Barrett (BBSI)

Barrett piques our interest. Its rising free cash flow margin gives it more chips to play with.― StockStory Analyst Team

1. News

2. Summary

Why Barrett Is Interesting

Operating as a professional employer organization (PEO) that serves over 8,000 companies with more than 120,000 worksite employees, Barrett Business Services (NASDAQ:BBSI) provides management solutions that help small and mid-sized businesses handle human resources, payroll, workers' compensation, and other administrative functions.

- ROIC punches in at 54.7%, illustrating management’s expertise in identifying profitable investments

- Additional sales over the last five years increased its profitability as the 13.7% annual growth in its earnings per share outpaced its revenue

- On the flip side, its ability to fund investments or reward shareholders with increased buybacks or dividends is restricted by its weak free cash flow margin of 1.6% for the last five years

Barrett shows some promise. If you like the story, the valuation seems fair.

Why Is Now The Time To Buy Barrett?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Barrett?

Barrett’s stock price of $27.86 implies a valuation ratio of 14.9x forward P/E. This multiple is lower than most business services companies, and we think the valuation is reasonable for the revenue growth you get.

Now could be a good time to invest if you believe in the story.

3. Barrett (BBSI) Research Report: Q4 CY2025 Update

Business management solutions provider Barrett Business Services (NASDAQ:BBSI) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 5.3% year on year to $321.1 million. Its GAAP profit of $0.64 per share was in line with analysts’ consensus estimates.

Barrett (BBSI) Q4 CY2025 Highlights:

- Revenue: $321.1 million vs analyst estimates of $323.4 million (5.3% year-on-year growth, 0.7% miss)

- EPS (GAAP): $0.64 vs analyst estimates of $0.64 (in line)

- Adjusted EBITDA: $20.68 million vs analyst estimates of $24.47 million (6.4% margin, 15.5% miss)

- Operating Margin: 5.8%, in line with the same quarter last year

- Market Capitalization: $795.9 million

Company Overview

Operating as a professional employer organization (PEO) that serves over 8,000 companies with more than 120,000 worksite employees, Barrett Business Services (NASDAQ:BBSI) provides management solutions that help small and mid-sized businesses handle human resources, payroll, workers' compensation, and other administrative functions.

Barrett Business Services operates through a co-employment model, where it shares employer responsibilities with its clients while the client companies maintain control over their day-to-day operations and workforce decisions. This arrangement allows business owners to offload administrative burdens while maintaining authority over their core business functions.

The company delivers its services through a three-tiered approach. It begins with tactical alignment, establishing administrative processes and controls. The relationship then progresses to organizational development, focusing on process improvement and leadership training. Finally, BBSI provides strategic counsel aligned with the client's long-term business objectives.

A business owner might engage BBSI to handle payroll processing, provide workers' compensation coverage, manage employee benefits, and offer human resources guidance—allowing the owner to focus on growing their business rather than administrative paperwork. For example, a manufacturing company with 50 employees could partner with BBSI to implement safety protocols, manage compliance requirements, and provide HR support without needing to hire specialized staff in-house.

BBSI generates revenue primarily through its Professional Employer Organization (PEO) services, charging clients a percentage of payroll or a flat fee for its comprehensive management platform. The company also offers staffing services, including on-demand temporary workers, contract staffing, and direct placement services.

The company maintains a decentralized delivery model with business teams typically located within 50 miles of client companies. These teams include professionals with expertise in human resources, workplace safety, recruiting, and employee benefits who provide personalized service to local businesses across 68 markets throughout the United States.

4. Professional Staffing & HR Solutions

The Professional Staffing & HR Solutions subsector within Business Services is set to benefit from evolving workforce trends, including the rise of remote work and the gig economy. With companies casting a wider net to find talent due to remote work, the expertise of staffing and recruiting companies is even more valuable. For those who invest wisely, the use of predictive AI in recruitment and screening as well as automation in HR workflows can enhance efficiency and scalability. On the other hand, digitization means that talent discovery is less of a manual process, opening the door for tech-first platforms. Additionally, regulatory scrutiny around data privacy in HR is evolving and may require companies in this sector to change their go-to-market strategies over time.

