Intuitive Surgical (ISRG)

Intuitive Surgical is intriguing. Its fusion of growth, profitability, and encouraging prospects makes it an appealing asset.― StockStory Analyst Team

1. News

2. Summary

Why Intuitive Surgical Is Interesting

Pioneering minimally invasive surgery since its first da Vinci system was FDA-cleared in 2000, Intuitive Surgical (NASDAQ:ISRG) develops and manufactures robotic-assisted surgical systems that enable minimally invasive procedures across various medical specialties.

- Successful business model is illustrated by its impressive adjusted operating margin

- Earnings growth has trumped its peers over the last five years as its EPS has compounded at 21.4% annually

- The stock is expensive, and we believe it’s best to wait until its quality rises or its valuation falls

Intuitive Surgical has some noteworthy aspects. This is a good company to add to your watchlist.

Why Should You Watch Intuitive Surgical

High Quality

Investable

Underperform

Why Should You Watch Intuitive Surgical

At $503.12 per share, Intuitive Surgical trades at 49.6x forward P/E. The rich valuation multiple means there is a lot of good news priced into the stock; short-term price swings could result if anything bursts that bubble.

Intuitive Surgical could improve its business quality by stringing together a few solid quarters. We’d be more open to buying the stock when that time comes.

3. Intuitive Surgical (ISRG) Research Report: Q4 CY2025 Update

Medical technology company Intuitive Surgical (NASDAQ:ISRG) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 18.8% year on year to $2.87 billion. Its non-GAAP profit of $2.53 per share was 11.6% above analysts’ consensus estimates.

Intuitive Surgical (ISRG) Q4 CY2025 Highlights:

- Revenue: $2.87 billion vs analyst estimates of $2.74 billion (18.8% year-on-year growth, 4.6% beat)

- Adjusted EPS: $2.53 vs analyst estimates of $2.27 (11.6% beat)

- Adjusted EBITDA: $1.07 billion vs analyst estimates of $1.15 billion (37.4% margin, 6.8% miss)

- Operating Margin: 30.2%, in line with the same quarter last year

- Market Capitalization: $185.6 billion

Company Overview

Pioneering minimally invasive surgery since its first da Vinci system was FDA-cleared in 2000, Intuitive Surgical (NASDAQ:ISRG) develops and manufactures robotic-assisted surgical systems that enable minimally invasive procedures across various medical specialties.

Intuitive's flagship product is the da Vinci surgical system, which translates a surgeon's hand movements into precise micro-movements of instruments inside the patient. The system consists of a surgeon console where the doctor operates while viewing a 3D high-definition image, a patient-side cart with robotic arms that manipulate specialized instruments, and a vision system that provides the 3D view of the surgical field.

The company offers several da Vinci models, including its newest fifth-generation da Vinci 5 system, as well as the da Vinci X, Xi, and SP (single-port) systems. Each system is complemented by a range of specialized instruments and accessories designed for specific surgical applications. These instruments include wristed tools that provide natural dexterity, staplers, and energy devices for tissue sealing.

In 2019, Intuitive expanded beyond surgery into diagnostic procedures with its Ion endoluminal system, which enables minimally invasive lung biopsies using an ultra-thin, maneuverable catheter that can navigate deep into the peripheral lung to access small, difficult-to-reach lesions.

Intuitive generates revenue through the initial sale of its systems (capital equipment), recurring sales of instruments and accessories that have limited uses before replacement, comprehensive service contracts, and training programs. The company's business model relies on this mix of one-time capital sales and ongoing recurring revenue.

The company's technology is used across five primary surgical specialties: general surgery (hernia repair, colorectal procedures), urology (prostatectomy, partial nephrectomy), gynecology (hysterectomy, sacrocolpopexy), cardiothoracic surgery (lobectomy), and head and neck surgery. Surgeons have performed millions of procedures using da Vinci systems worldwide.

Intuitive places significant emphasis on training and education, offering progressive learning pathways for surgeons, residents, and operating room staff through both in-person training at dedicated centers and technology-enabled platforms like SimNow, a simulation system that allows surgeons to practice their skills in a virtual environment.

The company also provides digital solutions that connect its systems to cloud-based services for proactive monitoring, software updates, and data insights that help hospitals optimize their robotic surgery programs.

