DNOW (DNOW)

DNOW doesn’t excite us. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think DNOW Will Underperform

Spun off from National Oilwell Varco, DNOW (NYSE:DNOW) provides distribution and supply chain solutions for the energy and industrial end markets.

- Poor expense management has led to an operating margin that is below the industry average

- ROIC of 7.2% reflects management’s challenges in identifying attractive investment opportunities, and its falling returns suggest its earlier profit pools are drying up

- A bright spot is that its market share is on track to rise over the next 12 months as its 67.1% projected revenue growth implies demand will accelerate from its two-year trend

DNOW’s quality doesn’t meet our expectations. We’re hunting for superior stocks elsewhere.

Why There Are Better Opportunities Than DNOW

High Quality

Investable

Underperform

Why There Are Better Opportunities Than DNOW

DNOW’s stock price of $11.87 implies a valuation ratio of 18.1x forward P/E. DNOW’s multiple may seem like a great deal among industrials peers, but we think there are valid reasons why it’s this cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. DNOW (DNOW) Research Report: Q4 CY2025 Update

Energy and industrial distributor DNOW (NYSE:DNOW) missed Wall Street’s revenue expectations in Q4 CY2025, but sales rose 68% year on year to $959 million. Its GAAP loss of $0.95 per share was significantly below analysts’ consensus estimates.

DNOW (DNOW) Q4 CY2025 Highlights:

- On November 6, 2025, DNOW completed its acquisition of MRC Global in an all-stock transaction. This is why revenue, revenue growth, and shares outstanding below all show unusual increases

- Revenue: $959 million vs analyst estimates of $985.6 million (68% year-on-year growth, 2.7% miss)

- EPS (GAAP): -$0.95 vs analyst estimates of $0.15 (significant miss)

- Adjusted EBITDA: $61 million vs analyst estimates of $68.7 million (6.4% margin, 11.2% miss)

- Operating Margin: -17.7%, down from 5.1% in the same quarter last year

- Market Capitalization: $3.04 billion

Company Overview

Spun off from National Oilwell Varco, DNOW (NYSE:DNOW) provides distribution and supply chain solutions for the energy and industrial end markets.

As background, National Oilwell and Varco were two companies founded in the 1800s that merged in 2005. The combined business manufactured and distributed pumps and derricks for oil and gas exploration. In 2014, the distribution business of the combined company was spun out and called DistributionNOW, or DNOW for short.

DNOW offers both products and services. Maintenance, repair, and operations (MRO) supplies are an important category and include everything from hand tools to safety equipment. The company is also known for its breadth of inventory in pipes, valves, and fittings (PVF) as well as for specialized equipment that services the oil and gas sector. Services include supply chain and materials management as well as engineering services such as weatherproofing systems and equipment.

In addition to reliably carrying these products, the company also adds value by delivering orders in a timely manner. Since some products are not easy to transport and since some job sites are difficult to access, this capability is a differentiator the eyes of customers.

4. Infrastructure Distributors

Focusing on narrow product categories that can lead to economies of scale, infrastructure distributors sell essential goods that often enjoy more predictable revenue streams. For example, the ongoing inspection, maintenance, and replacement of pipes and water pumps are critical to a functioning society, rendering them non-discretionary. Lately, innovation to address trends like water conservation has driven incremental sales. But like the broader industrials sector, infrastructure distributors are also at the whim of economic cycles as external factors like interest rates can greatly impact commercial and residential construction projects that drive demand for infrastructure products.

Competitors in the industrial distribution industry include MRC Global (NYSE:MRC), Wesco International (NYSE:WCC), and Ferguson (NYSE:FERG).

5. Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, DNOW’s sales grew at an impressive 11.7% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. DNOW’s annualized revenue growth of 10.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, DNOW achieved a magnificent 68% year-on-year revenue growth rate, but its $959 million of revenue fell short of Wall Street’s lofty estimates.

Looking ahead, sell-side analysts expect revenue to grow 90.7% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and implies its newer products and services will fuel better top-line performance.

6. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

DNOW has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 21.6% gross margin over the last five years. That means DNOW paid its suppliers a lot of money ($78.43 for every $100 in revenue) to run its business.

In Q4, DNOW produced a 7.1% gross profit margin, down 15.9 percentage points year on year. DNOW’s full-year margin has also been trending down over the past 12 months, decreasing by 5.2 percentage points. If this move continues, it could suggest deteriorating pricing power and higher input costs (such as raw materials and manufacturing expenses).

7. Operating Margin

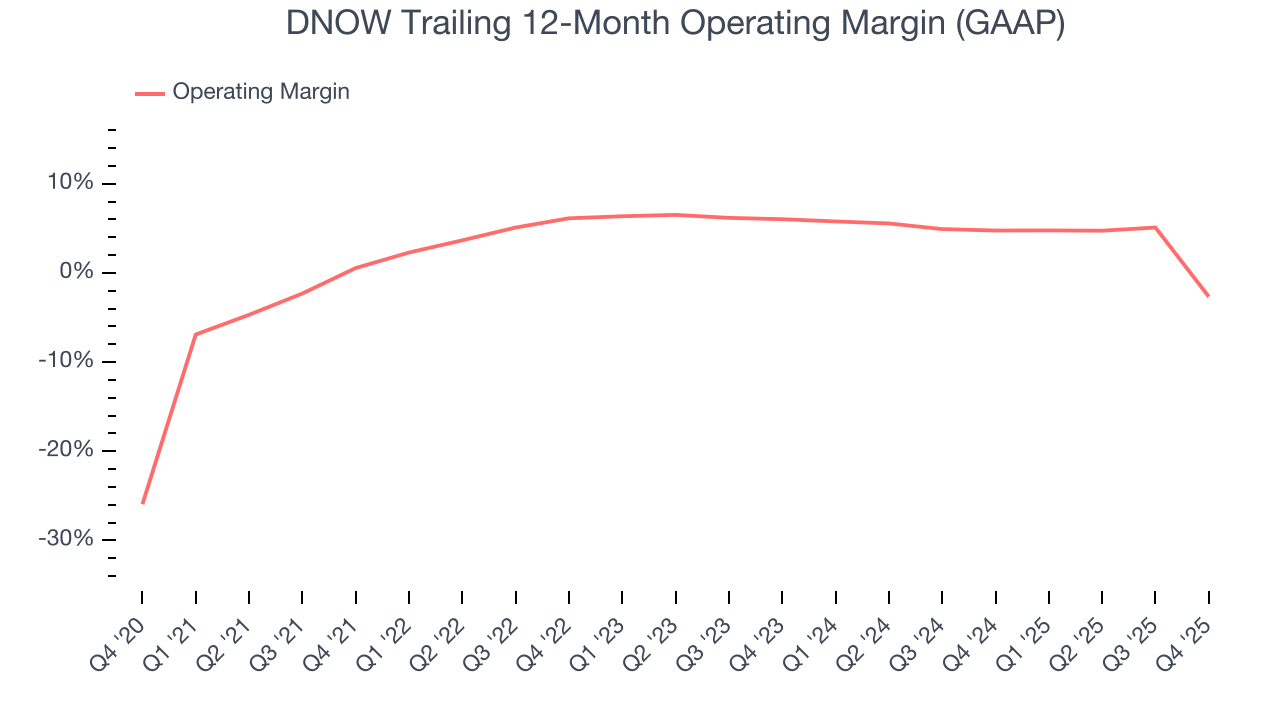

DNOW was profitable over the last five years but held back by its large cost base. Its average operating margin of 2.8% was weak for an industrials business. This result isn’t too surprising given its low gross margin as a starting point.

Analyzing the trend in its profitability, DNOW’s operating margin decreased by 3.2 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. DNOW’s performance was poor no matter how you look at it - it shows that costs were rising and it couldn’t pass them onto its customers.

