Cal-Maine (CALM)

We’d invest in Cal-Maine. Its blend of high growth and robust profitability makes for an attractive return algorithm.― StockStory Analyst Team

1. News

2. Summary

Why We Like Cal-Maine

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ:CALM) produces, packages, and distributes eggs.

- Disciplined cost controls and effective management have materialized in a strong operating margin, and its operating leverage amplified its profits over the last year

- Powerful free cash flow generation enables it to reinvest its profits or return capital to investors consistently, and its rising cash conversion increases its margin of safety

- Stellar returns on capital showcase management’s ability to surface highly profitable business ventures, and its returns are climbing as it finds even more attractive growth opportunities

Cal-Maine is a market leader. The price looks reasonable in light of its quality, so this might be a favorable time to invest in some shares.

Why Is Now The Time To Buy Cal-Maine?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Cal-Maine?

Cal-Maine’s stock price of $79.65 implies a valuation ratio of 13.8x forward P/E. Valuation is lower than most companies in the consumer staples space, and we believe Cal-Maine is attractively-priced for its quality.

Our analysis and backtests show high-quality businesses routinely outperform the market over a multi-year period, especially when priced like this.

3. Cal-Maine (CALM) Research Report: Q4 CY2025 Update

Egg company Cal-Maine Foods (NASDAQ:CALM) fell short of the markets revenue expectations in Q4 CY2025, with sales falling 19.4% year on year to $769.5 million. Its GAAP profit of $2.13 per share was 9.9% above analysts’ consensus estimates.

Cal-Maine (CALM) Q4 CY2025 Highlights:

- Revenue: $769.5 million vs analyst estimates of $794.6 million (19.4% year-on-year decline, 3.2% miss)

- EPS (GAAP): $2.13 vs analyst estimates of $1.94 (9.9% beat)

- Operating Margin: 16.1%, down from 29.2% in the same quarter last year

- Market Capitalization: $3.84 billion

Company Overview

Known for brands such as Egg-Land’s Best and Land O’ Lakes, Cal-Maine (NASDAQ:CALM) produces, packages, and distributes eggs.

The company was founded in 1957 by Fred R. Adams. Over time, Cal-Maine grew organically and also capitalized on strategic acquisitions. One of the largest was its 2012 purchase of Pilgrim Pride’s (NASDAQ:PPC) egg production assets. Today, it is one of the largest producers and distributors of eggs in the United States.

The product is self-explanatory, but Cal-Maine’s operations are vertically integrated and complex. The company starts by hatching chicks and growing flocks. These flocks produce eggs, which are then processed, packaged, and distributed. The company specifically offers eggs in six categories:cage-free, organic, brown, free-range, pasture-raised, and nutritionally enhanced as specialty eggs.

Cal-Maine distributes its eggs to large retailers and supermarkets. The end customer tends to be the buyer of groceries for a household, and most households will have a carton of eggs in the refrigerator at all times. These customers may buy eggs for family breakfasts, baking purposes, or some combination.

4. Perishable Food

The perishable food industry is diverse, encompassing large-scale producers and distributors to specialty and artisanal brands. These companies sell produce, dairy products, meats, and baked goods and have become integral to serving modern American consumers who prioritize freshness, quality, and nutritional value. Investing in perishable food stocks presents both opportunities and challenges. While the perishable nature of products can introduce risks related to supply chain management and shelf life, it also creates a constant demand driven by the necessity for fresh food. Companies that can efficiently manage inventory, distribution, and quality control are well-positioned to thrive in this competitive market. Navigating the perishable food industry requires adherence to strict food safety standards, regulations, and labeling requirements.

Vital Farms (NASDAQ:VITL) is a publicly-traded competitor. Private competitors include Rose Acre Farms Hillandale Farms, but Cal-Maine’s scale and market share are unique.

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $4.21 billion in revenue over the past 12 months, Cal-Maine carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale. On the bright side, it can still flex high growth rates because it’s working from a smaller revenue base.

