Lincoln Educational (LINC)

We wouldn’t buy Lincoln Educational. Its sales have underperformed and its low returns on capital show it has few growth opportunities.― StockStory Analyst Team

1. News

2. Summary

Why We Think Lincoln Educational Will Underperform

Established in 1946, Lincoln Educational (NASDAQ:LINC) is a provider of specialized technical training in the United States, offering career-oriented programs to provide practical skills required in the workforce.

- 11.6% annual revenue growth over the last five years was slower than its consumer discretionary peers

- Subpar operating margin constrains its ability to invest in process improvements or effectively respond to new competitive threats

- Cash burn makes us question whether it can achieve sustainable long-term growth

Lincoln Educational falls short of our quality standards. We’ve identified better opportunities elsewhere.

Why There Are Better Opportunities Than Lincoln Educational

High Quality

Investable

Underperform

Why There Are Better Opportunities Than Lincoln Educational

Lincoln Educational is trading at $27.55 per share, or 35.1x forward P/E. Not only does Lincoln Educational trade at a premium to companies in the consumer discretionary space, but this multiple is also high for its top-line growth.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. Lincoln Educational (LINC) Research Report: Q3 CY2025 Update

Education company Lincoln Educational (NASDAQ:LINC) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 23.6% year on year to $141.4 million. The company’s full-year revenue guidance of $507.5 million at the midpoint came in 2.8% above analysts’ estimates. Its GAAP profit of $0.12 per share was significantly above analysts’ consensus estimates.

Lincoln Educational (LINC) Q3 CY2025 Highlights:

- Revenue: $141.4 million vs analyst estimates of $131.5 million (23.6% year-on-year growth, 7.5% beat)

- EPS (GAAP): $0.12 vs analyst estimates of $0.02 (significant beat)

- Adjusted EBITDA: $16.9 million vs analyst estimates of $12.88 million (12% margin, 31.2% beat)

- The company lifted its revenue guidance for the full year to $507.5 million at the midpoint from $495 million, a 2.5% increase

- EBITDA guidance for the full year is $66 million at the midpoint, above analyst estimates of $61.84 million

- Operating Margin: 4.4%, in line with the same quarter last year

- Free Cash Flow was $5.53 million, up from -$13.76 million in the same quarter last year

- Enrolled Students: 18,244, up 2,357 year on year

- Market Capitalization: $562.8 million

Company Overview

Established in 1946, Lincoln Educational (NASDAQ:LINC) is a provider of specialized technical training in the United States, offering career-oriented programs to provide practical skills required in the workforce.

The company primarily operates through Lincoln Technical Institute, Lincoln College of Technology, and Euphoria Institute of Beauty Arts and Sciences. These institutions are spread across 14 states and offer a variety of diploma, degree, and certificate programs.

Lincoln Educational focuses on five core areas: Automotive Technology, Health Sciences, Skilled Trades, Hospitality Services, and Business and IT. Each program is designed to equip students with hands-on experience and skills relevant to their chosen field.

Automotive and Skilled Trades programs partner with leading companies, ensuring students receive education aligned with industry standards and have access to advanced technologies. Partnerships with companies like Audi and BMW not only enhance the curriculum but also create pathways for student internships and employment.

In the Health Sciences sector, Lincoln Education offers programs in Nursing, Medical Assistant, Dental Assistant, and other allied health professions. The Euphoria Institute focuses on beauty and wellness programs, providing training in cosmetology, esthetics, and massage therapy.

Lincoln Educational places a strong emphasis on career services, assisting students with job searching, resume writing, and interview preparation.

4. Education Services

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

Lincoln Educational's primary competitors include Universal Technical Institute (NYSE:UTI), Strayer Education (NASDAQ:STRA), Adtalem Global Education (NYSE:ATGE), and Grand Canyon Education (NASDAQ:LOPE).

