The New York Times (NYT)

The New York Times faces an uphill battle. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think The New York Times Will Underperform

Founded in 1851, The New York Times (NYSE:NYT) is an American media organization known for its influential newspaper and expansive digital journalism platforms.

- 9.6% annual revenue growth over the last five years was slower than its consumer discretionary peers

- Responsiveness to unforeseen market trends is restricted due to its substandard operating margin profitability

- ROIC of 16.9% reflects management’s challenges in identifying attractive investment opportunities

The New York Times fails to meet our quality criteria. You should search for better opportunities.

Why There Are Better Opportunities Than The New York Times

High Quality

Investable

Underperform

Why There Are Better Opportunities Than The New York Times

At $82.79 per share, The New York Times trades at 29.9x forward P/E. This multiple is higher than most consumer discretionary companies, and we think it’s quite expensive for the weaker revenue growth you get.

There are stocks out there featuring similar valuation multiples with better fundamentals. We prefer to invest in those.

3. The New York Times (NYT) Research Report: Q4 CY2025 Update

Newspaper and digital media company The New York Times (NYSE:NYT) reported revenue ahead of Wall Streets expectations in Q4 CY2025, with sales up 10.4% year on year to $802.3 million. Its non-GAAP profit of $0.89 per share was in line with analysts’ consensus estimates.

The New York Times (NYT) Q4 CY2025 Highlights:

- Revenue: $802.3 million vs analyst estimates of $791.3 million (10.4% year-on-year growth, 1.4% beat)

- Adjusted EPS: $0.89 vs analyst estimates of $0.88 (in line)

- Adjusted EBITDA: $182.5 million vs analyst estimates of $196.6 million (22.7% margin, 7.2% miss)