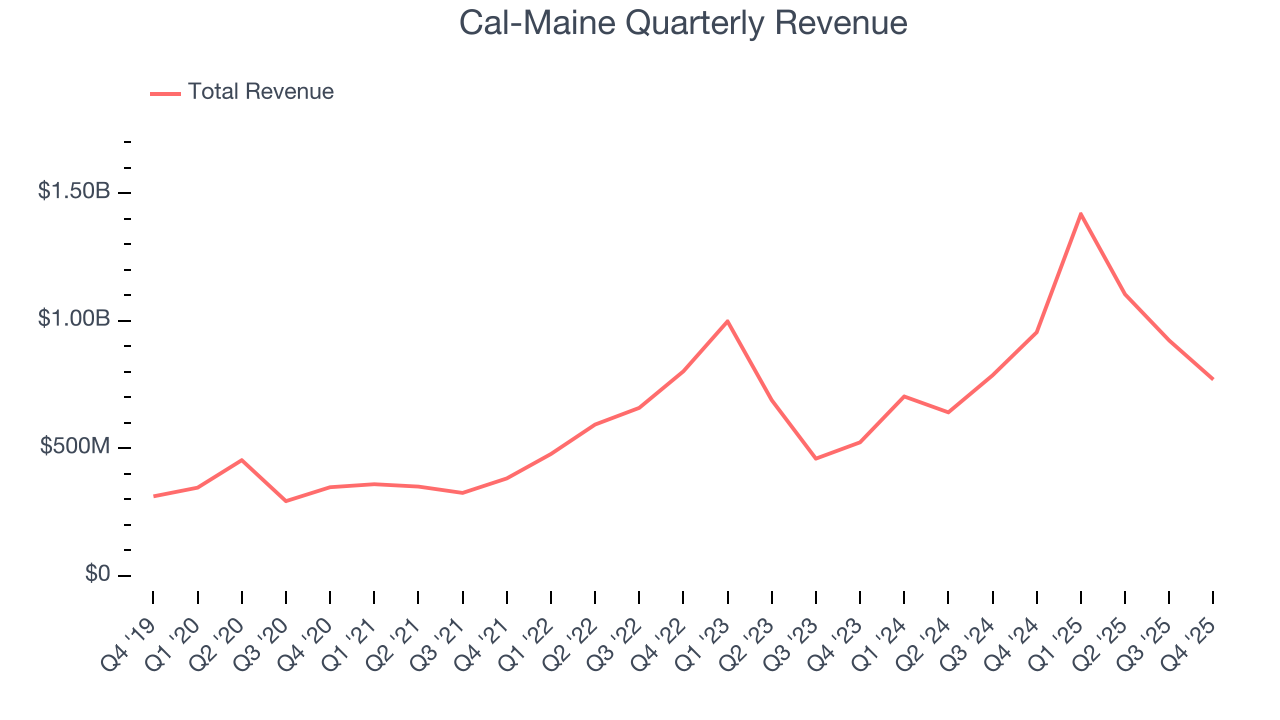

As you can see below, Cal-Maine’s sales grew at an impressive 18.5% compounded annual growth rate over the last three years. This is a great starting point for our analysis because it shows Cal-Maine’s demand was higher than many consumer staples companies.

This quarter, Cal-Maine missed Wall Street’s estimates and reported a rather uninspiring 19.4% year-on-year revenue decline, generating $769.5 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 28% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and suggests its products will face some demand challenges. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

All else equal, we prefer higher gross margins because they usually indicate that a company sells more differentiated products, has a stronger brand, and commands pricing power.

