Pangaea (PANL)

Pangaea doesn’t excite us. It not only barely produces cash but also has been less efficient lately, as seen by its falling margins.― StockStory Analyst Team

1. News

2. Summary

Why We Think Pangaea Will Underperform

Established in 1996, Pangaea Logistics (NASDAQ:PANL) specializes in global logistics and transportation services, focusing on the shipment of dry bulk cargoes.

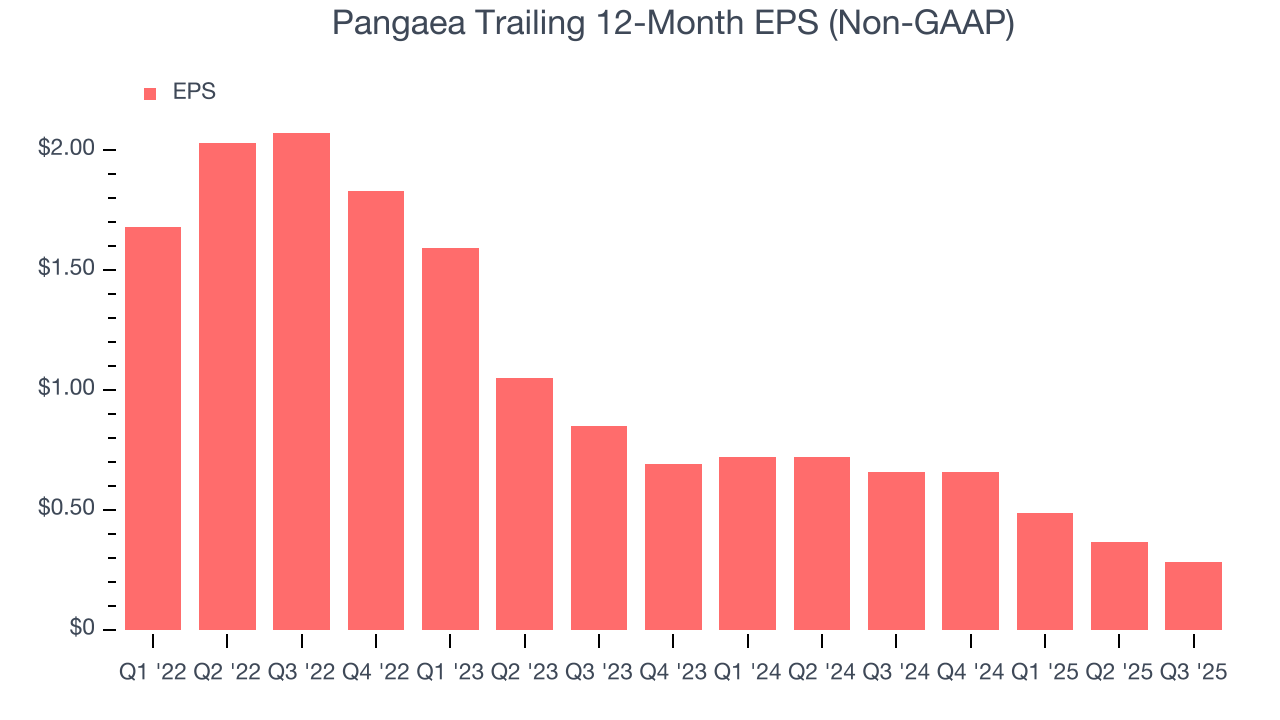

- Earnings per share have dipped by 33.6% annually over the past four years, which is concerning because stock prices follow EPS over the long term

- Lacking free cash flow limits its freedom to invest in growth initiatives, execute share buybacks, or pay dividends

- On the bright side, its exciting sales outlook for the upcoming 12 months calls for 27.3% growth, an acceleration from its two-year trend

Pangaea’s quality is insufficient. We believe there are better opportunities elsewhere.

Why There Are Better Opportunities Than Pangaea

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Pangaea

At $9.03 per share, Pangaea trades at 8.5x forward P/E. This certainly seems like a cheap stock, but we think there are valid reasons why it trades this way.