- Operating Margin: 20.1%, in line with the same quarter last year

- Free Cash Flow Margin: 19.6%, similar to the same quarter last year

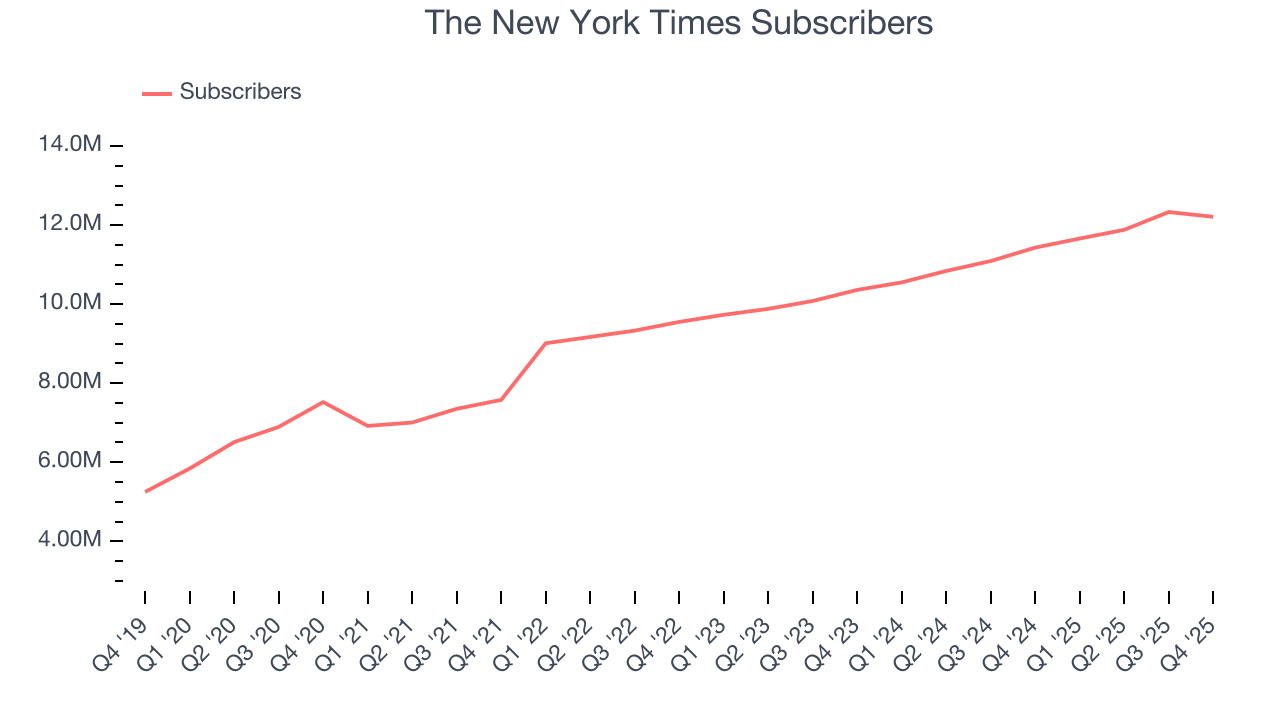

- Subscribers: 12.21 million, up 780,000 year on year

- Market Capitalization: $11.72 billion

Company Overview

Founded in 1851, The New York Times (NYSE:NYT) is an American media organization known for its influential newspaper and expansive digital journalism platforms.

Henry Jarvis Raymond and George Jones established The New York Times to provide factual, unbiased news reporting. This initiative was a response to the prevalent trend of opinionated journalism at the time. Over the years, The New York Times has garnered a reputation for in-depth reporting, earning numerous Pulitzer Prizes and establishing itself as a benchmark in quality news.

The organization offers a comprehensive range of content, including news articles, opinion pieces, features, and investigative journalism, available in both print and digital formats. The company's product portfolio also features Audm, a read-aloud audio service, and The Athletic, a digital-first sports media platform that was acquired in 2022.

The New York Times generates revenue through subscriptions, advertising, and content licensing. It has strategically shifted its focus toward digital subscriptions, adapting to the changing media consumption habits of consumers in the digital age.

4. Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

Competitors in the news publishing and digital media sector include Gannett (NYSE:GCI), News (NASDAQ:NWSA), and E.W. Scripps (NASDAQ:SSP).

5. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, The New York Times’s 9.6% annualized revenue growth over the last five years was weak. This fell short of our benchmark for the consumer discretionary sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. The New York Times’s recent performance shows its demand has slowed as its annualized revenue growth of 7.9% over the last two years was below its five-year trend.

The New York Times also discloses its number of subscribers, which reached 12.21 million in the latest quarter. Over the last two years, The New York Times’s subscribers averaged 9.6% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, The New York Times reported year-on-year revenue growth of 10.4%, and its $802.3 million of revenue exceeded Wall Street’s estimates by 1.4%.

Looking ahead, sell-side analysts expect revenue to grow 6.6% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its products and services will see some demand headwinds.

6. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

The New York Times’s operating margin has been trending up over the last 12 months and averaged 14.5% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports inadequate profitability for a consumer discretionary business.

This quarter, The New York Times generated an operating margin profit margin of 20.1%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

The New York Times’s EPS grew at a weak 20.6% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 9.6% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

In Q4, The New York Times reported adjusted EPS of $0.89, up from $0.80 in the same quarter last year. This print beat analysts’ estimates by 1.1%. Over the next 12 months, Wall Street expects The New York Times’s full-year EPS of $2.47 to grow 9.8%.

8. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

The New York Times has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 17.2%, lousy for a consumer discretionary business.

The New York Times’s free cash flow clocked in at $157.6 million in Q4, equivalent to a 19.6% margin. This cash profitability was in line with the comparable period last year and above its two-year average.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

The New York Times historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 17.3%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, The New York Times’s ROIC averaged 1.2 percentage point increases each year. This is a good sign, and we hope the company can continue improving.

10. Balance Sheet Assessment

One of the best ways to mitigate bankruptcy risk is to hold more cash than debt.

The New York Times is a profitable, well-capitalized company with $1.2 billion of cash and $400,000 of debt on its balance sheet. This $1.2 billion net cash position is 10.2% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

11. Key Takeaways from The New York Times’s Q4 Results

It was good to see The New York Times narrowly top analysts’ revenue expectations this quarter. On the other hand, its number of subscribers missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 2% to $70.77 immediately after reporting.

12. Is Now The Time To Buy The New York Times?

Updated: March 5, 2026 at 9:26 PM EST

When considering an investment in The New York Times, investors should account for its valuation and business qualities as well as what’s happened in the latest quarter.

We see the value of companies helping consumers, but in the case of The New York Times, we’re out. On top of that, The New York Times’s number of subscribers has disappointed, and its projected EPS for the next year is lacking.

The New York Times’s P/E ratio based on the next 12 months is 29.9x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $70.75 on the company (compared to the current share price of $82.79), implying they don’t see much short-term potential in The New York Times.