Elevance Health (ELV)

Elevance Health is intriguing. Its superb 27.7% ROIC illustrates its skill in making high-return investments.― StockStory Analyst Team

1. News

2. Summary

Why Elevance Health Is Interesting

Formerly known as Anthem until its 2022 rebranding, Elevance Health (NYSE:ELV) is one of America's largest health insurers, serving approximately 47 million medical members through its network-based managed care plans.

- ROIC punches in at 27.7%, illustrating management’s expertise in identifying profitable investments

- Unparalleled scale of $193.3 billion in revenue enables it to spread administrative costs across a larger membership base

- On the flip side, its weak customer trends over the past two years suggest it may need to improve its products, pricing, or go-to-market strategy

Elevance Health is solid, but not perfect. If you like the company, the valuation seems fair.

Why Is Now The Time To Buy Elevance Health?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Elevance Health?

Elevance Health is trading at $371.52 per share, or 13.9x forward P/E. This multiple is lower than most healthcare companies, and we think the valuation is reasonable for the quality you get.

If you think the market is not giving the company enough credit for its fundamentals, now could be a good time to invest.

3. Elevance Health (ELV) Research Report: Q3 CY2025 Update

Health insurance provider Elevance Health (NYSE:EVH) beat Wall Street’s revenue expectations in Q3 CY2025, with sales up 12.4% year on year to $50.71 billion. Its non-GAAP profit of $6.03 per share was 22% above analysts’ consensus estimates.

Elevance Health (ELV) Q3 CY2025 Highlights:

- Revenue: $50.71 billion vs analyst estimates of $49.93 billion (12.4% year-on-year growth, 1.6% beat)

- Adjusted EPS: $6.03 vs analyst estimates of $4.94 (22% beat)

- Management reiterated its full-year Adjusted EPS guidance of $30 at the midpoint

