Inspire Medical Systems (INSP)

Inspire Medical Systems is intriguing. Its revenue growth suggests its market share is rising, highlighting the value its offerings provide.― StockStory Analyst Team

1. News

2. Summary

Why Inspire Medical Systems Is Interesting

Offering an alternative for the millions who struggle with traditional CPAP machines, Inspire Medical Systems (NYSE:INSP) develops and sells an implantable neurostimulation device that treats obstructive sleep apnea by stimulating nerves to keep airways open during sleep.

- Annual revenue growth of 51.2% over the past five years was outstanding, reflecting market share gains this cycle

- Earnings growth has trumped its peers over the last five years as its EPS has compounded at 25.9% annually

- One pitfall is its modest revenue base of $912 million means it has less operating leverage but can also grow faster if it executes the right sales strategy

Inspire Medical Systems has the potential to be a high-quality business. If you like the stock, the price seems reasonable.

Why Is Now The Time To Buy Inspire Medical Systems?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Inspire Medical Systems?

At $62.98 per share, Inspire Medical Systems trades at 31.4x forward P/E. Yes, this is a premium multiple among healthcare companies. However, we still think the valuation is warranted given the top-line growth.

It could be a good time to invest if you see something the market doesn’t.

3. Inspire Medical Systems (INSP) Research Report: Q4 CY2025 Update

Medical technology company Inspire Medical Systems (NYSE:INSP) reported revenue ahead of Wall Street’s expectations in Q4 CY2025, with sales up 12.2% year on year to $269.1 million. On the other hand, the company’s full-year revenue guidance of $975 million at the midpoint came in 2.7% below analysts’ estimates. Its non-GAAP profit of $1.65 per share was significantly above analysts’ consensus estimates.

Inspire Medical Systems (INSP) Q4 CY2025 Highlights:

- Revenue: $269.1 million vs analyst estimates of $266.3 million (12.2% year-on-year growth, 1.1% beat)

- Adjusted EPS: $1.65 vs analyst estimates of $0.68 (significant beat)

- Adjusted EBITDA: $79.3 million vs analyst estimates of $55.41 million (29.5% margin, 43.1% beat)

- Lowered full-year revenue guidance vs update given roughly one month ago

- Adjusted EPS guidance for the upcoming financial year 2026 is $2.10 at the midpoint, beating analyst estimates by 25.5%

- “...based on this clarification, we believe the code will transition to CPT code 64582 for the Inspire V procedure, including the use of a -52 modifier...” which indicates a reduced or partially completed service rather than a complete hypoglossal nerve stimulation implantation

- Operating Margin: 17.1%, up from 13.3% in the same quarter last year

- Market Capitalization: $1.98 billion

Company Overview

Offering an alternative for the millions who struggle with traditional CPAP machines, Inspire Medical Systems (NYSE:INSP) develops and sells an implantable neurostimulation device that treats obstructive sleep apnea by stimulating nerves to keep airways open during sleep.

The company's flagship product, the Inspire system, consists of three implantable components: a pressure sensing lead that detects breathing attempts, a neurostimulator containing electronics and battery, and a stimulation lead that delivers electrical pulses to the hypoglossal nerve. This stimulation causes a slight forward movement of the tongue, preventing airway collapse during sleep.

Inspire therapy targets patients with moderate to severe obstructive sleep apnea who have failed or cannot tolerate positive airway pressure (PAP) treatments like CPAP machines. For these patients, the Inspire system offers a significant alternative to traditional treatments. A typical patient might be someone who has tried using a CPAP machine but found it uncomfortable or impractical for nightly use, leaving their sleep apnea untreated and putting them at risk for serious health complications.

The implantation procedure is typically performed by ear, nose, and throat (ENT) physicians or occasionally neurosurgeons as an outpatient procedure. Once implanted, patients use a remote control to activate the device before sleep and turn it off upon waking.

Inspire Medical Systems generates revenue by selling its systems to hospitals and ambulatory surgery centers. The company has built a substantial sales organization focused on educating ENT physicians, sleep centers, and patients about its therapy. It also maintains a dedicated reimbursement team that helps patients navigate insurance coverage and prior authorization processes.

The company has secured coverage from most major U.S. commercial insurers and Medicare, representing a significant milestone in making the therapy accessible to patients. Internationally, Inspire has expanded beyond the U.S. into European markets, Japan, Singapore, and Hong Kong, using a combination of direct sales forces and distributors.

4. Medical Devices & Supplies - Specialty

The medical devices industry operates a business model that balances steady demand with significant investments in innovation and regulatory compliance. The industry benefits from recurring revenue streams tied to consumables, maintenance services, and incremental upgrades to the latest technologies, although specialty devices are more niche. The capital-intensive nature of product development, coupled with lengthy regulatory pathways and the need for clinical validation, can weigh on profitability and timelines. In addition, there are constant pricing pressures from healthcare systems and insurers maximizing cost efficiency. Over the next several years, one tailwind is demographic–aging populations means rising chronic disease rates that drive greater demand for medical interventions and monitoring solutions. Advances in digital health, such as remote patient monitoring and smart devices, are also expected to unlock new demand by shortening upgrade cycles. On the other hand, the industry faces headwinds from pricing and reimbursement pressures as healthcare providers increasingly adopt value-based care models. Additionally, the integration of cybersecurity for connected devices adds further risk and complexity for device manufacturers.

