Angi (ANGI)

Angi doesn’t impress us. Its declining sales show demand has evaporated, a red flag for investors seeking high-quality stocks.― StockStory Analyst Team

1. News

2. Summary

Why Angi Is Not Exciting

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

- Sales tumbled by 17.2% annually over the last three years, showing consumer trends are working against its favor

- Engagement has been a thorn in its side as its service requests averaged 20.6% declines

- On the plus side, its platform is difficult to replicate at scale and results in a best-in-class gross margin of 95%

Angi is in the penalty box. There are more rewarding stocks elsewhere.

Why There Are Better Opportunities Than Angi

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Angi

Angi is trading at $12.71 per share, or 5.1x forward EV/EBITDA. Angi’s valuation may seem like a great deal, but we think there are valid reasons why it’s so cheap.

Cheap stocks can look like a great deal at first glance, but they can be value traps. They often have less earnings power, meaning there is more reliance on a re-rating to generate good returns - an unlikely scenario for low-quality companies.

3. Angi (ANGI) Research Report: Q3 CY2025 Update

Home services online marketplace ANGI (NASDAQ: ANGI) missed Wall Street’s revenue expectations in Q3 CY2025, with sales falling 10.5% year on year to $265.6 million. Its GAAP profit of $0.23 per share was 37.5% below analysts’ consensus estimates.

Angi (ANGI) Q3 CY2025 Highlights:

- Revenue: $265.6 million vs analyst estimates of $268.8 million (10.5% year-on-year decline, 1.2% miss)

- EPS (GAAP): $0.23 vs analyst expectations of $0.37 (37.5% miss)

- Operating Margin: 8.2%, up from 2.6% in the same quarter last year

- Free Cash Flow Margin: 1.8%, down from 16.1% in the previous quarter

- Market Capitalization: $578.7 million

Company Overview

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

Angi is an online marketplace focused on the large and very fragmented home services market. The marketplace seeks to match consumers' service requests with service professionals for a variety of home projects – everything from hanging a television to redoing a kitchen. Customers have the option to ask for a bid for a project or choose from a fixed price for a service, with the latter option the increasing focus for the business as consumers prefer the quicker time to service and lack of negotiation, while service providers who respond get assured revenue, rather than a negotiation or a fruitless waste of their advertising dollars.

For US homeowners who are generally faced with 6-10 household jobs per year, from replacing a dishwasher or boiler to wiring a new home entertainment system, Angi provides an aggregated collection of peer reviewed certified local service providers. For the service providers, Angi is another customer acquisition tool, where they can set defined budgets and measure how much business is coming in.

Many companies have tried their hand at building online marketplaces for home services but have struggled to match supply and demand; Angi is by far the largest platform in the US.

4. Gig Economy

The iPhone changed the world, ushering in the era of the “always-on” internet and “on-demand” services - anything someone could want is just a few taps away. Likewise, the gig economy sprang up in a similar fashion, with a proliferation of tech-enabled freelance labor marketplaces, which work hand and hand with many on demand services. Individuals can now work on demand too. What began with tech-enabled platforms that aggregated riders and drivers has expanded over the past decade to include food delivery, groceries, and now even a plumber or graphic designer are all just a few taps away.

Angi (NASDAQ: ANGI) competitors include Thumbtack, Houzz, Meta Platforms (NASDAQ:FB), Yelp (NYSE: YELP), and Porch Group (NASDAQ: PRCH)

