Enovis (ENOV)

We wouldn’t recommend Enovis. Its falling revenue and negative returns on capital suggest it’s destroying value as demand fizzles out.― StockStory Analyst Team

1. News

2. Summary

Why We Think Enovis Will Underperform

With a focus on helping patients regain or maintain their natural motion, Enovis (NYSE:ENOV) develops and manufactures medical devices for orthopedic care, from injury prevention and pain management to joint replacement and rehabilitation.

- Negative returns on capital show that some of its growth strategies have backfired, and its shrinking returns suggest its past profit sources are losing steam

- Customers postponed purchases of its products and services this cycle as its revenue declined by 6.5% annually over the last five years

- Low free cash flow margin gives it little breathing room, constraining its ability to self-fund growth or return capital to shareholders

Enovis falls short of our quality standards. We see more favorable opportunities in the market.

Why There Are Better Opportunities Than Enovis

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Enovis

Enovis is trading at $23.01 per share, or 7.2x forward P/E. Enovis’s valuation may seem like a bargain, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like great bargains at first glance, but you often get what you pay for. These mediocre businesses often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Enovis (ENOV) Research Report: Q3 CY2025 Update

Medical technology company Enovis Corporation (NYSE:ENOV) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 8.6% year on year to $548.9 million. The company expects the full year’s revenue to be around $2.26 billion, close to analysts’ estimates. Its non-GAAP profit of $0.75 per share was 15.6% above analysts’ consensus estimates.

Enovis (ENOV) Q3 CY2025 Highlights:

- Revenue: $548.9 million vs analyst estimates of $537.6 million (8.6% year-on-year growth, 2.1% beat)

- Adjusted EPS: $0.75 vs analyst estimates of $0.65 (15.6% beat)

- Adjusted EBITDA: $94.8 million vs analyst estimates of $92.05 million (17.3% margin, 3% beat)

- The company reconfirmed its revenue guidance for the full year of $2.26 billion at the midpoint

- Management raised its full-year Adjusted EPS guidance to $3.18 at the midpoint, a 1.6% increase

- EBITDA guidance for the full year is $400 million at the midpoint, above analyst estimates of $395.3 million

- Operating Margin: -102%, down from -6.3% in the same quarter last year

- Free Cash Flow Margin: 5.3%, up from 0.5% in the same quarter last year

- Market Capitalization: $1.8 billion

Company Overview

With a focus on helping patients regain or maintain their natural motion, Enovis (NYSE:ENOV) develops and manufactures medical devices for orthopedic care, from injury prevention and pain management to joint replacement and rehabilitation.

Enovis operates through two main segments: Prevention & Recovery and Reconstructive. The Prevention & Recovery segment offers products used by healthcare professionals to treat patients with musculoskeletal conditions. These include rigid and soft orthopedic braces, hot and cold therapy devices, bone growth stimulators, compression garments, therapeutic footwear, and electrical stimulators for pain management. For example, an athlete recovering from an ACL tear might use an Enovis knee brace during rehabilitation, while a patient with chronic pain might utilize one of their electrical stimulation devices as part of their therapy regimen.

The Reconstructive segment provides a comprehensive suite of joint replacement products for hips, knees, shoulders, elbows, feet, ankles, and fingers, along with surgical productivity tools. A patient suffering from severe osteoarthritis might receive an Enovis knee implant to reduce pain and improve mobility when conservative treatments have failed.

Enovis reaches its customers through multiple distribution channels, including independent distributors and direct sales representatives. Its products are used by orthopedic specialists, surgeons, physical therapists, athletic trainers, and other healthcare professionals across various treatment settings. The company also sells directly to retail consumers for at-home physical therapy and injury prevention.

The company employs its "Enovis Growth eXcellence" (EGX) business system—a set of tools, processes, and cultural elements—to continuously improve patient outcomes and drive growth. This system helps Enovis standardize best practices across its operations and focus on innovation.

While the United States represents Enovis's largest market, approximately one-third of its sales come from international operations, primarily in Europe with additional presence in the Asia-Pacific region. Like other medical device manufacturers, Enovis operates in a highly regulated environment, with products subject to FDA oversight in the United States and similar regulatory bodies internationally.