Inspire Medical Systems competes with traditional sleep apnea treatment providers like ResMed (NYSE:RMD) and Philips Respironics (NYSE:PHG) that manufacture CPAP machines, as well as companies offering alternative surgical interventions for sleep apnea such as Medtronic (NYSE:MDT) and LivaNova (NASDAQ:LIVN).

5. Revenue Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $912 million in revenue over the past 12 months, Inspire Medical Systems is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive. On the bright side, Inspire Medical Systems’s smaller revenue base allows it to grow faster if it can execute well.

6. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Inspire Medical Systems’s sales grew at an incredible 51.2% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Inspire Medical Systems’s annualized revenue growth of 20.8% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Inspire Medical Systems reported year-on-year revenue growth of 12.2%, and its $269.1 million of revenue exceeded Wall Street’s estimates by 1.1%.

Looking ahead, sell-side analysts expect revenue to grow 9.8% over the next 12 months, a deceleration versus the last two years. Still, this projection is commendable and indicates the market sees success for its products and services.

7. Operating Margin

Although Inspire Medical Systems was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 1.4% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Inspire Medical Systems’s operating margin rose by 22.7 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 12 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

In Q4, Inspire Medical Systems generated an operating margin profit margin of 17.1%, up 3.8 percentage points year on year. This increase was a welcome development and shows it was more efficient.

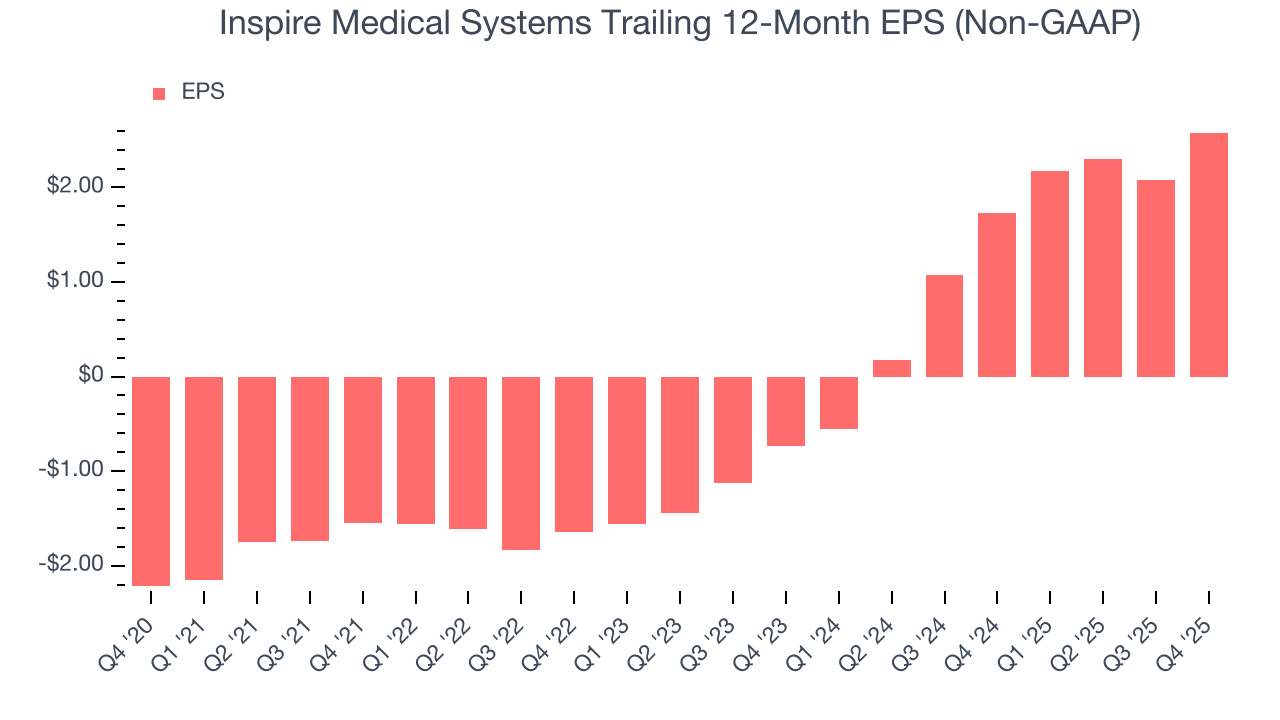

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Inspire Medical Systems’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

In Q4, Inspire Medical Systems reported adjusted EPS of $1.65, up from $1.15 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Inspire Medical Systems’s full-year EPS of $2.58 to shrink by 36.4%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Inspire Medical Systems has shown mediocre cash profitability over the last five years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 3.9%, subpar for a healthcare business.