5. Revenue Growth

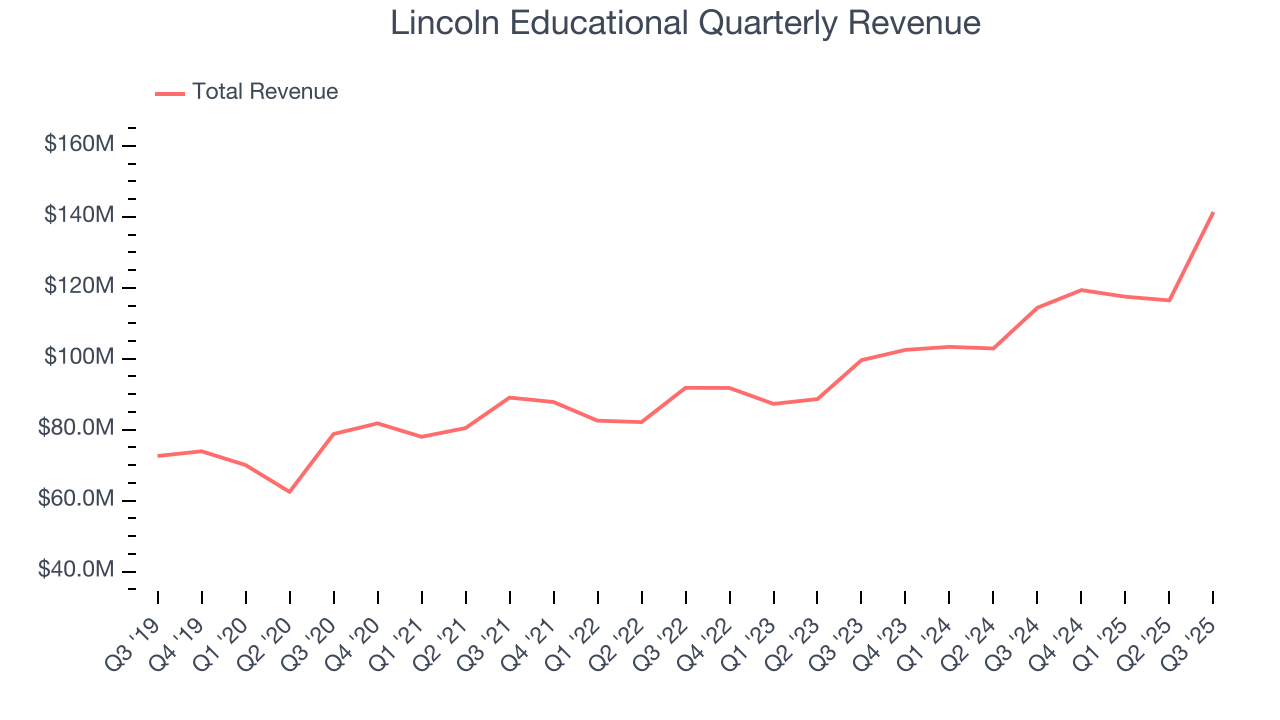

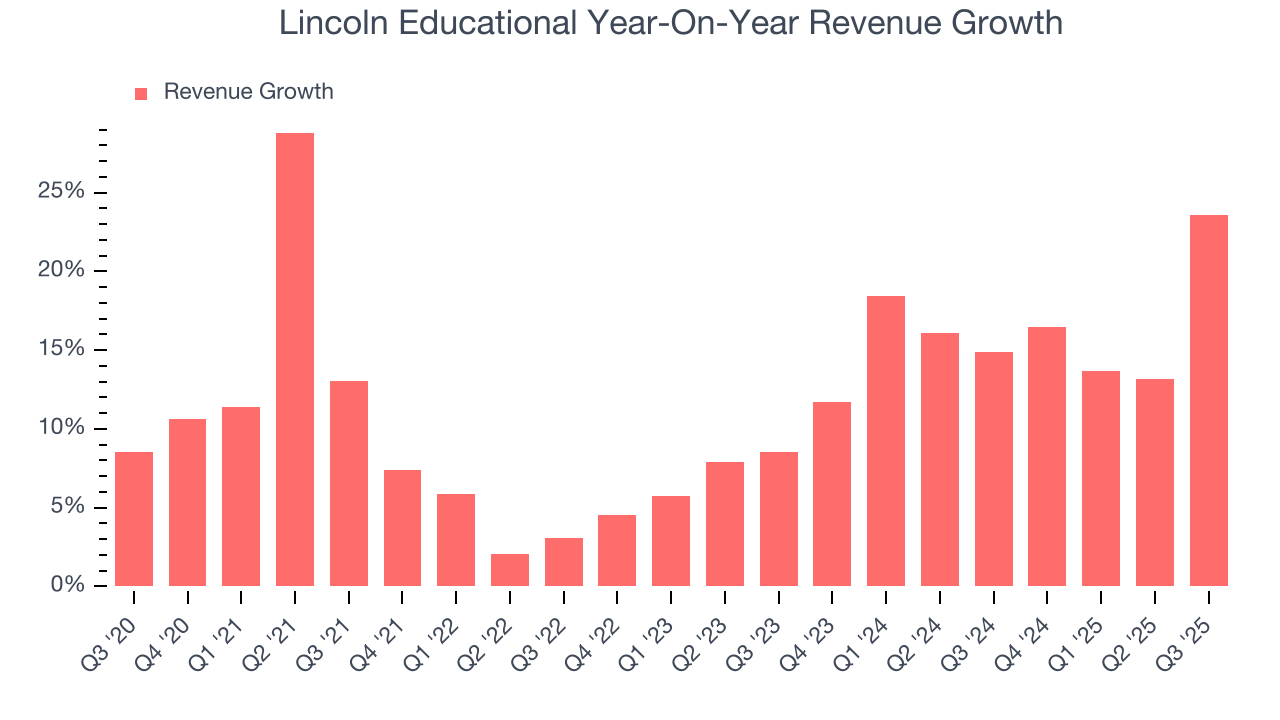

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, Lincoln Educational grew its sales at a 11.6% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Lincoln Educational’s annualized revenue growth of 16.1% over the last two years is above its five-year trend, suggesting some bright spots.

