Inter Parfums (IPAR)

Inter Parfums is intriguing. It generates heaps of cash that are reinvested into the business, creating a virtuous cycle of returns.― StockStory Analyst Team

1. News

2. Summary

Why Inter Parfums Is Interesting

With licenses to produce colognes and perfumes under brands such as Kate Spade, Van Cleef & Arpels, and Abercrombie & Fitch, Inter Parfums (NASDAQ:IPAR) manufactures and distributes fragrances worldwide.

- Products command premium prices and lead to a premier gross margin of 56.7%

- Stellar returns on capital showcase management’s ability to surface highly profitable business ventures

- A drawback is its subscale operations are evident in its revenue base of $1.49 billion, meaning it has fewer distribution channels than its larger rivals (but more room for growth)

Inter Parfums almost passes our quality test. If you’ve been itching to buy the stock, the valuation looks reasonable.

Why Is Now The Time To Buy Inter Parfums?

High Quality

Investable

Underperform

Why Is Now The Time To Buy Inter Parfums?

Inter Parfums is trading at $94.46 per share, or 19.6x forward P/E. When stacked up against other consumer staples companies, we think Inter Parfums’s multiple is fair for the fundamentals you get.

Now could be a good time to invest if you believe in the story.

3. Inter Parfums (IPAR) Research Report: Q4 CY2025 Update

Fragrance and perfume company Inter Parfums (NASDAQ:IPAR) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 6.8% year on year to $386.2 million. On the other hand, the company’s full-year revenue guidance of $1.48 billion at the midpoint came in 2% below analysts’ estimates. Its GAAP profit of $0.88 per share was 11.4% above analysts’ consensus estimates.

Inter Parfums (IPAR) Q4 CY2025 Highlights:

- Revenue: $386.2 million vs analyst estimates of $376.8 million (6.8% year-on-year growth, 2.5% beat)

- EPS (GAAP): $0.88 vs analyst estimates of $0.79 (11.4% beat)

- EPS (GAAP) guidance for the upcoming financial year 2026 is $4.85 at the midpoint, missing analyst estimates by 0.8%

- Operating Margin: 7.1%, down from 10% in the same quarter last year

- Market Capitalization: $3.26 billion

Company Overview

With licenses to produce colognes and perfumes under brands such as Kate Spade, Van Cleef & Arpels, and Abercrombie & Fitch, Inter Parfums (NASDAQ:IPAR) manufactures and distributes fragrances worldwide.

The company was founded in 1982 by Jean Madar and Philippe Benacin. Inter Parfums initially began as a distributor of imported European fragrances in the United States. Today, the company focuses on fragrances for the luxury to premium market with a capital-light model where Inter Parfums owns no manufacturing facilities but instead acts as a general contractor that sources from suppliers.

In addition to the brands mentioned, Inter Parfums portfolio of brands and partnerships include Coach, Jimmy Choo, Lacoste, and Montblanc. The Inter Parfums core customer is therefore consumers who seek out elevated brands that boast a combination of recognition and exclusivity. The buyers of these fragrances view personal scent as a key ingredient in their presentation and appearance, as important as clothing and accessories.

Inter Parfums' products are predominantly found in upscale department stores, specialty retailers, and duty-free shops across the globe. To maintain the luxury posture, products tend not to be available at discount retailers, drugstores, and lower-tier department stores.

4. Personal Care

While personal care products products may seem more discretionary than food, consumers tend to maintain or even boost their spending on the category during tough times. This phenomenon is known as "the lipstick effect" by economists, which states that consumers still want some semblance of affordable luxuries like beauty and wellness when the economy is sputtering. Consumer tastes are constantly changing, and personal care companies are currently responding to the public’s increased desire for ethically produced goods by featuring natural ingredients in their products.

Competitors in the luxury fragrance market include Estée Lauder (NYSE:EL) and L'Oréal (ENXTPA:OR).

5. Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $1.49 billion in revenue over the past 12 months, Inter Parfums is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

As you can see below, Inter Parfums’s 11.1% annualized revenue growth over the last three years was decent. This shows its offerings generated slightly more demand than the average consumer staples company, a helpful starting point for our analysis.

