AMN Healthcare Services (AMN)

We wouldn’t buy AMN Healthcare Services. Its poor sales growth and falling returns on capital suggest its growth opportunities are shrinking.― StockStory Analyst Team

1. News

2. Summary

Why We Think AMN Healthcare Services Will Underperform

With a network of thousands of healthcare professionals ranging from nurses to physicians to executives, AMN Healthcare (NYSE:AMN) provides healthcare workforce solutions including temporary staffing, permanent placement, and technology platforms for hospitals and healthcare facilities across the United States.

- Customers postponed purchases of its products and services this cycle as its revenue declined by 18.6% annually over the last two years

- Falling earnings per share over the last five years has some investors worried as stock prices ultimately follow EPS over the long term

- Projected sales decline of 3.3% over the next 12 months indicates demand will continue deteriorating

AMN Healthcare Services’s quality isn’t up to par. We’re looking for better stocks elsewhere.

Why There Are Better Opportunities Than AMN Healthcare Services

High Quality

Investable

Underperform

Why There Are Better Opportunities Than AMN Healthcare Services

AMN Healthcare Services’s stock price of $19.02 implies a valuation ratio of 26.8x forward P/E. This multiple is higher than most healthcare companies, and we think it’s quite expensive for the weaker revenue growth you get.

We’d rather invest in similarly-priced but higher-quality companies with more reliable earnings growth.

3. AMN Healthcare Services (AMN) Research Report: Q3 CY2025 Update

Healthcare staffing company AMN Healthcare Services (NYSE:AMN) reported Q3 CY2025 results exceeding the market’s revenue expectations, but sales fell by 7.7% year on year to $634.5 million. On top of that, next quarter’s revenue guidance ($722.5 million at the midpoint) was surprisingly good and 16.4% above what analysts were expecting. Its non-GAAP profit of $0.39 per share was 95.2% above analysts’ consensus estimates.

AMN Healthcare Services (AMN) Q3 CY2025 Highlights:

- Revenue: $634.5 million vs analyst estimates of $618 million (7.7% year-on-year decline, 2.7% beat)

- Adjusted EPS: $0.39 vs analyst estimates of $0.20 (95.2% beat)

- Adjusted EBITDA: $57.51 million vs analyst estimates of $48.86 million (9.1% margin, 17.7% beat)

- Revenue Guidance for Q4 CY2025 is $722.5 million at the midpoint, above analyst estimates of $620.6 million