We’d rather pay up for companies with elite fundamentals than get a bargain on weak ones. Cheap stocks can be value traps, and as their performance deteriorates, they will stay cheap or get even cheaper.

3. Pangaea (PANL) Research Report: Q3 CY2025 Update

Pangaea Logistics (NASDAQ:PANL) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 10.2% year on year to $168.7 million. Its non-GAAP profit of $0.17 per share was significantly above analysts’ consensus estimates.

Pangaea (PANL) Q3 CY2025 Highlights:

- Revenue: $168.7 million vs analyst estimates of $159.3 million (10.2% year-on-year growth, 5.9% beat)

- Adjusted EPS: $0.17 vs analyst estimates of $0.03 (significant beat)

- Adjusted EBITDA: $28.9 million vs analyst estimates of $21.57 million (17.1% margin, 33.9% beat)

- Operating Margin: 10%, in line with the same quarter last year

- Free Cash Flow was $24.4 million, up from -$20.1 million in the same quarter last year

- Market Capitalization: $324.9 million

Company Overview

Established in 1996, Pangaea Logistics (NASDAQ:PANL) specializes in global logistics and transportation services, focusing on the shipment of dry bulk cargoes.

Pangaea Logistics Solutions was founded to optimize the supply chain for industries reliant on bulk commodities. Specifically, the company sought to improve the efficiency of transporting materials such as grains, minerals, and other bulk goods across global shipping routes.

Pangaea Logistics operates a fleet of vessels suited for a variety of dry bulk cargoes. The company specializes in logistics solutions that manage maritime shipping for commodities like nickel ore from Indonesia, bauxite from the Caribbean, and ice-class trades in the Arctic region. Additionally, subsidiary Nordic Bulk Carriers allows Pangaea to navigate polar and harsh environments, offering services that differentiate them within the shipping industry.

The company’s revenue is primarily derived from long-term charter agreements and spot market contracts, allowing flexibility in adapting to changing market conditions. The long-term nature of charter agreements allow for a predictable revenue stream for Pangea, providing some security. Pangaea sells its shipping services to major industrial and commodities companies, utilizing direct sales and broker networks.

4. Marine Transportation

The growth of e-commerce and global trade continues to drive demand for shipping services, presenting opportunities for marine transportation companies. While ocean freight is more fuel efficient and therefore cheaper than its air and ground counterparts, it results in slower delivery times, presenting a trade off. To improve transit speeds, the industry continues to invest in digitization to optimize fleets and routes. However, marine transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins. Geopolitical tensions can also affect access to trade routes, and if certain countries are banned from using passageways like the Panama Canal, costs can spiral out of control.

Competitors in the logistics and transportation industry include Genco Shipping & Trading (NYSE:GNK), Daseke (NASDAQ:DSKE), and Star Bulk Carriers (NASDAQ:SBLK)