This quarter, Inter Parfums reported year-on-year revenue growth of 6.8%, and its $386.2 million of revenue exceeded Wall Street’s estimates by 2.5%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and implies its products will face some demand challenges. At least the company is tracking well in other measures of financial health.

6. Gross Margin & Pricing Power

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Inter Parfums has best-in-class unit economics for a consumer staples company, enabling it to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an elite 56.7% gross margin over the last two years. That means Inter Parfums only paid its suppliers $43.34 for every $100 in revenue.

This quarter, Inter Parfums’s gross profit margin was 61.5%, up 5.2 percentage points year on year. Inter Parfums’s full-year margin has also been trending up over the past 12 months, increasing by 1.8 percentage points. If this move continues, it could suggest better unit economics due to more leverage from its growing sales on the fixed portion of its cost of goods sold (such as manufacturing expenses).

7. Operating Margin

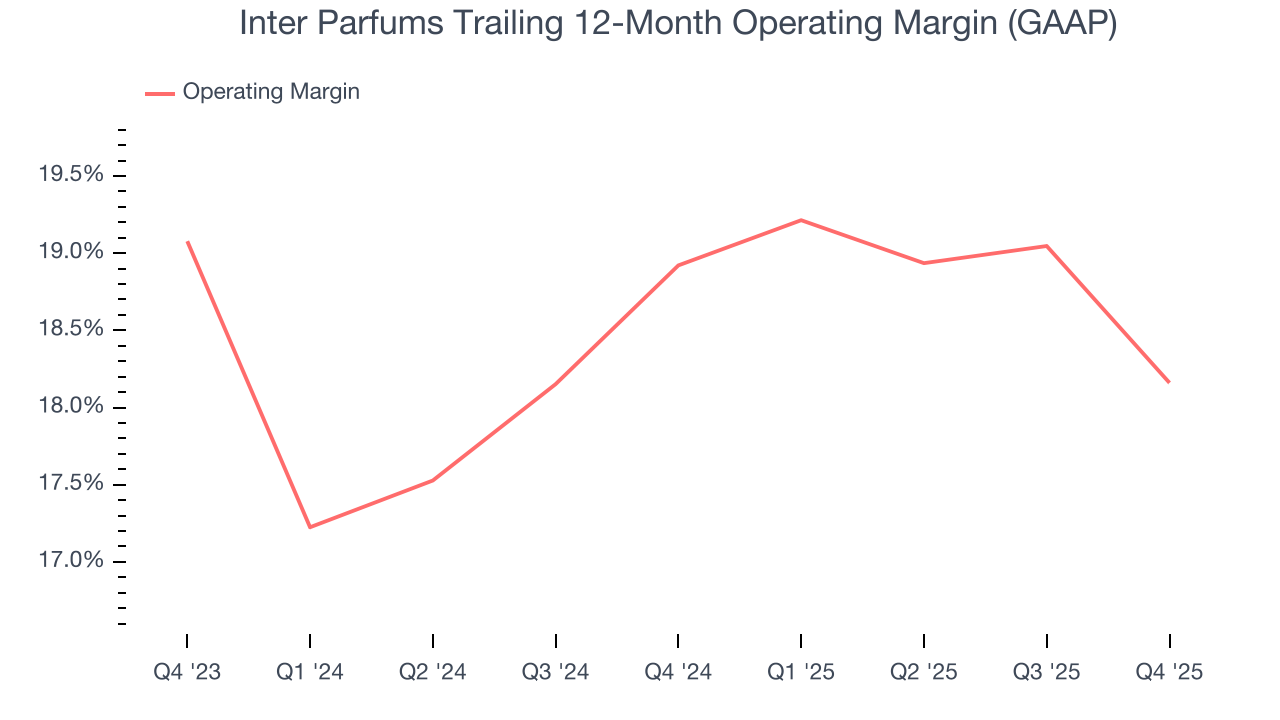

Inter Parfums’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 18.5% over the last two years. This profitability was top-notch for a consumer staples business, showing it’s an well-run company with an efficient cost structure. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Inter Parfums’s operating margin might fluctuated slightly but has generally stayed the same over the last year. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q4, Inter Parfums generated an operating margin profit margin of 7.1%, down 2.8 percentage points year on year. Conversely, its revenue and gross margin actually rose, so we can assume it was less efficient because its operating expenses like marketing, and administrative overhead grew faster than its revenue.