- Operating Margin: 2.8%, down from 4.3% in the same quarter last year

- Free Cash Flow Margin: 1.5%, down from 5.2% in the same quarter last year

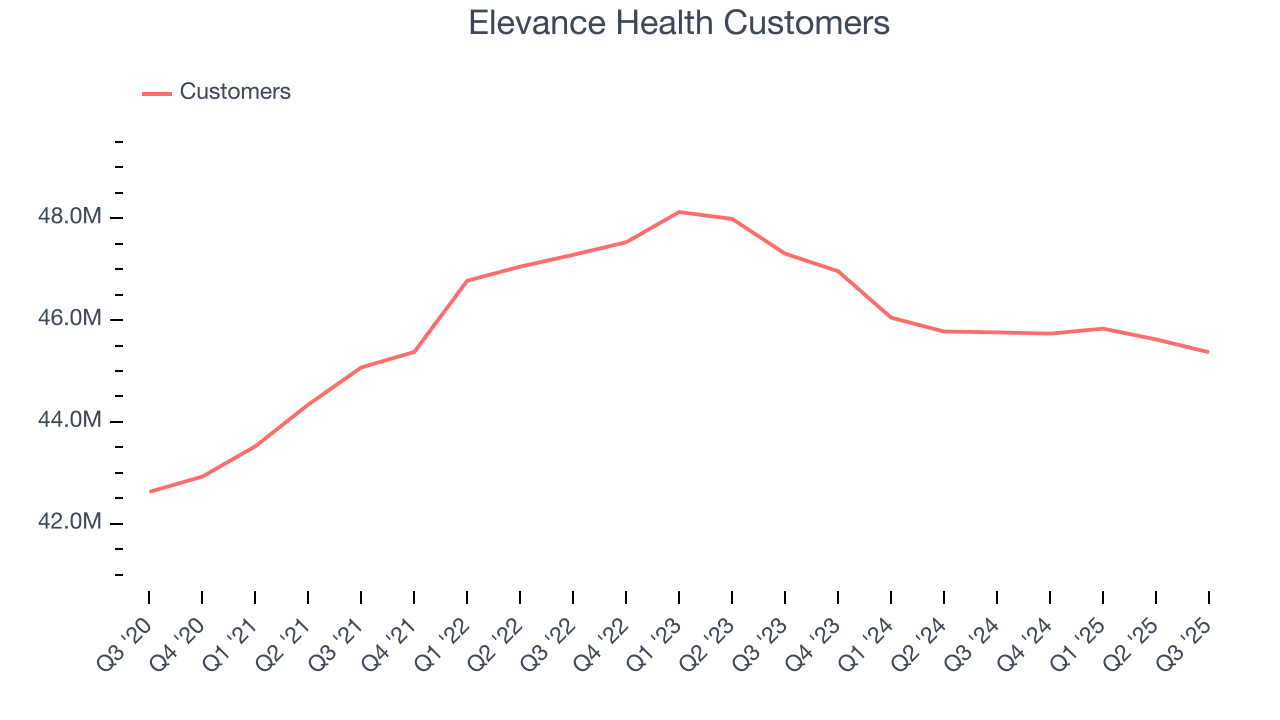

- Customers: 45.37 million, down from 45.62 million in the previous quarter

- Market Capitalization: $79.73 billion

Company Overview

Formerly known as Anthem until its 2022 rebranding, Elevance Health (NYSE:ELV) is one of America's largest health insurers, serving approximately 47 million medical members through its network-based managed care plans.

Elevance Health operates through a portfolio of brands including Anthem Blue Cross/Blue Shield in 14 states where it holds Blue Cross Blue Shield Association licenses, Wellpoint for its non-BCBS licensed plans, and Carelon for healthcare services. The company's business spans multiple market segments, offering health plans to individuals, employer groups, Medicare recipients, and Medicaid beneficiaries.

The company's health insurance products range from traditional PPO and HMO plans to consumer-driven health plans with health savings accounts. For Medicare-eligible individuals, Elevance offers Medicare Advantage plans, Medicare Supplement policies, and Medicare Part D prescription drug coverage. Its Medicaid business serves low-income populations across numerous states, including specialized programs for people with disabilities, foster children, and those needing long-term services.

Beyond insurance, Elevance provides an array of healthcare services through its Carelon division. These include pharmacy benefit management, behavioral health services, care management for complex conditions, and data analytics to improve healthcare outcomes. For example, a patient with multiple chronic conditions might receive coordinated care through Elevance's CareMore program (now Carelon Health), which provides personalized care plans and regular monitoring to prevent complications and reduce hospitalizations.

Elevance generates revenue primarily through insurance premiums paid by individuals, employers, and government programs. It also earns service fees from its pharmacy operations and healthcare services provided to external clients. The company leverages its scale to negotiate favorable rates with healthcare providers, helping to control costs for members while maintaining profitability.

The company employs sophisticated data analytics and digital tools to manage healthcare costs and improve outcomes. Its Sydney Health digital platform gives members access to their benefits information, telehealth services, and personalized health resources in one place. Elevance also offers care management programs for conditions like diabetes and heart disease, helping members navigate the healthcare system and adhere to treatment plans.

4. Health Insurance Providers

Upfront premiums collected by health insurers lead to reliable revenue, but profitability ultimately depends on accurate risk assessments and the ability to control medical costs. Health insurers are also highly sensitive to regulatory changes and economic conditions such as unemployment. Going forward, the industry faces tailwinds from an aging population, increasing demand for personalized healthcare services, and advancements in data analytics to improve cost management. However, continued regulatory scrutiny on pricing practices, the potential for government-led reforms such as expanded public healthcare options, and inflation in medical costs could add volatility to margins. One big debate among investors is the long-term impact of AI and whether it will help underwriting, fraud detection, and claims processing or whether it may wade into ethical grey areas like reinforcing biases and widening disparities in medical care.

Elevance Health's main competitors include other major health insurers such as UnitedHealth Group (NYSE:UNH), Cigna Group (NYSE:CI), CVS Health/Aetna (NYSE:CVS), Humana (NYSE:HUM), and Centene Corporation (NYSE:CNC).

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $194.8 billion in revenue over the past 12 months, Elevance Health is one of the most scaled enterprises in healthcare. This is particularly important because health insurance providers companies are volume-driven businesses due to their low margins.

