AerSale (ASLE)

We wouldn’t buy AerSale. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think AerSale Will Underperform

Providing a one-stop shop that integrates multiple services and product offerings, AerSale (NASDAQ:ASLE) delivers full-service support to mid-life commercial aircraft.

- Falling earnings per share over the last four years has some investors worried as stock prices ultimately follow EPS over the long term

- Increased cash burn over the last five years raises questions about the return timeline for its investments

- Sales were flat over the last two years, indicating it’s failed to expand this cycle

AerSale doesn’t fulfill our quality requirements. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than AerSale

High Quality

Investable

Underperform

Why There Are Better Opportunities Than AerSale

At $6.45 per share, AerSale trades at 10.8x forward P/E. This multiple is lower than most industrials companies, but for good reason.

It’s better to pay up for high-quality businesses with higher long-term earnings potential rather than to buy lower-quality stocks because they appear cheap. These challenged businesses often don’t re-rate, a phenomenon known as a “value trap”.

3. AerSale (ASLE) Research Report: Q4 CY2025 Update

Aerospace and defense company AerSale (NASDAQ:ASLE) missed Wall Street’s revenue expectations in Q4 CY2025, with sales falling 4% year on year to $90.94 million. Its non-GAAP profit of $0.16 per share was 17.9% below analysts’ consensus estimates.

AerSale (ASLE) Q4 CY2025 Highlights:

- Revenue: $90.94 million vs analyst estimates of $99.71 million (4% year-on-year decline, 8.8% miss)

- Adjusted EPS: $0.16 vs analyst expectations of $0.20 (17.9% miss)

- Adjusted EBITDA: $15.22 million vs analyst estimates of $16.53 million (16.7% margin, 7.9% miss)

- Operating Margin: 7.8%, up from 5.2% in the same quarter last year

- Free Cash Flow Margin: 10.8%, down from 34% in the same quarter last year

- Market Capitalization: $357.2 million

Company Overview

Providing a one-stop shop that integrates multiple services and product offerings, AerSale (NASDAQ:ASLE) delivers full-service support to mid-life commercial aircraft.

AerSale was founded in 2008 to provide fleet management and related services to the aviation sector. Since then, it has expanded into maintenance, repair, and the supply of components to customers. Some of this expansion was fueled through strategic acquisitions, such as the purchase of Aero Mechanical Industries in 2011, which broadened its capabilities in aircraft disassembly and MRO (Maintenance, Repair, and Overhaul) services.

Today, AerSale's core services encompass aircraft sales and leasing, aircraft and engine components, as well as comprehensive aftermarket support. Materials used in its components and aftermarket business are sourced from aircraft that have been decommissioned but that still have components that can be recycled and refurbished. AerSale's aircraft sales and leasing division caters to both commercial and military markets, offering these customers an alternative to big, lumpy capital expenditures on planes and jets.

The company's clientele includes airlines, aircraft operators, leasing companies, and military entities. The company's aircraft sales and leasing services attract commercial airlines seeking to expand or upgrade their fleet, while military entities benefit from AerSale's expertise in procuring and managing aircraft assets through contracts varying in duration. Airlines and MROs turn to AerSale for aftermarket support, including the delivery of replacement components and maintenance services.

AerSale's financial model encompasses revenue streams from aircraft sales and leasing, aftermarket services, and component products. The leasing portion and aftermarket sales of its business notably create recurring revenue streams, enhancing financial stability and predictability.

4. Aerospace

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

AerSale’s competitors include Park Aerospace (NYSE:PKE), Ducommun (NYSE:DCO), and Astronics (NASDAQ:ATRO)

5. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, AerSale’s sales grew at a solid 9.9% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. AerSale’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

We can dig further into the company’s revenue dynamics by analyzing its most important segments, Products and Services, which are 63.6% and 25.5% of revenue. Over the last two years, AerSale’s Products revenue was flat while its Services revenue averaged 9.8% year-on-year declines.

This quarter, AerSale missed Wall Street’s estimates and reported a rather uninspiring 4% year-on-year revenue decline, generating $90.94 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 20.1% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and indicates its newer products and services will catalyze better top-line performance.

6. Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

AerSale was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.2% was weak for an industrials business.

Analyzing the trend in its profitability, AerSale’s operating margin decreased by 11.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. AerSale’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, AerSale generated an operating margin profit margin of 7.8%, up 2.5 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