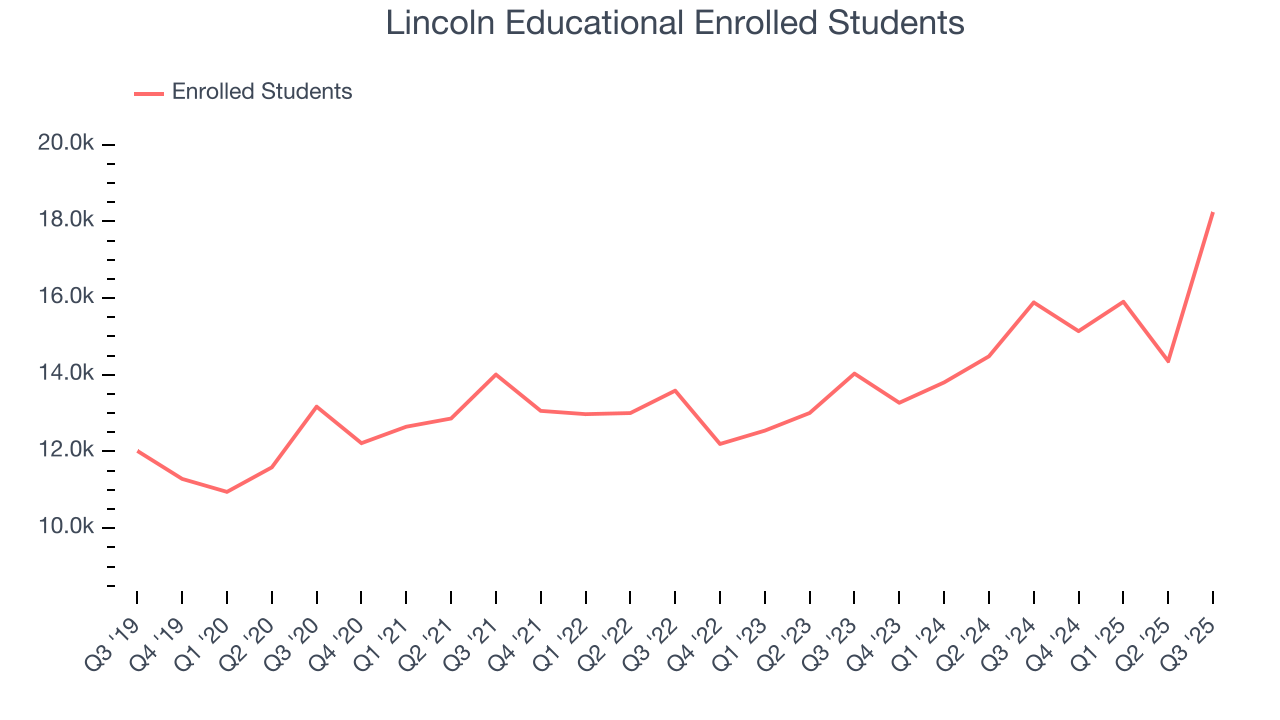

We can dig further into the company’s revenue dynamics by analyzing its number of enrolled students, which reached 18,244 in the latest quarter. Over the last two years, Lincoln Educational’s enrolled students averaged 10.8% year-on-year growth. Because this number is lower than its revenue growth during the same period, we can see the company’s monetization has risen.

This quarter, Lincoln Educational reported robust year-on-year revenue growth of 23.6%, and its $141.4 million of revenue topped Wall Street estimates by 7.5%.

Looking ahead, sell-side analysts expect revenue to grow 7.1% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

6. Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

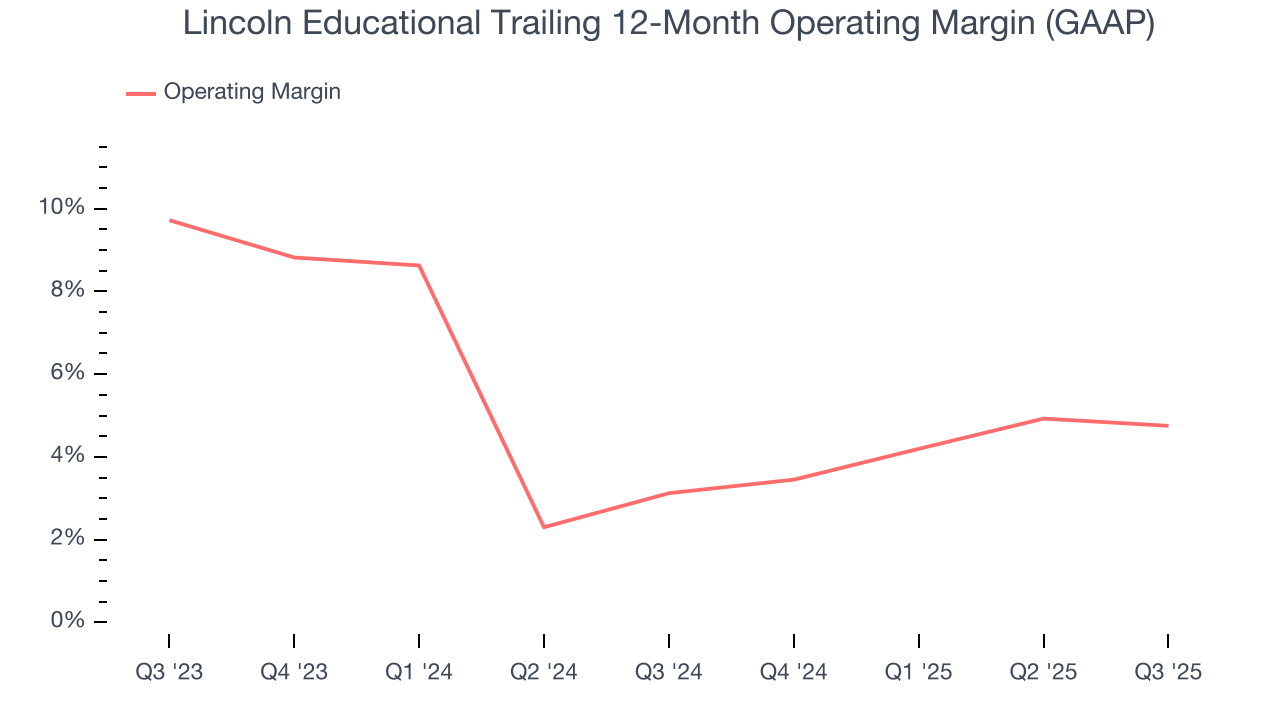

Lincoln Educational’s operating margin has been trending up over the last 12 months and averaged 4% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports lousy profitability for a consumer discretionary business.

This quarter, Lincoln Educational generated an operating margin profit margin of 4.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

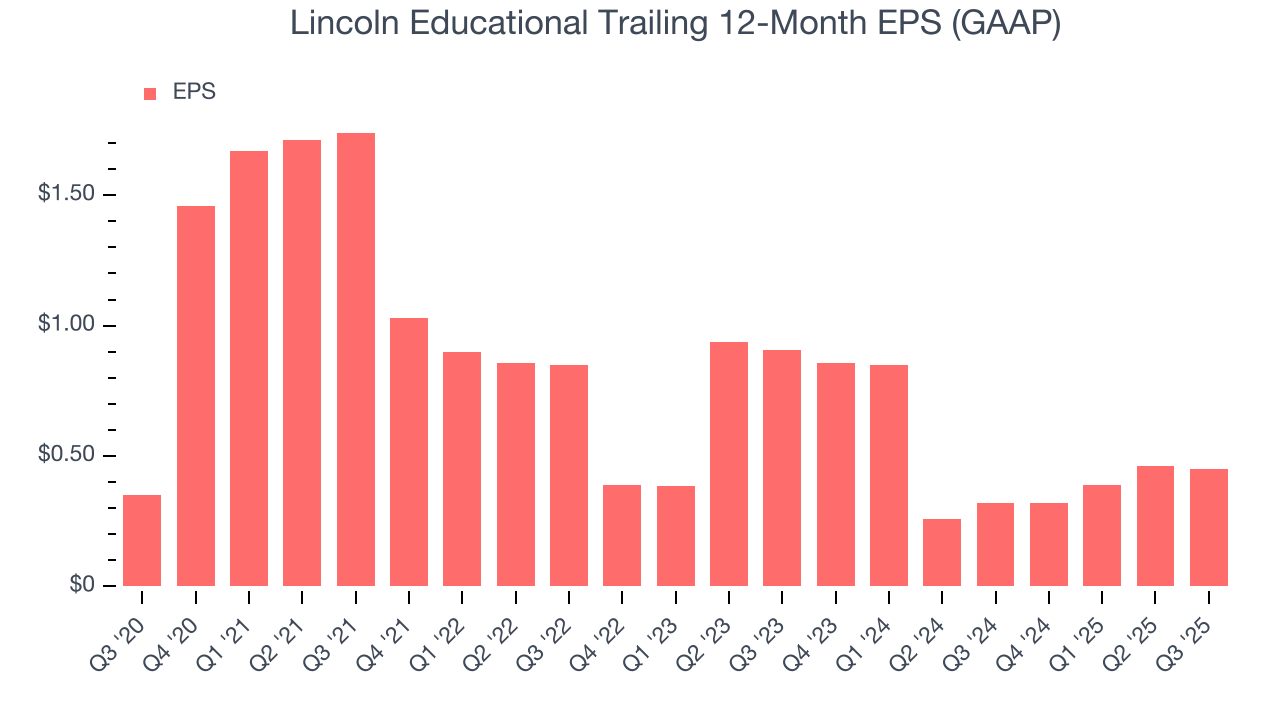

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Lincoln Educational’s EPS grew at an unimpressive 5.2% compounded annual growth rate over the last five years, lower than its 11.6% annualized revenue growth. However, its operating margin didn’t change during this time, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

In Q3, Lincoln Educational reported EPS of $0.12, down from $0.13 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Lincoln Educational’s full-year EPS of $0.45 to grow 36.7%.