4. Medical Devices & Supplies - Specialty

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies, although specialty devices are more niche. The capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

Enovis competes with several major medical device companies, including Össur and Breg in the Prevention & Recovery segment, and orthopedic giants like Stryker, Zimmer Biomet, and DePuy Synthes (a Johnson & Johnson company) in the Reconstructive segment.

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $2.23 billion in revenue over the past 12 months, Enovis lacks scale in an industry where it matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

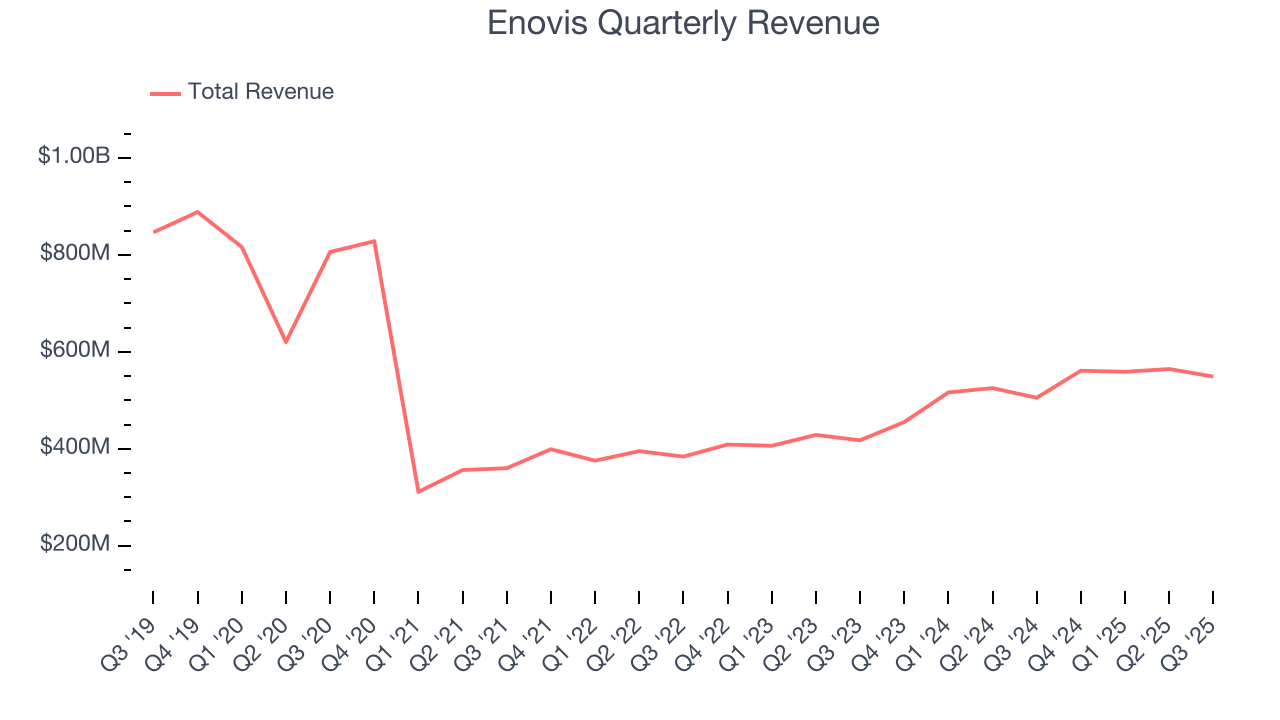

6. Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Enovis’s demand was weak over the last five years as its sales fell at a 6.5% annual rate. This wasn’t a great result and is a sign of poor business quality.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Enovis’s annualized revenue growth of 16% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

This quarter, Enovis reported year-on-year revenue growth of 8.6%, and its $548.9 million of revenue exceeded Wall Street’s estimates by 2.1%.

Looking ahead, sell-side analysts expect revenue to grow 5.7% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is above the sector average and suggests the market sees some success for its newer products and services.