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Inter Parfums’s solid 11.5% annual EPS growth over the last three years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

In Q4, Inter Parfums reported EPS of $0.88, up from $0.75 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Inter Parfums’s full-year EPS of $5.24 to shrink by 7.3%.

9. Cash Is King

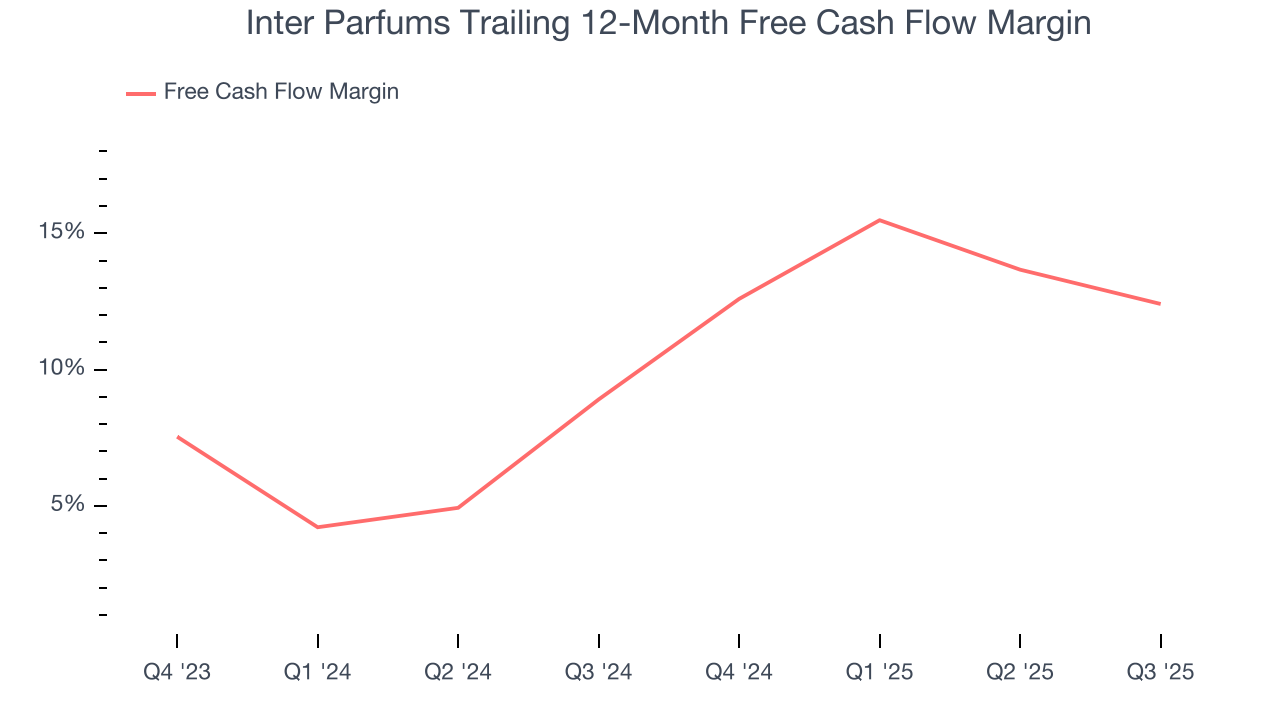

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Inter Parfums has shown impressive cash profitability, driven by its attractive business model that gives it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 8.9% over the last two years, better than the broader consumer staples sector.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Inter Parfums’s five-year average ROIC was 26.5%, placing it among the best consumer staples companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