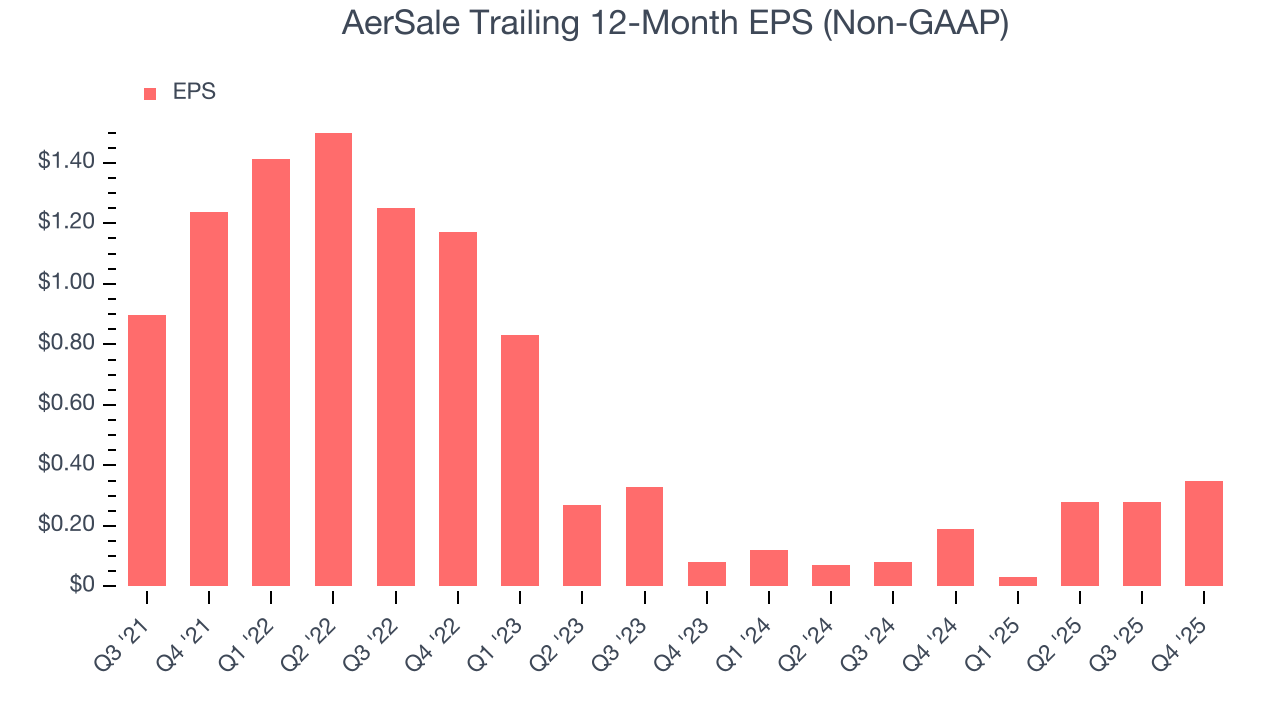

7. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

AerSale’s full-year EPS dropped 161%, or 27.1% annually, over the last four years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, AerSale’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

AerSale’s EPS grew at an astounding 109% compounded annual growth rate over the last two years, higher than its flat revenue. This tells us management responded to softer demand by adapting its cost structure.

Diving into the nuances of AerSale’s earnings can give us a better understanding of its performance. AerSale’s operating margin has expanded over the last two yearswhile its share count has shrunk 7.3%. Improving profitability and share buybacks are positive signs for shareholders as they juice EPS growth relative to revenue growth.

In Q4, AerSale reported adjusted EPS of $0.16, up from $0.09 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. Over the next 12 months, Wall Street expects AerSale’s full-year EPS of $0.35 to grow 84.3%.

8. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While AerSale posted positive free cash flow this quarter, the broader story hasn’t been so clean. AerSale’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 8.4%, meaning it lit $8.42 of cash on fire for every $100 in revenue.

Taking a step back, we can see that AerSale’s margin dropped by 31.4 percentage points during that time. Almost any movement in the wrong direction is undesirable because it is already burning cash. If the trend continues, it could signal it’s becoming a more capital-intensive business.

AerSale’s free cash flow clocked in at $9.78 million in Q4, equivalent to a 10.8% margin. The company’s cash profitability regressed as it was 23.3 percentage points lower than in the same quarter last year, but it’s still above its five-year average. We wouldn’t read too much into this quarter’s decline because capital expenditures can be seasonal and companies often stockpile inventory in anticipation of higher demand, leading to short-term swings. Long-term trends are more important.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

AerSale historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 6.2%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, AerSale’s ROIC has decreased significantly over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

AerSale reported $4.38 million of cash and $148.3 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $46.14 million of EBITDA over the last 12 months, we view AerSale’s 3.1× net-debt-to-EBITDA ratio as safe. We also see its $3.67 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from AerSale’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 4.2% to $7.00 immediately following the results.

12. Is Now The Time To Buy AerSale?

Updated: March 7, 2026 at 11:01 PM EST

Before deciding whether to buy AerSale or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

AerSale falls short of our quality standards. Although its revenue growth was solid over the last five years and is expected to accelerate over the next 12 months, its diminishing returns show management's prior bets haven't worked out. And while the company’s projected EPS for the next year implies the company’s fundamentals will improve, the downside is its declining EPS over the last four years makes it a less attractive asset to the public markets.

AerSale’s P/E ratio based on the next 12 months is 10.8x. While this valuation is reasonable, we don’t see a big opportunity at the moment. There are more exciting stocks to buy at the moment.

Wall Street analysts have a consensus one-year price target of $8 on the company (compared to the current share price of $6.45).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.