Taking a step back, an encouraging sign is that Inspire Medical Systems’s margin expanded by 21.8 percentage points during that time. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality.

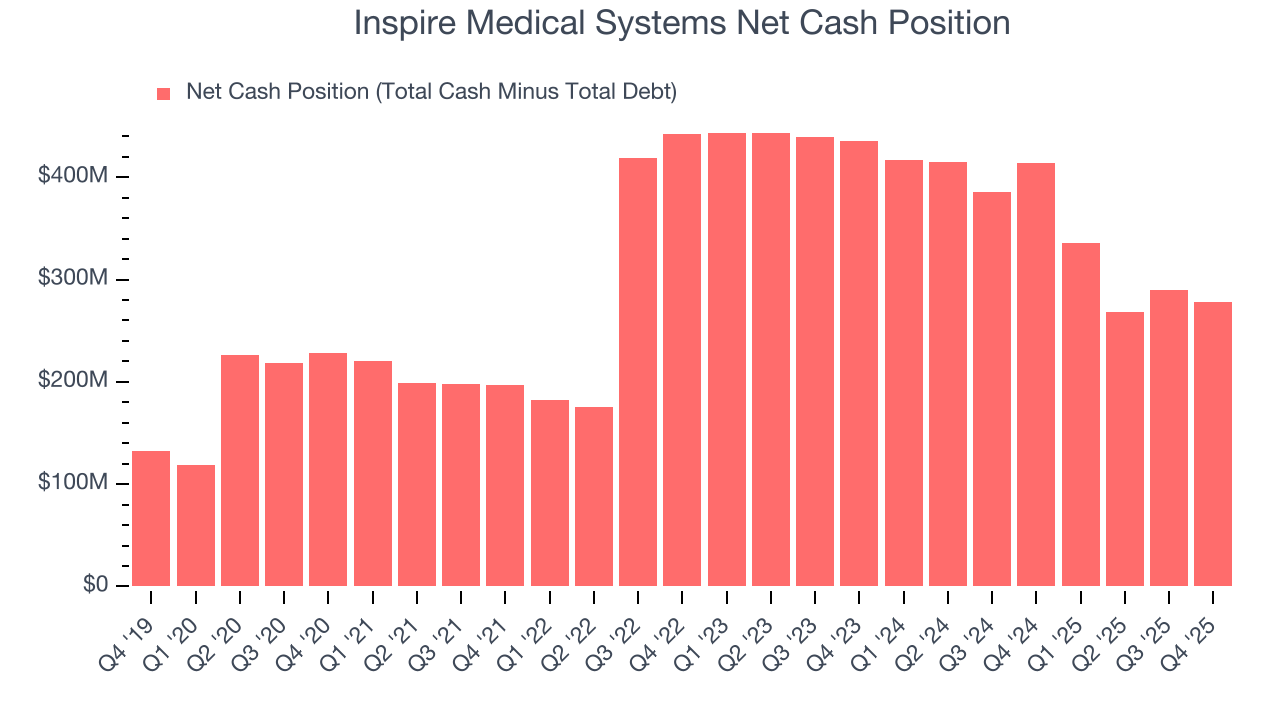

10. Balance Sheet Assessment

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Inspire Medical Systems is a profitable, well-capitalized company with $308.3 million of cash and $30 million of debt on its balance sheet. This $278.3 million net cash position is 14% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from Inspire Medical Systems’s Q4 Results

It was good to see Inspire Medical Systems beat analysts’ revenue and EPS expectations this quarter. However, full-year revenue guidance missed Wall Street's expectations, lowered from an update given roughly a month ago. Importantly, the company also mentioned getting more clarification regarding the coding that should be used for the Inspire V procedure. In short, it is a disappointing result because the coding clarification likely reduces physician reimbursement for its newer Inspire V procedure, which can create financial and adoption headwinds. It is this dynamic rather than the quarterly performance that is weighing on shares, and the stock traded down 6.3% to $63.93 immediately following the results.

12. Is Now The Time To Buy Inspire Medical Systems?

Updated: March 9, 2026 at 12:24 AM EDT

Before making an investment decision, investors should account for Inspire Medical Systems’s business fundamentals and valuation in addition to what happened in the latest quarter.

Inspire Medical Systems possesses a number of positive attributes. First off, its revenue growth was exceptional over the last five years. And while its subscale operations give it fewer distribution channels than its larger rivals, its rising cash profitability gives it more optionality. On top of that, its expanding adjusted operating margin shows the business has become more efficient.

Inspire Medical Systems’s P/E ratio based on the next 12 months is 31.4x. Looking at the healthcare space right now, Inspire Medical Systems trades at a compelling valuation. If you trust the business and its direction, this is an ideal time to buy.

Wall Street analysts have a consensus one-year price target of $77.14 on the company (compared to the current share price of $62.98), implying they see 22.5% upside in buying Inspire Medical Systems in the short term.