $65.87 million in Q3, equivalent to a 25.7% margin. The company’s cash profitability regressed as it was 5.3 percentage points lower than in the same quarter last year, but it’s still above its one-year average. We wouldn’t read too much into this quarter’s decline because investment needs can be seasonal, leading to short-term swings. Long-term trends trump temporary fluctuations.

Over the next year, analysts predict Alarm.com’s cash conversion will improve. Their consensus estimates imply its free cash flow margin of 15.7% for the last 12 months will increase to 20.4%, it options for capital deployment (investments, share buybacks, etc.).

11. Balance Sheet Assessment

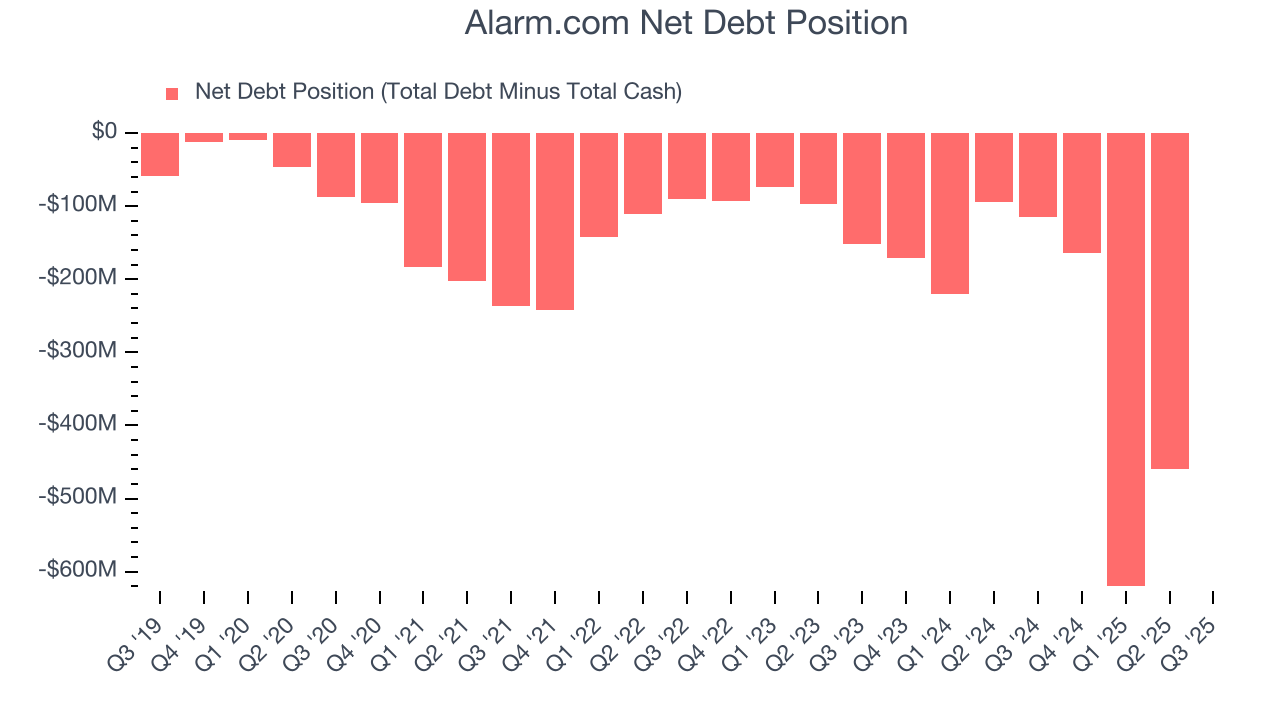

Alarm.com reported $1.07 billion of cash and $1.07 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $197.5 million of EBITDA over the last 12 months, we view Alarm.com’s 0.0× net-debt-to-EBITDA ratio as safe. We also see its $31.72 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Alarm.com’s Q3 Results

We were impressed by how significantly Alarm.com blew past analysts’ EBITDA expectations this quarter. We were also glad its full-year EPS guidance trumped Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock remained flat at $47.13 immediately following the results.

13. Is Now The Time To Buy Alarm.com?

Updated: January 21, 2026 at 9:43 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Alarm.com.

We see the value of companies addressing major business pain points, but in the case of Alarm.com, we’re out. For starters, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its efficient sales strategy allows it to target and onboard new users at scale, the downside is its expanding operating margin shows it’s becoming more efficient at building and selling its software. On top of that, its gross margins show its business model is much less lucrative than other companies.

Alarm.com’s price-to-sales ratio based on the next 12 months is 2.8x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $66.33 on the company (compared to the current share price of $49.28).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.