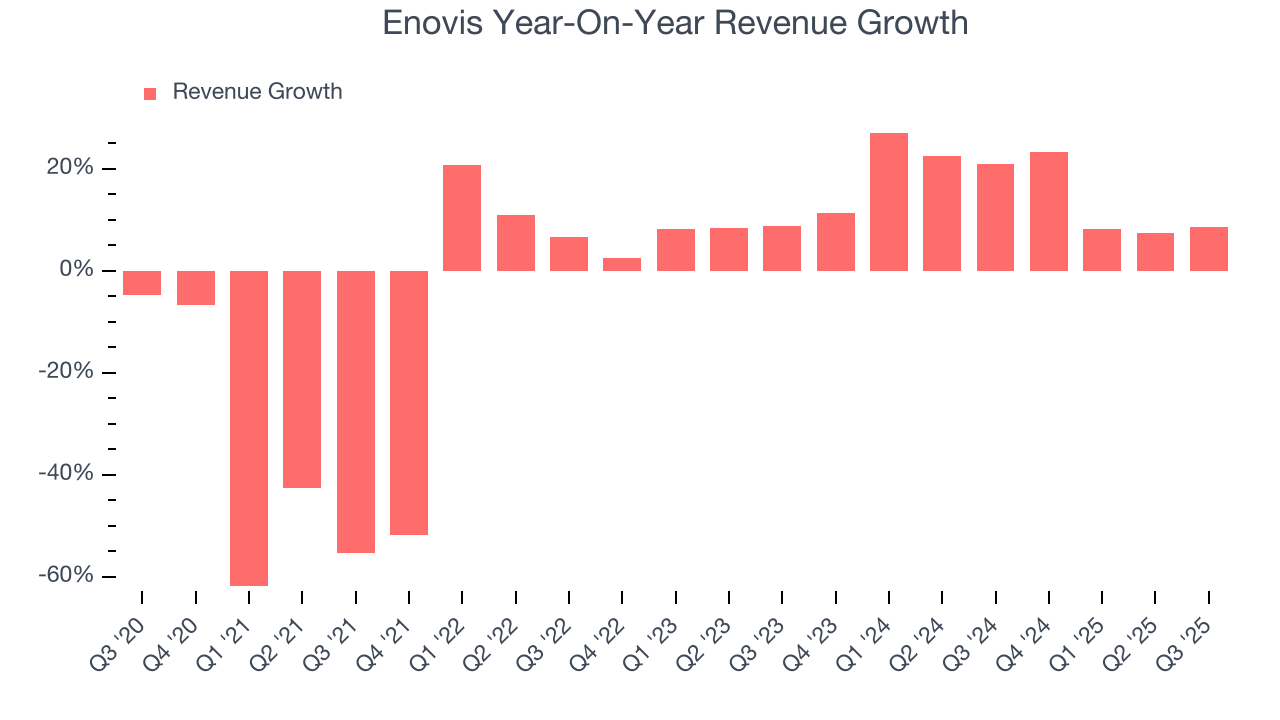

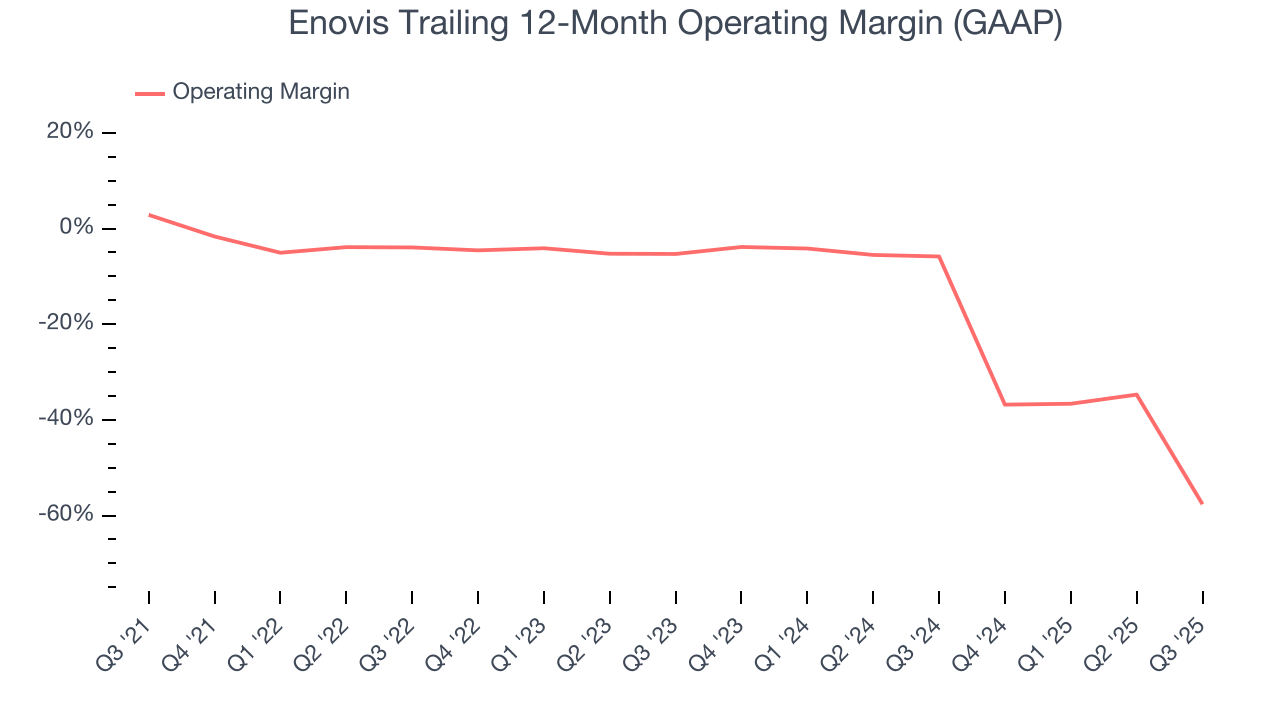

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Enovis’s high expenses have contributed to an average operating margin of negative 16.1% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Looking at the trend in its profitability, Enovis’s operating margin decreased by 60.5 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 52.3 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q3, Enovis generated a negative 102% operating margin. The company's consistent lack of profits raise a flag.