5. Revenue Growth

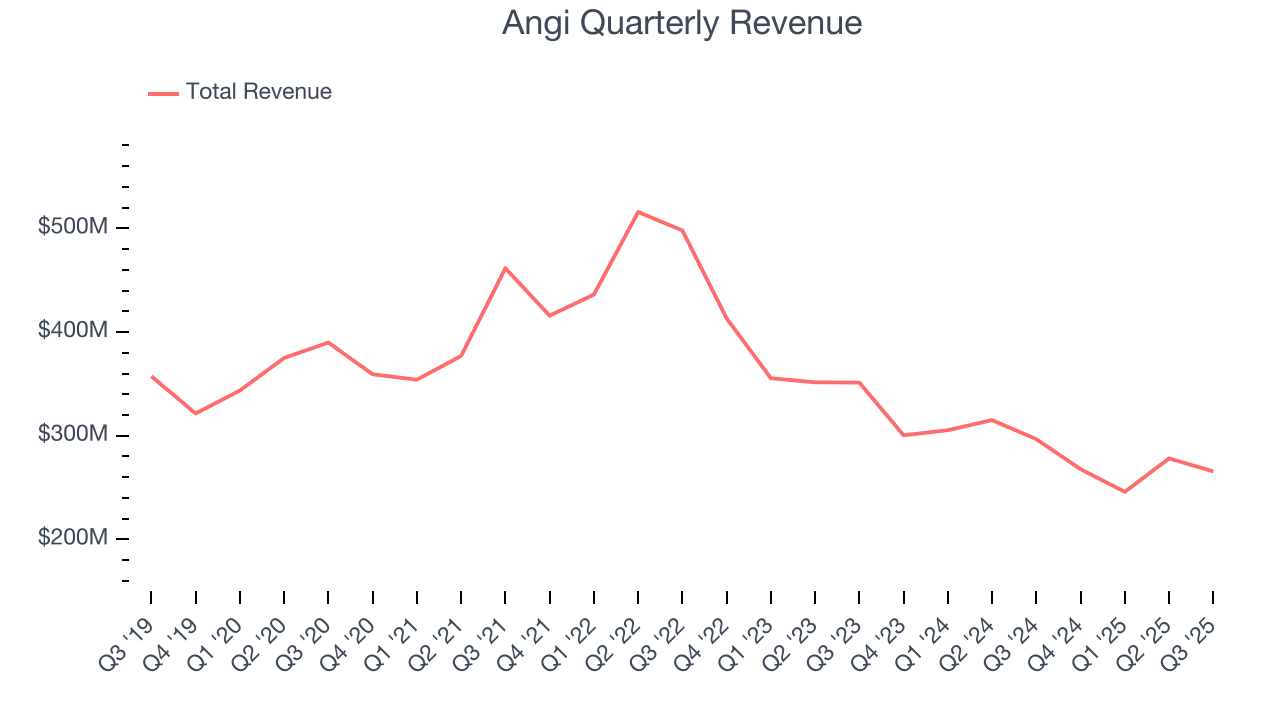

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Angi’s demand was weak and its revenue declined by 17.2% per year. This was below our standards and is a rough starting point for our analysis.

This quarter, Angi missed Wall Street’s estimates and reported a rather uninspiring 10.5% year-on-year revenue decline, generating $265.6 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 2.2% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

6. Service Requests

Request Growth

As a gig economy marketplace, Angi generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