6. Revenue Growth

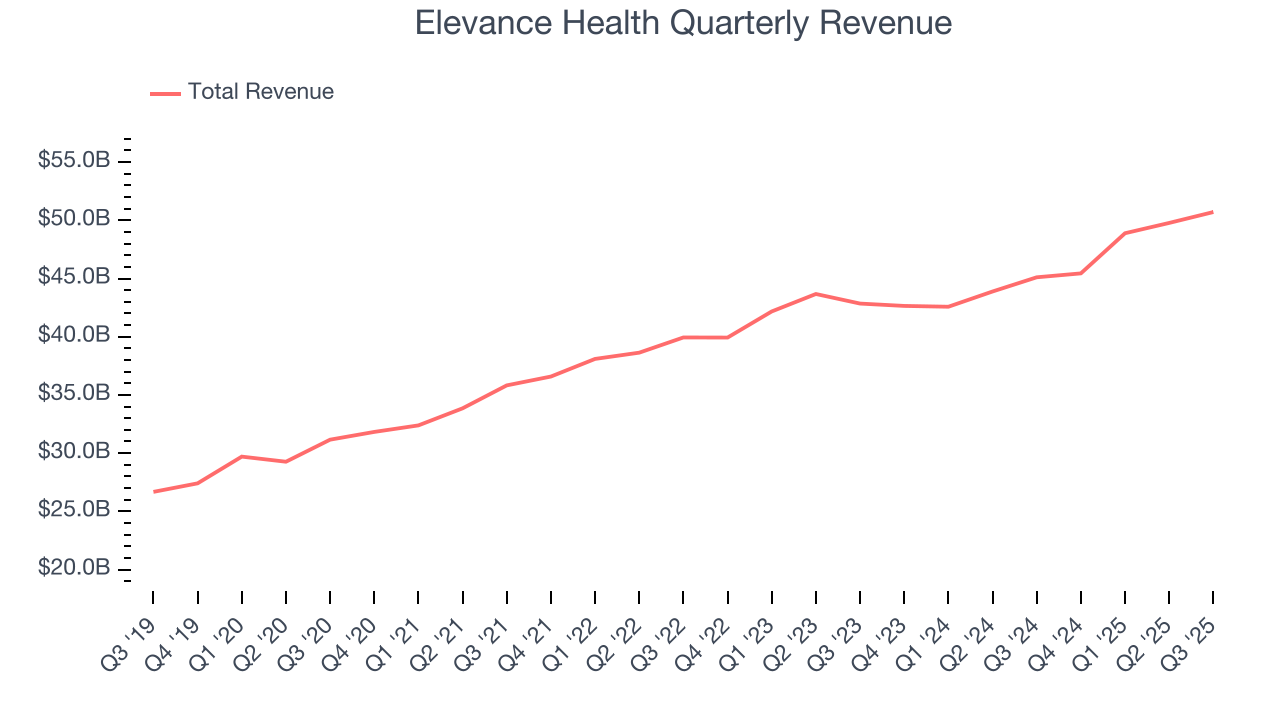

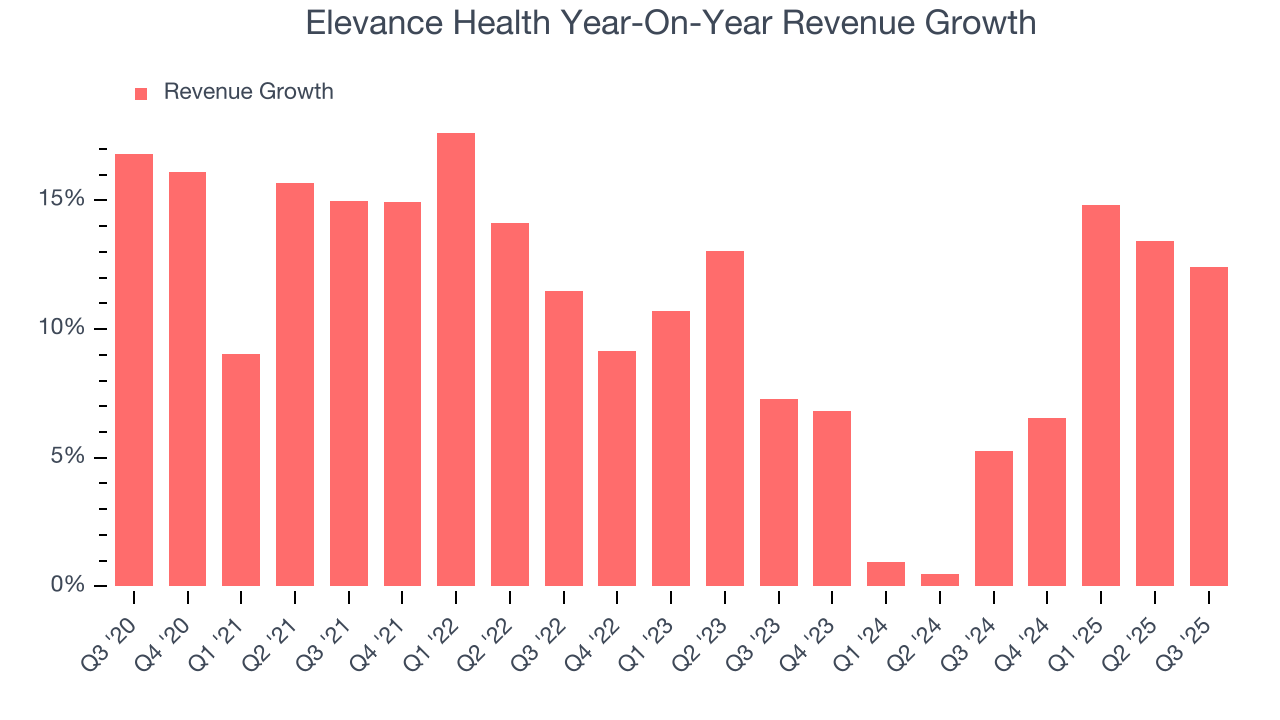

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Elevance Health’s 10.6% annualized revenue growth over the last five years was decent. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Elevance Health’s recent performance shows its demand has slowed as its annualized revenue growth of 7.5% over the last two years was below its five-year trend.

Elevance Health also reports its number of customers, which reached 45.37 million in the latest quarter. Over the last two years, Elevance Health’s customer base averaged 2.2% year-on-year declines. Because this number is lower than its revenue growth, we can see the average customer spent more money each year on the company’s products and services.

This quarter, Elevance Health reported year-on-year revenue growth of 12.4%, and its $50.71 billion of revenue exceeded Wall Street’s estimates by 1.6%.

Looking ahead, sell-side analysts expect revenue to grow 5.8% over the next 12 months, a slight deceleration versus the last two years. We still think its growth trajectory is satisfactory given its scale and indicates the market is baking in success for its products and services.