11. Balance Sheet Assessment

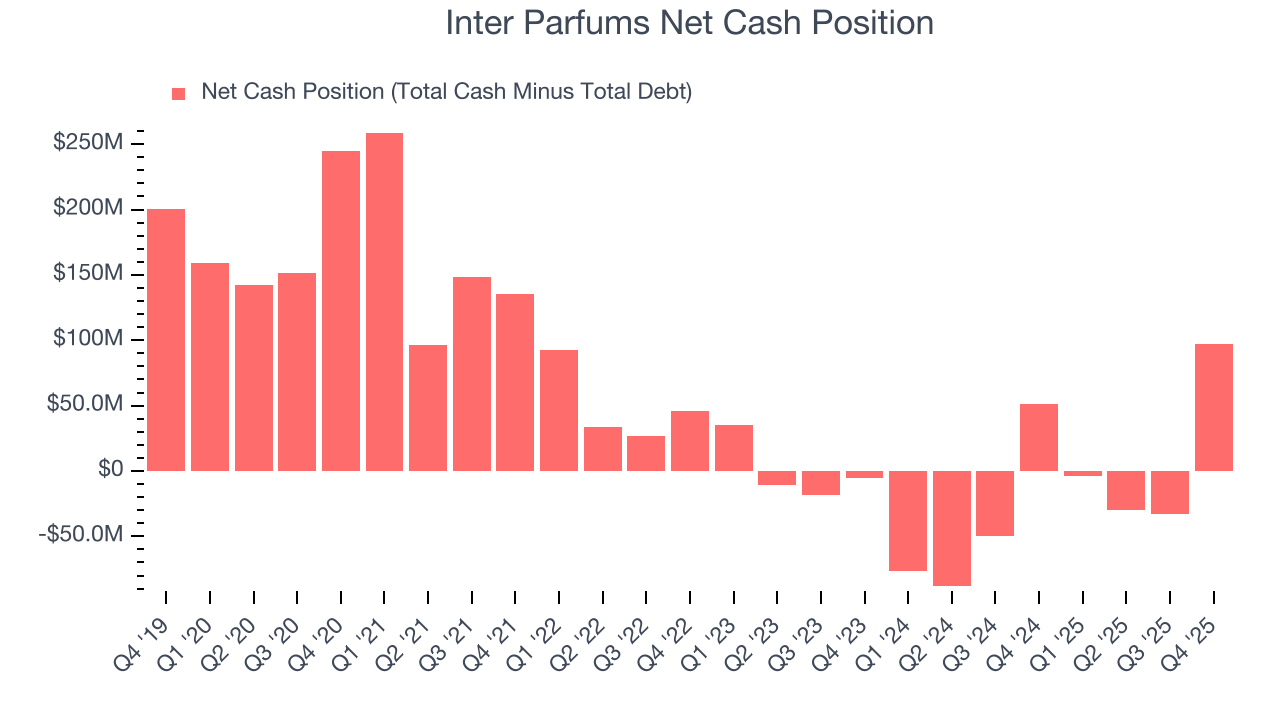

Businesses that maintain a cash surplus face reduced bankruptcy risk.

Inter Parfums is a profitable, well-capitalized company with $295.2 million of cash and $198.3 million of debt on its balance sheet. This $96.86 million net cash position is 2.9% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Inter Parfums’s Q4 Results

It was encouraging to see Inter Parfums beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. On the other hand, its gross margin missed and its full-year revenue guidance fell short of Wall Street’s estimates. Overall, this quarter was mixed. The stock remained flat at $103.01 immediately after reporting.

13. Is Now The Time To Buy Inter Parfums?

Updated: March 9, 2026 at 11:01 PM EDT

Are you wondering whether to buy Inter Parfums or pass? We urge investors to not only consider the latest earnings results but also longer-term business quality and valuation as well.

In our opinion, Inter Parfums is a good company. First off, its revenue growth was solid over the last three years. And while its projected EPS for the next year is lacking, its admirable gross margins are a wonderful starting point for the overall profitability of the business. On top of that, its stellar ROIC suggests it has been a well-run company historically.

Inter Parfums’s P/E ratio based on the next 12 months is 19.3x. Looking at the consumer staples landscape right now, Inter Parfums trades at a pretty interesting price. For those confident in the business and its management team, this is a good time to invest.

Wall Street analysts have a consensus one-year price target of $111.20 on the company (compared to the current share price of $92.87), implying they see 19.7% upside in buying Inter Parfums in the short term.