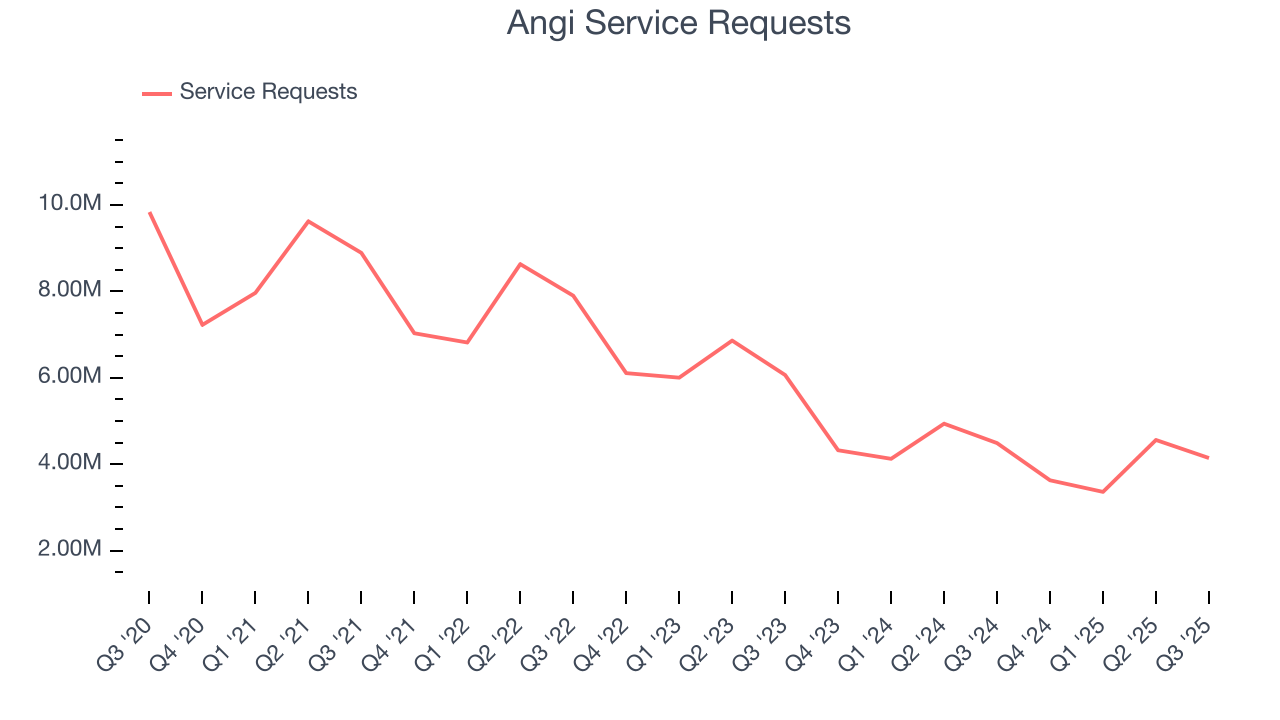

Angi struggled with new customer acquisition over the last two years as its service requests have declined by 20.6% annually to 4.14 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Angi wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

In Q3, Angi’s service requests once again decreased by 346,000, a 7.7% drop since last year. On the bright side, the quarterly print was higher than its two-year result and suggests its new initiatives are accelerating request growth.

Revenue Per Request

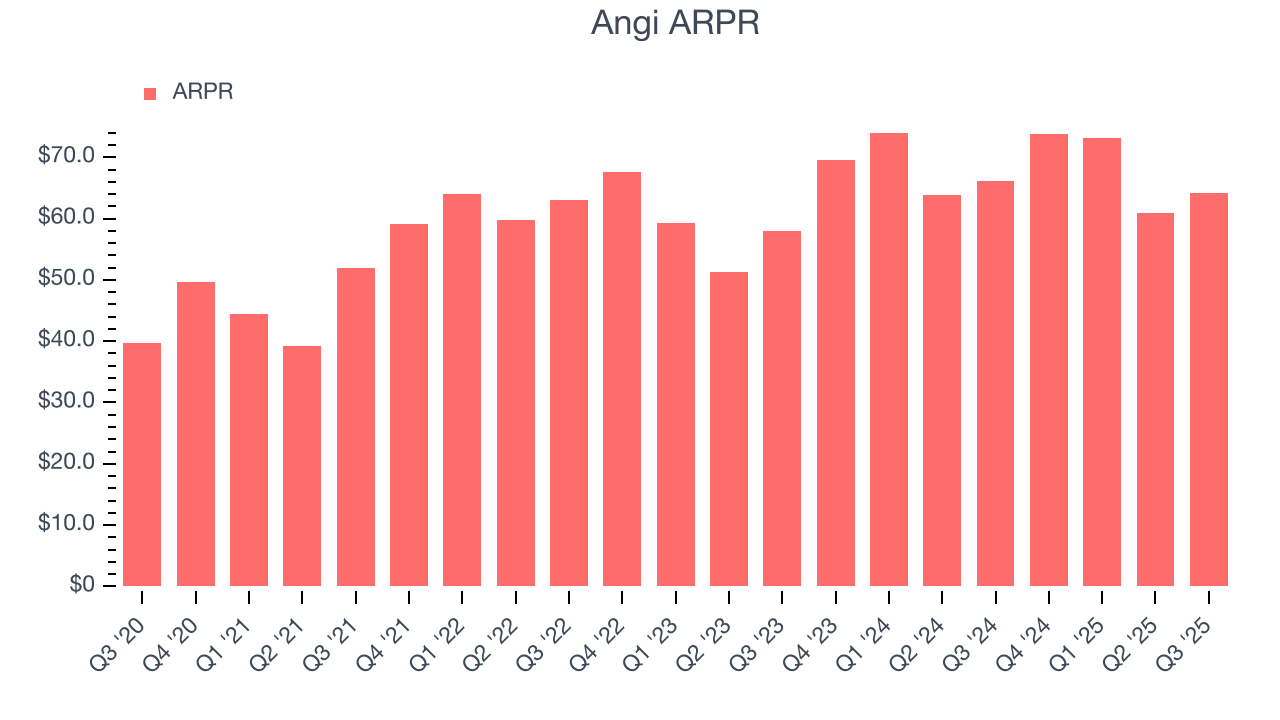

Average revenue per request (ARPR) is a critical metric to track because it measures how much the company earns in transaction fees from each request. This number also informs us about Angi’s take rate, which represents its pricing leverage over the ecosystem, or "cut" from each transaction.