- Operating Margin: 7.5%, up from 3.2% in the same quarter last year

- Free Cash Flow Margin: 3.6%, down from 6.9% in the same quarter last year

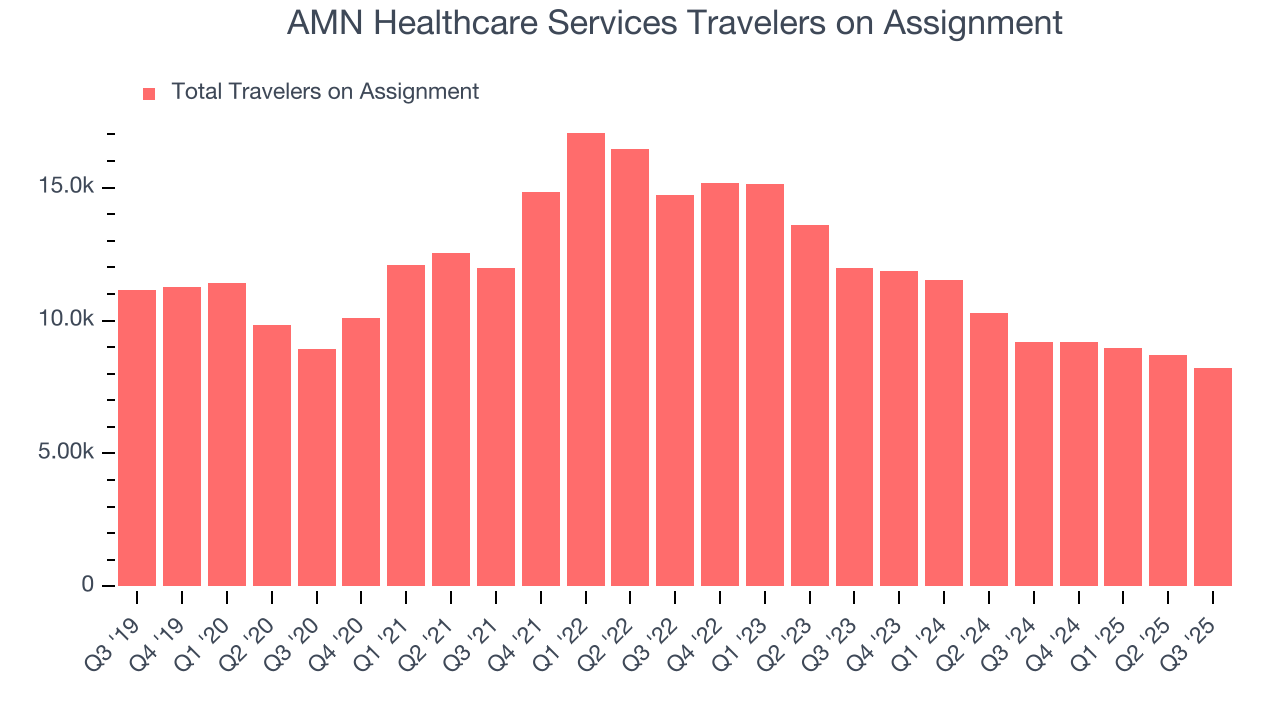

- Sales Volumes fell 10.6% year on year (-23.5% in the same quarter last year)

- Market Capitalization: $790.6 million

Company Overview

With a network of thousands of healthcare professionals ranging from nurses to physicians to executives, AMN Healthcare (NYSE:AMN) provides healthcare workforce solutions including temporary staffing, permanent placement, and technology platforms for hospitals and healthcare facilities across the United States.

AMN Healthcare operates through three main segments: nurse and allied solutions, physician and leadership solutions, and technology and workforce solutions. The company serves as a crucial intermediary between healthcare professionals and the facilities that need them, helping to address staffing shortages and workforce challenges in the healthcare industry.

In its nurse and allied solutions segment, AMN offers travel nursing assignments (typically 13 weeks), international nurse recruitment, crisis staffing for emergencies, and local staffing services. Allied health professionals placed by AMN include physical therapists, respiratory therapists, medical technologists, and pharmacists.

The physician and leadership solutions segment provides locum tenens (temporary physician) staffing, permanent physician recruitment, and interim leadership for healthcare organizations needing executives or clinical leaders on a temporary basis. This allows facilities to maintain operations during leadership transitions or address unexpected vacancies.

Through its technology and workforce solutions segment, AMN offers managed services programs (MSPs) where it oversees a client's entire contingent staffing process. The company's vendor management systems (VMS) help healthcare organizations track and manage their staffing needs efficiently. AMN also provides language interpretation services through video and phone platforms, helping healthcare providers communicate with patients who speak different languages.

AMN generates revenue by charging healthcare facilities for its staffing and workforce solutions while paying the healthcare professionals it places. The company typically earns the difference between what clients pay for services and what AMN pays to the healthcare professionals, creating a margin on each placement. For technology solutions, AMN often uses a subscription or service-fee model.

4. Specialized Medical & Nursing Services

The skilled nursing services industry provides specialized care for patients requiring medical or rehabilitative support after hospital stays or for chronic conditions. These companies benefit from stable demand driven by an aging population and recurring revenue from Medicare, Medicaid, and private insurance. However, the industry faces challenges such as thin margins due to high labor costs and stringent regulatory requirements. Looking ahead, the industry is supported by tailwinds from an aging population, which means higher chronic disease prevalence. Advances in medical technology, including using AI to better predict, diagnose, and treat illnesses, may reduce hospital readmissions and improve outcomes. However, headwinds such as labor shortages, wage inflation, and potential government reimbursement cuts pose challenges. Adapting to value-based care models may further squeeze margins by requiring investments in training, technology, and compliance.