8. Cash Is King

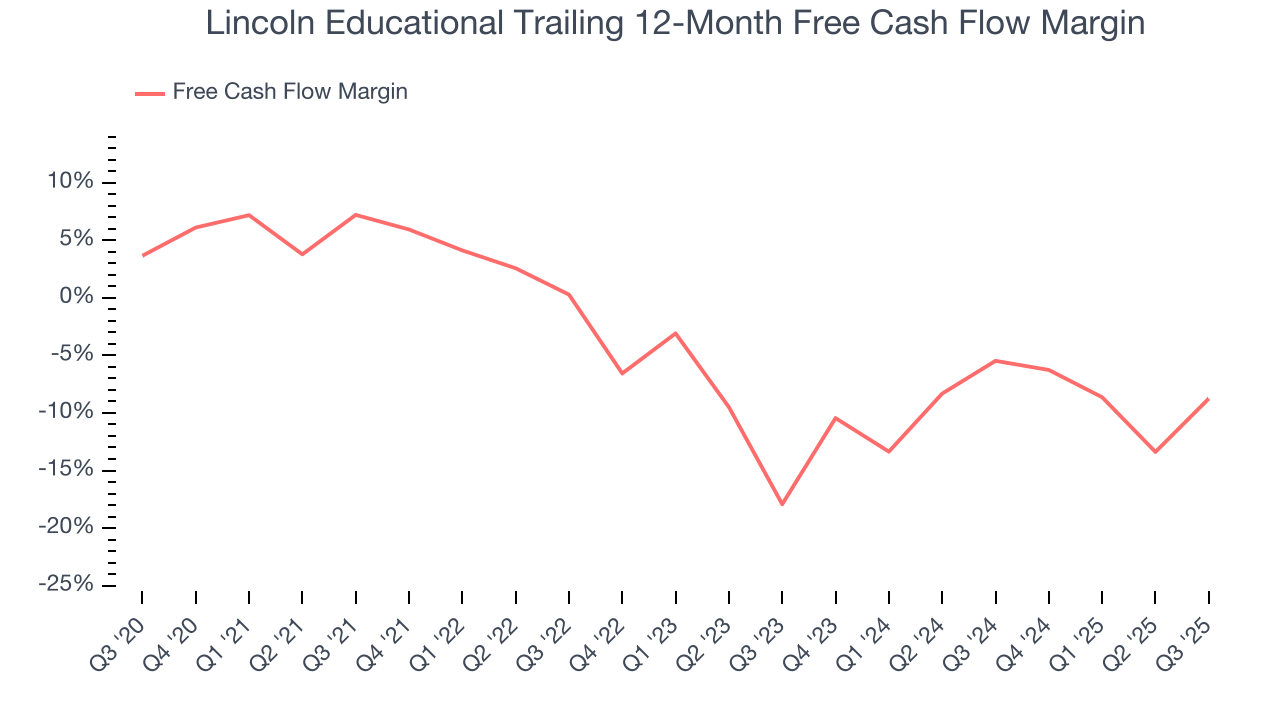

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

While Lincoln Educational posted positive free cash flow this quarter, the broader story hasn’t been so clean. Over the last two years, Lincoln Educational’s demanding reinvestments to stay relevant have drained its resources, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 7.2%, meaning it lit $7.24 of cash on fire for every $100 in revenue.