Angi’s ARPR growth has been impressive over the last two years, averaging 8%. Although its service requests shrank during this time, the company’s ability to successfully increase monetization demonstrates its platform’s value for existing requests.

This quarter, Angi’s ARPR clocked in at $64.10. It declined 3% year on year but outperformed the change in its service requests.

7. Gross Margin & Pricing Power

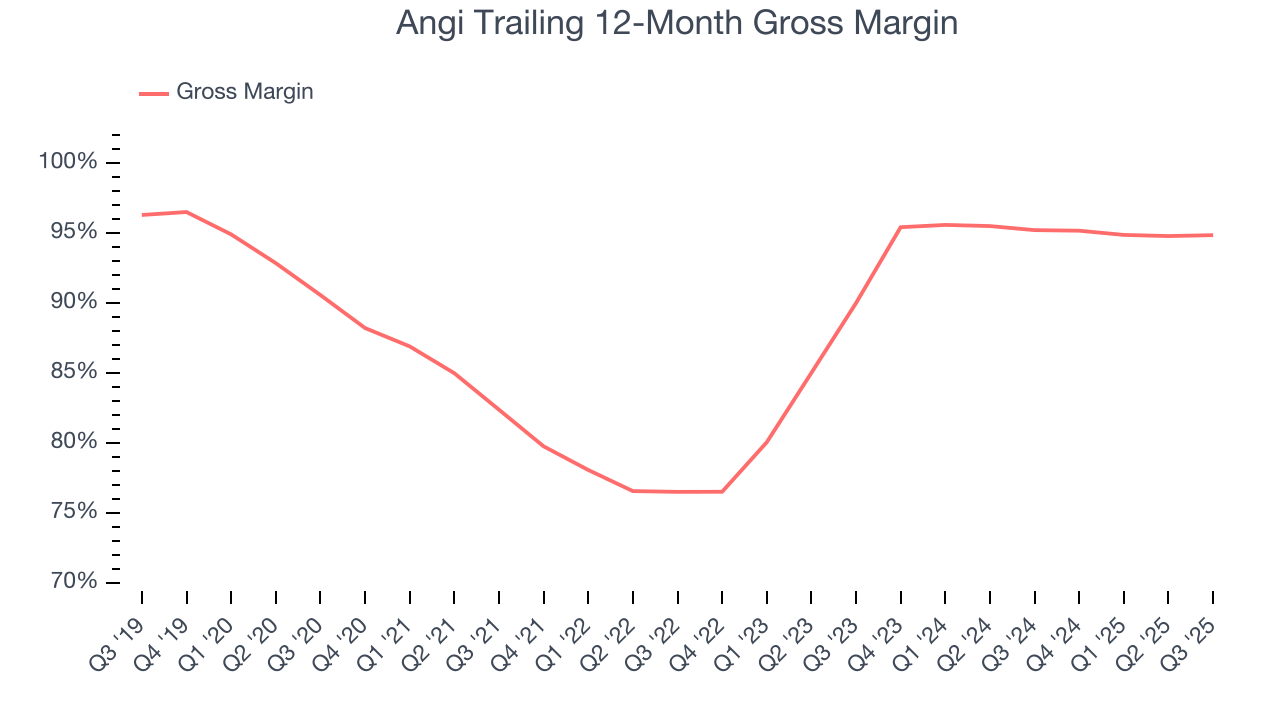

For gig economy businesses like Angi, gross profit tells us how much money the company gets to keep after covering the base cost of its products and services, which typically include server hosting, customer support, and payment processing fees. Another cost of revenue could also be insurance to protect against liabilities arising from providing transportation, housing, or freelance work services.

Angi’s gross margin is one of the highest in the consumer internet sector, an output of its asset-lite business model and strong pricing power. It also enables the company to fund large investments in product and marketing during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an elite 95% gross margin over the last two years. Said differently, roughly $95.05 was left to spend on selling, marketing, and R&D for every $100 in revenue.

In Q3, Angi produced a 95.3% gross profit margin, in line with the same quarter last year. Zooming out, the company’s full-year margin has remained steady over the past 12 months, suggesting its input costs have been stable and it isn’t under pressure to lower prices.