Barrett Business Services competes with professional employer organizations like Insperity (NYSE:NSP) and TriNet Group (NYSE:TNET), staffing services companies such as Robert Half International (NYSE:RHI) and ManpowerGroup (NYSE:MAN), and payroll processing providers including Automatic Data Processing (NASDAQ:ADP) and Paychex (NASDAQ:PAYX).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $1.24 billion in revenue over the past 12 months, Barrett is a mid-sized business services company, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

As you can see below, Barrett grew its sales at a solid 7.1% compounded annual growth rate over the last five years. This is an encouraging starting point for our analysis because it shows Barrett’s demand was higher than many business services companies.

Long-term growth is the most important, but within business services, a half-decade historical view may miss new innovations or demand cycles. Barrett’s annualized revenue growth of 7.7% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, Barrett’s revenue grew by 5.3% year on year to $321.1 million, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.8% over the next 12 months, similar to its two-year rate. This projection is healthy and implies the market sees success for its products and services.

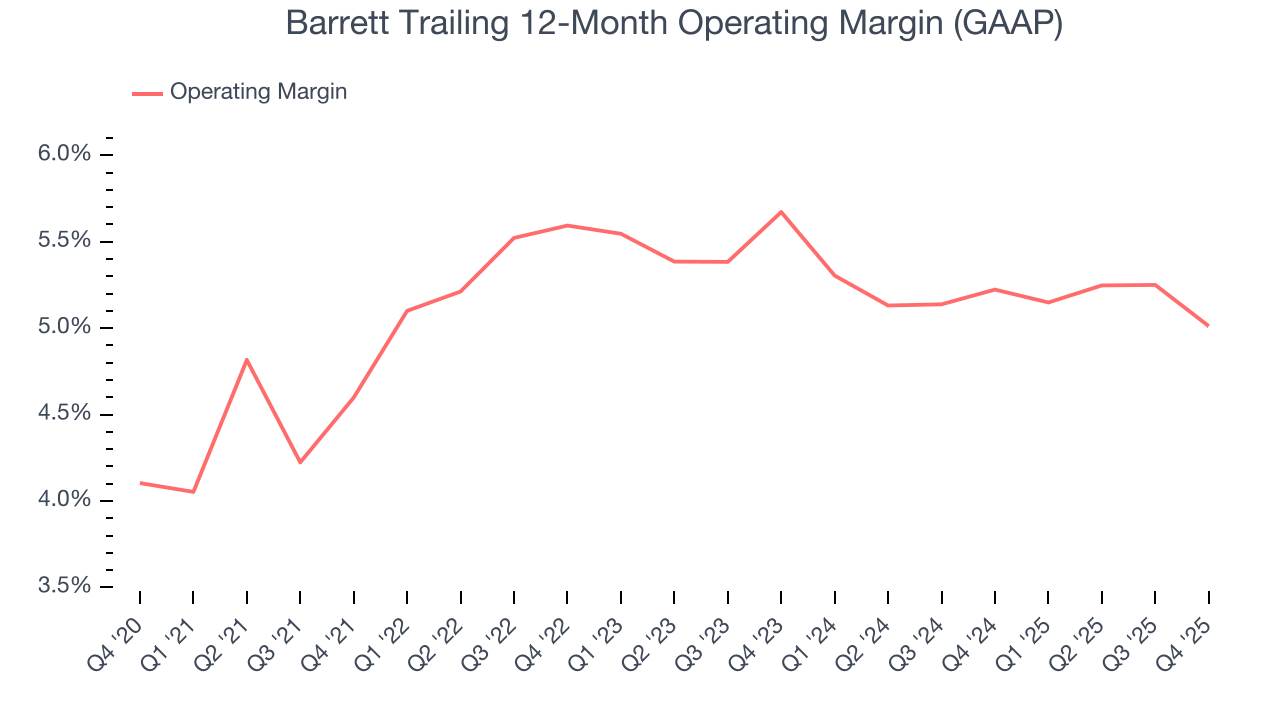

6. Operating Margin

Barrett’s operating margin might fluctuated slightly over the last 12 months but has generally stayed the same, averaging 5.2% over the last five years. This profitability was lousy for a business services business and caused by its suboptimal cost structure.