5. Revenue Growth

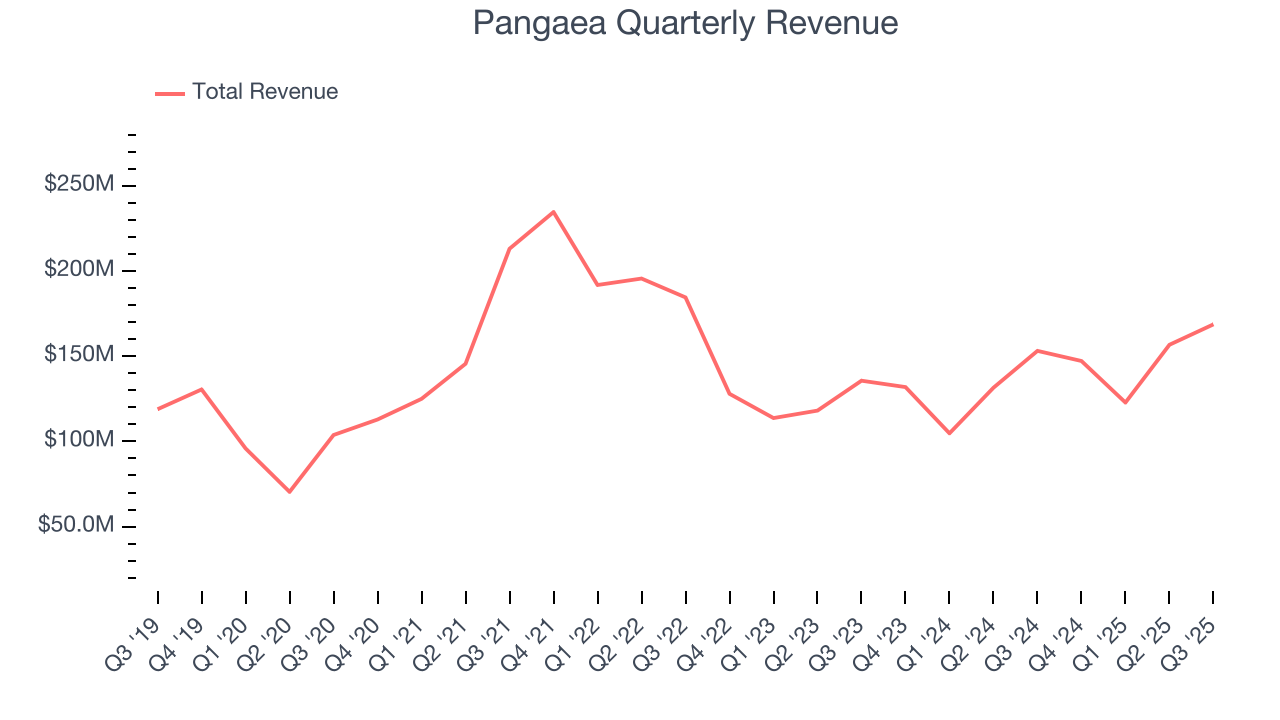

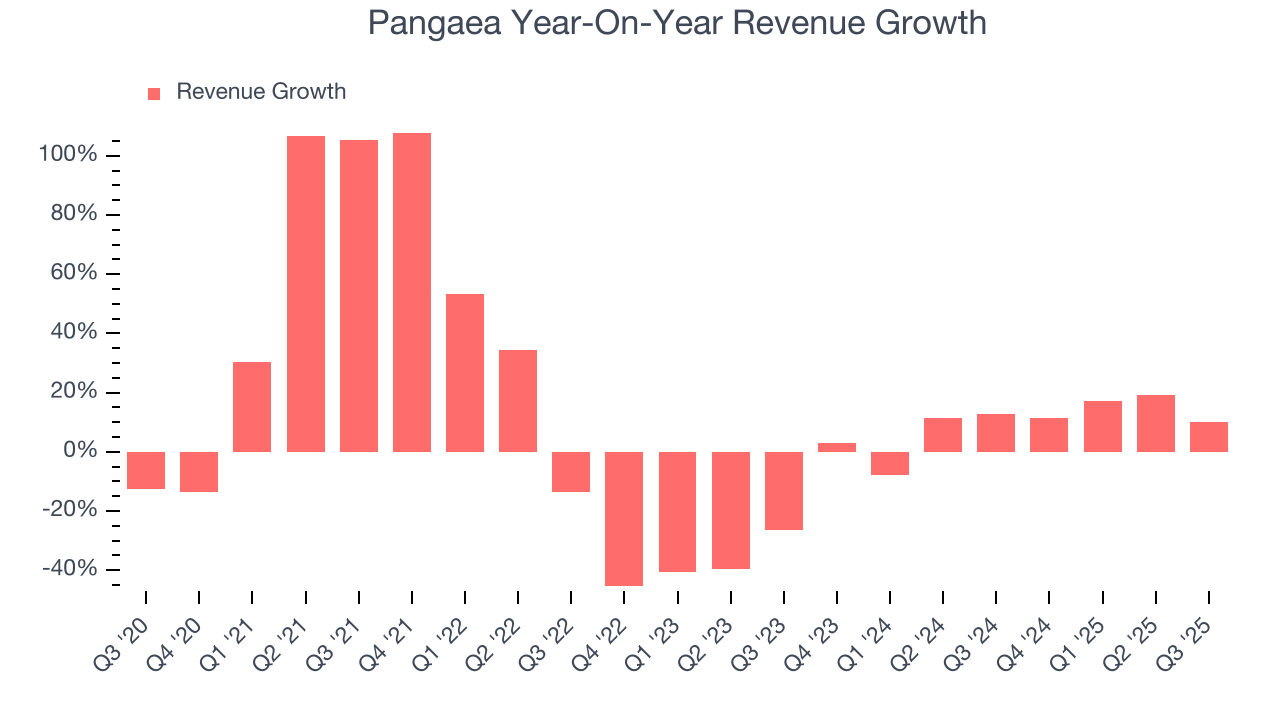

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Pangaea grew its sales at a decent 8.2% compounded annual growth rate. Its growth was slightly above the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Pangaea’s annualized revenue growth of 9.6% over the last two years is above its five-year trend, suggesting its demand recently accelerated. Pangaea recent performance stands out, especially when considering many similar Marine Transportation businesses faced declining sales because of cyclical headwinds.

This quarter, Pangaea reported year-on-year revenue growth of 10.2%, and its $168.7 million of revenue exceeded Wall Street’s estimates by 5.9%.

Looking ahead, sell-side analysts expect revenue to grow 14% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and suggests its newer products and services will fuel better top-line performance.