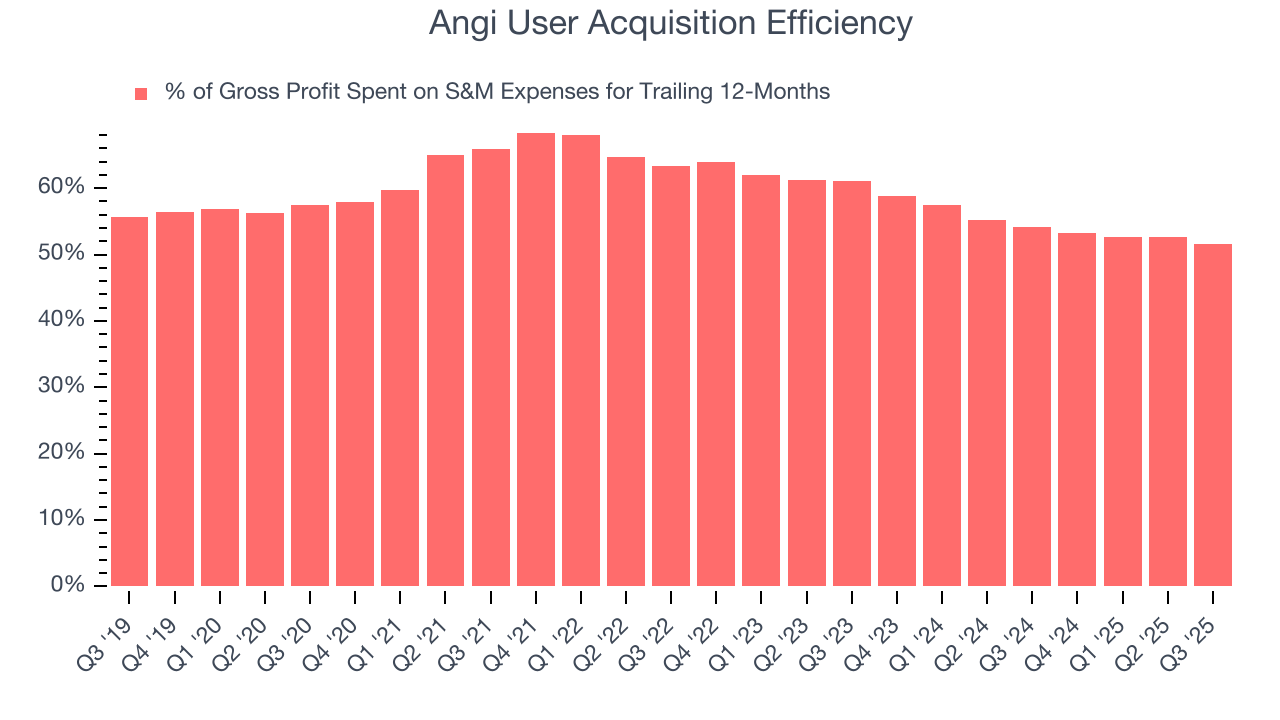

8. User Acquisition Efficiency

Unlike enterprise software that’s typically sold by dedicated sales teams, consumer internet businesses like Angi grow from a combination of product virality, paid advertisement, and incentives.

It’s expensive for Angi to acquire new users as the company has spent 51.6% of its gross profit on sales and marketing expenses over the last year. This inefficiency indicates that Angi’s product offering can be easily replicated and that it must continue investing to maintain an acceptable growth trajectory.