7. Operating Margin

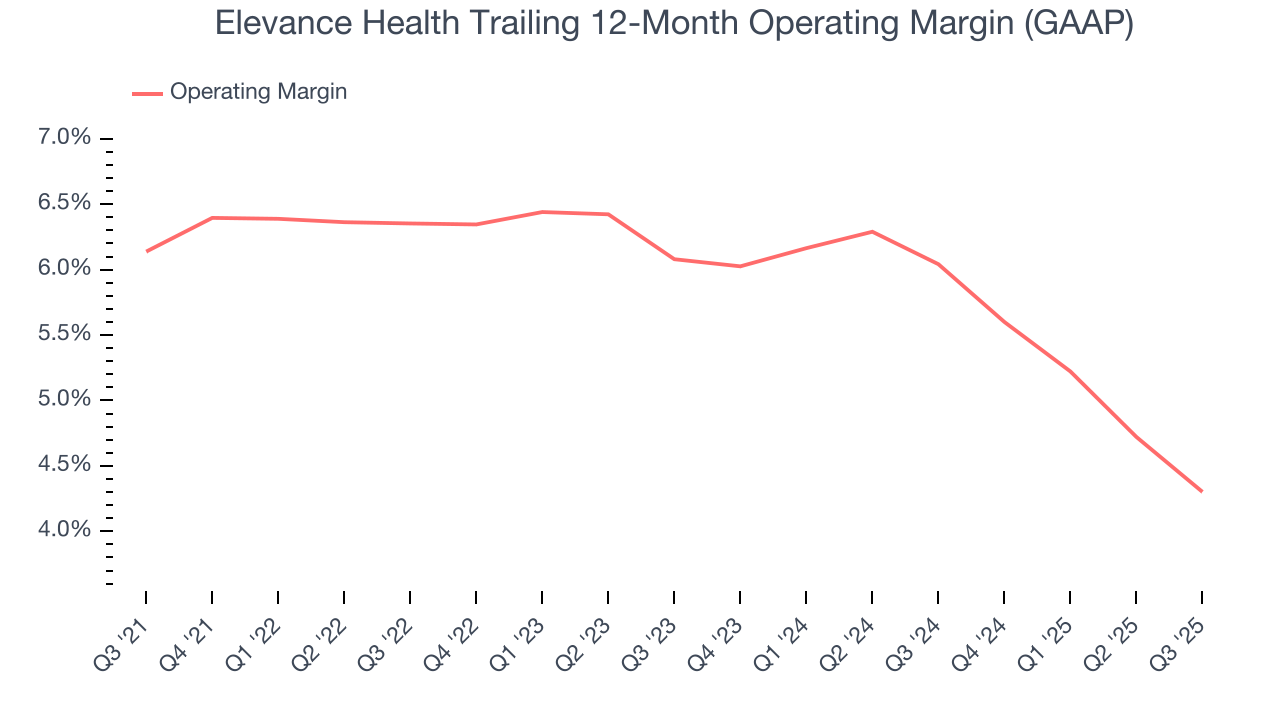

Elevance Health was profitable over the last five years but held back by its large cost base. Its average operating margin of 5.7% was weak for a healthcare business.

Looking at the trend in its profitability, Elevance Health’s operating margin decreased by 1.8 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 1.8 percentage points. We still like Elevance Health but would like to see some improvement in the future.

In Q3, Elevance Health generated an operating margin profit margin of 2.8%, down 1.6 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