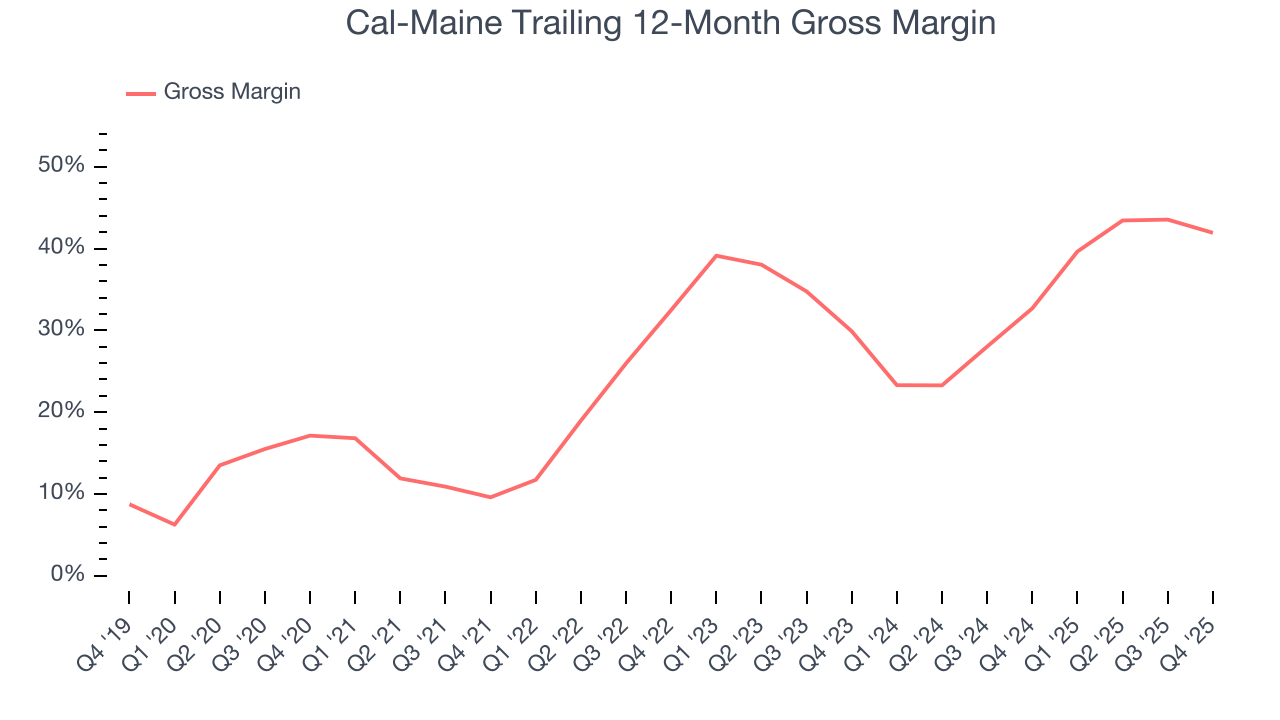

Cal-Maine has good unit economics for a consumer staples company, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see below, it averaged an impressive 38% gross margin over the last two years. Said differently, Cal-Maine paid its suppliers $61.98 for every $100 in revenue.

In Q4, Cal-Maine produced a 27% gross profit margin, marking a 10.3 percentage point decrease from 37.3% in the same quarter last year. On a wider time horizon, however, Cal-Maine’s full-year margin has been trending up over the past 12 months, increasing by 9.2 percentage points. If this move continues, it could suggest an environment where the company has better pricing power and stable or shrinking input costs (such as raw materials).

7. Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

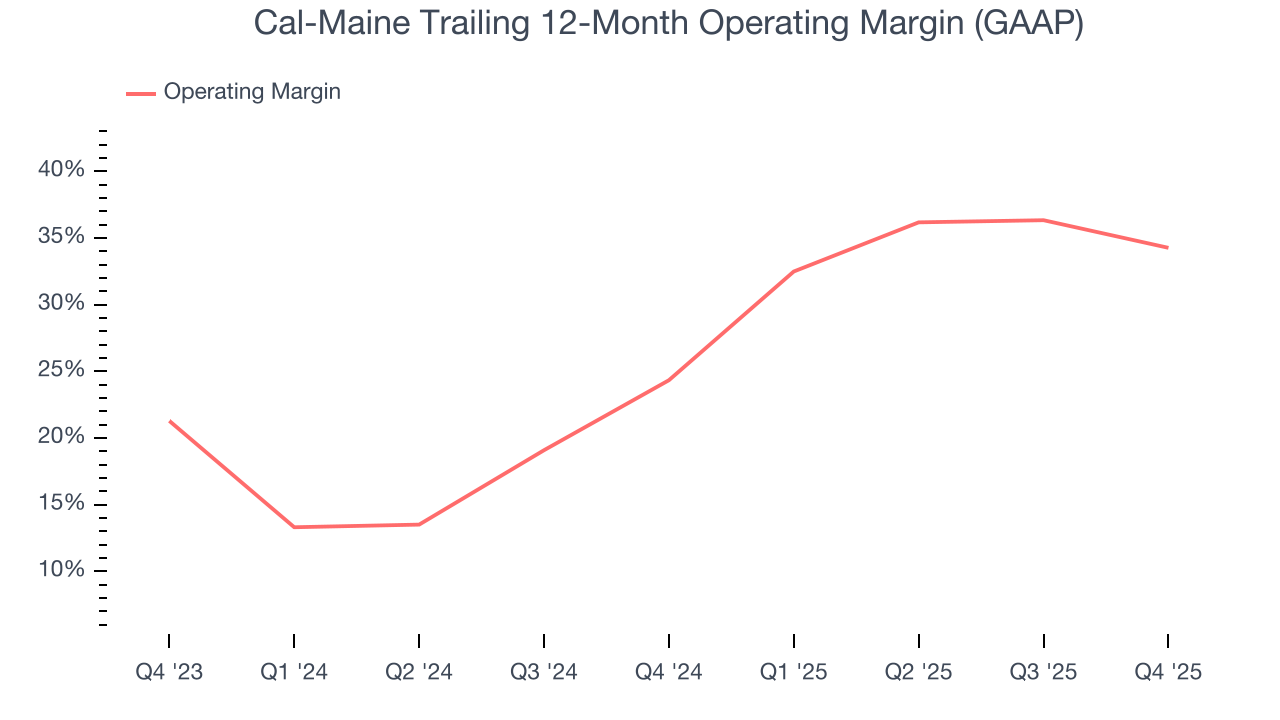

Cal-Maine has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer staples business, boasting an average operating margin of 30.1%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Cal-Maine’s operating margin rose by 9.9 percentage points over the last year, as its sales growth gave it immense operating leverage.

In Q4, Cal-Maine generated an operating margin profit margin of 16.1%, down 13.1 percentage points year on year. Since Cal-Maine’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, and administrative overhead increased.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