AMN Healthcare's main competitors include Cross Country Healthcare (NASDAQ: CCRN), CHG Healthcare Services, Aya Healthcare, HealthTrust Workforce Solutions, and Ingenovis Health. In the language services segment, it competes with LanguageLine Solutions.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $2.72 billion in revenue over the past 12 months, AMN Healthcare Services has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

6. Revenue Growth

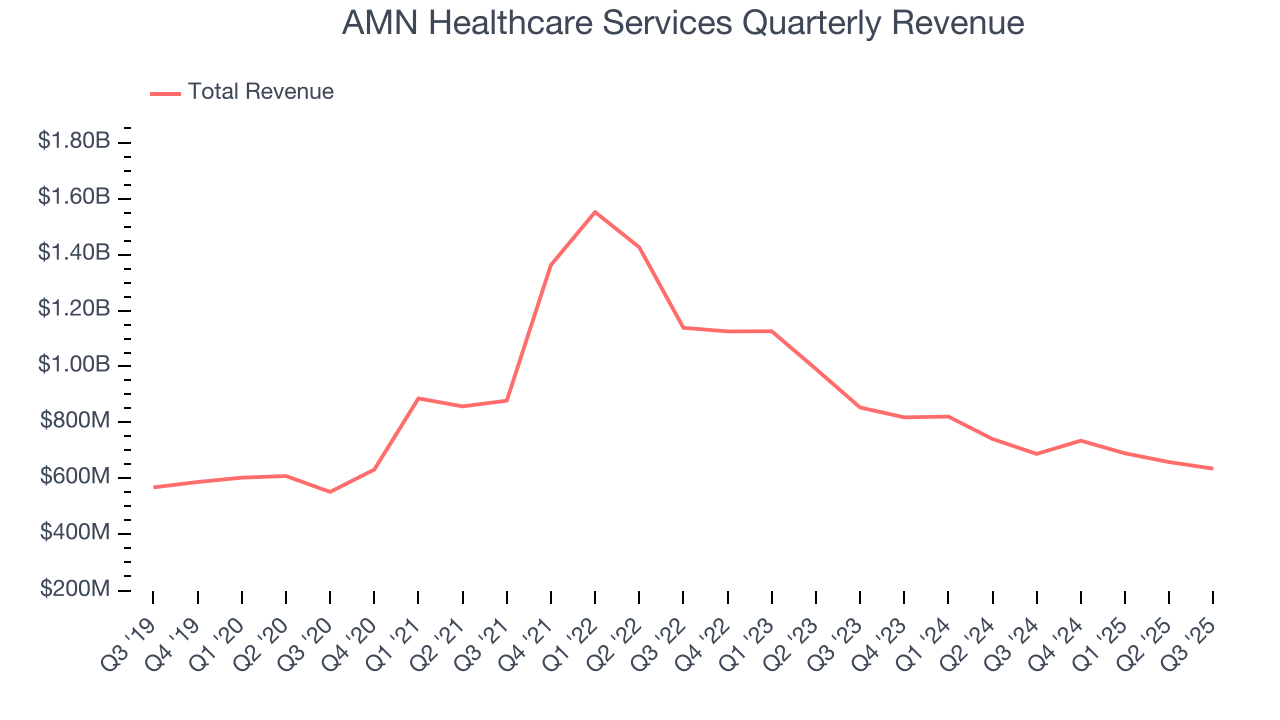

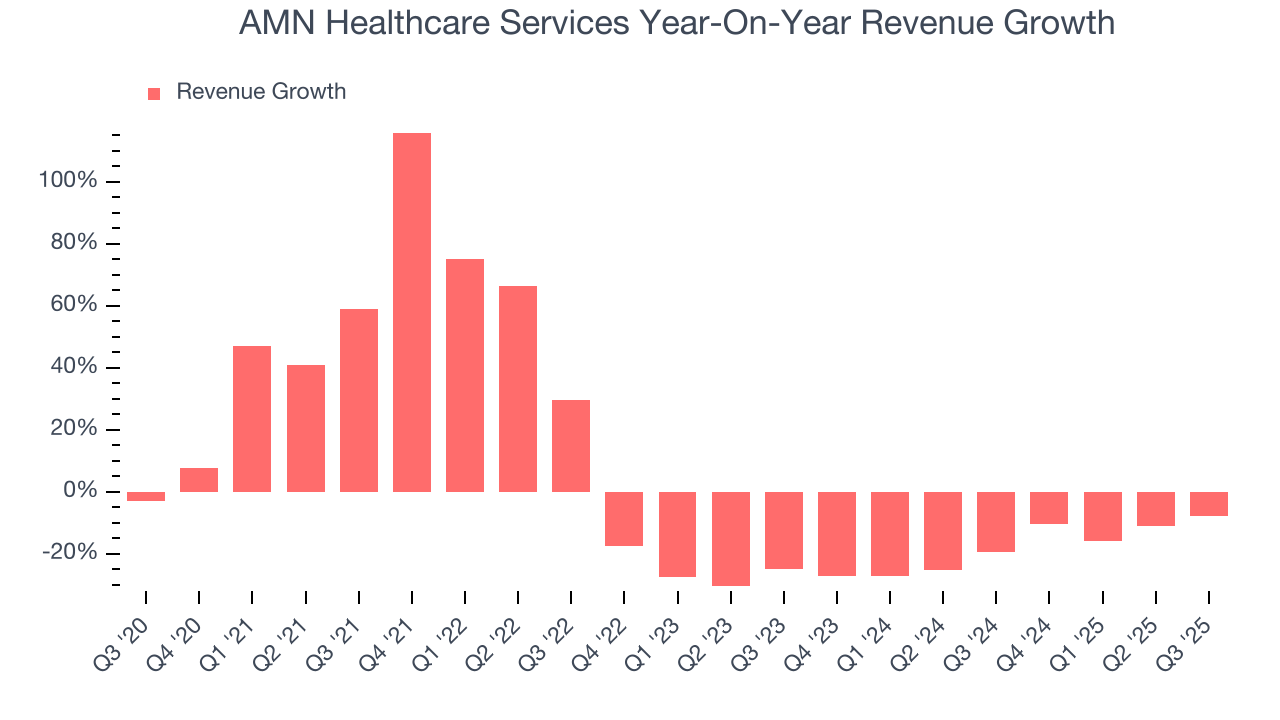

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, AMN Healthcare Services grew its sales at a tepid 2.9% compounded annual growth rate. This fell short of our benchmarks and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. AMN Healthcare Services’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 18.6% annually.

We can better understand the company’s revenue dynamics by analyzing its number of travelers on assignment, which reached 8,203 in the latest quarter. Over the last two years, AMN Healthcare Services’s travelers on assignment averaged 20.5% year-on-year declines. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, AMN Healthcare Services’s revenue fell by 7.7% year on year to $634.5 million but beat Wall Street’s estimates by 2.7%. Company management is currently guiding for a 1.7% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 7.3% over the next 12 months. Although this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