Looking at the trend in its profitability, Barrett’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Barrett generated an operating margin profit margin of 5.8%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

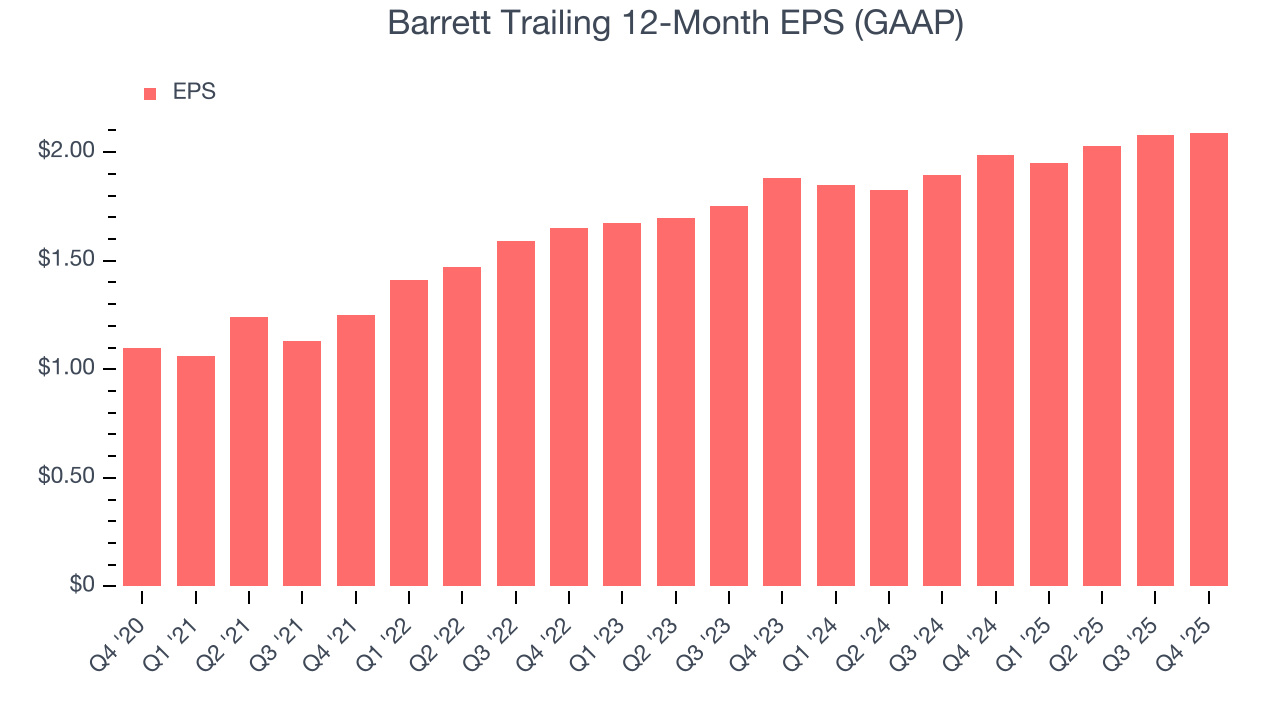

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Barrett’s EPS grew at a spectacular 13.7% compounded annual growth rate over the last five years, higher than its 7.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Barrett, its two-year annual EPS growth of 5.4% was lower than its five-year trend. This wasn’t great, but at least the company was successful in other measures of financial health.

In Q4, Barrett reported EPS of $0.64, up from $0.63 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Barrett’s full-year EPS of $2.09 to grow 14.8%.