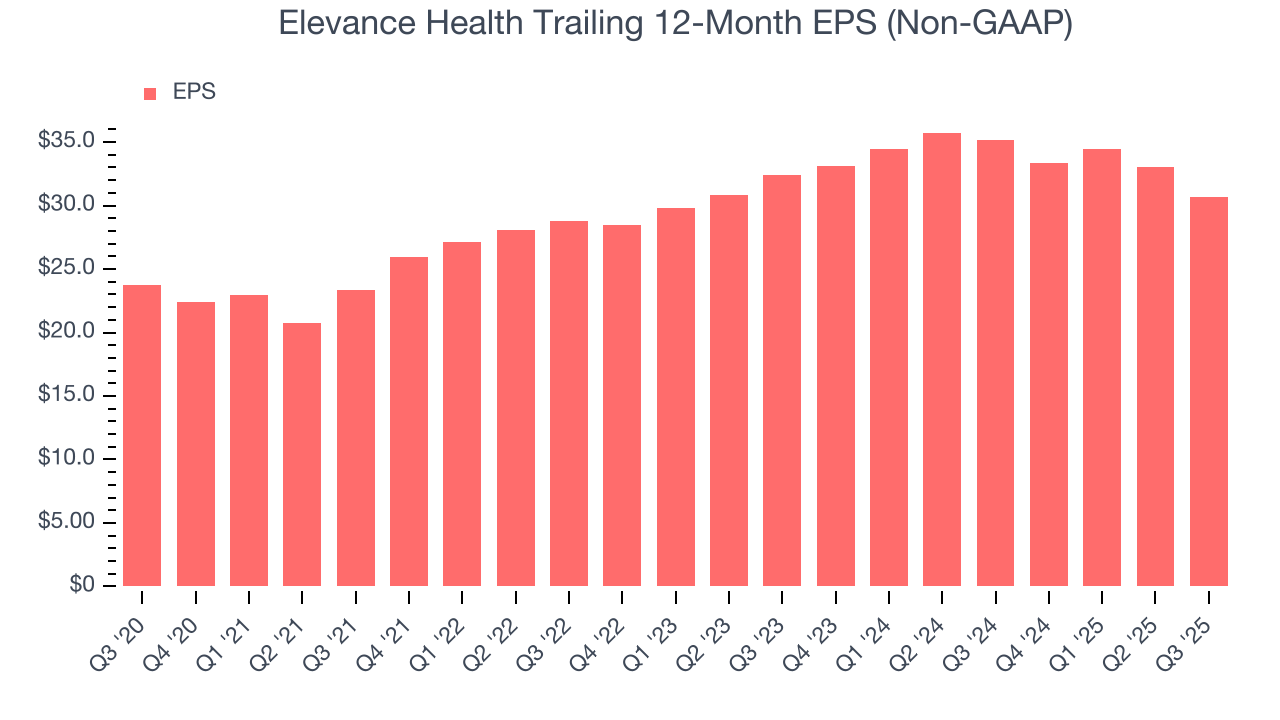

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Elevance Health’s EPS grew at a decent 5.2% compounded annual growth rate over the last five years. Despite its operating margin improvement and share repurchases during that time, this performance was lower than its 10.6% annualized revenue growth, telling us the delta came from reduced interest expenses or taxes.

Diving into Elevance Health’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Elevance Health’s operating margin declined by 1.8 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its lower earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q3, Elevance Health reported adjusted EPS of $6.03, down from $8.37 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Elevance Health’s full-year EPS of $30.68 to stay about the same.

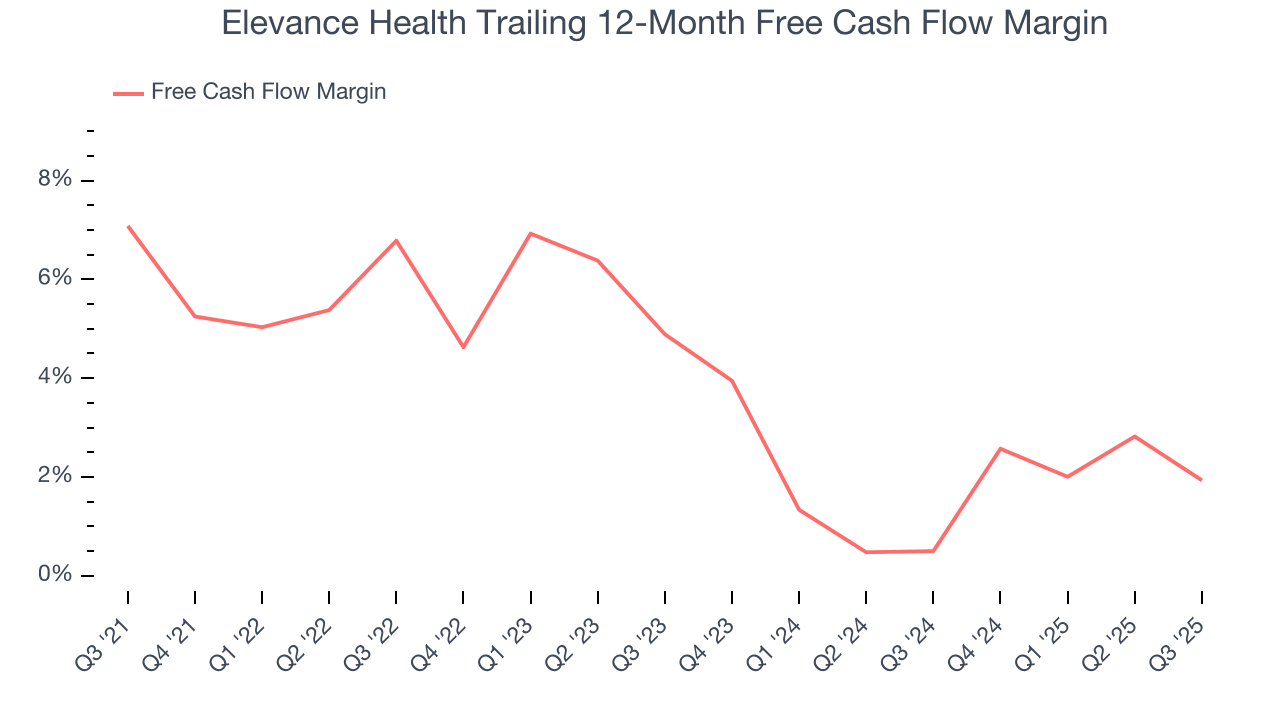

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Elevance Health has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4%, subpar for a healthcare business.