6. Gross Margin & Pricing Power

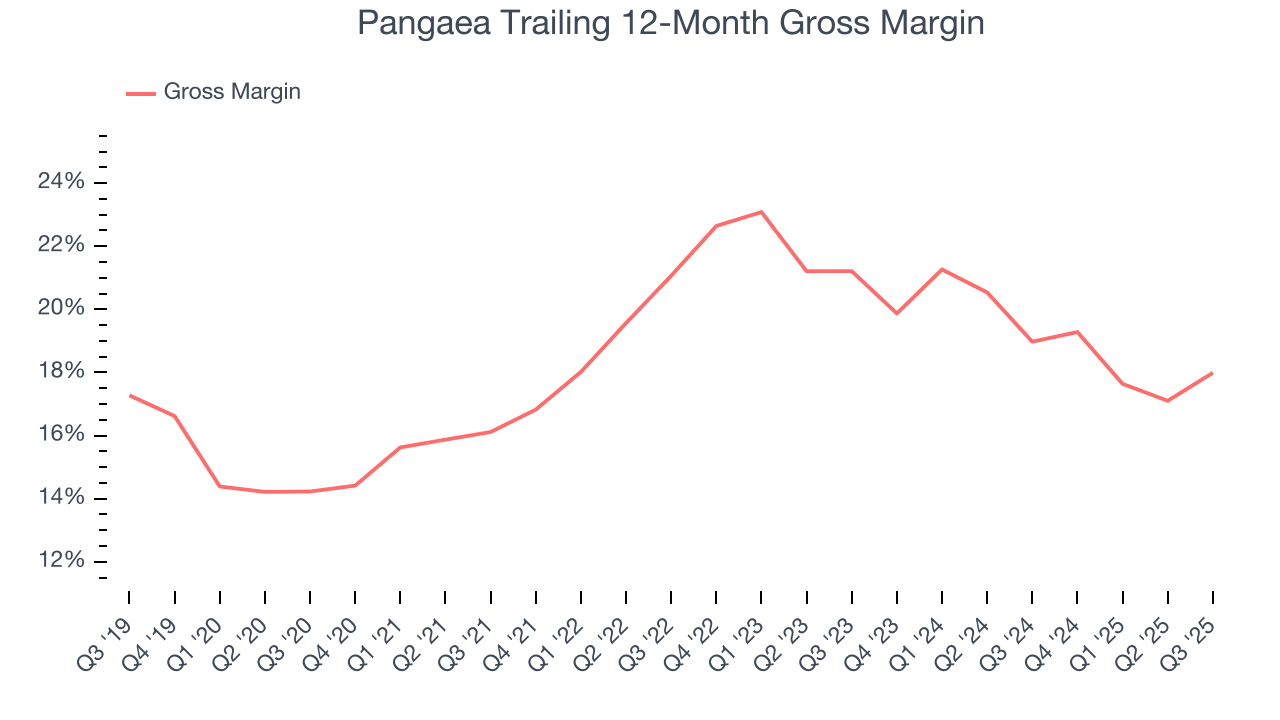

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

Pangaea has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 19.1% gross margin over the last five years. Said differently, Pangaea had to pay a chunky $80.86 to its suppliers for every $100 in revenue.

In Q3, Pangaea produced a 21.8% gross profit margin, up 3 percentage points year on year. On a wider time horizon, the company’s full-year margin has remained steady over the past four quarters, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