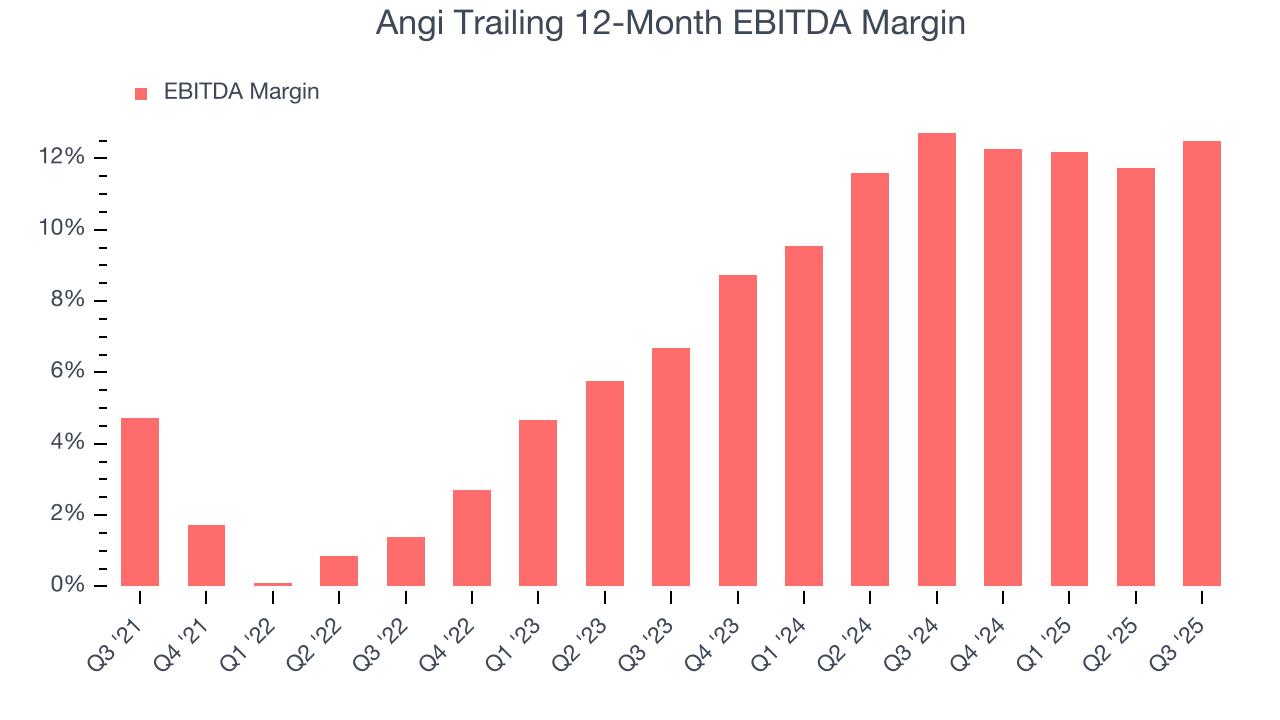

9. EBITDA

Operating income is often evaluated to assess a company’s underlying profitability. In a similar vein, EBITDA is used to analyze consumer internet companies because it excludes various one-time or non-cash expenses (depreciation), providing a clearer view of the business’s profit potential.

Angi has been an efficient company over the last two years. It was one of the more profitable businesses in the consumer internet sector, boasting an average EBITDA margin of 12.6%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Angi’s EBITDA margin rose by 11.1 percentage points over the last few years, showing its efficiency has improved.

In Q3, Angi generated an EBITDA margin profit margin of 14.9%, up 3 percentage points year on year. The increase was encouraging, and because its EBITDA margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