Taking a step back, we can see that Elevance Health’s margin dropped by 5.1 percentage points during that time. If the trend continues, it could signal it’s in the middle of a big investment cycle.

Elevance Health’s free cash flow clocked in at $775 million in Q3, equivalent to a 1.5% margin. The company’s cash profitability regressed as it was 3.7 percentage points lower than in the same quarter last year, which isn’t ideal considering its longer-term trend.

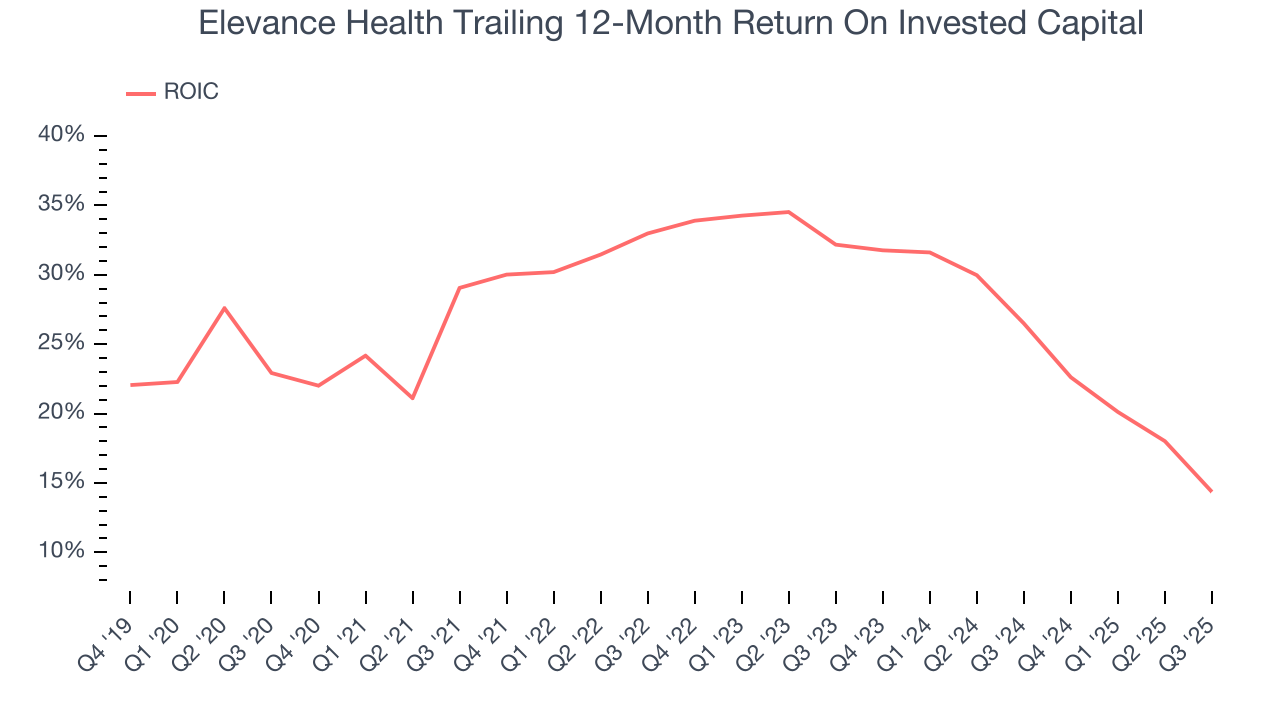

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Elevance Health’s five-year average ROIC was 27%, placing it among the best healthcare companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Elevance Health’s ROIC has decreased significantly over the last few years. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