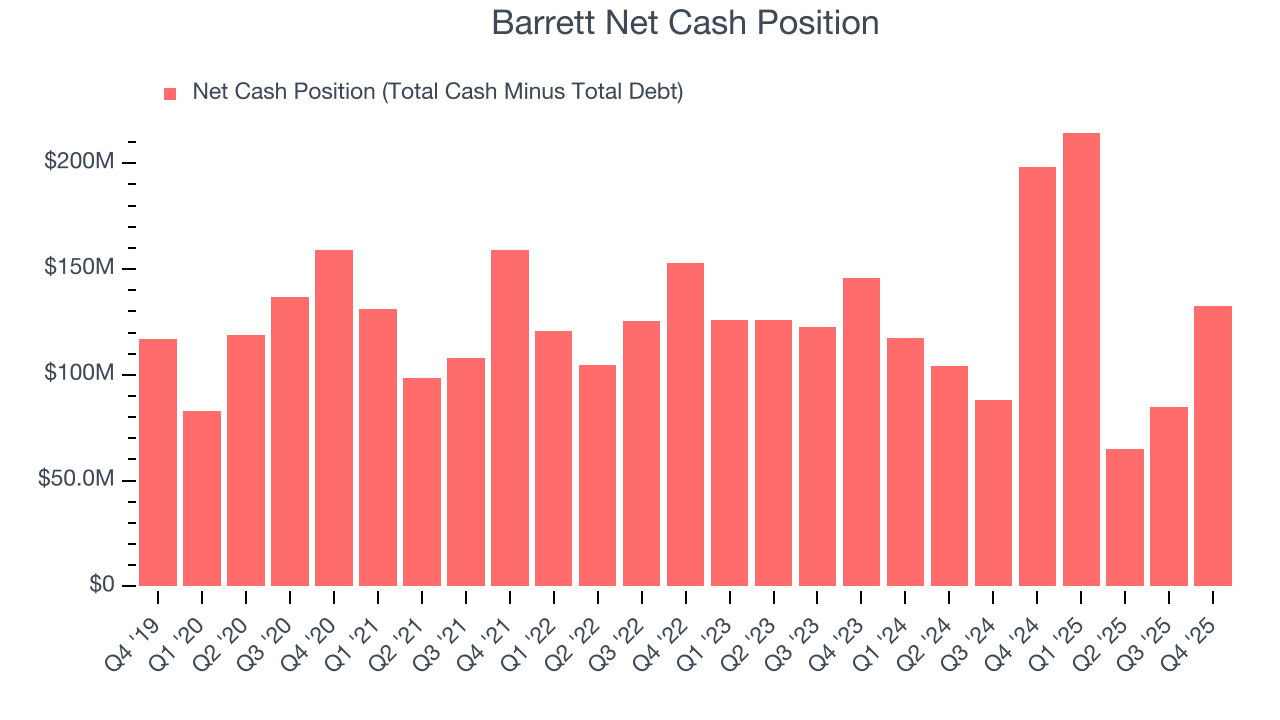

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Barrett broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Taking a step back, an encouraging sign is that Barrett’s margin expanded by 6.8 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability was flat.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Barrett’s five-year average ROIC was 54.7%, placing it among the best business services companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Barrett’s ROIC has decreased significantly over the last few years. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

10. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

Barrett is a profitable, well-capitalized company with $157.2 million of cash and $24.45 million of debt on its balance sheet. This $132.7 million net cash position is 19% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Barrett’s Q4 Results

We struggled to find many positives in these results. Overall, this was a softer quarter. The stock traded down 4.4% to $30.11 immediately following the results.

12. Is Now The Time To Buy Barrett?

Updated: March 3, 2026 at 11:45 PM EST

When considering an investment in Barrett, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

There are some positives when it comes to Barrett’s fundamentals. To kick things off, its revenue growth was solid over the last five years. And while its diminishing returns show management's recent bets still have yet to bear fruit, its rising cash profitability gives it more optionality. On top of that, its stellar ROIC suggests it has been a well-run company historically.

Barrett’s P/E ratio based on the next 12 months is 14.9x. Looking at the business services landscape right now, Barrett trades at a pretty interesting price. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $42.25 on the company (compared to the current share price of $27.94), implying they see 51.2% upside in buying Barrett in the short term.