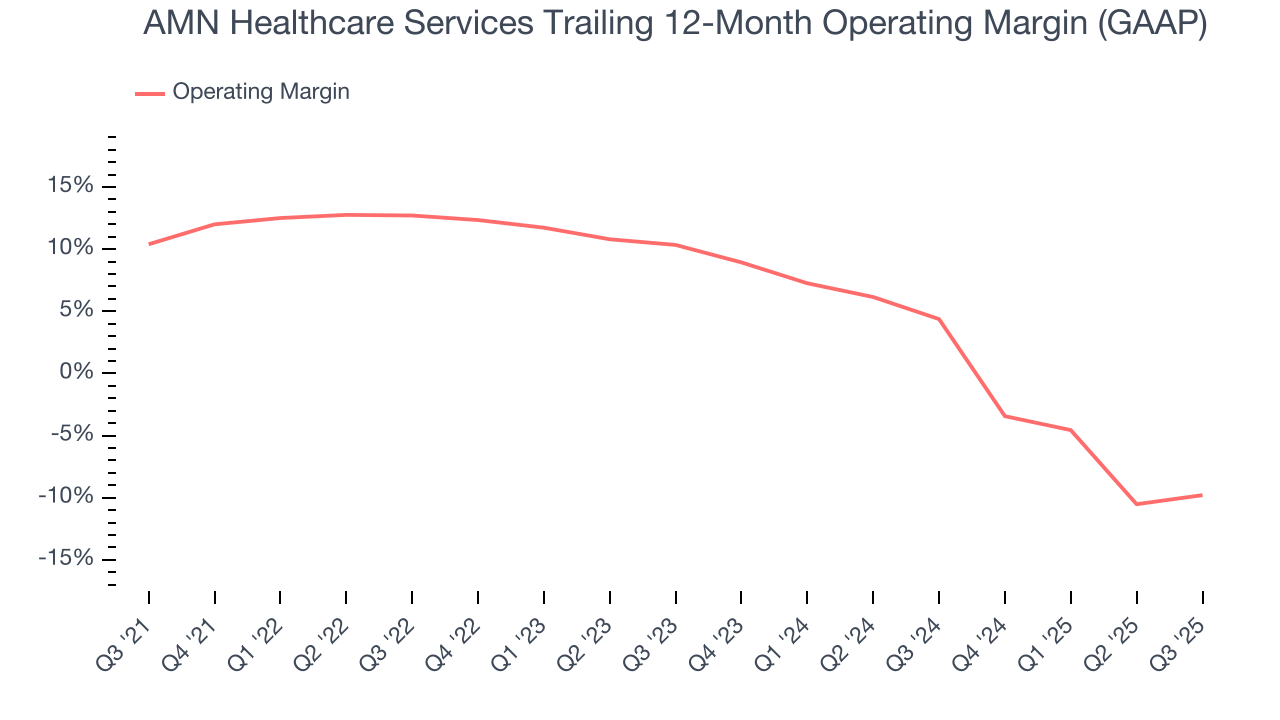

AMN Healthcare Services was profitable over the last five years but held back by its large cost base. Its average operating margin of 7.1% was weak for a healthcare business.

Looking at the trend in its profitability, AMN Healthcare Services’s operating margin decreased by 20.2 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 20.1 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, AMN Healthcare Services generated an operating margin profit margin of 7.5%, up 4.3 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