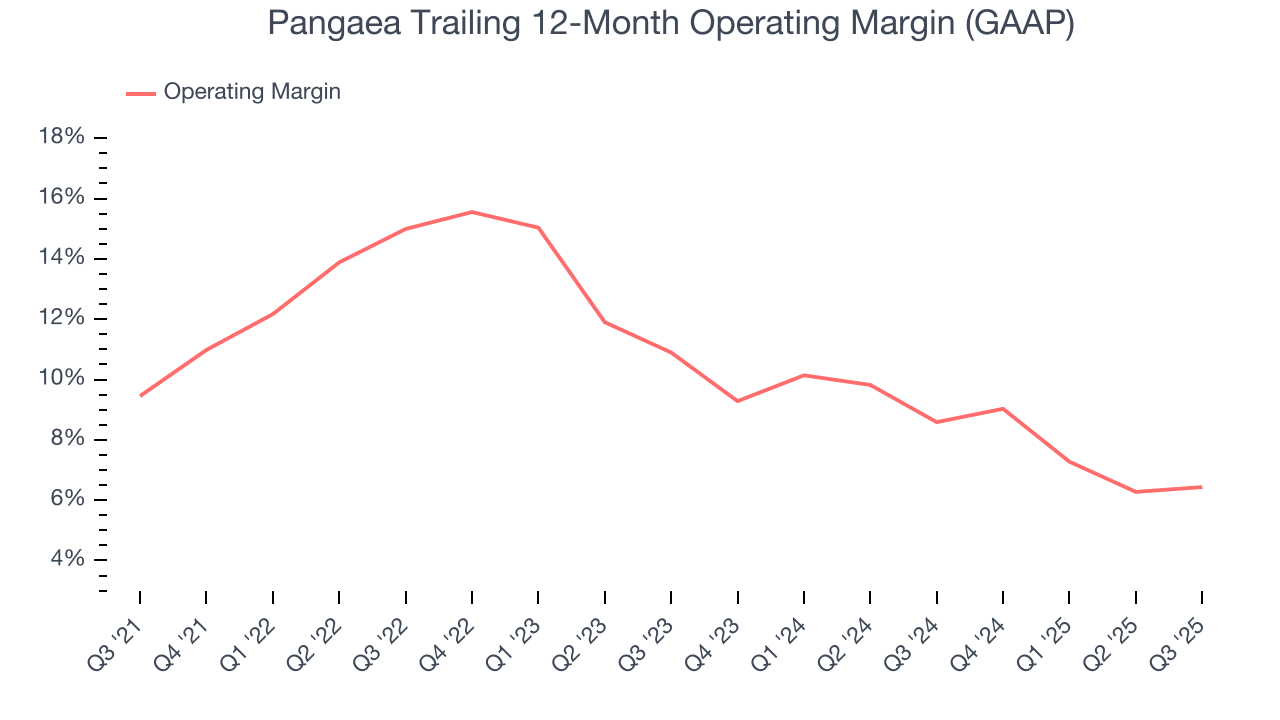

7. Operating Margin

Pangaea has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.4%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Looking at the trend in its profitability, Pangaea’s operating margin decreased by 3 percentage points over the last five years. Many Marine Transportation companies also saw their margins fall (along with revenue, as mentioned above) because the cycle turned in the wrong direction. We hope Pangaea can emerge from this a stronger company, as the silver lining of a downturn is that market share can be won and efficiencies found.

This quarter, Pangaea generated an operating margin profit margin of 10%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Pangaea’s full-year EPS dropped 218%, or 33.6% annually, over the last four