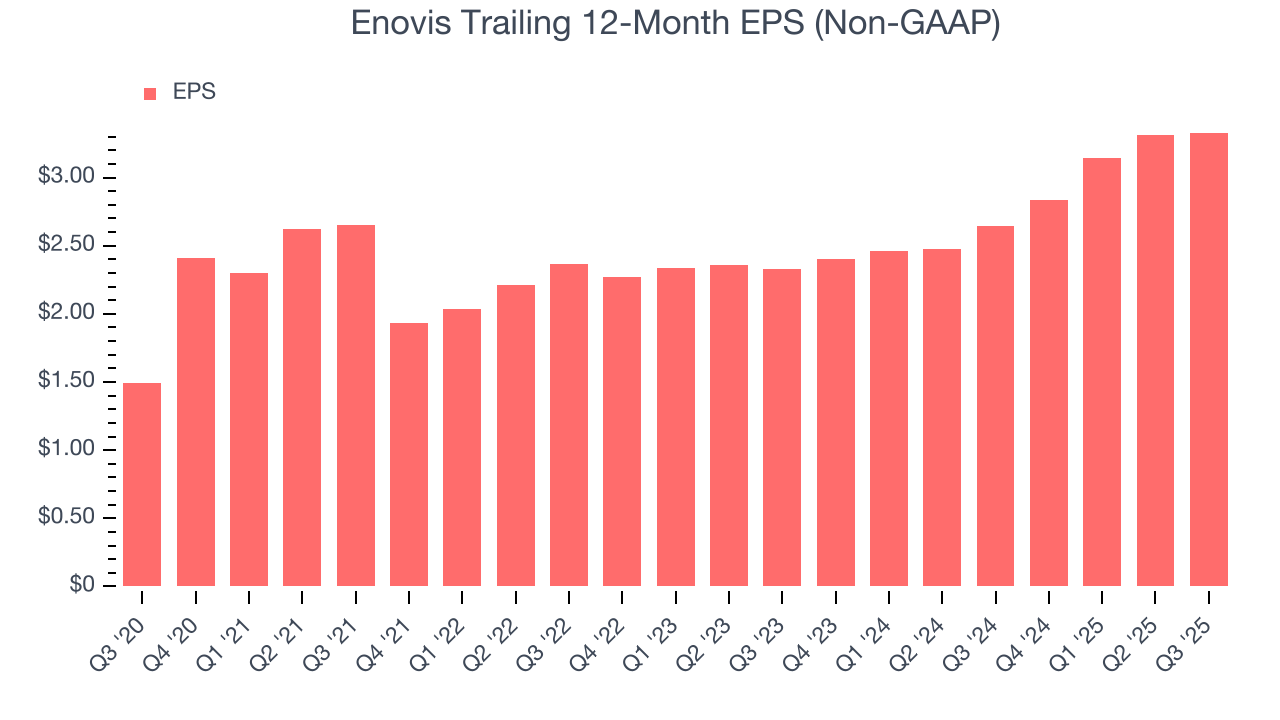

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Enovis’s EPS grew at an astounding 17.4% compounded annual growth rate over the last five years, higher than its 6.5% annualized revenue declines. However, we take this with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q3, Enovis reported