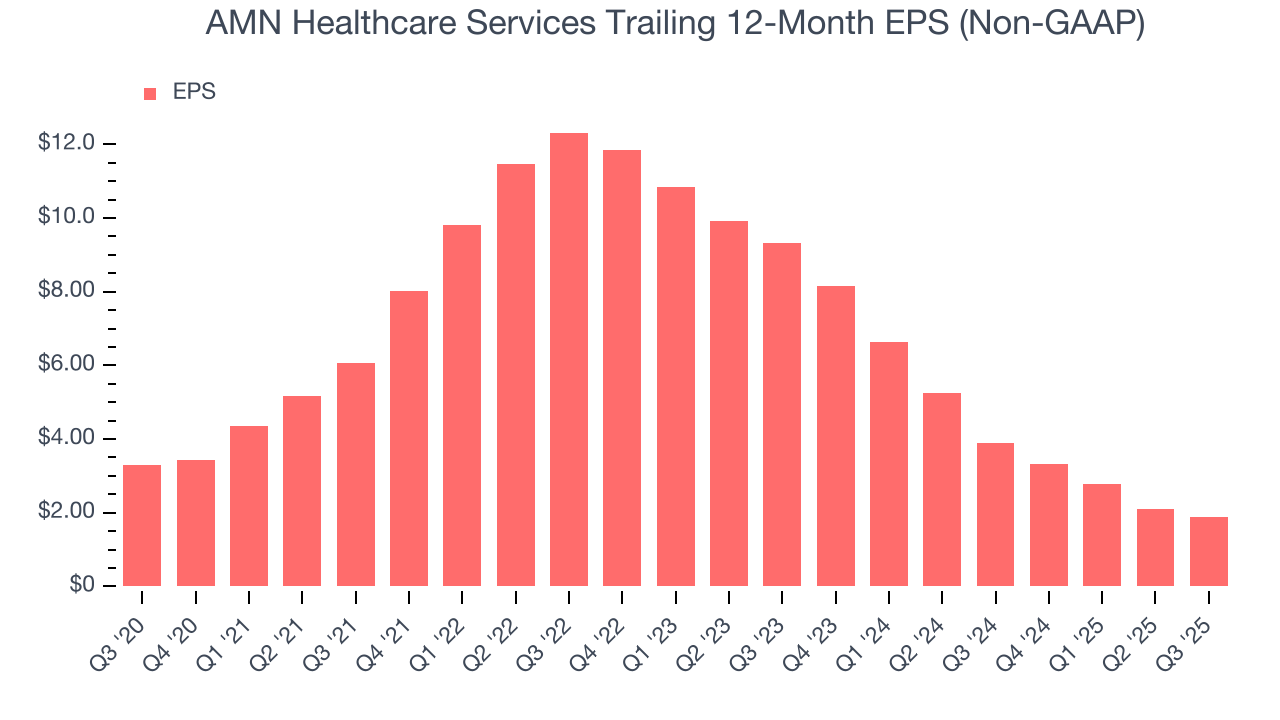

Sadly for AMN Healthcare Services, its EPS declined by 10.5% annually over the last five years while its revenue grew by 2.9%. This tells us the company became less profitable on a per-share basis as it expanded due to non-fundamental factors such as interest expenses and taxes.

We can take a deeper look into AMN Healthcare Services’s earnings to better understand the drivers of its performance. As we mentioned earlier, AMN Healthcare Services’s operating margin expanded this quarter but declined by 20.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, AMN Healthcare Services reported adjusted EPS of $0.39, down from $0.61 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects AMN Healthcare Services’s full-year EPS of $1.89 to shrink by 49.7%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