Lincoln Educational’s free cash flow clocked in at $5.53 million in Q3, equivalent to a 3.9% margin. Its cash flow turned positive after being negative in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends are more important.

Looking forward, analysts predict Lincoln Educational will generate cash on a full-year basis. Their consensus estimates imply its free cash flow margin of negative 8.8% for the last 12 months will increase to positive 2%, giving it more optionality.

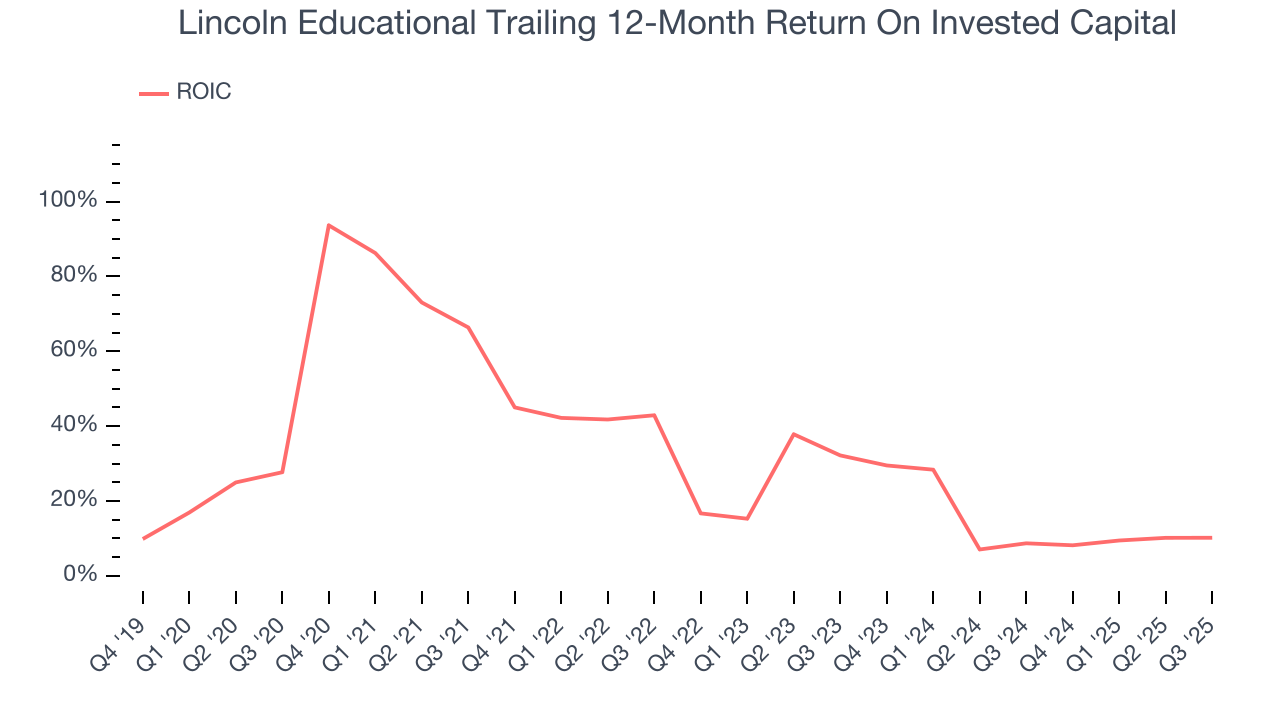

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Lincoln Educational hasn’t been the highest-quality company lately, it found a few growth initiatives in the past that worked out wonderfully. Its five-year average ROIC was 32.1%, splendid for a consumer discretionary business.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Lincoln Educational’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