years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, Pangaea’s low margin of safety could leave its stock price susceptible to large downswings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Pangaea, its EPS declined by 42.6% annually over the last two years while its revenue grew by 9.6%. This tells us the company became less profitable on a per-share basis as it expanded.

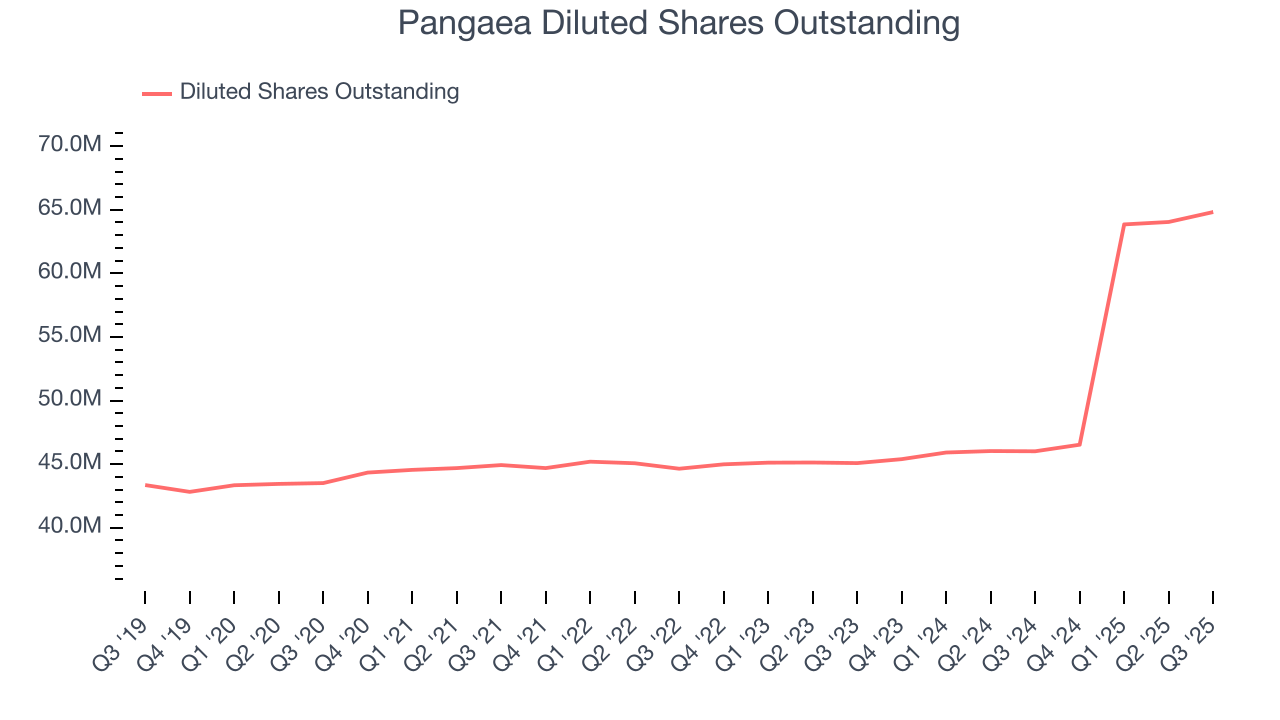

Diving into the nuances of Pangaea’s earnings can give us a better understanding of its performance. We mentioned earlier that Pangaea’s operating margin was flat this quarter, but a two-year view shows its margin has declinedwhile its share count has grown 43.8%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q3, Pangaea reported adjusted EPS of $0.17, down from $0.25 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