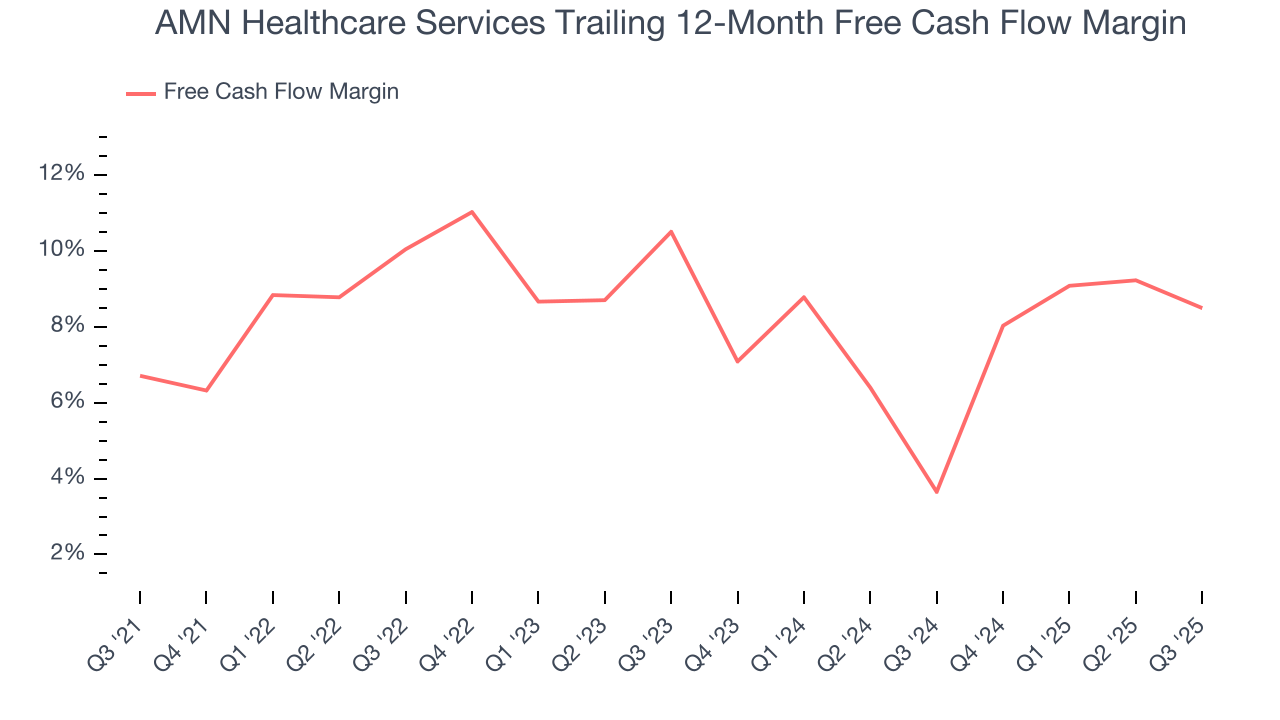

AMN Healthcare Services has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.3% over the last five years, slightly better than the broader healthcare sector.

Taking a step back, we can see that AMN Healthcare Services’s margin expanded by 1.8 percentage points during that time. This shows the company is heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

AMN Healthcare Services’s free cash flow clocked in at $22.67 million in Q3, equivalent to a 3.6% margin. The company’s cash profitability regressed as it was 3.3 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

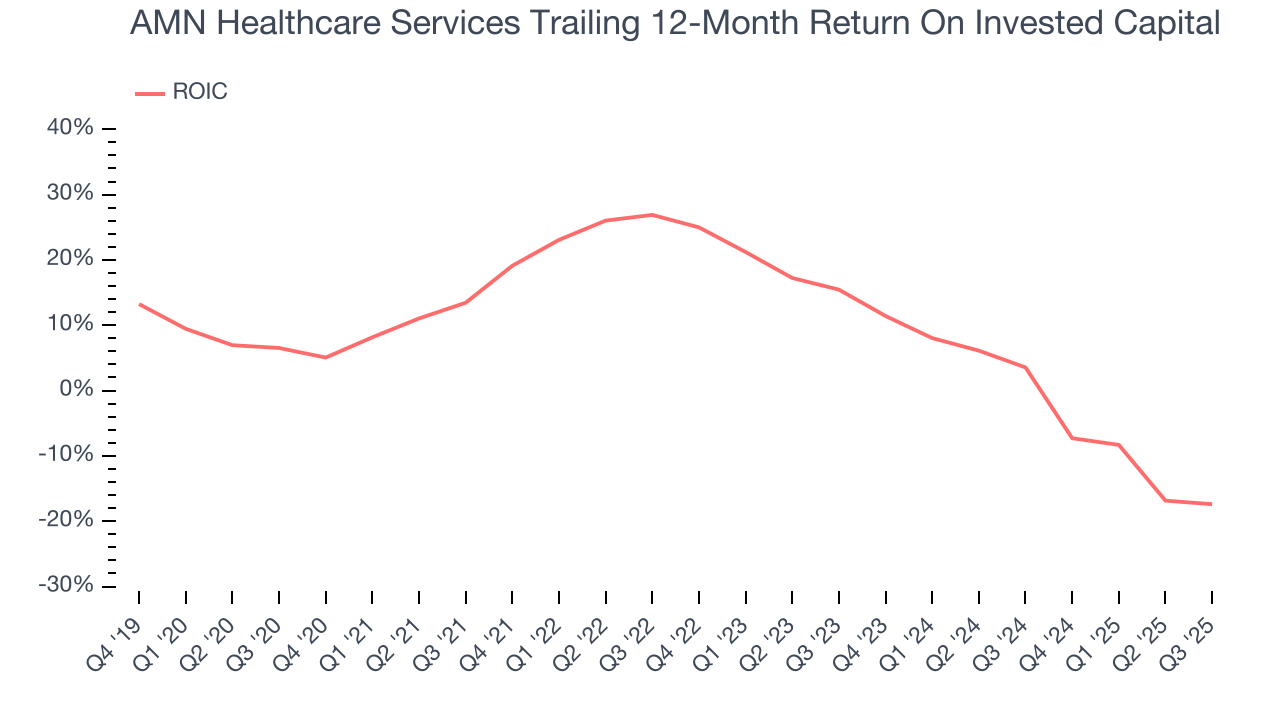

AMN Healthcare Services’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 8.4%, slightly better than typical healthcare business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, AMN Healthcare Services’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

