Republic Services (RSG)

Republic Services doesn’t excite us. It’s recently struggled to grow its revenue, a worrying sign for investors seeking high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why Republic Services Is Not Exciting

Processing several million tons of recyclables annually, Republic (NYSE:RSG) provides waste management services for residences, companies, and municipalities.

- Estimated sales growth of 3.2% for the next 12 months implies demand will slow from its two-year trend

- One positive is that its disciplined cost controls and effective management have materialized in a strong operating margin, and its operating leverage amplified its profits over the last five years

Republic Services doesn’t meet our quality criteria. We’d search for superior opportunities elsewhere.

Why There Are Better Opportunities Than Republic Services

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Republic Services

Republic Services’s stock price of $231.70 implies a valuation ratio of 32x forward P/E. Not only is Republic Services’s multiple richer than most industrials peers, but it’s also expensive for its fundamentals.

There are stocks out there similarly priced with better business quality. We prefer owning these.

3. Republic Services (RSG) Research Report: Q4 CY2025 Update

Waste management company Republic Services (NYSE:RSG) missed Wall Street’s revenue expectations in Q4 CY2025 as sales rose 2.2% year on year to $4.14 billion. The company’s full-year revenue guidance of $17.1 billion at the midpoint came in 1.3% below analysts’ estimates. Its non-GAAP profit of $1.76 per share was 7.9% above analysts’ consensus estimates.

Republic Services (RSG) Q4 CY2025 Highlights:

- Revenue: $4.14 billion vs analyst estimates of $4.21 billion (2.2% year-on-year growth, 1.8% miss)

- Adjusted EPS: $1.76 vs analyst estimates of $1.63 (7.9% beat)

- Adjusted EBITDA: $1.30 billion vs analyst estimates of $1.3 billion (31.3% margin, in line)

- Adjusted EPS guidance for the upcoming financial year 2026 is $7.24 at the midpoint, missing analyst estimates by 0.8%

- EBITDA guidance for the upcoming financial year 2026 is $5.5 billion at the midpoint, below analyst estimates of $5.55 billion

- Operating Margin: 19.3%, in line with the same quarter last year

- Free Cash Flow Margin: 9.8%, down from 11% in the same quarter last year

- Sales Volumes fell 1% year on year (1.2% in the same quarter last year)

- Market Capitalization: $69.09 billion

Company Overview

Processing several million tons of recyclables annually, Republic (NYSE:RSG) provides waste management services for residences, companies, and municipalities.

Republic Services was founded in 1998, founded from the merger of Republic Waste Services and Republic Industries. In its early years, it focused on building a foundation by acquiring smaller local and regional waste management companies. The company’s most transformative acquisition came in 2008 when it acquired Allied Waste Industries for $6.1 billion. This significantly expanded Republic’s scale, resources, and capabilities while eliminating a key competitor.

Republic provides curbside waste and recycling collection services based on a pickup schedule for residences, commercial businesses, municipalities, and the industrial sector. When doing so, it considers complex waste management needs by offering specialized services needed for hazardous waste disposal, construction debris, or handling food waste. Once waste is deposited in the landfill, it undergoes compaction to reduce its volume which helps extend the lifespan of the landfill.

Additionally, it operates numerous recycling centers that process paper, cardboard, plastics, and metals. These facilities play a crucial role in diverting waste from landfills, conserving natural resources, and reducing greenhouse gas emissions.

The company engages in contracts that vary in length but typically span several years, though agreements can be for upwards of a decade. Pricing for these contracts can be structured based on factors such as the volume of waste generated, frequency of service, and additional service requests.

4. Waste Management

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

Competitors offering similar products include Waste Management (NYSE:WM), Waste Connections (NYSE:WCN), and Casella Waste Systems (NASDAQ:CWST).

5. Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Republic Services’s sales grew at a solid 10.3% compounded annual growth rate over the last five years. Its growth beat the average industrials company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Republic Services’s recent performance shows its demand has slowed as its annualized revenue growth of 5.3% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

We can dig further into the company’s revenue dynamics by analyzing its number of units sold. Over the last two years, Republic Services’s units sold were flat. Because this number is lower than its revenue growth, we can see the company benefited from price increases.

This quarter, Republic Services’s revenue grew by 2.2% year on year to $4.14 billion, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its newer products and services will not accelerate its top-line performance yet. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

Gross profit margin is a critical metric to track because it sheds light on its pricing power, complexity of products, and ability to procure raw materials, equipment, and labor.

Republic Services’s unit economics are great compared to the broader industrials sector and signal that it enjoys product differentiation through quality or brand. As you can see below, it averaged an excellent 41.6% gross margin over the last five years. Said differently, roughly $41.62 was left to spend on selling, marketing, R&D, and general administrative overhead for every $100 in revenue.

Republic Services’s gross profit margin came in at 41.9% this quarter , marking a 5.3 percentage point decrease from 47.2% in the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs (such as raw materials and manufacturing expenses) have been stable and it isn’t under pressure to lower prices.

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Republic Services has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 19%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Republic Services’s operating margin rose by 1.5 percentage points over the last five years, as its sales growth gave it operating leverage.

In Q4, Republic Services generated an operating margin profit margin of 19.3%, in line with the same quarter last year. This indicates the company’s cost structure has recently been stable.

8. Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Republic Services’s EPS grew at a remarkable 14.4% compounded annual growth rate over the last five years, higher than its 10.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into Republic Services’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Republic Services’s operating margin was flat this quarter but expanded by 1.5 percentage points over the last five years. On top of that, its share count shrank by 3.1%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Republic Services, its two-year annual EPS growth of 11.9% was lower than its five-year trend. We still think its growth was good and hope it can accelerate in the future.

In Q4, Republic Services reported adjusted EPS of $1.76, up from $1.58 in the same quarter last year. This print beat analysts’ estimates by 7.9%. Over the next 12 months, Wall Street expects Republic Services’s full-year EPS of $7.01 to grow 4.1%.

9. Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Republic Services has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 13.8% over the last five years.

Taking a step back, we can see that Republic Services’s margin expanded by 2.2 percentage points during that time. This is encouraging because it gives the company more optionality.

Republic Services’s free cash flow clocked in at $404 million in Q4, equivalent to a 9.8% margin. The company’s cash profitability regressed as it was 1.3 percentage points lower than in the same quarter last year, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings. Long-term trends trump fluctuations.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Republic Services’s management team makes decent investment decisions and generates value for shareholders. Its five-year average ROIC was 10.9%, slightly better than typical industrials business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Republic Services’s ROIC averaged 1.6 percentage point increases each year. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

11. Balance Sheet Assessment

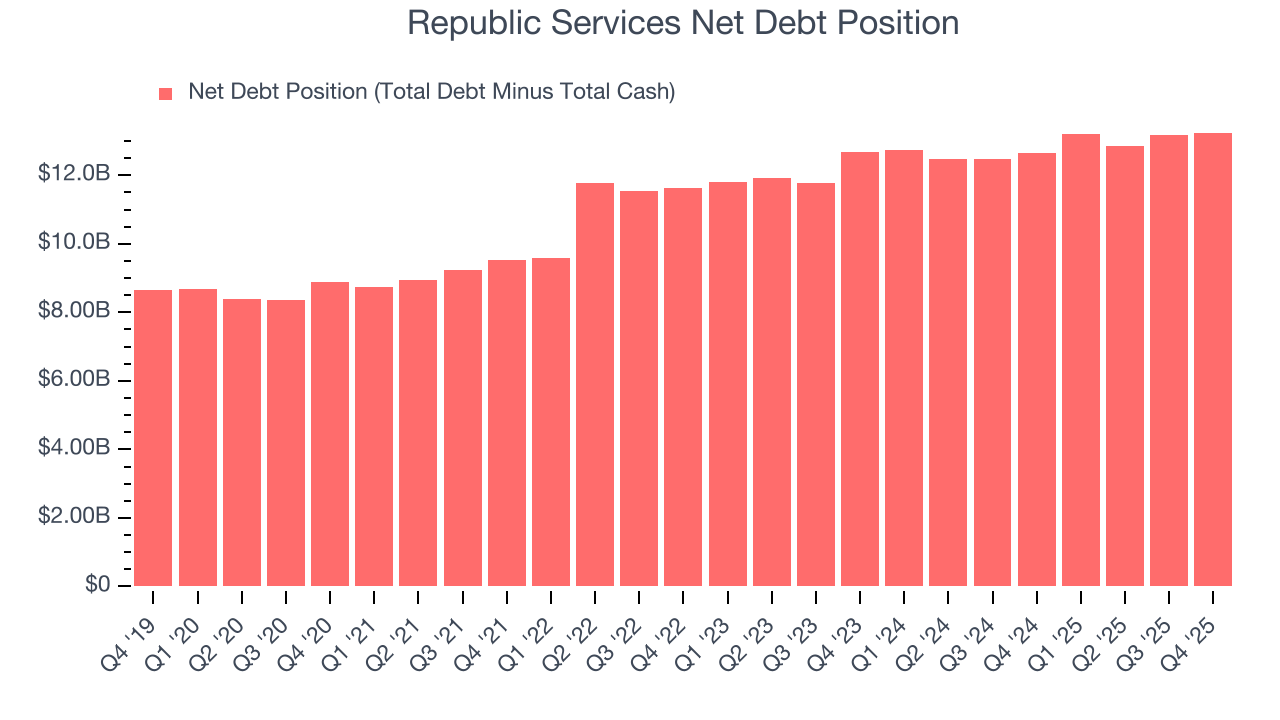

Republic Services reported $335 million of cash and $13.58 billion of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $5.31 billion of EBITDA over the last 12 months, we view Republic Services’s 2.5× net-debt-to-EBITDA ratio as safe. We also see its $278 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

12. Key Takeaways from Republic Services’s Q4 Results

It was good to see Republic Services beat analysts’ EPS expectations this quarter. On the other hand, its revenue missed and its full-year revenue guidance fell slightly short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 1.5% to $217.97 immediately following the results.

13. Is Now The Time To Buy Republic Services?

Updated: March 5, 2026 at 10:15 PM EST

Before deciding whether to buy Republic Services or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

Republic Services doesn’t top our investment wishlist, but we understand that it’s not a bad business. First off, its revenue growth was solid over the last five years. And while Republic Services’s flat unit sales disappointed, its impressive operating margins show it has a highly efficient business model.

Republic Services’s P/E ratio based on the next 12 months is 32x. Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are superior stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $244.46 on the company (compared to the current share price of $231.70).