This quarter, DNOW generated an operating margin profit margin of negative 17.7%, down 22.8 percentage points year on year. Since DNOW’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although DNOW’s full-year earnings are still negative, it reduced its losses and improved its EPS by 41.3% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

Sadly for DNOW, its EPS declined by 45.6% annually over the last two years while its revenue grew by 10.2%. This tells us the company became less profitable on a per-share basis as it expanded.

Diving into the nuances of DNOW’s earnings can give us a better understanding of its performance. DNOW’s operating margin has declined over the last two yearswhile its share count has grown 44.9%. This means the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, DNOW reported EPS of negative $0.95, down from $0.21 in the same quarter last year. This print missed analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

9. Cash Is King

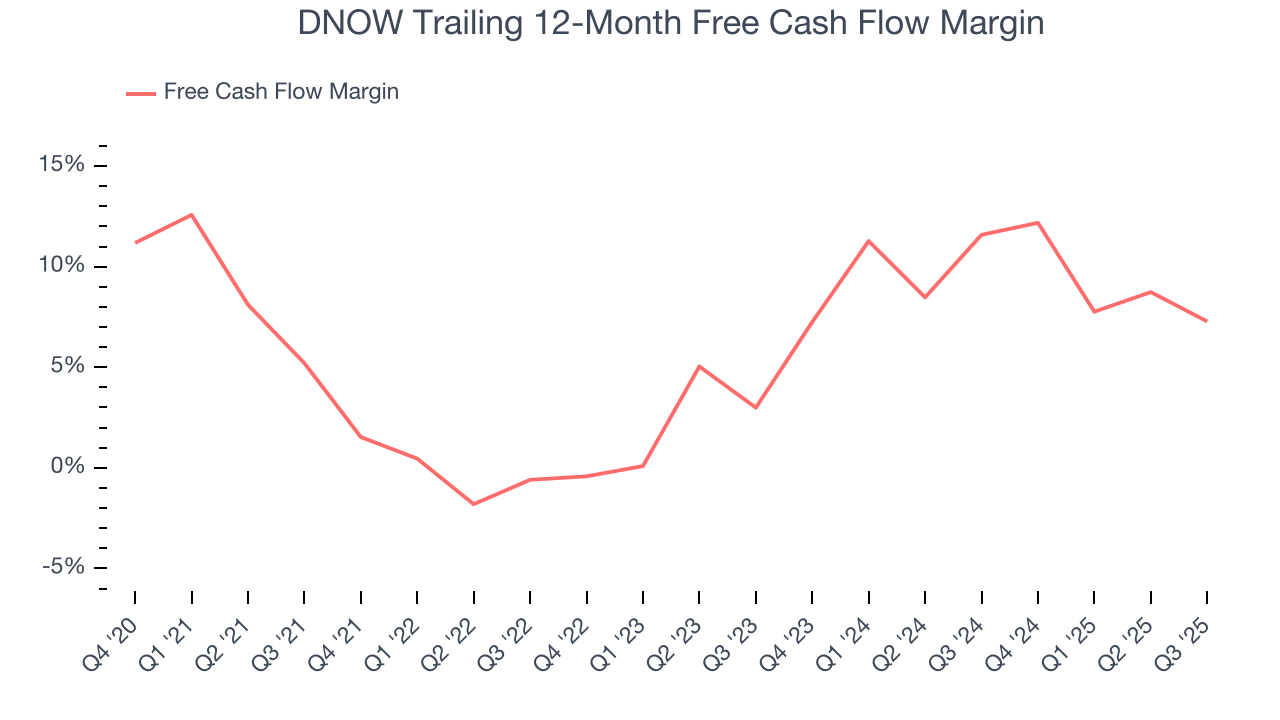

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

DNOW has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 5.1%, subpar for an industrials business.