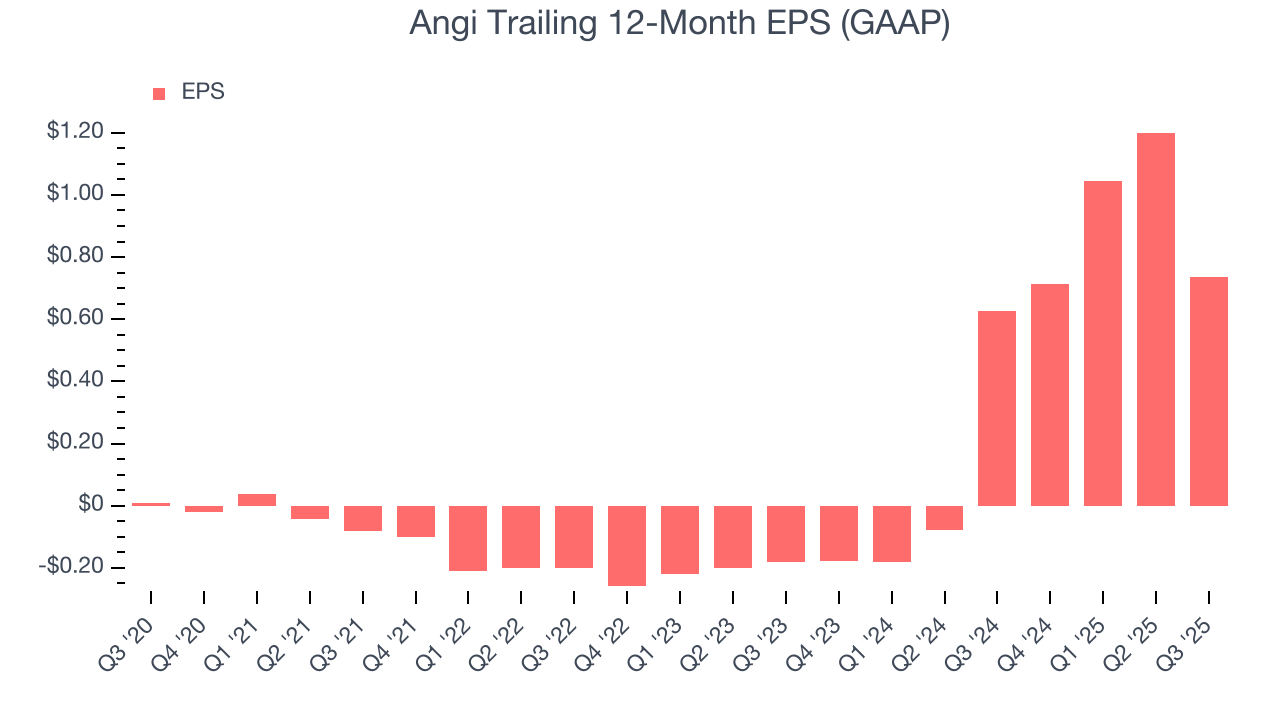

10. Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

In Q3, Angi reported EPS of $0.23, down from $0.70 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Angi’s full-year EPS of $0.73 to grow 102%.

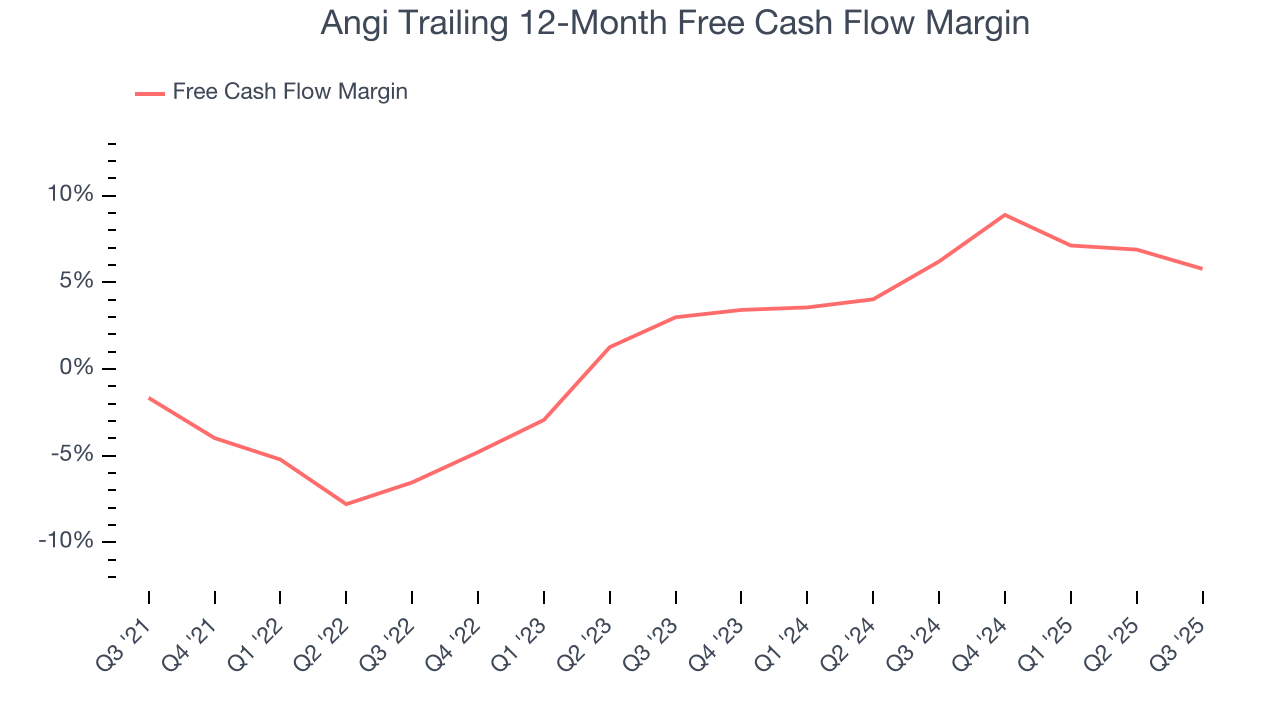

11. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Angi has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6% over the last two years, slightly better than the broader consumer internet sector.