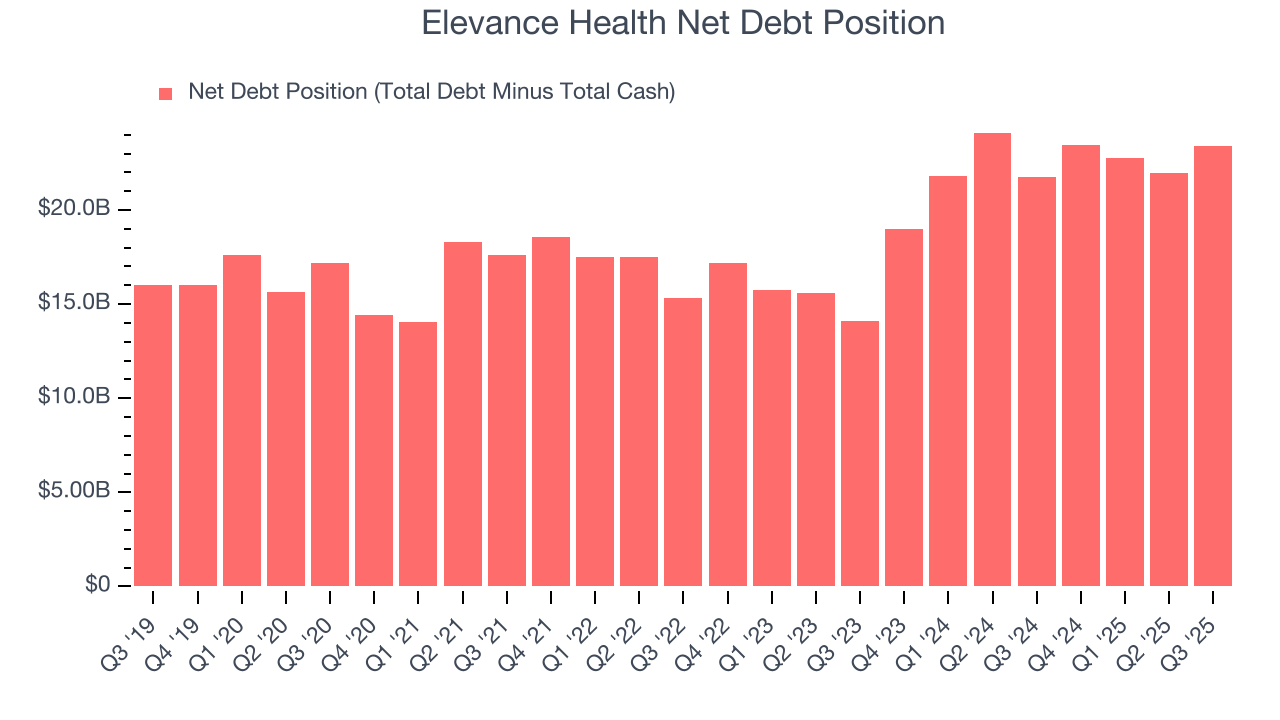

11. Balance Sheet Assessment

Elevance Health reported $8.71 billion of cash and $32.1 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $10.7 billion of EBITDA over the last 12 months, we view Elevance Health’s 2.2× net-debt-to-EBITDA ratio as safe. We also see its $674 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Elevance Health’s Q3 Results

It was good to see Elevance Health beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its customer base slightly missed. Overall, this print had some key positives. The stock traded up 5.9% to $374.80 immediately following the results.

13. Is Now The Time To Buy Elevance Health?

Updated: January 22, 2026 at 11:00 PM EST

When considering an investment in Elevance Health, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We think Elevance Health is a good business. First off, its revenue growth was good over the last five years. And while its diminishing returns show management's recent bets still have yet to bear fruit, its scale gives it meaningful leverage when negotiating reimbursement rates. On top of that, its stellar ROIC suggests it has been a well-run company historically.

Elevance Health’s P/E ratio based on the next 12 months is 13.9x. Looking at the healthcare landscape right now, Elevance Health trades at a pretty interesting price. If you believe in the company and its growth potential, now is an opportune time to buy shares.

Wall Street analysts have a consensus one-year price target of $395.40 on the company (compared to the current share price of $371.52), implying they see 6.4% upside in buying Elevance Health in the short term.