11. Balance Sheet Assessment

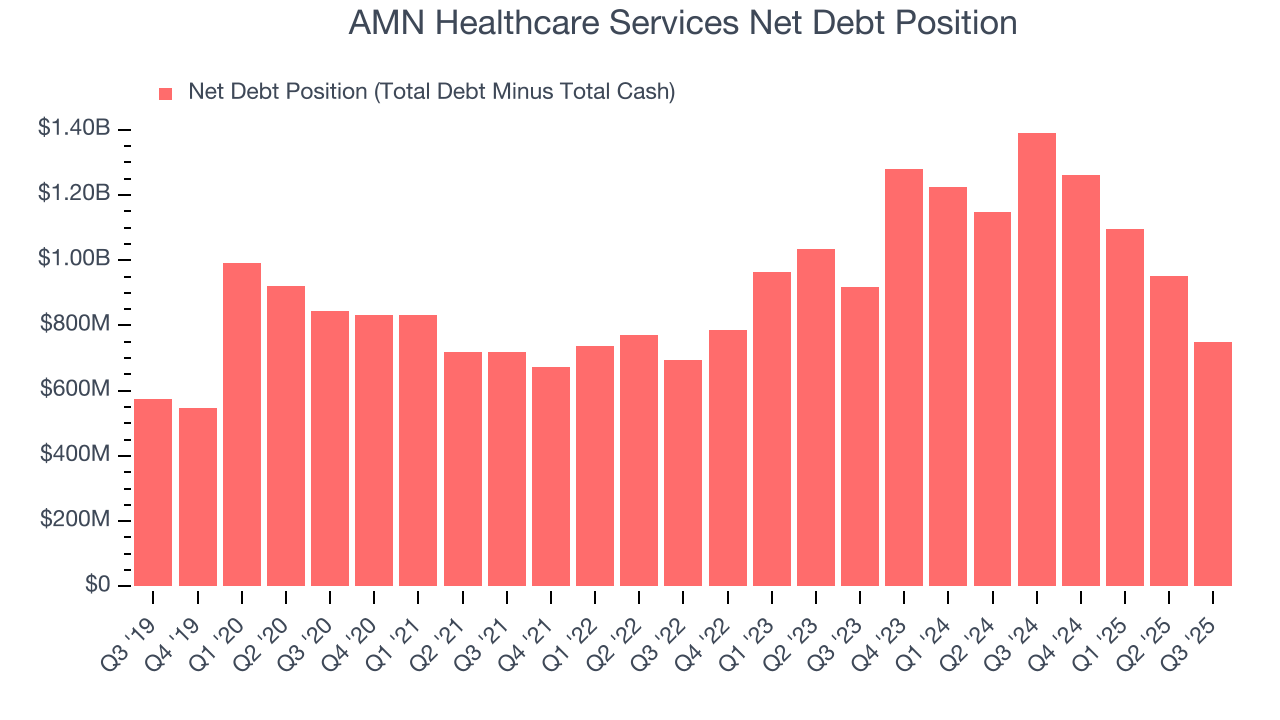

AMN Healthcare Services reported $97 million of cash and $846.8 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $255.1 million of EBITDA over the last 12 months, we view AMN Healthcare Services’s 2.9× net-debt-to-EBITDA ratio as safe. We also see its $37.17 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from AMN Healthcare Services’s Q3 Results

It was good to see AMN Healthcare Services beat analysts’ EPS expectations this quarter. We were also glad its revenue guidance for next quarter trumped Wall Street’s estimates. Zooming out, we think this quarter featured some important positives. The stock traded up 5.3% to $19.40 immediately after reporting.

13. Is Now The Time To Buy AMN Healthcare Services?

Updated: January 19, 2026 at 10:58 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in AMN Healthcare Services.

AMN Healthcare Services falls short of our quality standards. First off, its revenue growth was uninspiring over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its above-average ROIC suggests its management team has made good investment decisions, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its declining EPS over the last five years makes it a less attractive asset to the public markets.

AMN Healthcare Services’s P/E ratio based on the next 12 months is 26.8x. This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $20.86 on the company (compared to the current share price of $19.02).