adjusted EPS of $0.75, up from $0.73 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Enovis’s full-year EPS of $3.33 to stay about the same.

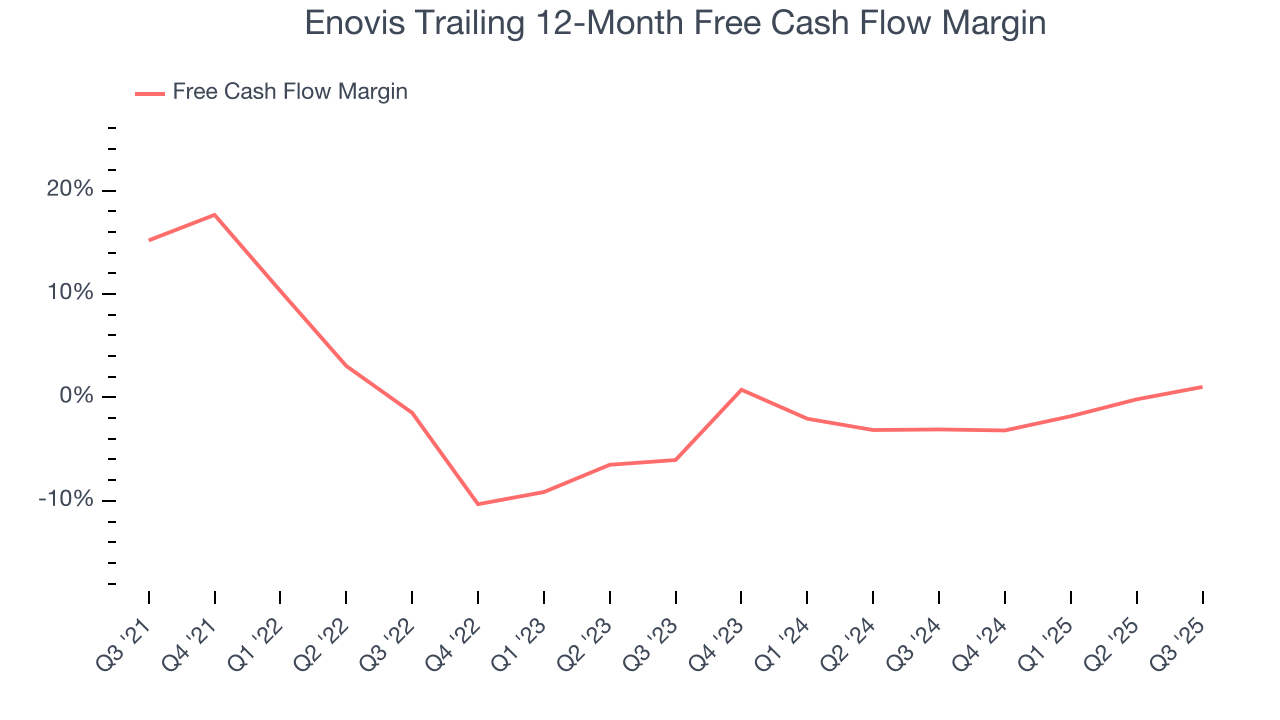

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Enovis has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.3%, subpar for a healthcare business.