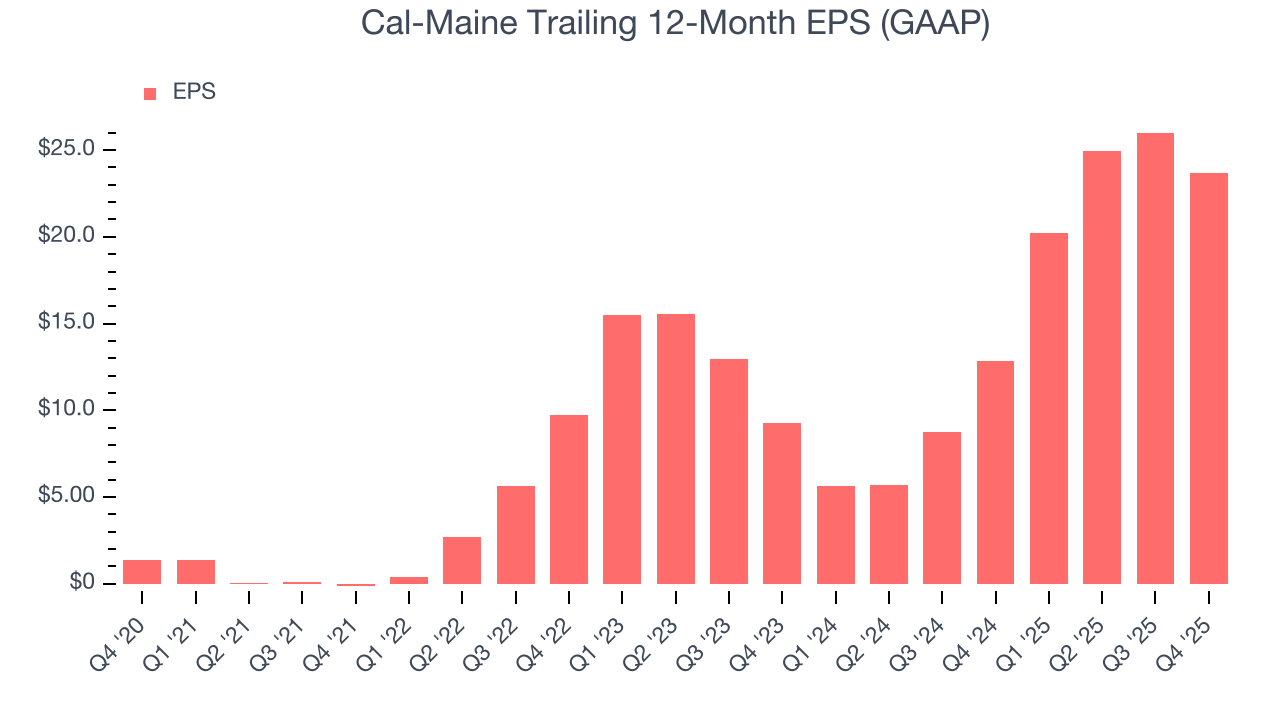

Cal-Maine’s EPS grew at an astounding 34.6% compounded annual growth rate over the last three years, higher than its 18.5% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

In Q4, Cal-Maine reported EPS of $2.13, down from $4.47 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 9.9%. Over the next 12 months, Wall Street expects Cal-Maine’s full-year EPS of $23.67 to shrink by 75.7%.

9. Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

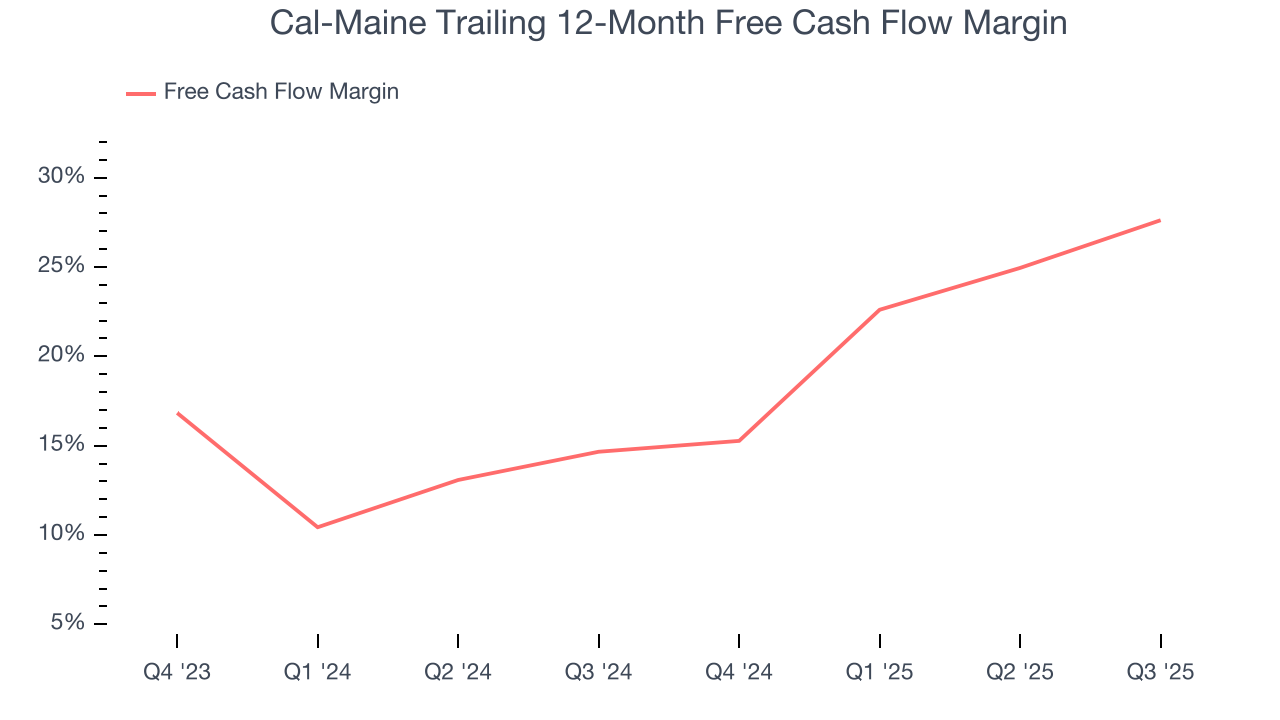

Cal-Maine has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 24.4% over the last two years.