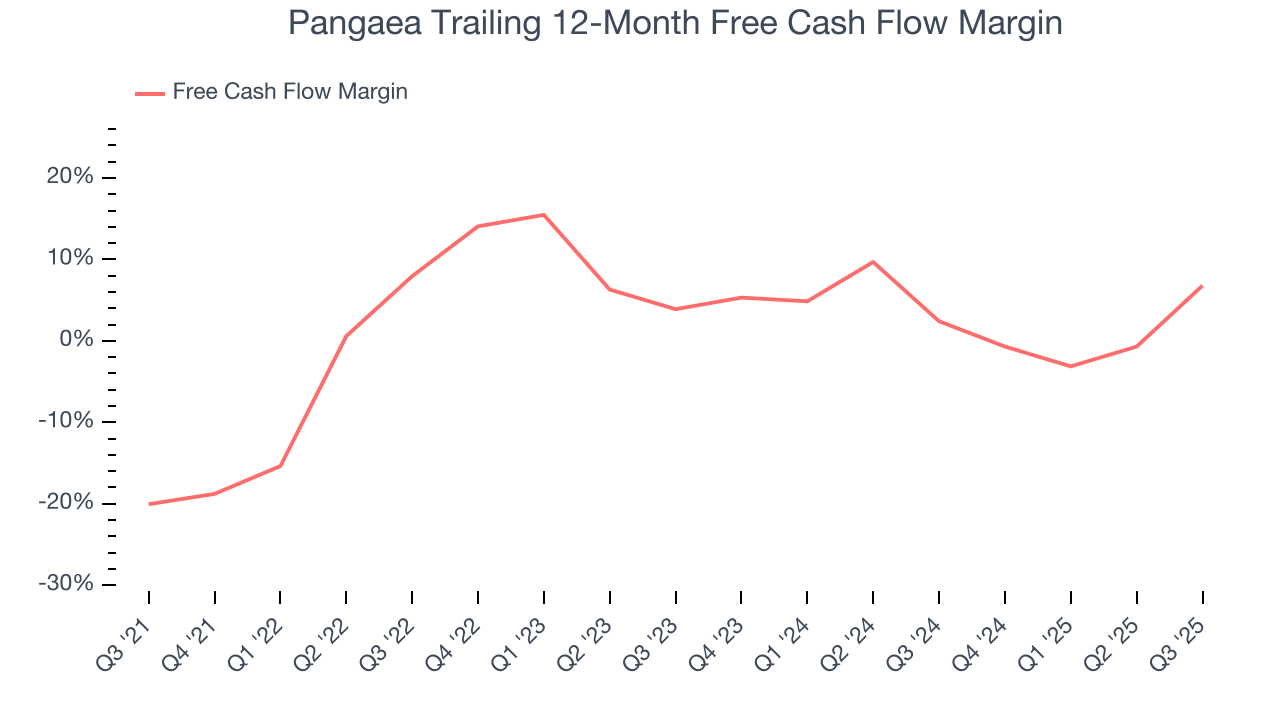

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Pangaea broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders. The divergence from its good operating margin stems from its capital-intensive business model, which requires Pangaea to make large cash investments in working capital and capital expenditures.

Taking a step back, an encouraging sign is that Pangaea’s margin expanded by 26.8 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

Pangaea’s free cash flow clocked in at $24.4 million in Q3, equivalent to a 14.5% margin. Its cash flow turned positive after being negative in the same quarter last year, building on its favorable historical trend.