Taking a step back, we can see that Enovis’s margin dropped by 14.2 percentage points during that time. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the longer-term trend returns, it could signal it’s in the middle of a big investment cycle.

Enovis’s free cash flow clocked in at $29.09 million in Q3, equivalent to a 5.3% margin. This result was good as its margin was 4.8 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

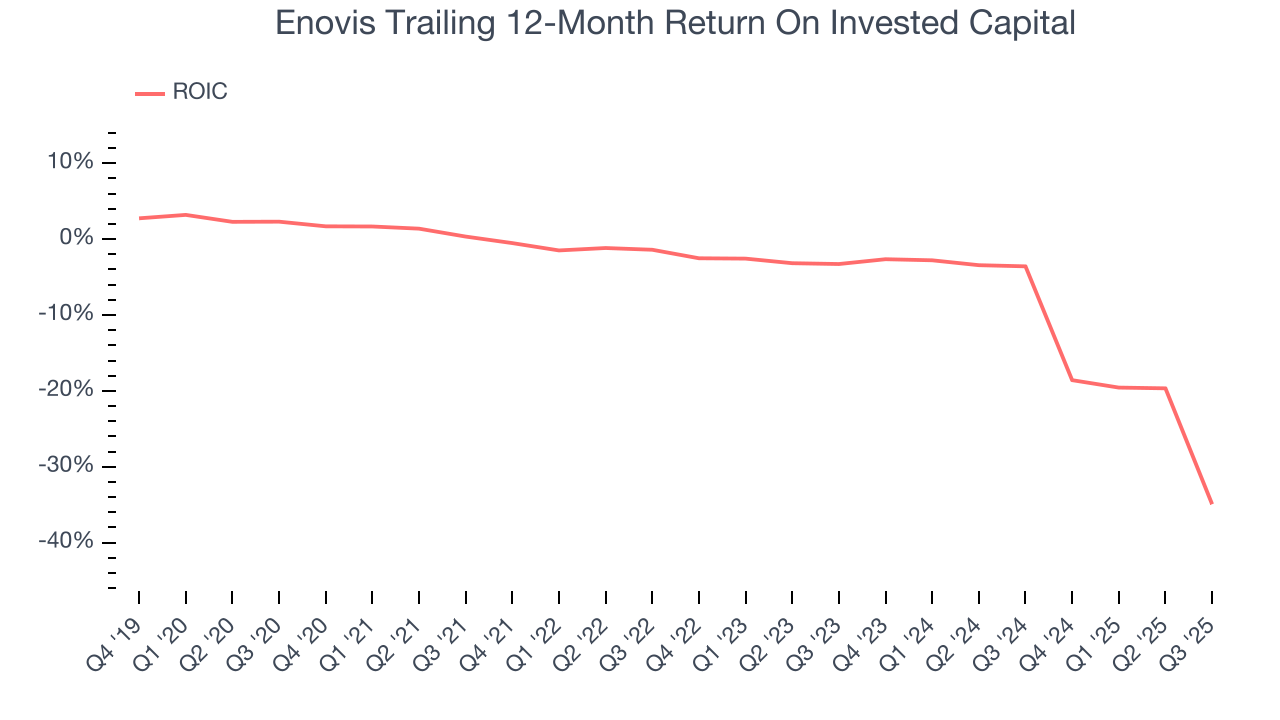

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Enovis’s five-year average ROIC was negative 8.6%, meaning management lost money while trying to expand the business. Its returns were among the worst in the healthcare sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Enovis’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