Taking a step back, we can see that Angi’s margin expanded by 12.3 percentage points over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Angi’s free cash flow clocked in at $4.9 million in Q3, equivalent to a 1.8% margin. The company’s cash profitability regressed as it was 4.5 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

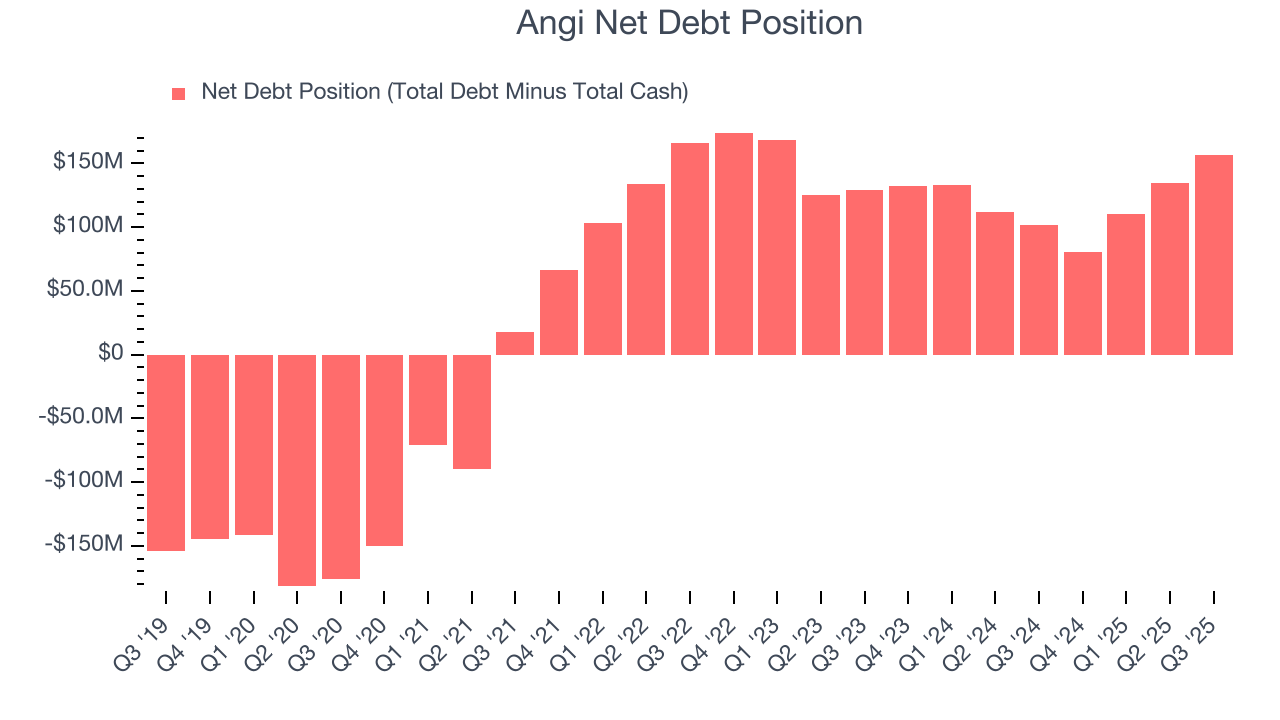

12. Balance Sheet Assessment

Angi reported $340.7 million of cash and $497.5 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $132.1 million of EBITDA over the last 12 months, we view Angi’s 1.2× net-debt-to-EBITDA ratio as safe. We also see its $2.81 million of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

13. Key Takeaways from Angi’s Q3 Results

Both revenue and EPS missed. Overall, this was a softer quarter. The stock traded down 12.4% to $11.27 immediately following the results.

14. Is Now The Time To Buy Angi?

Updated: January 23, 2026 at 9:20 PM EST

Are you wondering whether to buy Angi or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

Angi has a few positive attributes, but it doesn’t top our wishlist. Although its revenue has declined over the last three years, its growth over the next 12 months is expected to be higher. And while Angi’s service requests have declined, its admirable gross margins are a wonderful starting point for the overall profitability of the business.

Angi’s EV/EBITDA ratio based on the next 12 months is 5.1x. This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere.

Wall Street analysts have a consensus one-year price target of $20.86 on the company (compared to the current share price of $12.71).