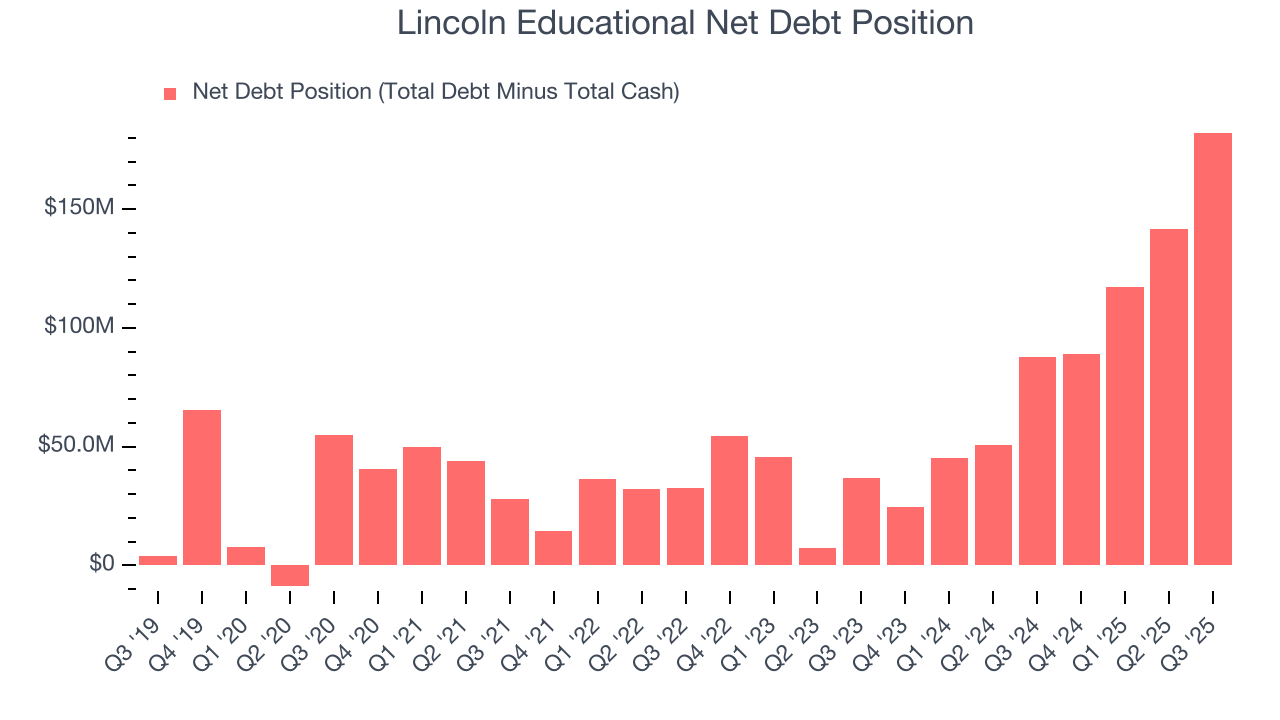

10. Balance Sheet Assessment

Lincoln Educational reported $13.48 million of cash and $195.7 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $57.28 million of EBITDA over the last 12 months, we view Lincoln Educational’s 3.2× net-debt-to-EBITDA ratio as safe. We also see its $771,000 of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from Lincoln Educational’s Q3 Results

It was good to see Lincoln Educational beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 10.3% to $19.66 immediately following the results.

12. Is Now The Time To Buy Lincoln Educational?

Updated: January 22, 2026 at 9:53 PM EST

The latest quarterly earnings matters, sure, but we actually think longer-term fundamentals and valuation matter more. Investors should consider all these pieces before deciding whether or not to invest in Lincoln Educational.

Lincoln Educational doesn’t pass our quality test. First off, its revenue growth was weak over the last five years, and analysts expect its demand to deteriorate over the next 12 months. And while its Forecasted free cash flow margin suggests the company will have more capital to invest or return to shareholders next year, the downside is its number of enrolled students has disappointed. On top of that, its projected EPS for the next year is lacking.

Lincoln Educational’s P/E ratio based on the next 12 months is 35.1x. This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now.

Wall Street analysts have a consensus one-year price target of $27 on the company (compared to the current share price of $27.55).