10. Return on Invested Capital (ROIC)

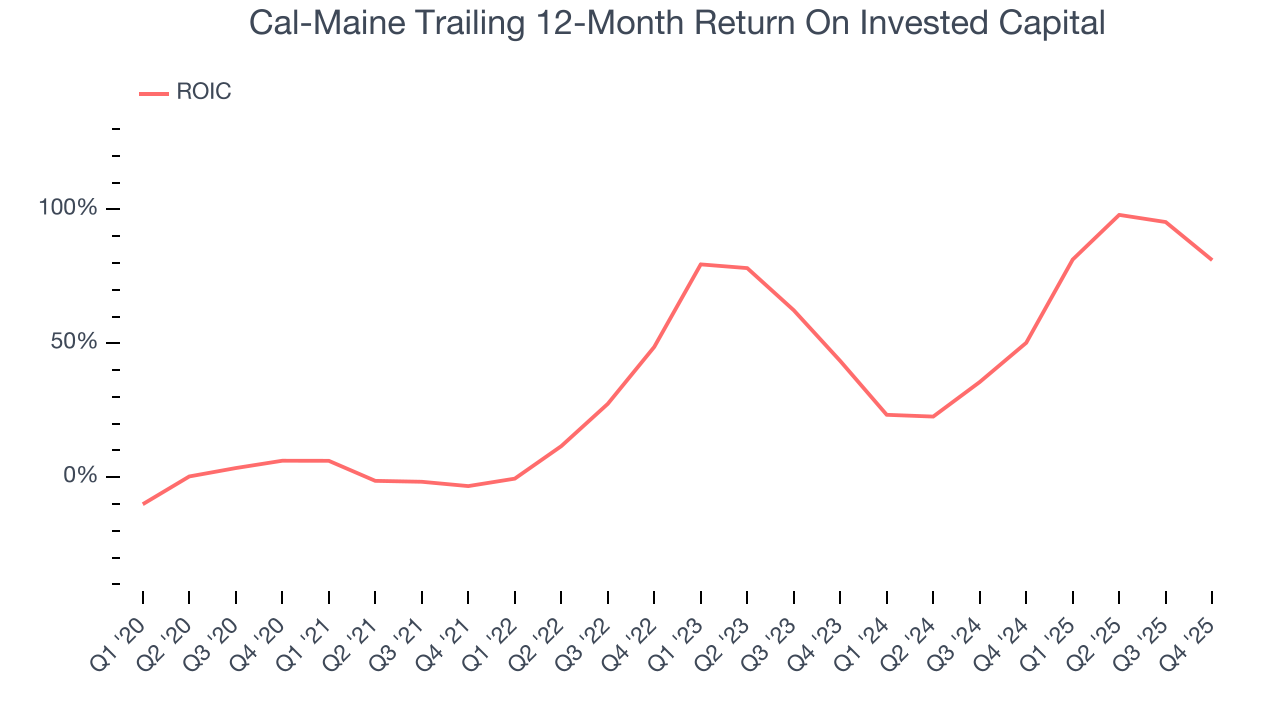

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Cal-Maine’s five-year average ROIC was 44%, placing it among the best consumer staples companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

11. Key Takeaways from Cal-Maine’s Q4 Results

We were impressed by how significantly Cal-Maine blew past analysts’ gross margin expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its revenue missed. Overall, this quarter was mixed. Still, the stock traded up 1.8% to $80.47 immediately following the results.

12. Is Now The Time To Buy Cal-Maine?

Updated: January 7, 2026 at 6:51 AM EST

Before deciding whether to buy Cal-Maine or pass, we urge investors to consider business quality, valuation, and the latest quarterly results.

In our opinion, Cal-Maine is a solid company. First off, its revenue growth was impressive over the last three years. And while its projected EPS for the next year is lacking, its impressive operating margins show it has a highly efficient business model. On top of that, its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

Cal-Maine’s P/E ratio based on the next 12 months is 16.5x. Looking across the spectrum of consumer staples companies today, Cal-Maine’s fundamentals shine bright. We like the stock at this price.

Wall Street analysts have a consensus one-year price target of $95.50 on the company (compared to the current share price of $80.25), implying they see 19% upside in buying Cal-Maine in the short term.