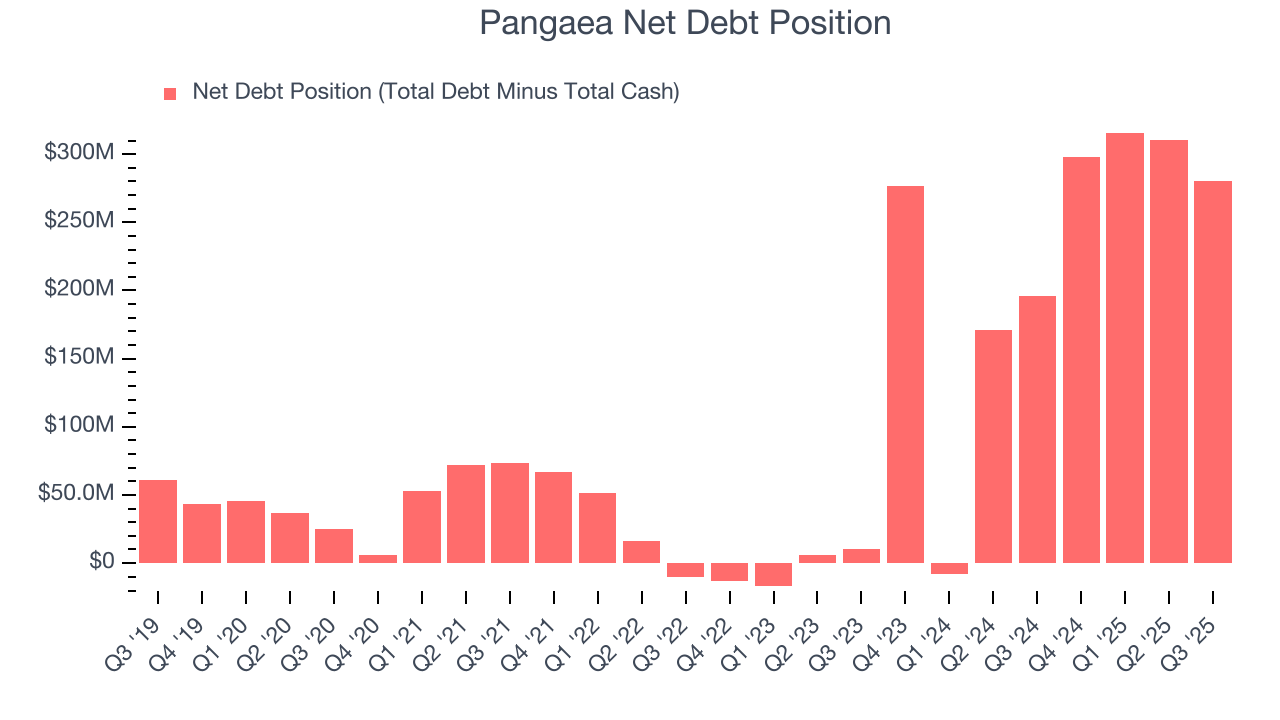

10. Balance Sheet Assessment

Pangaea reported $94.02 million of cash and $374 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $82.2 million of EBITDA over the last 12 months, we view Pangaea’s 3.4× net-debt-to-EBITDA ratio as safe. We also see its $9.58 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Pangaea’s Q3 Results

It was good to see Pangaea beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 4.9% to $5.16 immediately after reporting.

12. Is Now The Time To Buy Pangaea?

Updated: February 12, 2026 at 10:22 PM EST

Before making an investment decision, investors should account for Pangaea’s business fundamentals and valuation in addition to what happened in the latest quarter.

Pangaea isn’t a terrible business, but it doesn’t pass our quality test. Although its revenue growth was decent over the last five years and is expected to accelerate over the next 12 months, its declining EPS over the last four years makes it a less attractive asset to the public markets. And while the company’s rising cash profitability gives it more optionality, the downside is its low free cash flow margins give it little breathing room.

Pangaea’s P/E ratio based on the next 12 months is 8.7x. While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $10.42 on the company (compared to the current share price of $8.45).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.