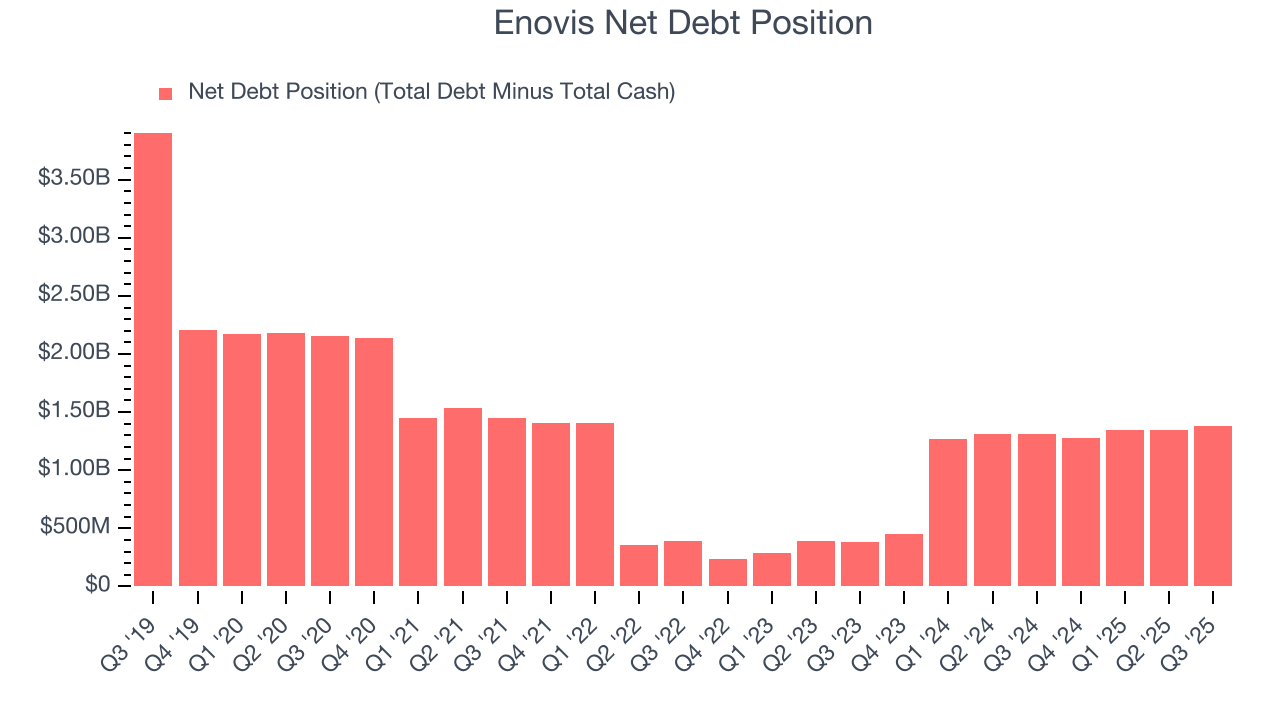

11. Balance Sheet Assessment

Enovis reported $33.62 million of cash and $1.42 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $404 million of EBITDA over the last 12 months, we view Enovis’s 3.4× net-debt-to-EBITDA ratio as safe. We also see its $18.72 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Enovis’s Q3 Results

It was good to see Enovis beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, this print had some key positives. The stock remained flat at $31.50 immediately following the results.

13. Is Now The Time To Buy Enovis?

Updated: January 25, 2026 at 11:04 PM EST

Before making an investment decision, investors should account for Enovis’s business fundamentals and valuation in addition to what happened in the latest quarter.

We cheer for all companies helping people live better, but in the case of Enovis, we’ll be cheering from the sidelines. To begin with, its revenue has declined over the last five years. And while its astounding EPS growth over the last five years shows its profits are trickling down to shareholders, the downside is its diminishing returns show management's prior bets haven't worked out. On top of that, its relatively low ROIC suggests management has struggled to find compelling investment opportunities.

Enovis’s P/E ratio based on the next 12 months is 7.2x. While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $45.45 on the company (compared to the current share price of $23.01).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.