4. Surgical Equipment & Consumables - Specialty

The surgical equipment and consumables industry provides tools, devices, and disposable products essential for surgeries and medical procedures. These companies therefore benefit from relatively consistent demand, driven by the ongoing need for medical interventions, recurring revenue from consumables, and long-term contracts with hospitals and healthcare providers. However, the high costs of R&D and regulatory compliance, coupled with intense competition and pricing pressures from cost-conscious customers, can constrain profitability. Over the next few years, tailwinds include aging populations, which tend to need surgical interventions at higher rates. The increasing integration of AI and robotics into surgical procedures could also create opportunities for differentiation and innovation. However, the industry faces headwinds including potential supply chain vulnerabilities, evolving regulatory requirements, and more widespread efforts to make healthcare less costly.

Intuitive Surgical's competitors include Johnson & Johnson (NYSE:JNJ) with its Ottava robotic surgery platform, Medtronic (NYSE:MDT) with its Hugo system, Stryker (NYSE:SYK) with its Mako platform for orthopedic procedures, and Zimmer Biomet (NYSE:ZBH) with its Rosa surgical robot. The company also faces competition from Asensus Surgical (NYSE:ASXC) and privately-held companies like CMR Surgical and Vicarious Surgical.

5. Economies of Scale

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With $10.06 billion in revenue over the past 12 months, Intuitive Surgical has decent scale. This is important as it gives the company more leverage in a heavily regulated, competitive environment that is complex and resource-intensive.

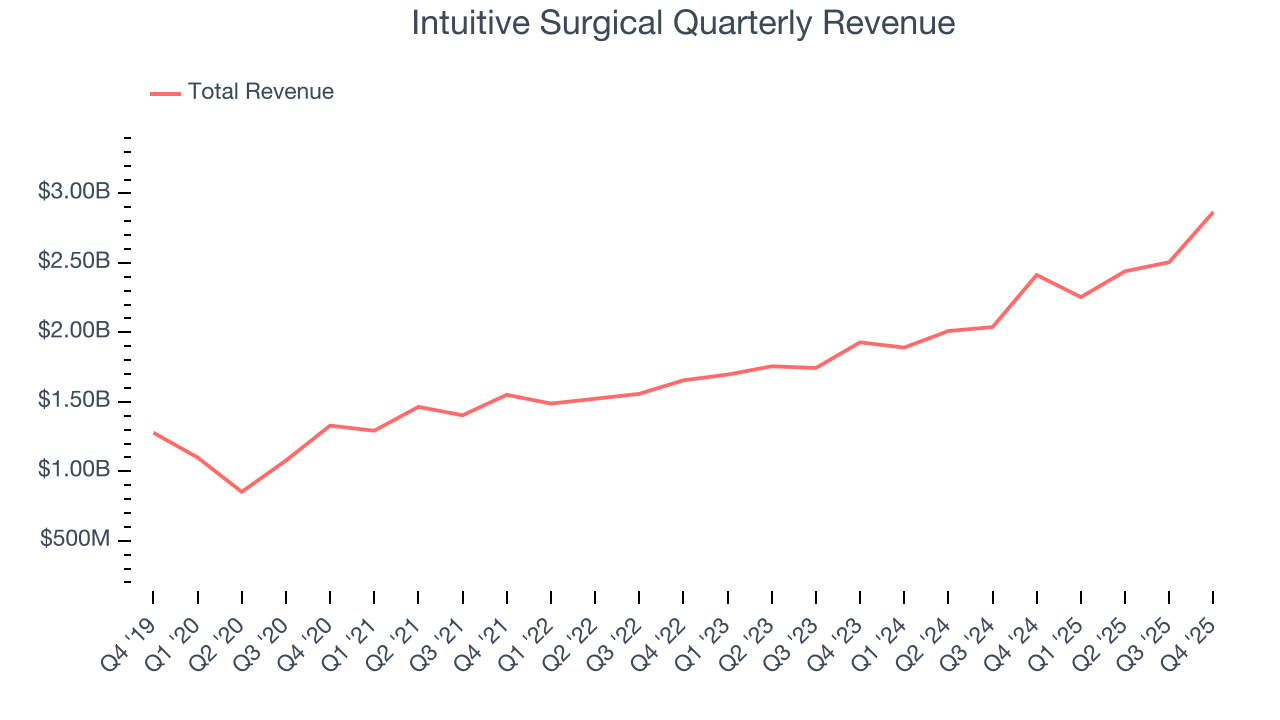

6. Revenue Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Intuitive Surgical’s 18.2% annualized revenue growth over the last five years was impressive. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Intuitive Surgical’s annualized revenue growth of 18.9% over the last two years aligns with its five-year trend, suggesting its demand was predictably strong.

This quarter, Intuitive Surgical reported year-on-year revenue growth of 18.8%, and its $2.87 billion of revenue exceeded Wall Street’s estimates by 4.6%.