Taking a step back, an encouraging sign is that DNOW’s margin expanded by 1.1 percentage points during that time. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose while its operating profitability fell.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

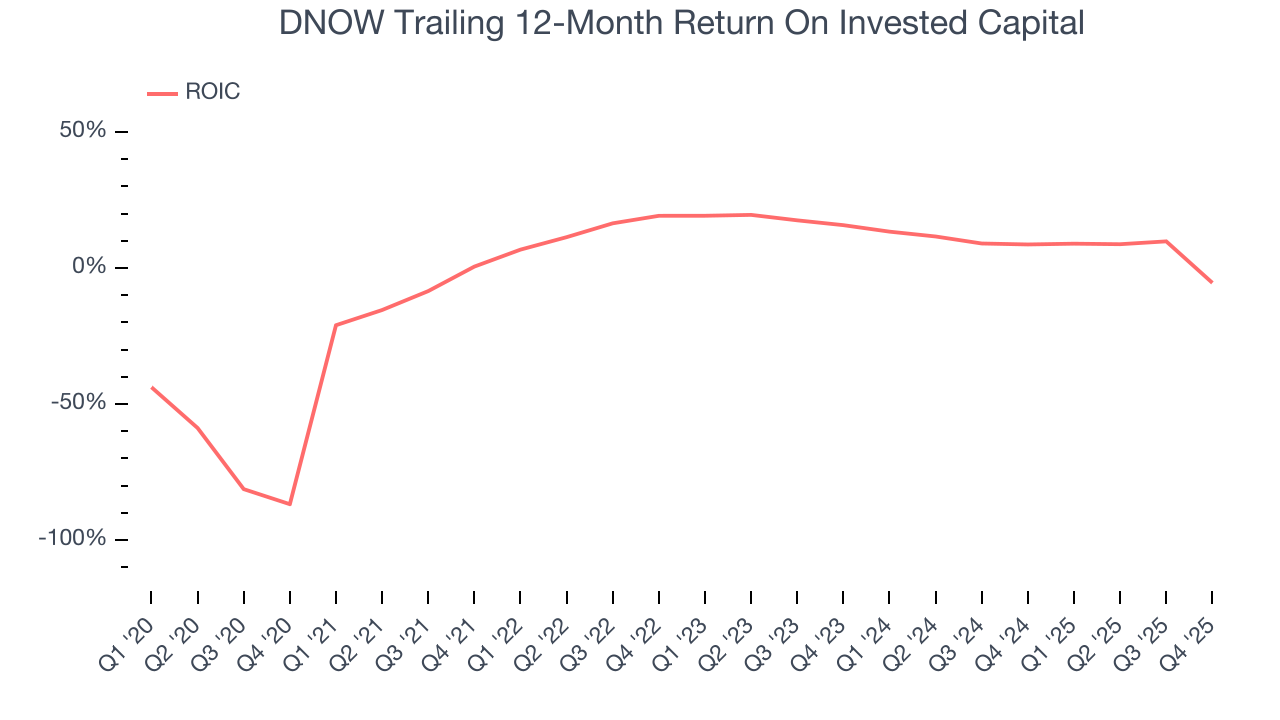

DNOW historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 7.7%, somewhat low compared to the best industrials companies that consistently pump out 20%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, DNOW’s ROIC has decreased over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

11. Balance Sheet Assessment

DNOW reported $164 million of cash and $540 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $209 million of EBITDA over the last 12 months, we view DNOW’s 1.8× net-debt-to-EBITDA ratio as safe. We also see its $2 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from DNOW’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock remained flat at $16.52 immediately after reporting.

13. Is Now The Time To Buy DNOW?

Updated: February 23, 2026 at 10:30 PM EST

Before investing in or passing on DNOW, we urge you to understand the company’s business quality (or lack thereof), valuation, and the latest quarterly results - in that order.

DNOW isn’t a terrible business, but it doesn’t pass our quality test. Although its revenue growth was impressive over the last five years and is expected to accelerate over the next 12 months, its diminishing returns show management's prior bets haven't worked out. And while the company’s astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its projected EPS for the next year is lacking.

DNOW’s P/E ratio based on the next 12 months is 18.1x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $16 on the company (compared to the current share price of $11.87).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.