Looking ahead, sell-side analysts expect revenue to grow 12.8% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is attractive given its scale and suggests the market is baking in success for its products and services.

7. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Intuitive Surgical has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 27.9%.

Looking at the trend in its profitability, Intuitive Surgical’s operating margin decreased by 2.6 percentage points over the last five years, but it rose by 4.5 percentage points on a two-year basis. We like Intuitive Surgical and hope it can right the ship.

This quarter, Intuitive Surgical generated an operating margin profit margin of 30.2%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

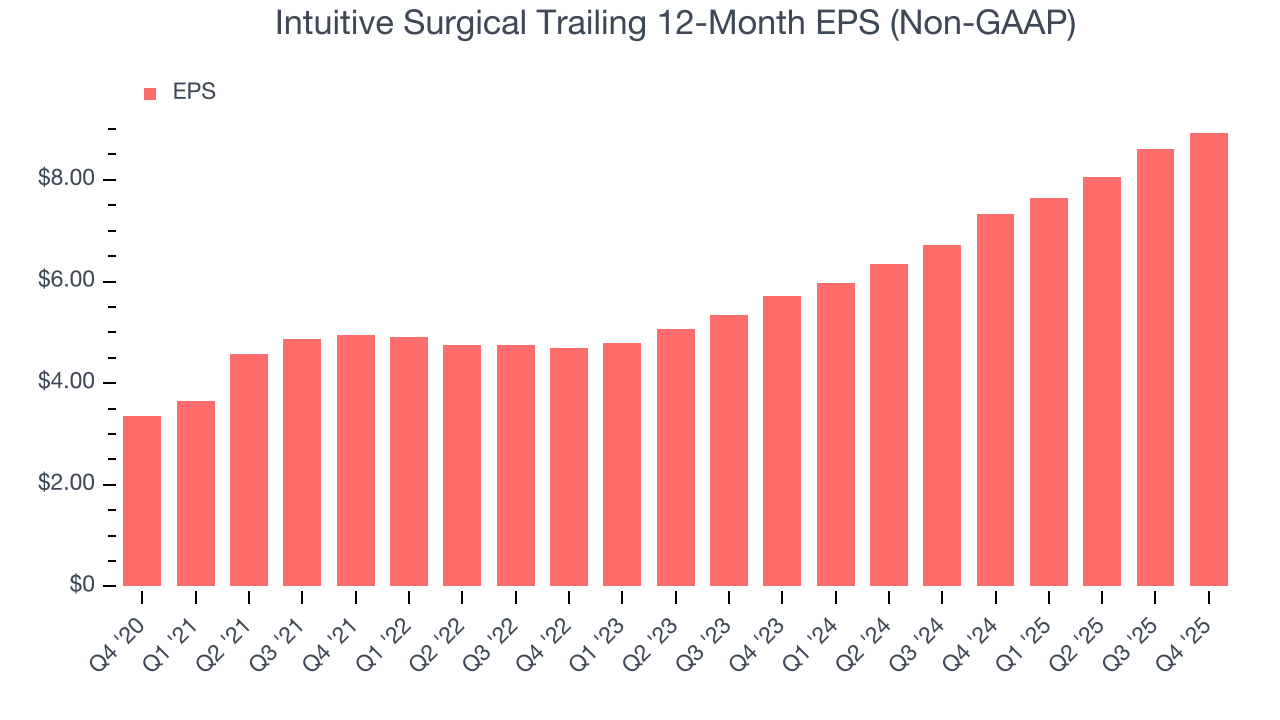

8. Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Intuitive Surgical’s EPS grew at an astounding 21.6% compounded annual growth rate over the last five years, higher than its 18.2% annualized revenue growth. However, we take this with a grain of salt because its operating margin didn’t improve and it didn’t repurchase its shares, meaning the delta came from reduced interest expenses or taxes.

In Q4, Intuitive Surgical reported adjusted EPS of $2.53, up from $2.21 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Intuitive Surgical’s full-year EPS of $8.93 to grow 8.5%.

9. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Intuitive Surgical has shown robust cash profitability, giving it an edge over its competitors and the ability to reinvest or return capital to investors. The company’s free cash flow margin averaged 18.8% over the last five years, quite impressive for a healthcare business.

Taking a step back, we can see that Intuitive Surgical’s margin dropped by 7.3 percentage points during that time. If its declines continue, it could signal increasing investment needs and capital intensity.

10. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Intuitive Surgical’s five-year average ROIC was 17.2%, beating other healthcare companies by a wide margin. This illustrates its management team’s ability to invest in attractive growth opportunities and produce tangible results for shareholders.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Uneventfully, Intuitive Surgical’s ROIC has stayed the same over the last few years. Rising returns would be ideal, but this is still a noteworthy feat since they're already high.

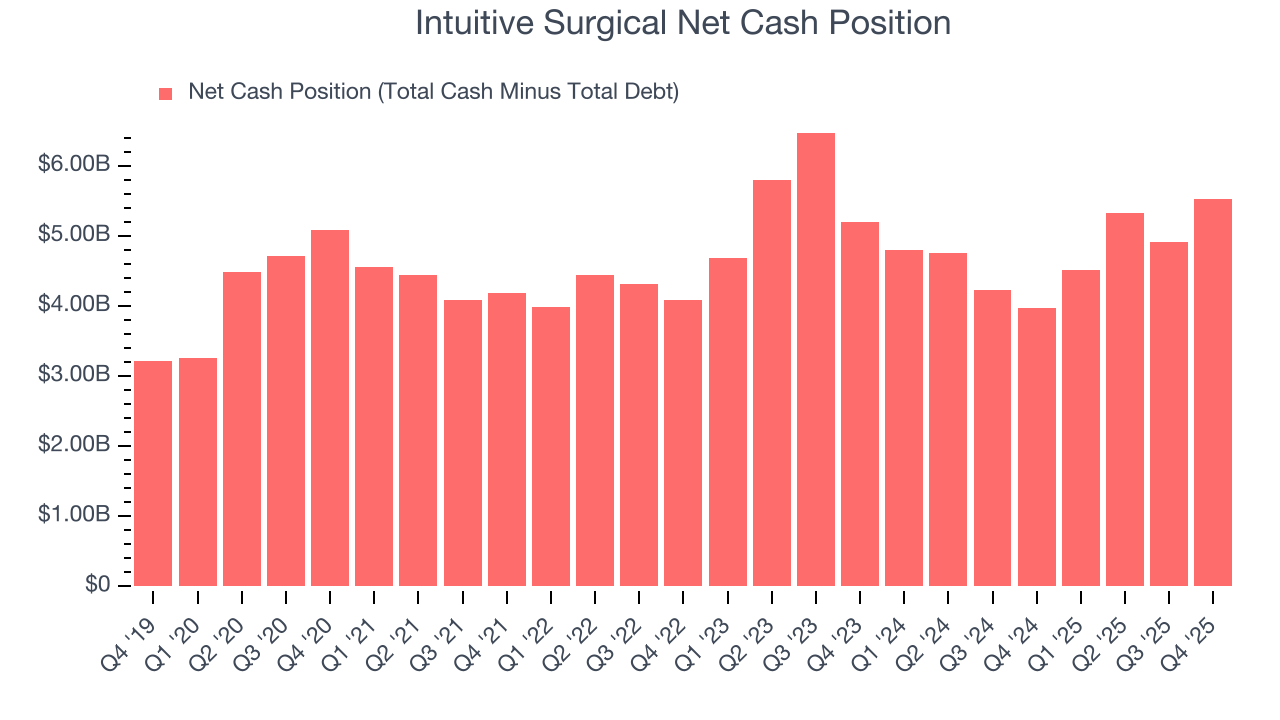

11. Balance Sheet Assessment

Companies with more cash than debt have lower bankruptcy risk.

Intuitive Surgical is a profitable, well-capitalized company with $5.53 billion of cash and no debt. This position is 3% of its market cap and gives it the freedom to borrow money, return capital to shareholders, or invest in growth initiatives. Leverage is not an issue here.

12. Key Takeaways from Intuitive Surgical’s Q4 Results

We enjoyed seeing Intuitive Surgical beat analysts’ revenue expectations this quarter. We were also glad its EPS outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 1.1% to $531.88 immediately after reporting.

13. Is Now The Time To Buy Intuitive Surgical?

Updated: March 4, 2026 at 11:03 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Intuitive Surgical.

Intuitive Surgical is a fine business. First off, its revenue growth was impressive over the last five years. And while its cash profitability fell over the last five years, its impressive operating margins show it has a highly efficient business model. On top of that, its astounding EPS growth over the last five years shows its profits are trickling down to shareholders.

Intuitive Surgical’s P/E ratio based on the next 12 months is 49.6x. This valuation tells us it’s a bit of a market darling with a lot of good news priced in. Add this one to your watchlist and come back to it later.

Wall Street analysts have a consensus one-year price target of $609.82 on the company (compared to the current share price of $503.12).